Inside Florida’s undercover investigation into GSPartners

Florida’s November 17th GSPartners securities fraud cease and desist order comes in at two hundred and eighty-six pages.

Florida’s November 17th GSPartners securities fraud cease and desist order comes in at two hundred and eighty-six pages.

Thankfully most of that is evidentiary exhibits of GSPartners’ alleged fraud. What the order also contains though is two affidavits from Florida’s Office of Financial Regulation’s agents, detailing undercover investigations into GSPartners.

So far BehindMLM has documented nine GSPartners regulatory fraud warnings from US regulators. This is the first time we’ve seen insight into how the investigations are conducted.

The first documented investigation was conducted by a financial investigator from the Economic Crimes of the Bureau of Financial Investigations division of OFR.

The investigation began on October 26th, following a request from OFR’s Bureau Chief.

The available agent attended an October 28th GSPartners marketing event, put on in Belleview, Florida by WealthBuilders Global.

WealthBuilders Global is a US GSPartners recruitment team headed up by Michael Dalcoe and Nathaniel Hines (aka Nate Hines).

As detailed in the first exhibited affidavit;

On October 28th, 2023, at 12:30 hrs, we arrived at the Belleview Library.

Upon entry into the library, we were immediately confronted with a dry-erase whiteboard that stated the following:

Wealth Builders Global Event

Today @ 1 pm EST come join us.

“Get paid while you sleep every day can be a pay day.”

This event is for educational purpose only.

Please join us!Immediately to the right of the dry-erase board was the room for the event.

A sign was posted at the entry door of the room stating “Notification of Filming & Photography”. This sign notifies attendees that upon entry into the event they consent to audio and video recordings.

Due to this posting, I decided to audio-record the presentation. At the time of this observation, the room was empty.

Soon after arriving, my wife and I were met by Ruel Milson (“Milson”). He appeared to be the presenter for the event.

During Milson’s introduction, he informed my wife and I that the presentation would last 15 minutes.

Upon entry, we were required to sign in: (Name, Phone number, and email address.)

At 1300 hours, there were only 3-people present. This figure included my wife and myself.

We were notified by Milson that the presentation would be delayed 15 minutes. No reason was provided for the delay.

At approximately 1320 hours, a person entered the event purporting to be another attendee. This individual called himself “Jeff”.

Prior to the start of the presentation, Milson spoke briefly about himself and- his background. Milson had a very strong Haitian/Creole accent.

During this time, he informed attendees that company leaders were live via video conference to assist with the Q&A after the presentation.

At the start of the video presentation, Milson was not the presenter. Rather, the video was narrated by an unidentified individual who was not present in person.

The video quality of the presentation was poor.

At the end of the presentation. Milson expressed positive remarks about the presentation and requested to know if anyone had questions.

At which time, this investigator decided to ask several questions concerning the following.

a. Volatile nature of bitcoin when it comes to profits.

b. Pyramid Scheme?

c. Is this an investment opportunity or business opportunity?

The associate’s responses to these questions seemed somewhat argumentative and unclear.

Following my questions, attendee “Jeff” decided to interject. He boasted about the presentation and his review of the company.

Jeff claimed to be familiar with AMWAY, referencing my question regarding a pyramid scheme. According to Jeff, this company was different.

In response to my question about this being an investment opportunity, Jeff claimed that during his review, he noticed that the company and presentation do not mention the products as an investment.

According to Jeff, this is done to prevent any issues with the SEC.

In response, the associate agreed Jeff went on to ask specific questions concerning bonuses and the payment process.

The associate’s response to his questions was again convoluted and unclear.

At the end of the presentation. Milson provided some additional information concerning training.

While exiting, I noticed that attendee Jeff met with Milson alone.

It appeared from their interaction, together with his responses during the Q&A, that he was not an attendee but rather someone who was affiliated with the company.

In conclusion, I found the presentation to be very unprofessional, convoluted, and difficult to follow. It was difficult to determine what exactly was being offered.

As far as Milson is concerned, he appeared to be someone who recently started with the company.

It is my belief that this presentation was in an effort to assist him with obtaining members to build his referrals.

A second affidavit from a Financial Examiner reveals OFR’s investigation began prior to the first exhibit above, following an alert from the North American Securities Administrators Association.

It was explained that the Alabama Securities Commission was leading an investigation into a suspected investment fraud scheme and requested other states to join the working group.

Within twenty-four hours OFR’s investigation had begun, starting with a review of GSPartners’ online presence on October 13th.

