GSPartners & Josip Heit fraud C&D from Arizona

GSPartners and owner Josip Heit are named respondents in a temporary cease and desist order, issued by the Arizona Corporation Commission (ACC).

GSPartners and owner Josip Heit are named respondents in a temporary cease and desist order, issued by the Arizona Corporation Commission (ACC).

Following an internal investigation into GSPartners and Heit, the ACC determined “public welfare requires immediate action”.

The Securities Division, in coordination (with) other regulatory agencies from the United States and Canada, is entering this Temporary Order to Cease and Desist to stop the parties from inflicting immediate and irreparable public harm.

As per the ACC’s November 16th order;

Swiss Valorem Bank Ltd.; GSB Gold Standard Corporation AG; and GSB Gold Standard Pay Ltd. acting under the brand GSDeFi; Josip Heit; and Tannisha Glaspie are engaging in or are about to engage in acts and practices that constitute violations of the Arizona Securities Act.

ACC cites Heit (right) as “a person controlling” GSB Gold Standard Corporation AG and GSB Gold Standard Pay Ltd., making him

ACC cites Heit (right) as “a person controlling” GSB Gold Standard Corporation AG and GSB Gold Standard Pay Ltd., making him

jointly and severally liable … for their violations of the antifraud provisions of the Securities Act.

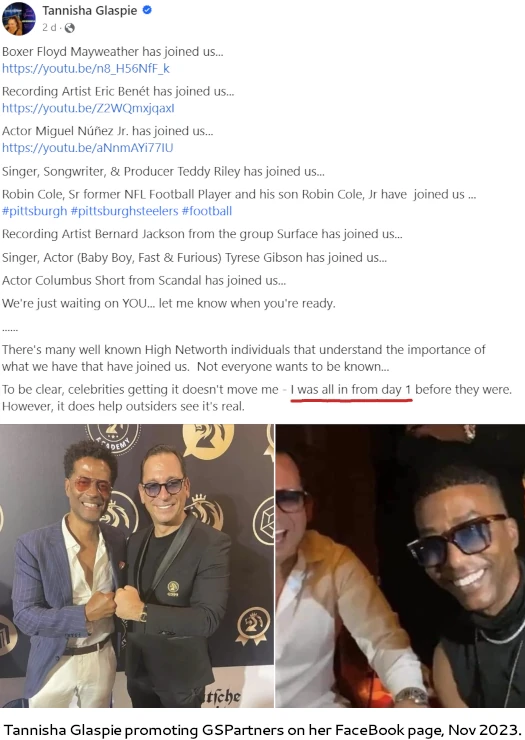

Tannisha Glaspie, an “unmarried Arizona resident”, is a GSPartners promoter who who claims she’s been “all in from day 1”.

Glaspie, who refers to herself as “The Gold Doctor”, promotes GSPartners through her YouTube channel, Instagram account and the website “Positive Farm”

Citing a recent October 31st GSPartners webinar, ACC quotes Glaspie as claiming;

I haven’t needed a job in years thanks to this. My 24-year-old daughter hasn’t needed a job either because she’s listening.

We don’t have to share this information with anyone. We choose to. It would be selfish to keep it to yourself.

On FaceBook Glaspie cites herself as a colon hydrotherapist and barber.

ACC describes GSPartners as an “exploitative investment scheme”, requiring its business model to be “constantly evolving and repackaged into a new offering”.

GSPartners has been engaging in an international scheme to illegally offer and sell fraudulent investments tied to a metaverse, liquidity pools, staking platforms, and digital assets that can purportedly yield highly lucrative returns where profits are allegedly generated via foreign exchange (forex) trading, real-estate, and renewable energy.

It’s scheme is being driven by an international confederation of multilevel marketers that have collectively earned around $11 million in commissions and purported promotions from athletes such as retired professional boxer Floyd Mayweather.

The ACC’s investigation left them unable to verify GSPartners’ external revenue claims, leaving new investment as the only source of generated revenue.

