BNB Profit Review: BinanceCoin 200% ROI bandwagon Ponzi

BNB Profit provides no information on its website about who owns or runs the company.

BNB Profit provides no information on its website about who owns or runs the company.

BNB Profit’s website domain (“bnbprofit.io”) was privately registered on March 4th, 2021.

A YouTube video embedded on BNB Profit’s website is titled “BNB Profit Presentation Zoom with Jose 4-13-2021”.

At approximately [0:53] into the video the man Jose does identify himself but I couldn’t catch his last name.

Jose thanks Andrew Curto for “inviting” him to speak on the presentation. Fortune Five, the YouTube channel hosting the video, has multiple videos featuring Curto.

According to Andrew Curto’s Facebook profile he’s based out of Arizona.

Prior to BNB Profit Curto was promoting the TronCase Ponzi scheme.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Silwana Global Review: GogolCoin Ponzi points

Silwana Global appears to have launched last year as Silwana Diamond.

Silwana Global appears to have launched last year as Silwana Diamond.

Silwana Diamond will create the largest platform for farmers and buyers from all over the world, enabling them to easily communicate with each other, and have fruitful transactions and trading of local and international commodities.

This way; the brokers will be cut and their commissions in turn will benefit you directly.

Around mid 2020 Silwana Diamond was ditched for Silwana Global. The name-change coincided with the introduction of GogolCoin.

Today Silwana Global operates from “silwanaglobal.com” (registered April 2020).

Heading up Silwana Global and GogolCoin is founder and CEO Feras Abu-Hdaib (right).

Heading up Silwana Global and GogolCoin is founder and CEO Feras Abu-Hdaib (right).

As of January 2021, Abu-Hdaib is based out of Dubai in the UAE.

Possibly due to language-barriers, I was unable to put together an MLM history on Abu-Hdaib. From what I was able to piece together though, Silwana Global appears to be his first MLM venture.

Read on for a full review of Silwana Global’s MLM opportunity. [Continue reading…]

Up2Give’s failed Helium Network venture

Up2Give was launched by Jerry Lopez in late 2019.

Up2Give was launched by Jerry Lopez in late 2019.

A fraudulent gifting scheme, Up2Give as it originally launched collapsed mid last year.

Lopez however was intent on further milking Up2Give participants. Cue the introduction of U2G Network late last year. [Continue reading…]

Alan Friedland playing fast and loose with fraud evidence

Alan Friedland (right) appears to be withholding evidence from the CFTC.

Alan Friedland (right) appears to be withholding evidence from the CFTC.

Outstanding requests for production of documents to Friedland date back to August 2020.

After eight months of stuffing around on Friedland’s part, on April 9th the CFTC filed a motion seeking to compel production. [Continue reading…]

Crunchi Review: No comp plan? Avoid.

![]() I hit a brick wall researching Crunchi. I searched high and low and couldn’t find a copy of their compensation plan.

I hit a brick wall researching Crunchi. I searched high and low and couldn’t find a copy of their compensation plan.

Not an original document. Not a presentation. Not even a summary – outdated or otherwise.

Oz, why don’t reach out to MLM companies for information. I’m sure they’d be happy to provide you with what you need! [Continue reading…]

DOJ intervenes in SEC’s Krstic case, stay granted

![]() The DOJ has been granted an intervention in the SEC’s civil case against Kristijan Krstic, John DeMarr and Robin Enos.

The DOJ has been granted an intervention in the SEC’s civil case against Kristijan Krstic, John DeMarr and Robin Enos.

The granted intervention is followed by an order staying the case, pending the outcome of parallel criminal proceedings. [Continue reading…]

Impero Solutions Review: 2.1% a day Boris CEO Ponzi

Impero Solutions provides no information about who owns or runs the company on its website.

Impero Solutions provides no information about who owns or runs the company on its website.

Impero Solutions’ website domain (“impero.solutions”) was registered on September 3rd, 2020.

Impero Solutions is listed as the domain owner, through a redacted address in Quebec, Canada.

To that end Impero Solutions also provides a corporate address in Montreal, Quebec on their website.

Further research however reveals this address actually belongs to Regus, who sell virtual office addresses.

In a further attempt to tie itself to Canada, Impero Solutions provides Canadian incorporation documents for Impero Solutions Limited.

Considering the same virtual address appears on these incorporation documents, one can safely dismiss Impero Solutions Limited as a shell company.

In other words, Impero Solutions has no actual ties to Canada.

Impero Solutions pretending to be based out of Canada hasn’t gone unnoticed by Canadian authorities.

Quebec’s financial regulator Autorite des Marches Financiers has added Impero Solutions Limited to its “warning list of companies that solicit investors illegally”.