On November 6th the second OFR Agent

registered to become a member of the GSP platform through the “Back Office” of the Swiss Valorem Bank website.

After registration, I was taken to a dashboard that functions as an investment portal where I could invest in GSP by purchasing different company-issued MetaCertificates priced in Tether tokens (USDT) of various denominations.

In all, an investor who purchases a “Success Series” MetaCertificate, for instance, and assumes all of the opportunities to achieve maximum returns offered by the program, can expect to see a 176,000% return on their investment over the term fo the contract which can be as short as 18 months.

Based on my experience while serving the BFI, these returns are outrageous and indicative of a high-level fraud scheme.

Additional evidence collected through the course of OFR’s investigation includes:

- footage from “GS Partners Presentation – Meta Certificates”, a June 22nd, 2023 YouTube video on the channel Lonwabo Fololo (video appears to have been deleted)

- footage from “GS Partners – Business Presentation, product, current promotions – 20230906”, a September 6th, 2023 YouTube video on the channel GS Partners – TWE Team

- footage from “GS Partners – Full Team Call 20230904”, a September 4, 2023 YouTube video on the channel GS Partners – TWE Team

- footage from “GSPartners Tuesday Presentation and Q&A 10-31-23”, a November 3rd, 2023 YouTube video on the channel “The Gate Keeper” (video is narrated by David Jennings)

- footage from “GSPartners New Success Series Certificates (Presentation), a November 5th, 2023 YouTube video on the channel Lonwabo Fololo (video is narrated by Bruce Hughes, appears to have been deleted)

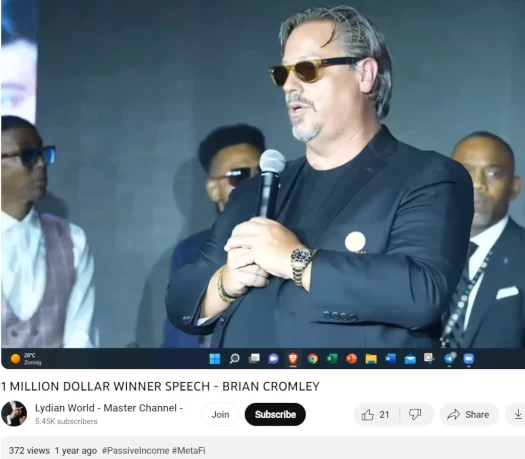

- footage from “1 MILLION DOLLAR WINNER SPEECH – Brian Cromley”, an August 25th, 2022 YouTube video on the channel Lydian World – Master Channel (channel is owned and operated by Dutch national Jacobus van Schaik, aka Harry Aims)

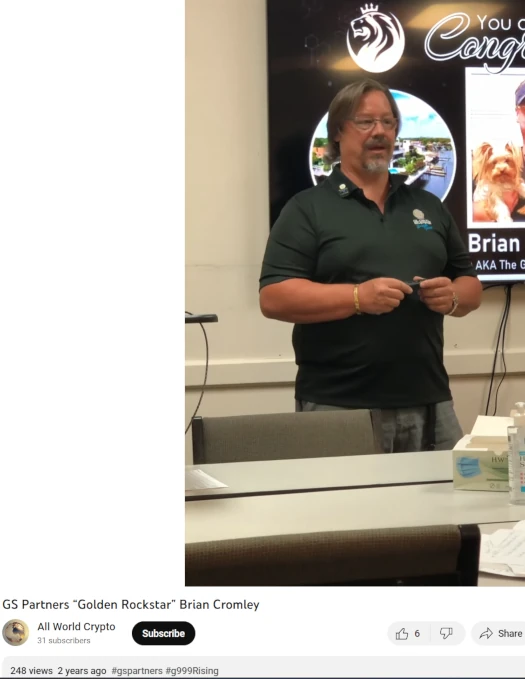

- footage from “GS Partners ‘Golden Rockstar’ Brian Cromley”, a June 3rd, 2021 YouTube video on the channel All World Crypto

- footage from “SALT LAKE CITY OCT. 2022 BRIAN CROMLEY & JOHN JOHNSON”, an October 25th, 2022 YouTube video on the channel Lydian World – Master Channel

- footage from “Tech Tuesday Training with Crypto Steve 10-10-2023”, an October 11th, 2023 YouTube video on the channel Wealth-Builders Global (note all videos on the Wealth-Builders Global channel have either been deleted or marked private/unlisted)

