GSPartners securities fraud C&D from Mississippi

GSPartners has received a securities fraud cease and desist order from Mississippi.

GSPartners has received a securities fraud cease and desist order from Mississippi.

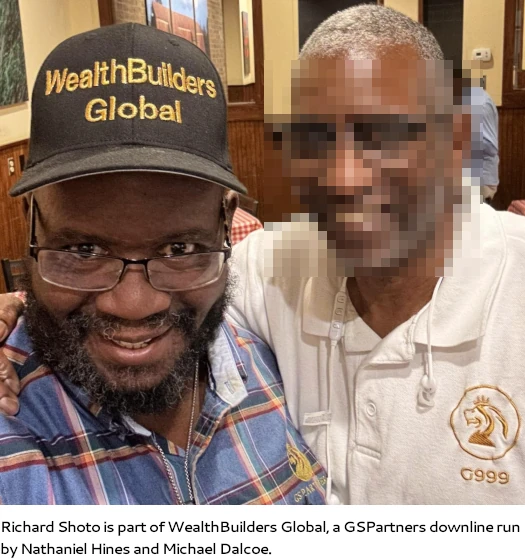

The December 6th order also applies to GSPartners’ owner Josip Heit, and local Mississippi promoter Richard L. Shoto.

The order, issued by Secretary of State Michael Watson, certifies that GSPartners’ metacertificates “are unregistered securities in Mississippi”.

GSPartners solicits investment on the promise of weekly returns. The scheme is run through metacertificate investment positions, funded by tether (USDT).

Watson states he issued the order against GSPartners, Heit (right) and Shoto “to stop an ongoing internal scheme threatening immediate and irreparable harm.”

Watson states he issued the order against GSPartners, Heit (right) and Shoto “to stop an ongoing internal scheme threatening immediate and irreparable harm.”

This action is representative of the importance of continuous communication between the Secretary of State’s Office and the public on how to identify, avoid, and report potentially fraudulent activity.

If an offer is described as risk free, guaranteed, and very lucrative, please protect yourself by calling our Securities Team for verification

The action was the product of a working group of securities regulators from the United States and Canada.

They coordinated their investigations as part of a working group, and this filing marks the most recent effort to protect the public from alleged misconduct.

According to his FaceBook profile, Richard Shoto is a resident of Pearl, Mississippi.

Shoto appears to be part of WealthBuilders, a GSPartners downline run by Nathaniel Hines and Michael Dalcoe.

As a result of Watson’s order, GSPartners is effectively banned in Mississippi.

The order prohibits the named parties from further offers and/or sales of unregistered securities as well as acting as unregistered broker-dealers, agents, investment advisers, or investment adviser representatives.

In addition to Mississippi, Florida, Arizona, New Hampshire, Arkansas, Wisconsin, Kentucky, California, Washington, Alabama and Texas have all taken regulatory action against GSPartners and Josip Heit.

BehindMLM also recently confirmed ongoing CFTC and SEC investigations into GSPartners.

Outside of the US, GSPartners has received seven securities fraud warnings from Canadian authorities; British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec and Saskatchewan.

As part of a joint operation with their US counterparts, in November the British Columbia Securities Commission took further action against three GSPartners promoters.

The Australian Securities and Investments Commission added GSPartners to its Investor Alert List on November 15th. South Africa’s FSCA also issued a GSPartners securities fraud warning on November 22nd.

Given the scope of GSPartners’ fraud across the US and involvement of federal regulators, it’s highly likely the DOJ are also building a criminal case.

To date neither Josip Heit or any GSB executives have addressed the GSPartners regulatory enforcement actions.

Great I invested $3k to these shysters!

Michael Dalcoe was South Africa lately and he caught up with Australian scammers Peter Ford and Coral Parker. They talked about Michael and Monica?- is Monica Dalcoes’s partner?