AddWallet Review: Third incarnation of WCA?

There is no information on the Addwallet website indicating who owns or runs the business.

The company’s website domain (“addwallet.com”) was registered on the 26th of December 2012, however the domain registration information is set to private.

Further research into the ownership of Addwallet however has revealed one unconfirmed possibility.

Back when AddWallet first launched a few weeks ago, the website was hosted on a server hosted on the 63.208.1.30 IP address. According to two independent WHOIS records, another domain (and attached subdomains) were also being hosted on this address.

A Google cache of HypeStat reveals one other website on the same domain:

With TrustOrg showing additional subdomains:

Out of the above domains, “wcanow.com” and “members.wcanow.com” are of concern to our research. For those not familiar with the seedier side of the MLM industry, WCA stands for World Consumer Alliance.

World Consumer Alliance is a $2 micro Ponzi scheme started by Paul Skulitz back in late 2012 under the name Wealth Creation Alliance (WCAREV).

Following the initial launch of Wealth Creation Alliance, CEO “Coach” Blaine announce the company was changing its name to World Consumer Alliance, after it was revealed a previous “Wealth Creation Alliance” had turned out to be a scam.

Despite being a Ponzi scheme themselves, Blaine explained they didn’t want to be associated with the previous WCA scam (which had no connection to Skulitz’s new WCA).

In a further attempt to distance itself from the name, the company then later changed its website domain from “wcarev.com” to “wcanow.com”.

Not surprisingly, in early January members of World Consumer Alliance began reporting that the company was not paying its members. Coincidentally, this was also around the time AddWallet was first announced.

The obvious theory here would be that after convincing thousands of people to invest in Wealth Creation Alliance and World Consumer Alliance, that the admins had paid out what they could (initial Ponzi ROIs attract new investors), and were now looking to launch a new scheme under the “AddWallet” name.

This certainly explains why there’s no management or owner information on the AddWallet website and the domain registration is set to private.

To date, no explanation has been provided by either AddWallet or World Consumer Alliance as to why the two company’s websites were being hosted off the same domain.

As late as a week or so ago, both the AddWallet and World Consumer Alliance websites were moved off the shared hosting account and placed on their own dedicated hosting servers.

Update 30th March 2013 – On a recent AdWallet affiliate call Louis Cordero was named as the Ecuador based CEO of AddWallet.

Brandon Bradshaw was also named as Vice-President (based in Florida in the US) and Logan Chamberlain as CFO (based in Ecuador).

An AddWallet presentation I was recently forwarded also names AddWallet as a subsidiary of “Cartera International”, allegedly a registered corporation in Ecuador. /end update

Read on for a full review of the AddWallet MLM business opportunity.

Auruma International Review: Bullion & recruitment

Auruma International was launched in late 2011 by CEO Victor Foo. Foo, a Malaysian national, operates Auruma out of Singapore however the company itself is actually incorporated in the British Virgin Islands (a known tax haven).

Foo has been involved in the insurance industry since 1991, with Auruma appearing to be his first MLM venture.

In addition to Auruma, Foo (photo right) has also operated SG Net Pte Ltd since 2009. SG Net

offers customers a platform to buy and sell physical gold and silver products on a secured online portal.

In early 2012 Foo launched a third venture, Singapore Precious Metals Exchange Pte Ltd (SGPMX). SGPMX is a “valuables” storage facility that ‘offers clients anonymity as well as speedy transactions‘.

SGPMX has a $1 million USD minimum deposit rule and operates out of a “free trade zone” that has been established next to Changi International Airport.

Citing Malaysia’s Kuala Lumpur International Airport (KLIA) as a comparison, Foo told “The Star Online” back in February 2012 that

Moving 100kg of gold from your house to KLIA is no laughing matter. To clear a consignment at KLIA takes at least 45 minutes. But at Changi Airport, it takes only three minutes.

If you are a high nett worth individual, you wouldn’t want to expose yourself and you don’t want your name to appear in the export papers.

Foo reassured The Star however that he wasn’t ‘going to be laundering any blood money‘ though, because if he was ‘the Singapore authorities will close (him) down‘.

