GSPartners securities fraud warning from South Africa

Just days after a marketing event was held in South Africa, the Financial Sector Conduct Authority has issued a GSPartners securities fraud warning.

Just days after a marketing event was held in South Africa, the Financial Sector Conduct Authority has issued a GSPartners securities fraud warning.

As per the FSCA’s November 22nd fraud warning;

It has come to the attention of the Financial Sector Conduct Authority (FSCA) that GS Partners also known as GSP or Gold Standard Partners (GS Partners) are soliciting investments in South Africa.

GS Partners is not licensed under any financial sector law to provide financial products or financial services in South Africa.

By failing to register with the FSCA, GSPartners and its promoters are committing securities fraud in South Africa.

Addressing GSPartners’ business model, the FSCA writes;

The FSCA is concerned about the unrealistic returns offered by GS Partners, and is conducting a preliminary investigation into its activities in South Africa.

The FSCA has contacted GSPartners and given them until November 24th to reply. When the FSCA contacted GSPartners is unclear.

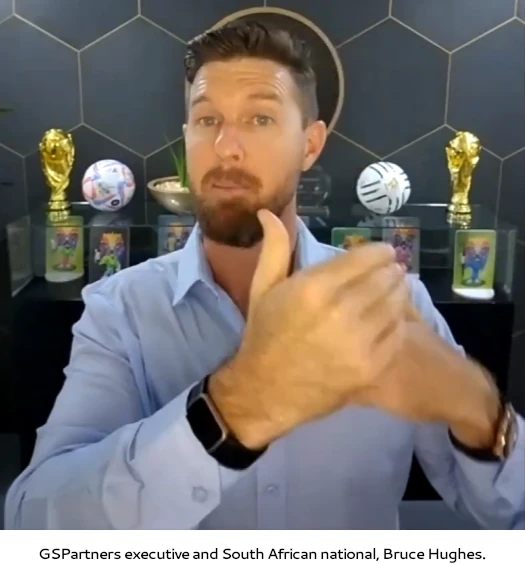

Of note is a number of GSPartners insiders and executives are from South Africa. These include Bruce Hughes, Andrew Eaton and Antonio Euclides Menesis De Gouveia (aka Tony De Gouveia).

Someone else of potential interest to the FSCA and US authorities is Schalke van der Merwe.

In violation of New York and federal US securities laws, Merwe is promoting a GSPartners “live business presentation” in early December.

Last year Van der Merwe and his wife were charged with conspiracy to commit murder.

In addition to South Africa, GSPartners has received multiple fraud warnings and regulatory lawsuits from the US and Canada.

In the US these include Texas, Washington, Alabama, California, Wisconsin and Kentucky.

In Canada fraud warnings have been issued by British Columbia, Ontario, Alberta (G999, GSTrade and GSPartners), Quebec, and Saskatchewan.

The British Columbia Securities Commission has also taken action against three GSPartners promoters, among them top ranked Nitsa Nakos.

GSPartners is run by Josip Heit (right).

GSPartners is run by Josip Heit (right).

Following the US regulatory fraud warnings last week, Heit failed to personally attend the South Africa event over the weekend.

Along with other GSPartners top brass, Heit is believed to be hiding out in Dubai.

Pending any updates on the FSCA’s ongoing investigation into GSPartners, stay tuned…

Oh wow, finally!

How many warnings do these guys now have against them?

Is there not one single country that acts seriously against these people and arrests them ?

I’m kinda surprised the FSCA jumped on this. Hopefully that should slow down some recruitment in SA.

Finally, Joseph Heit and his croonies are going down! Listen up people “beware of these scammers in other ponzi schemes!!

Trully and excellent update. With schalk on the Radar now, will he still continue to try and launch his very own ponzi?

The noose is getting tigher now Schalk, they gonna strangle you now for sure. Take a deep breath.

From experience with the FSCA, if it’s a direct complaint and they want your first response (or need further clarity) it’s usually 14 days notice.

If it’s with the enforcement department they usually issue you with their findings and you have 30 days to respond. They would have known before they got on their flights to SA last week.

Failure to respond will likely trigger an administrative judgement from them.

What may be worth doing now is subjecting each marketer to the same scrutiny as each one is supposed to be registered with the FSCA as a financial advisor prior to dispensing advice. GS may be in the crosshairs, but why shouldn’t each of the 4000 from Saturday be as well?

Why is that smiling crook Brendon Earp Jones and his fake recruiters like Anesca Swart and others not also included in this as they were promoting CT event and countless others recently??

Mature investor – they may be, but the company is the source of the issue to the FSCA. However, as per my comment above – people need to complain about the individuals involved now to trigger investigations into each of them. If you are aware of anyone in SA promoting and selling their products, submit a complaint to the FSCA about them purely on the basis that they are not compliant with FAIS and not accredited as a financial service provider/or are not a rep of an accredited financial services provider. If it’s helpful I can maybe point to each section of FAIS they may be in breach of?

Oz – An update regarding when and what they had responded to the FSCA found on this link.

dailymaverick.co.za/article/2023-11-28-yet-another-scam-blemishes-the-cryptocurrency-horizon-regulator-investigating-gs-partners/

Lol.

I always choose to see the good in people, so my initial thought was JH is the only scammer and the top promoters got fooled just like the rest.

But seeing these top promoters jetting off to Las Vegas for Eric Worres, Go Pro event, instead of going into damage control mode after all these regulatory warnings. I am now convinced all of the top promoters (in South Africa) knew it was a ponzi and they are all to happy to enjoy a life of luxury with stolen money.

I WANT TO KNOW IF I AM EVER GOING TO GET MY CONTRIBUTION BACK I AM A PENSIONER AND THINKTHERE WAS NOT ENOUGH EXPLANATIONS DONE ..PLEASE LET ME KNOW.

Explanation: You invested into a Ponzi scheme and your money is gone.

You can either file a complaint with authorities or let Heit and friends get away with it.

Just a few months ago, there were 13 comments on the “GSPartners securities fraud warning from South Africa.”

No one returned to announce that GSP won the case. (Ozedit: snip, see below)

Putting aside there was no case to win, a securities fraud warning is not a case, there have been no further public updates from the FSCA on GSPartners.

Feel free to provide verifiable evidence to the contrary.