Argent Global confirm regulatory issues behind payout delays

Like most of the schemes forged in the aftermath of TelexFree’s billion dollar Ponzi meltdown, Argent Global’s top priority was establishing itself where they believed they’d be out of reach of US regulators.

Like most of the schemes forged in the aftermath of TelexFree’s billion dollar Ponzi meltdown, Argent Global’s top priority was establishing itself where they believed they’d be out of reach of US regulators.

With Argent Global soliciting $10 to $2400 investments on the promise of weekly returns of up to $160 a week, why owner Victor Rival felt he had to “hide” the business from regulators is obvious enough.

Where exactly owner Rival (aliases “Victor Rivel”, “Victorien Rival” and “Victorien Antoine Rivel”) is running Argent Global out of is unclear. However as is common with these types of schemes, efforts to dodge regular banking channels attracts with it a host of payment processor problems.

Last we checked in Argent Global they’d just announced the suspension of signing up new US investors, along with ROI payouts through i-Payout.

That was late July, with Argent Global investors claiming withdrawal requests haven’t been honored dating as far back as August:

I hope its (sic) not a dead horse…. I have invested money, a lot of it and That was my first withdrawal in august that Im (sic) still waiting on. I dont (sic) want to turn anyone off here but I cant help feeling like I have lost alot of money.

I knew there were risks involved. It looks like it was really taking off and then one payment processor after the other stopped paying out for agn. If they had of got their argentpay sorted out earlier it might have made all the difference.

I think alot of people got alot of money out of it. I was told it could not fail, they had some sort of master algorithm that could not fail….. ? I hope for my sake and the sake of friends who loaned huge amounts of money from banks and credit unions

With investor complaints on social media piling up (the majority of which appear to be in the US, Brazil and Russia), Rival held an affiliate call less than 24 hours ago.

The call was certainly revealing, with Rival (right) laying out precisely why Argent Global was set up the way it is:

The call was certainly revealing, with Rival (right) laying out precisely why Argent Global was set up the way it is:

[2:16] From the very beginning we registered Argent Pay (later corrected as “Argent Network”) in a non-US district, or a non-US country, so that we’d have the flexibility to be able to operate without some of the US… um, regulatory mandates.

One such mandate of course being the illegality of Ponzi schemes.

[2:58] But now we have members in the US and to be able to operate and have US members, we still have to have our company to be compliant with the US laws for our industry.

Making a Ponzi scheme compliant with US law?

Here’s where Argent Global began to come undone… [Continue reading…]

iFreeX pyramid scheme warning issued by Massachusetts

A few days prior to our downtime, BehindMLM published a review of iFreeX.

A few days prior to our downtime, BehindMLM published a review of iFreeX.

Advertised as “the next TelexFree”, iFreeX are planning on charging affiliates monthly fees and in turn paying them recruitment commissions and shares in monthly revenue pools.

Whether or not regulators in Massachusetts read the review is unclear. Not even a week after it was published however, Secretary of State William F. Galvin issued a public warning: [Continue reading…]

Faith Sloan poorhouse dichotomy continues…

![]() As part of our continued coverage of the aftermath of the TelexFree Ponzi shutdown, today we again focus in on the claims of defendant Faith Sloan.

As part of our continued coverage of the aftermath of the TelexFree Ponzi shutdown, today we again focus in on the claims of defendant Faith Sloan.

Sloan, along with several other top investors is currently being sued by the SEC for her involvement in TelexFree, a billion dollar Ponzi scheme. [Continue reading…]

90,297 checks sent out to Zeek Rewards victims

Against the backdrop of net-winners desperately fighting to keep their stolen riches, some good news now for the victims of Zeek Rewards.

Against the backdrop of net-winners desperately fighting to keep their stolen riches, some good news now for the victims of Zeek Rewards.

As per the August order decreeing that payments would go out on September 30th, [Continue reading…]

Team BeachBody Review: Reconizable but lack of retail focus

![]() BeachBody launched back in 1998 and market a series of weight-loss brands via infomercials.

BeachBody launched back in 1998 and market a series of weight-loss brands via infomercials.

In 2007 Team BeachBody was launched, and has since served as the network marketing arm of the business.

The company operates out of the US state of California and is headed up by co-founders Carl Daikeler (CEO) and Jon Congdon (President).

Daikeler (right) has a history in marketing, with Team Beach Body appearing to be his first MLM venture.

Daikeler (right) has a history in marketing, with Team Beach Body appearing to be his first MLM venture.

As per Daikeler’s Team BeachBody corporate bio,

Having worked for every major infomercial marketer, including beauty juggernaut Guthy-Renker, Carl has 23 years of extensive product marketing experience.

Carl has worked in every aspect of the direct response business, from creating products to advertising, media buying, operations, international distribution, and general management.

His first foray into fitness product development was as co-founder of TelAmerica Media, where he created 8-Minute Abs.

In 1998, he assembled 20 angel investors to launch Product Partners and the Beachbody brand, which in 10 years has legitimized fitness products sold on TV and the Internet, and developed hundreds of thousands of fans.

In 2007 Carl launched Team Beachbody, the first multi-level marketing (MLM) business focused on a holistic approach to fitness and weight loss.

Congdon also has a marketing background, with his bio revealing that he met Daikeler whilst working at Guthy-Renker.

Read on for a full review of the Team BeachBody MLM business opportunity. [Continue reading…]

UK jails Give and Take pyramid schemers

Launched in May 2008, Give and Take saw UK-based investors invest £3000 GBP ($4873 USD) on the implied guarantee of a £21,000 GBP ($34,115 USD) ROI.