In an interview with “AurumaWorld” (April 2011), Foo claimed he set up Auruma after his previously launched SG Net business stabilised:

After SG Net found it’s footing, I started to look for easily accessible avenues for the man in the street to preserve his, or her, wealth.

That was what prompted me leverage on SG Net’s infrastructure and to start Auruma International.

Read on for a full review of the Auruma International MLM business opportunity. [Continue reading…]

How is Inspired Living Application being marketed?

In BehindMLM’s recent review of Inspired Living Application (also known as iLA), I identified a concern regarding the viability of charging people $6.95 for library access to videos that are initially given away for free, and a further $3 to participate in the iLA income opportunity.

Although the $6.95 product is iLA’s retail offering, I wasn’t entirely convinced people were going to pay $6.95 for library access, especially when they can receive iLA’s weekly videos for free.

Over time iLA might amass a sizeable library worth charging $6.95 a month for, but what happens until then?

With the income opportunity priced just $3 more, I suspected that most people are going to sign up as an affiliate, with little to no retail activity occurring within the company.

Shortly after publication of my Inspired Living Application Review, company president and co-owner John Rodgers sought to address some of the concerns I’d raised:

The difference between the free membership and the retail membership is huge. Access to the archive will be of tremendous value.

I would add that I think that it’s premature to speak of the “lack of value” in the product when you have yet to see the product. We will be very confident in our product as we will be producing it.

I think that you’ll find that when our final marketing pieces are done (we have not even opened for prelaunch at this time and a lot of things are in progress) you will find that we will not be beating on the “money drum” in the way that a lot of MLM companies have been known to.

Regarding the value of the library retail membership, despite my concerns I agreed that it wouldn’t be until an official launch that the ratio of retail customers vs. affiliates would be useable as an indication of the makeup of the company.

With Inspired Living Application’s prelaunch set for February 1st and full launch in “early April” (iLA FAQ, cited 20th January, 2012), no doubt how the company is being marketed today will set the tone and culture for the future of the business.

So right here right now, how is iLA being marketed?

Today I thought we’d take a look at the first page of Google results and analyse how iLA affiliates are marketing Inspired Living Application. [Continue reading…]

AdvanX3 Review: A $10 a month “investment”?

There is no information on the AdvanX3 website indicating who owns or runs the business, with the company only providing the following vague statement:

AdvanX3 was recently established by four executive professionals with a combined experience of over 60 years in the direct sales industry.

AdvanX3 does provide a company address in the US state of Washington, however the company’s website domain registration is set to private (registered 25th April, 2012).

A “Loren Taylor” is named as company President, with Advanx3 claiming that Taylor has ‘vast experience in sales via technologically advanced Internet marketing‘ and ‘has created and managed over 35 companies that have been successful in reaping the benefits of marketing via the Internet‘.

AdvanX3 does not clarify whether or not Taylor is one of the “four executive professionals” they cite as being the co-founders of the company.

Additionally, despite the claims made by AdvanX3 above I wasn’t able to find much of an online MLM history on Taylor.

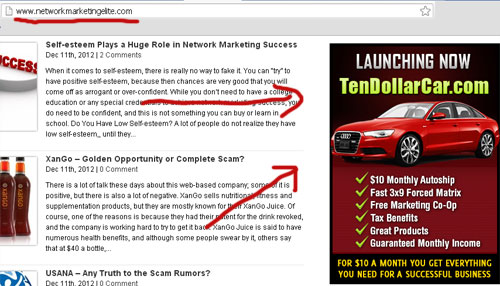

At the end of an eZineArticles article written by Taylor in June 2012 he cites himself as a “writer” of the “NetworkMarketingElite” blog:

There is no information on the NetworkMarketingElite website indicating who owns the site (domain registration also set to private), with the site appearing to be not much more than marketing spam targeting various MLM company names and the word “scam”.