- marketing materials and information from WealthBuilders Global’s website

- subpoenaed financial records from CoinBase, pertaining to 27,192 transactions between CoinBase and a crypto wallet identified as belonging to GSPartners (1146 of the transactions pertained to Florida wallet owners) and

- “confidential sources”

The conclusion of the second OFR agent’s investigation into GSPartners was

it is apparent that the “MetaCertificates” and “Blockfolios” offered by GS partners constitute an investment contract under the Howey Test, in that investors are making an investment of money (USDT) in a common enterprise (the GS Partners Wealth Builder’s program and associated entities) with a reasonable expectation of profits (termed by GS Partners promoters as “assured” payouts) to be derived from the efforts of others (inferred from the suggestion to investors that their funds will be placed in and managed by professionals in various industries.

Based on my knowledge and experience as a Financial Crimes Investigator, I find that the wildly inflated returns being offered by GS Partners and its extreme emphasis on securing continued inflows of new investor monies as its principal business operation (rather than the sale of legitimate products or services), are each clear indications of an underlying investment fraud scheme.

Given the magnitude and scale of this scheme, with GS Partners boasting that it has program participants in 170 countries worldwide, I recommend that an Immediate Order to Cease and Desist … be issued.

BehindMLM has consistently reached the same conclusions, dating back to our original 2021 GSPartners review.

In addition to Florida, Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory action against GSPartners and founder Josip Heit (right).

In addition to Florida, Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory action against GSPartners and founder Josip Heit (right).

BehindMLM also recently confirmed ongoing CFTC and SEC investigations into GSPartners.

Outside of the US, GSPartners has received seven securities fraud warnings from Canadian authorities; British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec and Saskatchewan.

As part of a joint operation with their US counterparts, earlier this week the British Columbia Securities Commission took further action against three GSPartners promoters.

The Australian Securities and Investments Commission added GSPartners to its Investor Alert List on November 15th. South Africa’s FSCA also issued a GSPartners securities fraud warning on November 22nd.

Given the scope of GSPartners’ fraud across the US and involvement of federal regulators, it’s highly likely the DOJ are also building a criminal case.

To date neither Josip Heit or any GSB executives have addressed the GSPartners regulatory enforcement actions.

Looking right into the eyes of an undercover investigator and saying “yeah we just say that bullshit to avoid problems with the SEC”. Like wow.

Selling drugs but calling it “candy” is still a crime because your terminology does not change the facts of what you doing.

Changing the words or names of things to skirt the laws does not make it ‘legal’, rather it shows that you in fact know the laws exist, and that what you are doing is wrong, and instead of stopping, you are trying to break it and get away with it.

lOVELY TO SEE bRUCE up there with the rest of them. Finally made it to the top of the pyramid scheme foodchain. I wonder how far back schalk and jeff are ?

Oh things are not looking good for that so-called Christian, Michael Dalcoe!

“FBI, OPEN UP!”

In the article it is said that the nickname of the Youtube channel “Lydian World – Master Channel” owner is “aka Harry Aimes” (incorrect, probably a typo), but this should be “aka Harry Aims”.

The following photo shows Mister AIMS (aka Harry Aims) from the “Lydian World – Master Channel” Youtube channel on stage with some of the mayor players, somewhere around June 2022:

share-your-photo.com/8bbcd7e09c

In the video youtube.com/watch?v=19n3xrcYnDI he is reporting on GSPartners “credibility” using a link/site that probably was their own… but now shows 404 for the /gspartners-company-credibility page.

The video does browse through what was there in the past, including a mention of BehindMLM from the 8:00 mark in the context of them taking legal action to shut down (false) critics.

The remainder of the video is just cult following promotion and believe GSPartners must be legit (video was posted 12 August 2023 on his “Lydian World – Master Channel” Youtube channel).

It is kind of funny that in the background of his feed you can read “Do whatever it takes” as their/his motto.

@Inga Thanks for catching that.

That aims guy has a limitless supply of the koolaid, serving the followers together with norman of lydian world, they are the ones who a running the statistics and increasing amounts of ponzitivity , encouraging members to spend even more money , and alongside bruce, muting all questions pertaing to trading , g999, and other other projects , relating the the ecosystem. Lydia questions in lydian world only, nothing else is allowed. enjoy your freedom norman and aims, the circle is getting smaller and the net is getting bigger.

Is that Norm(an) Lihaven? Who obviously didn’t get the memo to scrub Karatbars from his LinkedIn page.