Despite the promise of highly lucrative returns and the payment of significant commissions, GSPartners is concealing key information from the public, including information relevant to its capitalization, its use of principal, and the way it actually generates sufficient revenue to pay profits and cover compensation.

It is unclear how profits are generated by GSPartners’ alleged trading in forex, real-estate, or renewal [sic] energy. Rather, investors make money through a referral rewards program by becoming promoters.

Thus, investors are incentivized by recruiting new investors and selling memberships because their profits are tied to the downline.

GSPartners solicits investment on the promise of up to 5% a week. No external revenue would of course make GSPartners a Ponzi scheme.

BehindMLM reviewed and has been reporting on GSPartners since 2021. This has resulted in retaliatory legal action filed in the New York Supreme Court.

GSPartners’ retaliatory legal action against BehindMLM is cited in ACC’s order;

On the legal page of the GSPartners Global Website, there is also a section titled “Defamation and Disinformation,” where GSPartners claims “Due to current ongoing legal action against a group of criminals … our legal team, along with the Brand and Relationship Management team, have issued instructions to suspends [sic] the accounts of the small number of offending members who are working with the criminals to further their cause”.

The “criminals” referred to by GSPartners are the owners of a website called BehindMLM.

BehindMLM has been posting information about GSPartners which includes allegations that GSPartners through Swiss Valorem Bank, GSB Gold Standard Corporation, and other related GSPartners companies are running a Ponzi scheme.

On or about December 20, 2022, GSPartners filed a lawsuit in the State of New York in an attempt to silence the cliams made by BehindMLM.

ACC also cites GSPartners’ Code of Ethics” as a means to “preemptively control negative comments about the company”, as well as a Virginia lawsuit filed against Chris Saunders in late 2021.

The measure described above demonstrated GSPartners’ impudent attempts to silence stories and accounts about its business operations as a fraud or Ponzi scheme.

Another point of note in ACC’s order is GSPartners’ purportedly lying about Swiss Valorem Bank being “fully regulated”.

On both the Swiss Valorem Bank and GSB Global Websites, they claim Swiss Valorem Bank is a type of bank that is “fully regulated”, with a class private banking license of L11863, and a registration number of 11863.

However, there is no explanation (of) which regulatory body that license number is registered to.

Both websites also claim they are registered with the Republic of Kazakhstan for electronic payment processing under the name IBBP Pay Services LTD with a BIN number of 210440025439.

However, a search performed of the electronic licensing website maintained by the Republic of Kazakhstan produces no results.

A search of the private banking license of L11863 and registration number of 11863 on Kazakhstan’s e-License Website produces results that do not appear to be related to Swiss Valorem or any GSPartners affiliates.

GSPartners claimed “A-Class banking license” is also called into question.

On the Gold Standard Website, GSPartners also claims they have an “A-Class banking license” under another affiliate company called GSB Gold Standard Bank LTD, registered and licensed with Mwali, an island off the coast of Africa.

The Mwali International Service Authority (MISA) is a regulatory body that supervises the financial sector in Mwali.

MISA has a website where the public can research companies, and on the MISA website, GSB Gold Standard Bank LTD is listed on their page title “Companies in liquidation”.

Furthermore, GSB Gold Standard Bank LTD is not a currently active company in Mwali.

BehindMLM documented GSPartners’ Mwali shenanigans in July 2021.

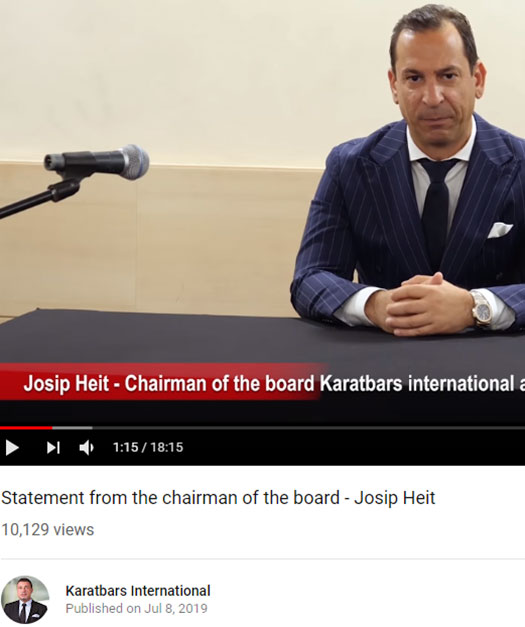

Prior to GSPartners, Josip Heit was Chairman of the Board at Karatbars International.