One particular entry for EPXBody however does include affiliate links for a “taylor” (credited as an anonymous “team leader”):

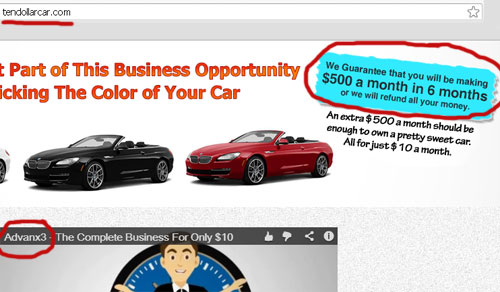

Meanwhile on the main homepage of the NetworkMarketingElite blog, this huge ad for something called “TenDollarCar” caught my eye:

Noting that it sounded an awful like what I’d read thus far on Advanx3 itself and with the ad claiming the TenDollarCar opportunity was “launching now”, I clicked through, only to be hit with the same welcome video that appears on the AdvanX3 website:

Also note the worrying “you will earn $500 a month within 6 months” guarantee offered on the top right of the site.

Why the AdvanX3 promotional video is playing on the TenDollarCar website I have no idea, but I can tell you that the TenDollarCar domain was registered on the 23rd of August 2011.

And the owner?

None other than Loren Taylor, with the exact same Washington address provided as that given on the AdvanX3 website as their corporate headquarters.

Putting all of the above information together, TenDollarCar was launched in 2011 by Loren Taylor and after that crashed and burned he then joined EPXBody at some point (that was the only MLM company link I found, although I didn’t look very hard). Taylor promoted his EPXBody business and TenDollarCar (or tried to) via the NetworkMarketingElite blog.

Now it appears Taylor is back and is trying to relaunch the $10 a month concept he started with TenDollarCar, only without the raffle ticket scheme.

Call me cynical but I’m going to go out on a limb here and suggest that Taylor himself is the owner of AdvanX3. Whether the “four executive professionals” AdvanX3 cite exist (or three if Taylor is one of them) remains to be seen.

Read on for a full review of the AdvanX3 MLM business opportunity. [Continue reading…]

Chartfords Review: Fine art & MLM?

![]()

There is no information on the Chartfords website indicating who owns or runs the business.

An address in Canada is provided on the Chartfords website, however a Google search reveals mulitple businesses operating out of this address meaning it’s most likely just virtual office space (mailing address).

The domain registration for the Chartfords website (“chartfords.com”) only adds confusion to the mix, providing another address in Kent, UK under the registrant “Midas Marketing Group”.

Midas Marketing Group have their own website over at “midasgrp.co.uk” which is currently promoting the Chartfords MLM opportunity:

The Midas Marketing Group website domain registration lists a “Barrie Sapsford” as the owner, operating out of Essex in the UK.

On his Facebook profile Barrie Sapsford credits himself as the Director of Midas Marketing Group since early 2000:

I wasn’t able to dig up any further MLM history on Sapsford, possibly indicating that Chartfords is his first MLM venture.

Read on for a full review of the Chartfords MLM business opportunity. [Continue reading…]

Residual Cash Ads Review: 2 level $9 Ponzi scheme

There is no information on the Residual Cash Ads website indicating who owns or runs the business.

The Residual Cash Ads website domain (“residualcashads.com”) was registered on the 24th of December 2012 and names a “Katie Buchanan” as the domain owner.

An address in the US state of Alaska is also provided:

KATIE Buchanan

New York

New York, Alaska 10016

United States

However this appears to be fake. New York and Alaska are both US states with the provided postcode being in New York. New York most certainly isn’t in Alaska.

As such I’m going to go out on a limb here and suggest that “Katie Buchnanan” in all likelihood doesn’t exist either.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Herbalife Review: Pyramid scheme or not?

Herbalife operate in the health and wellness niche of the MLM industry and is based out of the US state of California, however is incorporated in the Cayman Islands (a known tax-haven).

Herbalife was founded way back in 1980 by Mark Hughes, who purportedly sold Herbalife products “from the trunk of his car”.

Hughes often stated that the genesis of his product and program stemmed from the weight loss concerns of his mother Joanne, whose premature death he attributed to an eating disorder and an unhealthy approach to weight loss.

His goal was to change the nutritional habits of the world.

Despite achieving success with Herbalife however, Hughes died in 2000 from an ‘accidental overdose of alcohol and doxepin, an anti-depressant‘.

