Grossbyte Review: Crypto mining Ponzi targeting Africa

Grossbyte operates in the cryptocurrency MLM niche.

Grossbyte operates in the cryptocurrency MLM niche.

The company states on its website that it is headed up by “Thomas Patrick”.

A cropped image of Patrick appears on the Grossbyte website. Patrick however has no digital footprint outside of the “about us” page on Grossbyte’s website.

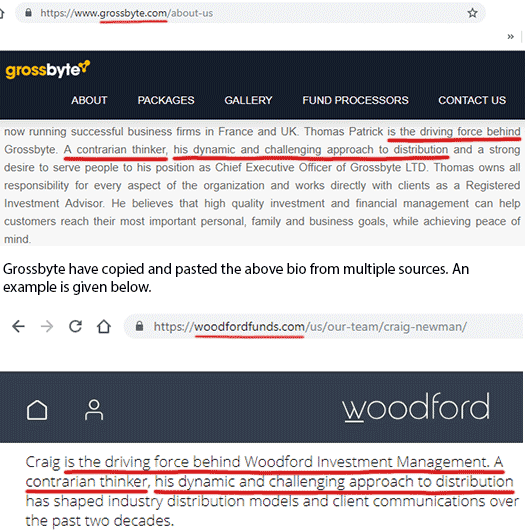

Furthermore, it appears Patrick’s entire Grossbyte corporate bio is rewritten content stolen from other executives.

Given this, it’s highly likely that neither Thomas Patrick or any of the other executives listed on the Grossbyte website actually exist.

Grossbyte provides an incorporation number that corresponds with Grossbyte LTD in the UK.

UK incorporation is dirt cheap and for the most part unregulated. It is a favorite for scammers looking to incorporate dodgy companies.

Incorporation certificates for Grossbyte are also provided for Seychelles and Ras Al Khaimah, two additional dodgy jurisdictions.

Whoever is actually running Grossbyte has a poor command of English, as evidenced by numerous paragraphs like this on their website;

Online investment attraction is that the best way to build our business grow quicker.

At the time of publication Alexa estimates Nigeria (31%), Ghana (18%) and Tanzania (14%) are the largest source of traffic to the Grossbyte website.

It’s highly likely (but not certain) that whoever is actually running Grossbyte is based out of Africa itself.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Konstantin Ignatov detained pending OneCoin charges in NY

The DOJ has secured the detention of Konstantin Ignatov, pending his facing charges in New York. [Continue reading…]

The DOJ has secured the detention of Konstantin Ignatov, pending his facing charges in New York. [Continue reading…]

eBiz pyramid scheme busted in India, two arrests

Authorities in Hyderabad, India, have shutdown the long-running eBiz pyramid scheme.

Authorities in Hyderabad, India, have shutdown the long-running eBiz pyramid scheme.

Two eBiz representatives have been arrested;

- Hitak Malhan, son of eBiz Managing Director Pavan Malhan; and

- eBiz Director Anitha Malhan, wife of Hitak Malhan.

Noble 8 Revolution funneling elder abuse victims into Pyur Global

In the latest chapter of the disturbing Noble 8 Revolution story, victims of the scheme, many of whom are elderly, are being funneled into Pyur Global. [Continue reading…]

In the latest chapter of the disturbing Noble 8 Revolution story, victims of the scheme, many of whom are elderly, are being funneled into Pyur Global. [Continue reading…]

Ruja Ignatova was originally indicted on October 12th, 2017

The specifics of Ruja Ignatova’s OneCoin exit-scam are coming together.

The specifics of Ruja Ignatova’s OneCoin exit-scam are coming together.

The latest piece of the puzzle is the revelation that Ignatova was initially indicted back October 2017 – around the same time she “went on maternity leave”. [Continue reading…]

Wakaya Perfection vs. Youngevity lawsuit stayed

Last we checked in Wakaya Perfection’s lawsuit against Youngevity had been dismissed.

Last we checked in Wakaya Perfection’s lawsuit against Youngevity had been dismissed.

Wakaya Perfection filed an appeal shortly after the decision in the Tenth Circuit.

The Tenth Circuit overturned the case, kicking it back to the Utah Central Division District Court.

Youngevity’s next move was to file a motion to stay proceedings, which was granted on February 28th. [Continue reading…]

CorVive Review: Jeremy Fouts improves Genesis Pure’s offering

Update 5th April 2025 – Brandi Snow, Director of Customer Support at Corvive, has been in touch to advise “CorVive has transitioned away from the MLM model.”

For over two years, CorVive has operated as a direct-to-consumer (DTC) company. We no longer utilize an MLM compensation plan.

As per Corvive’s website, the company now runs a single-level commission model;

Get a unique affiliate link upon signup to promote our brand. Any order made via your link will be credited to you.

Earn an attractive 20% commission on every order you bring in.

Although Corvive is no longer an MLM company, this review is maintained for historical reference. /end update

CorVive’s website provides no information about who owns or runs the business.

The CorVive website domain was privately registered on January 19th, 2018.

Further research reveals CorVive affiliates citing Jeremy Fouts as founder and CEO of the company (note incorrectly credited as “Fout” below).

Fouts does promote CorVive on social media, however on the CorVive website itself he is conspicuously absent.

According to his LinkedIn profile, prior to founding CorVive Jeremy Fouts was a Crown Diamond in Genesis Pure.

Genesis Pure was an MLM company launched in 2009. Heading up the company was founder and CEO, Lindsey Duncan.

Duncan was also credited as “head formulator” of Genesis Pure’s products.

BehindMLM reviewed Genesis Pure in 2013 and, among other things, cited concerns over pay to play revenue-sharing.

In 2014 the Texas Attorney General sued Lindsey Duncan for fraud. This was followed by a $9 million dollar fine from the FTC.

Despite Duncan’s reputation left in tatters, Genesis Pure continued on as Live Pure.

I’m not sure exactly when he left, but by August 2017 however Jeremy Fouts was out.

Up until a year ago, Fouts was marketing his own branded “leadership training” on YouTube.

Read on for a full review of the CorVive MLM opportunity. [Continue reading…]

BitClub Network trying to cash in on passive trading bot trend

Following the collapse of their mining Ponzi scheme late last year, BitClub Network is now asking gullible investors to pay them for access to a trading bot. [Continue reading…]

Following the collapse of their mining Ponzi scheme late last year, BitClub Network is now asking gullible investors to pay them for access to a trading bot. [Continue reading…]

DOJ pushing for September 2019 Mark Scott OneCoin trial date

The case against the first of OneCoin insider to fall, Mark Scott, is slowly progressing towards trial.

The case against the first of OneCoin insider to fall, Mark Scott, is slowly progressing towards trial.

At present there’s a bit of a standoff regarding an agreed trial date.

The DOJ want a trial on or around September 2019. Mark Scott’s attorneys want July. [Continue reading…]

The LuLaRoe victim class-action arbitration mess

LuLaRoe’s attempts to thwart a victim class-action has devolved into a legal mess.

LuLaRoe’s attempts to thwart a victim class-action has devolved into a legal mess.

To recap, back in late 2017 LuLaRoe was sued by several former affiliates.

The lawsuit claims damages of over $5 million and potentially 80,000 class members.

As of April 17th, the case was stayed pending the outcome of compulsory arbitration.

Three days later LuLaRoe filed arbitration demands that sought to have each plaintiff file separate claims (22 in total), which were then to also be arbitrated separately.

In other words; divide and conquer.

Arbitration proceedings played out for the rest of 2018, up until a partial decision was made on January 2nd, 2019. [Continue reading…]