Heit and his team oversaw Karatbars’ transition to cryptocurrency fraud, which ended in disaster mid 2019. This was the precursor to GSPartners.

Heit was previously involved with a company called Karatbars International.

Heit appeared in videos for Karatbars and held himself out as Karatbars’ Chairman of the Board.

On May 3, 2019, the Bank of Namibia declared Karatabars as a pyramid scheme following an investigation.

On October 21, 2019, the German Federal Financial Supervisory Authority, also known as BaFin, issued a cease and desist order to Karatbit, which upon information and belief is another name that Karatabars operated as, to stop issuing the Karat Gold Coin without the proper license.

Upon information and belief, GSPartners does not disclose to potential investors that its Chairman, Josip Heit, was previously involved in with the Karatbars alleged pyramid scheme.

There is no mention of Karatbars on the GSPartners Global or Swiss Valorem Bank websites.

Upon information and belief, GSPartners does not disclose to potential G999 investors that its Chairman, Josip Heit, was previously involved with a cryptocurrency coin offering, Karat Gold Coin, where a German regulator issued a cease and desist order to stop the issuance of that cryptocurrency.

There is no mention of Karatbars, Karatbit, or the Karat Gold Coin on the G999 website.

Oh and if you’re wondering how far back Tannisha Glaspie’s “all in from day 1” goes;

Even after the Bank of Namibia’s declaration and Bafin’s cease and desist order, Glaspie promoter Karatbars on February 5, 2020, with a video posted on her YouTube channel titled, “Corporate Headquarters – Karatbars”.

With respect to GSPartners’ securities fraud, this takes place through GSPartners’ “metacertificates”.

GSPartners’ MetaCertificates essentially functions as investment plans or investment options, where investors can make money through this certificate program.

GSPartners deals primarily with cryptocurrency transactions and investments are paid with a cryptocurrency called Tether (USDT).

The investments issued include staking pools, digital assets, non-fungible tokens, and products tied to a metaverse that can be accessed with an internet browser (the “Lydian World Metaverse”).

As part of its “staking pools” scheme, GSPartners’ failed G999 cryptocurrency also gets a mention.

Through the G999 Website, GSPartners represents to potential investors that they can earn “passive rewards in G999” by investing in the masternodes and by staking.

For the G999 masternodes, GSPartners represent that investors can make profitable, passive income fromthe G999 blockchain with returns of 7.5% annually.

The G999 Website also encourages staking of the G999 Coin by claiming that owners can exchange coins generated from staking for gold coins, and then to physical gold.

As of November 25th, G999 is trading at $0.0002433 with a 24 hour volume of $765.

ACC’s order lobs three alleged violations of Arizona law at GSPartners, Josip Heit and Tannisha Glaspie (right);

ACC’s order lobs three alleged violations of Arizona law at GSPartners, Josip Heit and Tannisha Glaspie (right);

- offer and sale of unregistered securities (violation of A.R.S. §44-1841)

- transactions by unregistered dealers or salesmen (violation of A.R.S. §44-1842)

- fraud in connection with the offer or sale of securities (violation of A.R.S. §44-1991)

The Temporary Order, which is in place for 180 days, requires GSPartners, Heit and Glaspie to “cease and desist from any violations of the Securities Act”.

The temporary nature of the order gives GSPartners, Heit and Glaspie an opportunity to respond. This must be done within 20 days of service of the order.