What the exact story there is I’m not sure but Herbalife continued to plough along and today is headed up by Chairman and CEO Michael Johnson (photo right).

For a broader history of Herbalife be sure to check out their Wikipedia entry, whereas here I’m going to focus on three recent events involving the company.

In November 2011, after seven years of litigation, the Commercial Court in Belgium ruled that Herbalife was a pyramid scheme.

The case was brought forward by the non-profit organisation “Test Aankoop” and claims that Herbalife breached the WPMC (market practices act) by running a pyramid scheme.

In response, Herbalife filed a defamation counterclaim (surprise surprise) against Test Aankoop.

As is often the case here on BehindMLM, analysis by the court focused on the revenue makeup of Herbalife and what its distributors were primarily compensated for doing.

In comparing retail and downline (internal consumption commissions), the court noted

the provided incomes out of the distribution network are therefore significantly higher as the provided incomes from the same amount of clients (retail customers).

And that

there is a chance of a compensation which is derived primarily from delivering (recruiting) new distributors into the system then out of the sale or the usage of the products.

Furthermore the most purchases were performed against a discount percentage of 25% and 35%, which shows that Herbalife is getting the biggest part of her profit out of the distributors.

Following the foregoing shows that it is a lot more profitable for a supervisor to sell to a distributor, rather than selling directly to a consumer.

Herbalife tried to argue that their distributors purchasing product counted as retail sales (with the distributors purportedly eventually selling the product purchased to retail customers), but ultimately failed.

Curiously, in making such a claim Herbalife attempted to place the burden of proof in proving that their distributors went on to sell internally purchased products to retail customers on Test Aankoop, rather than themselves.

Herbalife of course couldn’t provide any proof as they don’t track what their distributors do with purchased product (despite have a 70% rule in their distributor agreement), with the court rejecting the notion that Test Aankoop prove Herbalife’s claim.

Ultimately the Commercial Court found Herbalife

in breach of Articles 91, 4 and 99 of the Act regarding market practises and consumer protection because it has established,managed or promoted a pyramid scheme.

The defamation counterclaim against Test Aankoop was dismissed. The entire order from the Commercial Court can be viewed here.

Fast forward to December 2012 and it is this time in the US that pyramid scheme allegations arise. On the 20th of December 2012, hedge fund manager Bill Ackman (photo right) gave a three-hour long presentation detailing why he believed Herbalife was a “modern day Ponzi scheme”.

Accompanying the presentation was a 300 page long slideshow, which after the presentation Ackman said would be “handed over to the regulators”.

Ackman’s claims were instantly dismissed by Herbalife CEO Michael Johnson, who claimed that Ackman’s presentation was ‘a ridiculous assertion by people who are trying to manipulate our stock‘.

Johnson, who was America’s best paid chief executive in 2011, said his lawyers “would go crazy” if he went into too much detail about why Ackman’s analysis was “bogus”.

He added that he would ask the US Securities and Exchange Commission to investigate the hedge fund tycoon’s motives.

And it appears investigate they will.

On January 9th 2012, it was uncovered that the SEC (New York) had launched an “inquiry” not into Ackman, but into Herbalife itself:

The Securities and Exchange Commission has opened an inquiry into Herbalife Ltd. amid an intensifying public battle between the seller of nutritional supplements and a hedge fund that argues it is a pyramid scheme, a person close to the probe said Wednesday.

The inquiry is being led by enforcement officials in the SEC’s New York office, the person said.

The probe won’t necessarily result in any enforcement action, but it adds pressure on Herbalife a day before a meeting with investors at which the direct seller has promised a full rebuttal of the allegations lodged by hedge-fund manager William Ackman.

The inquiry by the SEC’s enforcement division follows scrutiny of Herbalife’s financial disclosures by the regulator’s corporation finance division last year.

A spokeswoman for the SEC declined to comment. Herbalife had no immediate comment.

I myself haven’t read Ackman’s presentation or written anything up till now on this issue, and that’s solely because to date I haven’t reviewed Herbalife on BehindMLM.

Typically I place established MLM companies towards the bottom of my review list because there’s usually more than enough information out there on them. Newer companies tend to have less information out there on them and as such I tend to favour researching and analysing them first.

