Residual Income Ads Review: $10 a month matrix recruitment

There is no information on the Residual Income Ads website indicating who owns or runs the business.

There is no information on the Residual Income Ads website indicating who owns or runs the business.

The Residual Income Ads website domain (“residualincomeads.com”) was registered on the 6th of June 2015, with Tom Taylor listed as the domain owner. An address in the Philippine province of Cebu is also provided.

Tom Taylor (right) first popped up on BehindMLM’s radar as the admin of UltimateAdClub back in February. Taylor then again popped up in March as the admin of MegaCyclerClub.

Tom Taylor (right) first popped up on BehindMLM’s radar as the admin of UltimateAdClub back in February. Taylor then again popped up in March as the admin of MegaCyclerClub.

UltimateAdClub saw affiliates purchase $50 matrix positions and get paid to recruit others who did the same. A lack of interest in the scheme saw the matrix positions later reduced to $30.

MegaCyclerClub similarly saw affiliates purchase $50 matrix positions, on the promise of an advertised $650 ROI.

Interest in UltimateAdClub waned shortly after launch, with MegaCyclerClub generating even less interest. It is likely both schemes being on the path to collapse has prompted Taylor to launch Residual Income Ads.

Read on for a full review of the Residual Income Ads MLM business opportunity. [Continue reading…]

PayMeForward Review: 2010 gifting scheme gets a relaunch

![]() There is no information on the PayMeForward website indicating who owns or runs the business.

There is no information on the PayMeForward website indicating who owns or runs the business.

As of the time of publication, the PayMeForward website is currently parked on a “coming soon” page, advising visitors that the opportunity is going to launch in June 2015.

The PayMeForward website domain meanwhile was registered on the 29th of March 2006, however the domain registration is set to private.

Of note is that the PayMeForward website domain is currently using the name-servers of “newgenerationtraffic.com”:

The NewGenerationTraffic domain was registered on the 1st of November 2008, with Peter Wolfing listed as the owner.

For the PayMeForward domain to be using the name-servers of NewGenerationTraffic, Wolfing has to have admin access to both domains – which pretty much confirms Wolfing is running PayMeForward.

Peter Wolfing (right) first appeared on BehindMLM’s radar back in 2012, as the admin of Turbo Cycler ($200-$1000 matrix-based Ponzi scheme).

Peter Wolfing (right) first appeared on BehindMLM’s radar back in 2012, as the admin of Turbo Cycler ($200-$1000 matrix-based Ponzi scheme).

Since then we’ve also reviewed two more of Wolfing’s opportunities, Business ToolBox and Ultimate Cycler, two similar matrix cycler Ponzi schemes launched in October 2014.

Wolfing’s most recent opportunity launch is National Wealth Center, a $25 to $3500 cash gifting scheme.

National Wealth Center is a reboot of Infinity 100, yet another gifting scheme of Wolfing’s.

National Wealth Center was launched mid 2014 in July. The beginnings of a collapse has likely prompted the prelaunch of PayMeForward, with Wolfing assumed to be heavily promoting PayMeForward to existing National Wealth Center affiliates.

Read on for a full review of the PayMeForward MLM business opportunity. [Continue reading…]

Avorel Review: $40-$10,000 straight-queue Ponzi scheme

![]() There is no information on the Avorel website indicating who owns or runs the business.

There is no information on the Avorel website indicating who owns or runs the business.

The Avorel website domain (“avorel.net”) was registered on the 13th of December 2011, with a “Mark Brown” listed as the domain owner.

Further research reveals Brown answering Avorel customer support queries using the “appollotrading.com” domain.

The Appollo Trading website has recently been redirected to “gohostit4me.com”, also registered to Brown.

A Google cache listing for the Appollo Trading website, dated 11th of May 2015, reveals the following:

Appollo Trading Limited is a family run business based in Cannock, Staffordshire with a vast range of experience in various markets and industries and was incorporated into its current form in 2011.

We have built up an excelent (sic) reputation over the years for good service and fair prices and we intend to keep up that reputation .