The British Columbia Securities Commissions also put out an Impero Solutions securities fraud notice on March 15th.

On or around December 2020 Impero Solutions presented this actor as their CEO, William Morrison.

The actor playing Morrison appears to have a British accent. He is very clearly reading off a script.

The actor playing Morrison misrepresents Impero Solutions’ Canadian incorporation as requiring an audit, and giving the company permission to offer securities all over the world.

As opposed to going the usual Boris CEO route and uploading a rented office video, Impero Solutions staged a catered corporate event.

Likely to mask the accent of the extras hired, the video is dubbed over with elevator music.

I didn’t find anything overtly Russian in the video but this is typically the playbook of Russian scammers.

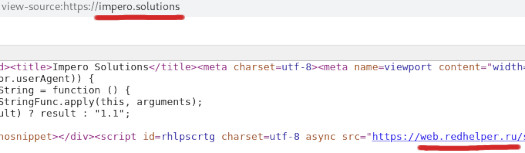

What I did find was a reference to RedHelper in Impero Solution’s website source-code:

RedHelper are behind the chat bot functionality that appears on Impero Solution’s website.

RedHelper doesn’t have anything to with Impero Solutions beyond providing a web service. It is however a Russian company targeting Russian clients.

Impero Solutions appears to be Russian scammers pretending to be in Canada with the usual Boris CEO actor videos.

Alexa currently ranks the top sources of traffic to Impero Solutions as the US (65%), Canada (4%) and Australia (2%).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Coop5050 Review: David Rosen’s 2020 gifting scheme reboot

Coop5050 provides no information on its website about who owns or runs the company.

Coop5050 provides no information on its website about who owns or runs the company.

Coop5050’s website domain (“coop5050.com”) was first registered in 2018. The private registration was last updated on November 4th, 2020.

To suss out who’s behind Coop5050 we have to turn to social media:

David T. Rosen first popped up on BehindMLM’s radar in 2015, as founder of the PIE 24/7 pyramid scheme.

In early 2018 Rosen launched Cooperative Crowdfunding, a matrix-based gifting scheme. This was followed by 50/50 Crowdfunding in late 2018.

In late 2019 Rosen rebooted 50/50 Crowdfunding as CoopCrowd. That brings us to the late 2020 reboot launch of Coop5050.

David Rosen is believed to run his various scams from Ontario, Canada.

Alexa traffic analysis reveals Coop5050 recruitment is currently taking place in the US (71%) and Dominican Republic (22%).

Read on for a full review of Coop5050’s MLM opportunity. [Continue reading…]

Bitles securities fraud cease and desist from Texas

Bitles has received an emergency securities fraud cease and desist from Texas in the US.

Bitles has received an emergency securities fraud cease and desist from Texas in the US.

The Texas State Securities references Bitles Limited, Janis Lacis, C3 Data Services and Edward Carter. [Continue reading…]

Ncrease Review: Top iBuumerang promoters launch own opp

![]() Ncrease launched in late 2020. The company is based out of Texas and operates in the personal care and education MLM niches.

Ncrease launched in late 2020. The company is based out of Texas and operates in the personal care and education MLM niches.

Heading up Ncrease are co-founders Karen and Peter Hirsch. For some reason only Karen Hirsch is credited on Ncrease’s website.

Karen Hirsch serves as Ncrease’s CEO. Peter Hirsch is the company’s Chief Visionary Officer.

Karen Hirsch serves as Ncrease’s CEO. Peter Hirsch is the company’s Chief Visionary Officer.

Right up until they launched Ncrease on or around November 2020, the Hirschs were iBuumerang distributors.

In July 2020 BusinessForHome reported the couple had earned $1 million over 15 months at iBuumerang.

I wasn’t able to ascertain why the Hirsch’s abandoned their top position within iBuumerang.

According to her LinkedIn profile, Karen Hirsch has MLM executive experience through Traverus Global.

Traverus Global owns Xstream Travel, who offer travel services through Paycation (defunct) and iBuumerang.

Peter Hirsch markets himself as a social entrepreneur. In addition to being an iBuumerang top earner, he also held an executive division at the company’s charitable Buum Foundation.

In 1999 Hirsch was a named defendant in an FTC lawsuit against 2Xtreme and its successor USAsurance Group/Akahi.

The FTC described the companies as “a vast pyramid scheme (that) claims to have recruited more than 60,000 consumers”.

An $80 million dollar final judgment was entered into against Hirsch on January 29th, 2001.

Hirsch appears to have kept his nose out of regulatory trouble since then.

Read on for a full review of Ncrease’s MLM opportunity. [Continue reading…]