Lyoness under preliminary investigation in Italy

In what very well could be an early death-knell for Lyoness, Italian authorities have announced a preliminary investigation into the company.

In what very well could be an early death-knell for Lyoness, Italian authorities have announced a preliminary investigation into the company.

The Italian Antitrust and Consumer Protection Authority (AGCM) published a bulletin on September 24th.

Details of the regulators investigation into Lyoness feature in the PDF version of the bulletin on page 23.

The AGCM state their investigation has been initiated due to a “large number of complaints” about Lyoness.

Specifically, the AGCM is investigating Lyoness for misleading advertising, unfair commercial practices, contractual violation of consumer rights and the use of discriminating or unfair terms and conditions.

Not surprisingly, the finer details of the AGCM’s investigation sounds like your typical Ponzi pyramid affair.

Lyoness, in the exercise of his own activity of promotion and a system of cashback, has put in place an unfair commercial practice that requires significant amount (of money) for access to the Multi Level Marketing.

(The MLM entry fee) and other significant amounts are presented as “advances” with respect to the cash back future earnings.

The methods for presenting the sales scheme created by Lyoness – and by affiliates promoting it – appear to be potentially based on incomplete representations (that are) not transparent and (create a false impression for) consumers who pay money to enter the System.

Specifically;

(i) the terms and conditions of the (Lyoness) Program presented to consumers, which explain the nature of the commitment that the consumer assumes by signing up for (Lyoness) membership;

(ii) the actual probability of obtaining profits by adhering to the scheme proposed by Lyoness;

(iii) to the normatively provided information. (Ozedit: Not sure what (iii) is supposed to mean)

Lyoness affiliates invest funds in shopping units and then set about recruiting others who do the same.

Once enough new investment has been made, Lyoness take a percentage of it and use it to pay existing affiliates a ROI.

The cashback side of the business is used to justify this baked in Ponzi scheme.

What’s never disclosed to consumers, as AGCM will no doubt find out, is that the length of time and raw dollars required to generate similar income, as opposed to straight investment in units, is not comparable.

Lyoness uses cashback to lure unsuspecting consumers into its Ponzi net.

Once they’ve got shopping units under them, they eventually realize they’re not realistically going to see that money unless they invest and then get others to invest.

The exception is individuals who manage to convince thousands, if not hundreds of thousands of shoppers to sign up under them – typically through large groups.

In the past we’ve seen this shamelessly take place through government councils and sporting clubs.

AGCM’s investigation is significant for Lyoness, as for well over a year now Italy has made up the bulk of new investment into the company.

At the time of publication Alexa cite Italy as providing 46% and 32% of traffic to the Lyoness and Lyconet websites respectively.

Lyoness’ business model typically sees the company focus on migrating to a new market when either recruitment collapses or regulators shut it down.

Victims in existing markets are promised riches if they help recruitment efforts in the chosen new country, which also serves to stop them cooperating with authorities and/or filing complaints against the company.

Unsuspecting consumers are targeted in the new country for a set period of time. If Lyoness fails to take off then a new country is targeted.

If, as in the case of Italy, Lyoness takes off, consumers are milked dry until recruitment dries up or regulators step in.

Wash, rinse and repeat.

As of yet a successor country for Lyoness to pillage if Italian recruitment is shut down hasn’t emerged.

Poland, sitting at 13% of traffic to the Lyconet website, could be a contender but it’s still too early to tell.

Update 26th September 2018 – A reader contacted me to let me know they couldn’t find information on the Lyoness preliminary investigation in Italian.

I thought this was odd, seeing as we’d linked to the AGCM source announcement in our article.

Turns out within 24 hours of this article going live AGCM removed any mention of the preliminary investigation from their website.

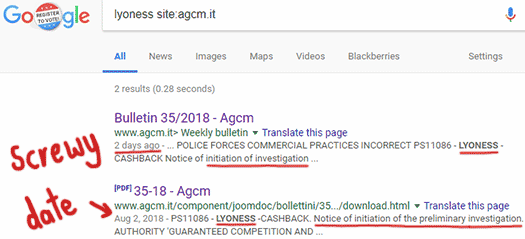

Here’s a copy of Google cache search results, proving that the announcement was made:

No idea why mention of the investigation was removed. The bulletin document did contain a bunch of other information, so perhaps there was something else in there they weren’t ready to share with the public yet (or it could have been the Lyoness investigation itself).

Update 28th September 2018 – Some time in the last 24 hours AGCM has restored access to the September 24th bulletin.

Update 15th January 2019 – AGCM has concluded Lyoness is a pyramid scheme and fined the company €3.2 million euro.

Article updated with evidence AGCM made the investigation announcement after they removed access to it.

link for the official doc (Lyoness pag 23): (www.)agcm.it/dotcmsdoc/bollettini/2018/35-18.pdf

Ah, it’s back up. Thanks for that.

Opinions Upon opinions.

Once again (like in the last 15 years) – zero countrys closed.

Haters gonna hate.

Norway. Scammers gon’ scam.

There is also number of countries Lyoness did not manage to install the fraudulent system in, which did not prevent some citizens from being ripped-off however.

Paraguay in 2013 for example:

cc-lyoness.blogspot.com/2013/05/lyoness-paraguay-win-win-win.html

Oz the office it’s still working.

The Cashback program it’s still working.

I already explained to you how the government structure works in Norway once. You still think that the ministry of arts and culture that regulate games have authority to close a company!

Haters gon’ hate

Lyoness shut down it’s AU Ponzi in Italy, I just haven’t put together an article on it yet. Will have one up soon.

As for Norway, fact remains Lyoness is illegal in Norway. The Gaming Board regulate the MLM industry in Norway (at least as far as Ponzi and pyramid schemes go).

You can ignore the facts but they are what they are.

Oz – you might need to read the latest news from Lottstift on Lyoness…

NOLINK – lottstift.no/wp-content/uploads/2018/06/Lyoness-beslutning-om-utsatt-iverksetting-av-vedtak-med-p%C3%A5legg-om-stans-jf-532760_5_1.pdf

So – xuxa is somewhat right… Yes – Cashback should still work…

However – what xuxa is leaving out is that…

1) NO new representatives are allowed in the company

2) NO new loyalty companies are allowed in their Ponzi System

3) NO discount coupons are allowed to be sold

4) NO shares in their “ponzi cloud” are allowed to be sold.

This is until their appeal has been handled – however , what xuxa also is leaving out is that…

The Ponzi side of Lyoness is essentially the MLM side of the business being banned.

Nobody cares about the cashback. If you look at companies where the Ponzi has collapsed, once AU recruitment collapses the cashback does not survive on its own.

It still might technically be available but the merchant network collapses and people stop recruiting new shoppers, in favor of recruitment of new investors in whatever the reboot region is (Italy in this case, possible Poland after).

Thank you for your work on this.

Lyoness under preliminary investigation in Germany, too. 🙂

I wrote this: gazzettadiretta.com/lyoness-sotto-accusa-in-germania-per-schema-ponzi/

Source: diepresse.com/home/wirtschaft/unternehmen/5349853/Betrugsverdacht_Staatsanwaltschaft-ermittelt-gegen-Lyoness

bild.de/news/inland/instagram/system-lyoness-in-bild-sprechen-menschen-die-sich-betrogen-fuehlen-55506918.bild.html

According to correspondence betwin authorities in norway and italy the italian investigation will come to a conclusion in december.

Where did you get this info?

Lottstift.no (lottery agency website in norway)

Can you provide a link? I can’t find any recent news. Thank you.

Diskusjon.no/uploads/monthly_11_2018/post-485796-0-90832400-1543406294.jpg