GSPartners to suspend investor accounts over KYC

GSPartners’ latest ploy to disable investor accounts is KYC.

GSPartners’ latest ploy to disable investor accounts is KYC.

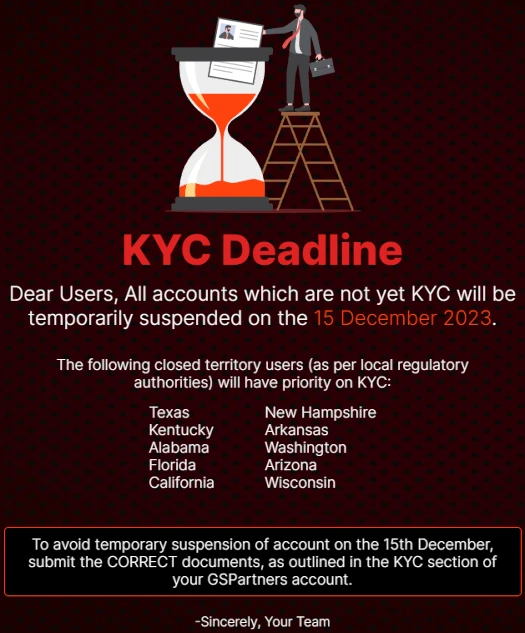

Despite not caring about KYC since it launched in 2020, GSPartners has advised investors they have until December 15th to comply.

Investors to who fail to provide GSPartners with photo ID and other personal documents, run the risk of their accounts being “temporarily suspended”.

As per the KYC notice shown to investors in their backoffice, US states that have taken regulatory action against GSPartners receive “priority on KYC”.

Thus far eleven US states have taken action against GSPartners; Mississippi, Florida, Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas.

We’re not sure what the point of collecting KYC from these investors is, seeing as GSPartners is certified to be operating illegally in these states.

One possibility is GSPartners could be gearing up to disable investor accounts in US states that have taken securities fraud related enforcement actions.

Supporting this is GSPartners referring to these states as “closed territories”.

It should be noted that securities fraud is a federal crime in the US. Individual states taking GSPartners to task over securities fraud is reflective of violations of the Securities and Exchange Act at the federal level.

In other words if GSPartners is committing securities fraud in one US state, it’s committing securities fraud across all US states.

BehindMLM has previously confirmed ongoing CFTC and SEC investigations into GSPartners.

With GSPartners unlikely to register itself with the SEC and CFTC (doing so would require it to file periodic audited financial reports), it’s looking like GSPartners will likely disable US investor accounts at some point.

What that looks like on the money side of things remains to be seen. To date GSPartners has failed to address any of the securities fraud warnings it has received.

Probably gearing up for the classic “We can’t register you if you’re in this state…but we do know of this handy VPN vendor wink wink”

But why bother then? From a legal perspective it’s still securities fraud.

Since when do criminals care about fraud or logic.

I mean it’s the method even Binance used.

You got me on logic. Using KYC to give the impression of combating fraud makes no sense when you’ve got regulators confirming to the public you’re operating illegally.

Theatrics to placate the docile victims. Stalling tactics while they circle the drain.

Andrew Eaton and his thieves don’t care! Eaton was in New York yesterday presenting GSP to a new bunch of minions!

Those who are too far gone will soon be accepting that lack of acceptable KYC is why nobody can access any funds, and then they all blame each other while the rug is pulled and the bad guys sail off into the night.

Yeah,

I’d run a mile if I was daft enough to have already invested at this point. Just hand over to people who are “definitely dodgy” documentation they could use to conduct Identity theft?

How much No can one person advise?

Tick, tock,tick,tock………

Okay I didn’t see a KYC rugpull, was hoping something less frivolous. A rugpull nonetheless is what we came to see and here it is.

Handing over identity documents to East European Mafia criminals operating a Ponzi scam is a recipe for disaster!

KYC verification has been a requirement to pull returns from GSP for as long as I was signed up. I joined in February and pulled all my returns out from day one.

This news makes me think there were loads of members just watching numbers on a screen until now. If that is the case you are f’ed. I’d just walk away at this point.

This is going to play out similarly to the way Nova Tech has, complete ban to North American users incoming. Certificates are coming due. It’s all over….

That was without “closed territories” though, i.e. it didn’t mean anything.

Two more days guys.

@psy

metacerts coming due?

Until KYC deadline 15 DEC.

How about people in Canada, How they get their money out?

So glad I didn,t sign up but my friends are.

You don’t. Any of them saying they’re getting money out without bank screenshots is full of it.