With the recent developments surrounding Herbalife however and potential SEC action looming later in the year, it occurred to me that if I want to comment and write on the subject with any real confidence, then I’ll first have to do a formal review Herbalife and its business model. So here it is.

Read on for a full review of the Herbalife MLM business opportunity. [Continue reading…]

Blue Bird Bids autobidding bot mystery deepens…

Bogus Bidders: Bots and Shills

Some dishonest auction sites use bid bots, which are computer programs that automatically bid on behalf of the website. And some fraudulent sites achieve the same effect using human shills.

You may be seconds away from winning an auction when another user places a bid. That keeps the clock ticking, and forces you into a bidding war to stay in first place.

Though the bidder appears to be another user, it may be a shill, or a bot programmed by the website to extend the auction and keep people bidding (and spending money) as they chase the “win.”

-FTC on penny auction autobidding bots (onguardonline.gov)

Earlier this month (possibly the last few days of December 2012), Blue Bird Bids pulled down their penny auctions citing the need for “maintenance”, “rigorous testing” and “behind the scenes structural changes” be carried out.

Earlier this month (possibly the last few days of December 2012), Blue Bird Bids pulled down their penny auctions citing the need for “maintenance”, “rigorous testing” and “behind the scenes structural changes” be carried out.

Once the auctions were down, Blue Bird Bids stated that the required maintenance would occur over ‘the next 72 hours or so‘ and that they would have ‘all functions back and running no later than Tuesday Jan 8th or Wednesday Jan 9th‘.

Well over 72 hours after this announcement was made the Blue Bird Bids penny auctions are still down, however that’s not to say things haven’t been happening behind the scenes… [Continue reading…]

Inspired Living Application Review: Mobile videos

There is no information on the Inspired Living Application website indicating who owns or runs the business, however going by the provided street address appears to be operating out of the US state of Oregon.

The company’s website domain (livingapp.com) was registered on the 13th of October 2012 and lists a “John Rodgers” as the owner.

Rodgers (photo right) was a “founding representative” of Zurvita (2008) under the branding of “FoundersTeam”. The FoundersTeam website is now defunct and redirects to that of Inspired Living Application.

On one of Rodger’s Zurvita marketing pages, Rodger’s states that ‘much of (his) background is in the ministry serving as a Bible teacher in Oregon‘.

No idea what happened with Zurvita (or when he left), but it appears John Rodgers has decided to launch his own MLM opportunity with Inspired Living Application. Read on for a full review. [Continue reading…]

Blue Bird Bids VP raises concern over auction bots

With the introduction of customer bid bots placing automated bids for customers in penny auctions, one of the ongoing concerns those who participate in the auctions has been that of legitimacy.

With the introduction of customer bid bots placing automated bids for customers in penny auctions, one of the ongoing concerns those who participate in the auctions has been that of legitimacy.

From a penny auction customer viewpoint there’s pretty much no way to verify that they are indeed bidding against actual customers, especially when automated bidding bots are outbidding them in under a second.

Am I bidding against actual customers or “the system”?

As we all know, the more bids used in a penny auction the higher the revenue for the company running them. In an MLM penny auction, this usually also means higher commission payouts for the field.

One of the shortfalls of the MLM penny auction model is that the companies rely on their affiliates to advertising for them and attract auction customers. The affiliates of course only do this if they’re getting paid.

In a legit MLM penny auction the affiliates only get paid when the auctions do well, so it’s a bit of a catch-22.

One potential way for an MLM company to ensure their affiliates earn enough commissions is to have what penny auctions customers the company does have, bidding against bots run by the company itself.

At the cost of undermining the legitimacy and integrity of their penny auctions, an MLM penny auction can thus ensure their affiliates are earning enough to continue promoting the opportunity.

Usually it’s penny auction customers who raise concerns, as ultimately they are the ones who lose money bidding against company run bots they cannot win against (or have to spend so much in bids to win against that it’s not worth their time).

In a recent email sent out to Blue Bird Bids corporate however, Vice-President Eric Swaim expressed some penny auction bot concerns of his own. [Continue reading…]