Failing which, the ACC has requested relief in the form of a permanent cease and desist order, restitution and an administrative penalty of up to $5000 per Securities Act violation ($15,000).

In addition to Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory action against GSPartners and Josip Heit.

BehindMLM also recently confirmed ongoing CFTC and SEC investigations into GSPartners.

Outside of the US, GSPartners has received seven securities fraud warnings from Canadian authorities; British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec and Saskatchewan.

As part of a joint operation with their US counterparts, earlier this week the British Columbia Securities Commission took further action against three GSPartners promoters.

The Australian Securities and Investments Commission added GSPartners to its Investor Alert List on November 15th. South Africa’s FSCA also issued a GSPartners securities fraud warning on November 22nd.

Given the scope of GSPartners’ fraud across the US and involvement of federal regulators, it’s highly likely the DOJ are also building a criminal case.

To date neither Josip Heit or any GSB executives have addressed the GSPartners regulatory enforcement actions.

Instead, sometime over the last few days GSPartners announced a “booster” scheme.

Under the new booster scheme, GSPartners investors are encouraged to make an additional 20% investment of their original deposit.

This is done on the promise of

- a 50% increased end-of-contract bonus;

- resetting of existing 52 week contracts; and

- a new equal value investment position in GSPartners’ new “Success Series” certificates scheme (equal to the original amount invested into a prior certificates scheme)

Notably, the booster scheme effectively pushes back the lump sum bonus GSPartners has to pay out at the end of existing contracts by up to 30 months.

In light of regulatory enforcement action from the US, Canada, South Africa and Australia, why GSPartners is desperate to dodge upcoming end-of-contract payouts should be obvious.

The booster scheme sounds amazing. I always sympathize with victims of ponzi schemes. But this booster scheme is next level, if you fall for it, you deserve to lose your money.

Reminiscent of booster shots, they suggested you take it, but probably unnecessary.

Some documents submitted into the eDocket on 9 February 2024 regarding Ms Glaspie, including some initial responses to the allegations made to her and the other respondents in the C&D.

Not sure what the point of Glaspie’s filings were.

Thank you, come again.

The rest of the filing is mostly “huh I don’t know?” responses, with the odd lies sprinkled in.

E.g.:

I think someone needs to tell “The Gold Doctor” deleting/hiding evidence doesn’t change what you did.

GSPartners’ and Heit’s response due by end of Monday 16th. Hopefully it’s just as comical.

Initial response from Josip Heit and the 2 GSBs e-filed into AZCC eDocket, dated 12 February 2024.

It states that the (Meta)certificates are not securities, there is no investment going on; allegations are insufficient, and even if they ever were…

Page 3 on lines 6-9:

Excellent, now all US victims… ehh… participants have a document from Heit’s legal team to which they can refer to claim their refund.

That’s not how regulation securities fraud works.

MetaCertificates clearly are securities as per the Howey Test so that denial isn’t going to go anywhere either.

Just a note on covering this, BehindMLM typically doesn’t report on filed Answers (not much to report when it’s mostly admit/deny responses).

Given the hearing was scheduled for September I think it was, we’ll watch the docket for any updates – otherwise cover the hearing I guess. A lot can happen in seven months.

Fully understand your position Oz.

Just thought it good for victims of GSPartners to know that the legal team of Josip Heit made it official that US participants can get a refund.

Think it is a great invitation for US victims to not wait any longer and submit their request; as who wants to wait till September 2024 or longer to gamble on the outcome of the AZCC hearing?

Especially when the odds are so bad. Since “loading value” into a “blockfolio” to enter into a “payback program” is beautiful poetry to describe an investment in securities.

As far as gathering evidence goes, the moment that notice went up on the GSPartners website they were liable for refunds.

Note the “eligible” clause remains a problem, so the refunds aren’t quite what GSB is representing in its AZ response filing.

If discovery is a thing shouldn’t take much to request a full list of refunds paid out closer towards the hearing.

All good discussing the filings here. I was only addressing a separate article.