If you’re not recruiting you won’t get a penny of your fake returns.

The main servers “gspartners.global” and “swissvalorembank.com” are down now and have been unable to be reached for hours already.

I have family that are doing this. Whats gonna happen? Are they gonna lose all their money? I don’t understand, they said they get some money back, is it all just fake?

Your family invested into a Ponzi scheme. What they’ve invested is already gone.

This appears to be the illusion coming to an end (still too early to call).

Did my KYC a few months ago and live in Maryland, which is not one of the 11 states basically banning GSP from operating, but cannot access the site.

Looks like they rebranded.

It’s funny how the deadline to top up certificates from those supposed trading losses in October just passed and the site goes down. It’s looking like it was just one last chance for them to turn the screws on those already in too deep.

That mid December date was just so arbitrary I have to believe it coincided with the due date on the first series of certificates.

With all the smoke around GSP you have to believe everyone and their dog is wanting to cash out at the first opportunity.

I had $40 still on there I wanted to grab today… I guess I’ll just pull out my popcorn and enjoy the show instead.

I was not able to complete my KYC by the 15th so does that mean that I have lost all of my investment?

I can’t login anymore. I can’t even get the site to come up. Do you know what’s going on?

David, keep us up to date on what you see in the internal chat groups if you have access!

They’ve posted a whole pile of rug pull, moved to a new site and crazy dumb disclaimers.

Game over here comes the reboot

gspro.network/

Ooooh shiiiiit they went on a full-on reboot to “education platform” hahaha,these guys are spiraling so hard

Those terms and conditions are absolutely hilarious

Ah, I see we’ve arrived at the “website musical chairs” phase of GSPartners’ collapse.

Indeed! You can literally read each sentence of their disclaimer point for point to counter specific laws they are breaking. This is some next level legal-waffle

*You cannot purchase any financial products or conduct any form of financial investments, through this website.

*This website solely explains the nature of the business of GSPro *and portrays the entity as a leading IT, software, and educational provider

*GSPro has implemented technology solutions to offer its members a comprehensive and advanced experience in their daily independent trading transactions

*GSPro is not a financial services provider or bank

*the entity does not provide any account opening possibilities

*GSPro classifies itself as a Software Powerhouse and not in any way as a financial services providing institution

*Therefore, GSPro does not take any liability for any trading losses, financial risks, or, in general, any other investment risks that may occur by using the GSPro software and API solutions

*The risk disclaimers of GSPro software users who have become independent members are in a contractual relationship with the respective entity and not with the GSPro platform, by not using GSPro content information

*GSPro does not service individual or corporate clients with its software solutions

*The software is solely accessible for independent members/providers who are in a contractual relationship with GSPro, using the contents and have received approval to use the software by purchasing the relevant licenses/membership for commercial use

*This website is not a public offer, nor does the webpage provide any incentive to purchase any financial product through a third party

*This website has been created with the purpose to portray the scope of IT Educational Services only.

“GSpartners” brand is now super tainted with all the worldwide news and BehindMLM coverage.

Ooof this income disclosure:

Much like changing your website and rebranding, saying you’re not offering securities doesn’t override you offering securities.

Haha their new Members agreement has some gems:

I went to GSpro.network all I see is links and a big red hand cant get in.

Ask your upline for the email address to use to demand a refund. As the legal orders are clear: this is fraud and illegal securities offerings.

Guess that was not what you signed up for… Now your upline may try to convince you that all is okay. It’s not, so record all communications; when by voice inform the other side upfront and make clear you are recording phone calls or meetings in person.

That will get them informed and you can use it when filling a complaint with authorities.

Do so and read the C&D orders as it is pretty clear.

Is there a way to demand a refund and has anybody found a website where we can contact GS partners?

Fly to Dubai and follow the musky smoke smell?

GSPartners very obviously doesn’t want anything to do with investors (they already have your money). Either bend over or get to filing complaints with the SEC/DOJ.

Always like to play the contrarian…. Not likely but what if they are cleared of these allegations. Will all of you who have posted negative comments here retract them?

Like when a politician you support is found out to be lying. Would you come out against them?

There’s no need for “what if”. US securities law is clear and documented evidence is supplied in most of the US fraud orders.

AFAIK the only order GSPartners has challenged is AZ, and the hearing for that is in September.

If you have to “what if?” when it comes to documented fraud you’ve already lost the discussion.

“If the moon was made of cheese would you eat it?” – sure,but I’m fairly certain it’s not possible so why waste time on such a scenario?