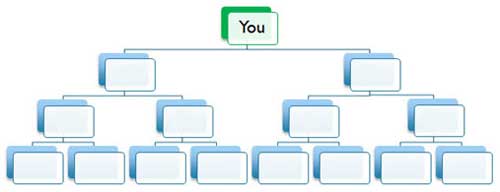

Like many schemes before it, Give and Take used a 2×3 matrix, with new investors funneled into the bottom.

Once all eight positions along the bottom were filled, the investor at the top was paid out. Every position below them then moved up a level, leaving two matrices with eight new blank positions to fill up again with new investors.

Give and Take ran for about a year, before authorities shut it down in April 2009. [Continue reading…]

VidCommX Review: $5000 video email platform?

There is no information on the VidCommX website indicating who owns or runs the business.

There is no information on the VidCommX website indicating who owns or runs the business.

The VidCommX website domain (“vidcommx.com”) was registered on the 4th of April 2014, and lists a “VidCommX General Trading LLC” as the owner. An address in Dubai is also provided, however nothing specific about who owns or runs the company.

Treat this as unconfirmed, but I have seen mention of an Indian address popping up when an affiliate signs up.

Further research led me to VidCommX’s Facebook page, on which I saw a 25th of August update that stated

Hope u all have read my Yesterday’s blogpost : has all the latest updates on what is happening this week in Vidcommx , what to expect and the future !

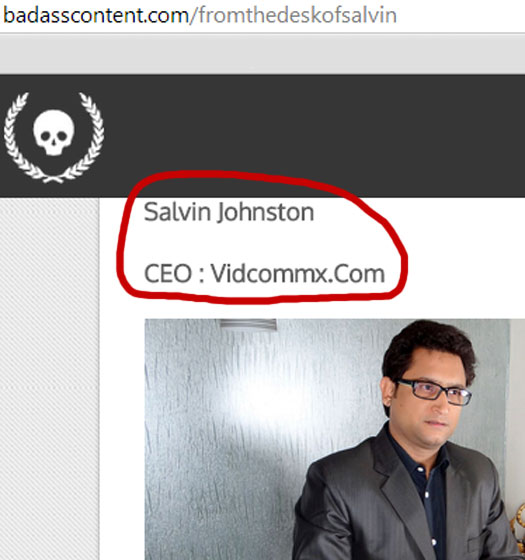

A link to an Empower Network blog was provided, on which someone called “Salvin Johnston” claims to be the CEO of VidCommX:

Marketing material uploaded by VidCommX affiliates appears to confirm this:

The video the above image was taken from was originally published on Vimeo, it has since been taken down.

Why Johnston does not reveal himself as the owner/CEO of VidCommX on the company website is a mystery.

Also a mystery is whether or not Johnston has been involved in other MLM companies. I was only able to find his name in connection to VidCommX.

Read on for a full review of the VidCommX MLM business opportunity. [Continue reading…]

Zeek pimps want discovery delay till dismiss motions resolved

With the first discovery responses in the ongoing clawback litigation filed against Zeek Reward’s top investors due less than a week from now, Trudy Gilmond, Jerry Napier and Darren Miller have filed a last-ditch effort in an attempt to avoid providing the Receivership with the requested information.

With the first discovery responses in the ongoing clawback litigation filed against Zeek Reward’s top investors due less than a week from now, Trudy Gilmond, Jerry Napier and Darren Miller have filed a last-ditch effort in an attempt to avoid providing the Receivership with the requested information.

With this information likely to be incriminating and used against them in the future, one can understand why Gilmond, Naper and Miller are so desperate to avoid answering the Receiver’s discovery requests. [Continue reading…]

TelexFree Trustee’s privilege waiver approved

![]() Following a request that a proposed order be drafted up and sent a court email address, an actual order on the Trustee’s motion for privilege waiver was posted yesterday.

Following a request that a proposed order be drafted up and sent a court email address, an actual order on the Trustee’s motion for privilege waiver was posted yesterday.

The short of it is the order was approved, with any client-attorney privilege TelexFree might have otherwise enjoyed waived in connection

with the prosecution by the United States Department of Justice of criminal indictments issued against Carlos Wanzeler and James Merrill, and in connection with the civil action commenced by the Securities and Exchange Commission against the Debtors and other parties.

Objections filed by TelexFree owners Carlos Wanzeler and James Merrill were acknowledged, but overruled.

Since the order was passed two additional interesting documents have appeared on KCC’s log of documents related to the case. [Continue reading…]

SEC shuts down eAdGear (GoFunPlaces, GoFunRewards)

Last I checked in eAdGear were still involved in a bitter dispute with JubiRev’s Randy Williams.

Last I checked in eAdGear were still involved in a bitter dispute with JubiRev’s Randy Williams.

That was back in early 2013 though, and I haven’t really been keeping tabs on William’s and eAdGear’s respective cases since.

Two Ponzi schemes suing eachother sounded interesting in premise but turned out to be terribly boring to follow.

Looking to shake things up, the SEC just jumped into the fray.

As part of their evident blitz on Chinese-backed Ponzi schemes, the SEC have shutdown eAdGear for being a ‘Ponzi and pyramid scheme that preyed on Chinese communities and caused investors to lose millions of dollars’.

Sound familiar? It should, Zhunrize was similarly shut down only a few days ago. Whereas Zhunrize used a differing e-commerce platform to front their fraud, they too targeted Chinese investors (although they admittedly focused more heavily on US and Korean investors). [Continue reading…]