Mark Brown

Managing Director

This is in line with Avorel’s Terms and Conditions, which states:

Your use of this website and any dispute arising out of such use of the website is subject to the laws of the UK.

Services listed on the now defunct Appollo Trading website include web design, domain name registration, search engine optimization and “prepaid credit card with cashback” services.

I wasn’t able to find anything concrete on Brown’s history in MLM, suggesting Avorel might be his first MLM venture.

Read on for a full review of the Avorel MLM business opportunity. [Continue reading…]

PaidAdZone Review: 150% Ponzi ROI “just in few days”

![]() There is no information on the PaidAdZone website indicating who owns or runs the business.

There is no information on the PaidAdZone website indicating who owns or runs the business.

The PaidAdZone website domain (“paidadzone.com”) was registered on the 18th of May 2015, with a “Villamor Sagadraca” listed as the owner. An incomplete address in the Thai province of Nonthaburi is also provided.

Back in 2012 Sagadraca launched Satisfaction Bux, which paid affiliates 1 cent for every new affiliate they recruited.

More recently, Sagadraca launched RevHitz in March of this year.

RevHitz is a Ponzi scheme that sees affiliates invest $5 on the promise of an advertised $8 ROI, paid out of subsequently invested funds.

At the time of publication the RevHitz website is still online, with traffic to the site growing in late May. Alexa currently estimate that Russia is the source of 32.4% of all traffic to the RevHitz domain, with Poland coming in second at 17.4%.

One can probably safely assume new investment has likely begun to dry up in RevHitz, prompting the launch of PaidAdZone.

Read on for a full review of the PaidAdZone MLM business opportunity. [Continue reading…]

Success2Paradise Review: $2 three-tier cash gifting

![]() There is no information on the Success2Paradise website indicating who owns or runs the business.

There is no information on the Success2Paradise website indicating who owns or runs the business.

The Success2Paradise website domain (“success2paradise.com”) was registered on the 17th of May 2015, with a “Phonia Chamber” listed as the owner. A likely fake address in the US state of Kansas is also provided (incomplete street details and fake postcode).

The phrase “Phonia Chamber” only appears online in connection with the Success2Paradise domain registration.

This, combined with the obviously bogus address in Kansas is a pretty good indication the individual, as represented in the Success2Paradise domain registration, does not exist.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

JetStream Direct Review: $499 stream-capable piracy boxes

There’s no direct information on the JetStream Direct website indicating who owns or runs the business.

There’s no direct information on the JetStream Direct website indicating who owns or runs the business.

A press-release uploaded to the site on the 13th of April lists “Mark DeLanney, Sr.” as a contact for JetStream Direct, with the release itself quoting him:

JetStream Direct is the leader in premier streaming media TV boxes,” says Mark DeLanney, Sr.

“We offer the JetStream TV Box and the Android TV Box, effectively allowing for streaming on all types of devices. Our new distributor and reseller program allows people to start their own business in this highly popular entertainment field that consumers are excited about.”

The use of possesive suggests DeLanney Sr. is the owner of JetStream Direct. Further supporting this are a number of YouTube videos that feature on the JetStream Direct website, hosted on an account bearing DeLanney Sr.’s name.

Of note is that up until recently DeLanney Sr. credited himself as an “Independent Business Owner at JetStream Direct” on his LinkedIn profile:

This information has since been removed, with DeLanney Sr. now crediting himself as CEO of xmWired TV, LLC (as of June 2015).

After saturating myself in the “streaming media” marketplace and learning all there is to know with this new technology, I have developed the absolute best streaming device available.

With help from the manufacturer, I have made the necessary upgrades and adjustments that makes this product not only the “best in it’s (sic) class”, but also consumer friendly.

I was unable to find any further information on xmWired TV, with any relationship between the company and JetStream TV remaining unclear.

Read on for a full review of the JetStream Direct MLM business opportunity. [Continue reading…]

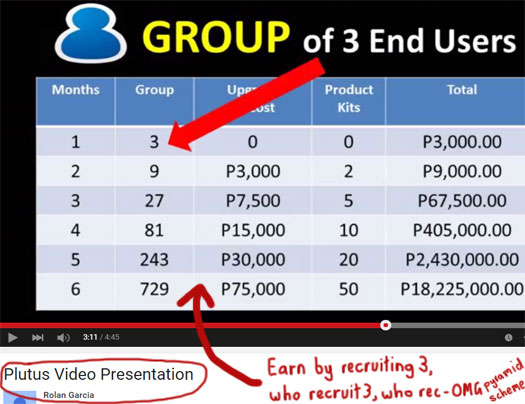

Plutus Society Review: $10 ten-tier matrix Ponzi cycler

Plutus Society was founded in June 2015 and claim to be based out of Quezon City in the Philippines.

Plutus Society was founded in June 2015 and claim to be based out of Quezon City in the Philippines.

Cited as founder of the company on the Plutus Society website is Rolan Garcia.

Garcia (right) appears fond of the Plutus brand, having previously launched Plutus Marketing in late 2014.

Garcia (right) appears fond of the Plutus brand, having previously launched Plutus Marketing in late 2014.

The mission is so simple to alleviate poverty by empowering people with dynamic and stable opportunity through entrepreneurship.

On the Plutus Marketing website, Garcia credits himself as President and Medical Director of the company.

The original concept of Plutus, as per a marketing video dated September 2014, appears to have been the offering of discounts and medical consultations (billed as “Plutus Wellness”), integrated into an MLM business opportunity.

That opportunity saw affiliates pay 1500 PHP ($33 USD) and get paid to recruit others who did the same:

Before Plutus Marketing, Garcia launched “The Exodus Society”. The company’s website is no longer offline, but Exodus Society Marketing material suggests it too was a recruitment scheme:

Alexa traffic estimates to the Plutus Marketing website suggest the opportunity never really took off, which has likely prompted the launch of Plutus Society.

Read on for a full review of the Plutus Society MLM business opportunity. [Continue reading…]

164 indictments in Thai uFun Club Ponzi case

Following the submission of a criminal case report by Thai police last Friday, Public Prosecutors have decided to file charges against the accused.

Following the submission of a criminal case report by Thai police last Friday, Public Prosecutors have decided to file charges against the accused.

Some 164 indictments have been handed down, with those indicted facing ‘charges of operating lending and borrowing services in a way suspected to be public fraud.‘ [Continue reading…]

Summer Fun Matrix Review: $22 three-tier Ponzi cycler

![]() There is no information on the Summer Fun Matrix website indicating who owns or runs the business.

There is no information on the Summer Fun Matrix website indicating who owns or runs the business.

The Summer Fun Matrix website domain (“summerfunmatrix.com”) was registered on the 1st of June 2015, with “Optimus Dale” listed as the domain owner. An address in the US state of Arkansas is also provided.

Optimus Dale is the pseudonym of Sherm Mason (right), admin of Magnetic Builder (2012) and more recently Paradise Payments and Magnetic Gratitude.

Optimus Dale is the pseudonym of Sherm Mason (right), admin of Magnetic Builder (2012) and more recently Paradise Payments and Magnetic Gratitude.

Magnetic Gratitude was launched back in April, with affiliates purchasing $10 matrix positions on the promise of an advertised $590,720 ROI.

At the time of publication Magnetic Gratitude appears to be well into decline, which has likely prompted the launch of Summer Fun Matrix.

Read on for a full review of the Summer Fun Matrix MLM business opportunity. [Continue reading…]

MyFreePassiveIncome Review: $5 app-based cash gifting

There is no information on the MyFreePassiveIncome website indicating who owns or runs the business.

The MyFreePassiveIncome website domain (“myfreepassiveincome.com”) was registered on the 18th of May 2015, with a “John Apuna” listed as the owner. An address in the US state of Arizona is also provided.

I wasn’t able to dig up any additional information on Apuna, with any MLM history he might have remaining a mystery.

Read on for a full review of the MyFreePassiveIncome MLM business opportunity. [Continue reading…]