Craddock abandons BTG180 legal action

Just twenty-four hours after announcing BTG180 had been “classified as a Ponzi scheme“, Robert Craddock is now abandoning his plans to launch legal action against the company.

Craddock’s short but colourful campaign saw him urge BTG180 affiliates to contact a journalist and file scripted complaints with local authorities.

BTG180 were quick to respond, threatening to file their own legal action against Craddock. BTG accused Craddock of failing to perform the duties the company paid him for and using “disparaging tactics”. [Continue reading…]

Craddock: “BTG180 has been classified a Ponzi”

In what appears to be a direct response to BTG180’s claims of legal action being taken against him yesterday, Robert Craddock has escalated the war he is currently waging against the company.

In a BTGLegal update email, Craddock is now claiming that BTG180 ‘has been classified as a Ponzi Scheme‘. [Continue reading…]

Kettner: Being a top Zeek winner “is a laugh”

According to court-filed documents, Mary Ann Kettner withdrew $465,866 of her fellow Zeek affiliate’s money off an initial investment of $1495. For her part in receiving a 31,161% ROI and refusing to pay it back to the victims she effectively stole from, the Zeek Receiver yesterday named and shamed Kettner as a top Zeek Ponzi profiteer.

Her response?

“What a laugh”. [Continue reading…]

BTG180 to hit Robert Craddock with legal action

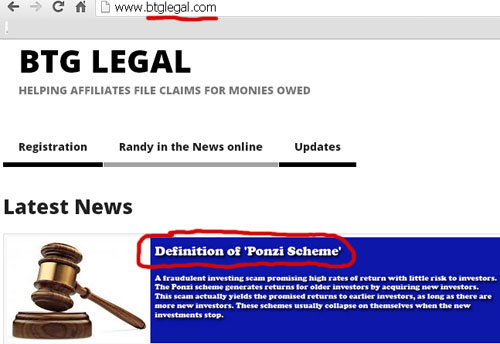

The BTGLegal website (“btglegal.com”) was anonymously registered on the 11th of December 2013.

In addition to providing visitors with an uncredited “definition of a Ponzi scheme”, the site paints a pretty bleak picture of the BTG180 MLM business opportunity.

If you have landed here due to broken promises, missed commission and the overall feeling of being taken, well you are not alone.

Most people join a program with high expectations and assume the company and management will act in a professional and honest manor, but when that does not happen, the normal tactic for the company, owner or both is to attack the very people that went to work sometimes 18 hours a day to help build the company.

All they ask is to receive the commissions they were promised and to not have a never changing set of conditions in which they can withdraw their monies earned.

As we move forward we will post the complaint, information we have learned and all documents associated with the ongoing action.

If the need arises we will work with law enforcement, state and federal regulators in any investigation they decide to conduct into the actions of person(s) associated with the BTG, BTG180, Liberty Freedom Network, Freedom Lifestyle and others connected with Mr. Jeffers

We appreciate your help and support as we move forward to correct the concerns now facing most of the people that were once and currently associated with the Bids that Gives program and BTG180.

Broken promises, missed commission payouts and the feeling of being taken? If the above is to be believed than things are sounding pretty dire over at BTG180.

For those not familiar with BTG180 (formerly Bids That Give), the company runs on the familiar MLM revenue-sharing penny auction business model.

BTG180 Affiliates invest in bids and via a point system, the company uses this money to pay out affiliate investors who have previously invested in bids.

Once affiliates stop investing new money into the scheme, the company runs out of money and can’t pay out affiliates.

In addition to the gloomy picture painted above, the BTGLegal website also urges BTG180 affiliates to ‘tell (their) story and post (their) experience in dealing with the BTG regime‘ on the BBB and Ripoff Report website.

Affiliates are also told to contact ‘ABC investigative reporter Matt Gutman‘.

If you would send him your story and how you were encouraged by Randy to purchase the business in a box package.

Go in detail how you were told it would pay you a daily income and, help kids at the same time. I would suspect this is a national story they would want to do.

The site also promises a weekly update every Monday at 8pm EST,

to let everyone know how we are doing and things we have learned.

We will have different people on explaining how they were misled by this company

Phone: 559-726-1300

Pin: 457659

Despite the first person prose used on the BTGLegal website, no information is provided as to who is behind the campaign.

Publishing an official response to what they label as “disparaging tactics” however, BTG180 out the creator of BTGLegal as none other than Robert Craddock.

That Robert Craddock?

Yup. [Continue reading…]

Zeek Rewards top Ponzi winners named & shamed

You invested in the Zeek Rewards Ponzi scheme, you collectively ripped off millions of dollars from thousands of people and you got caught.

Not only that but in the aftermath of the Zeek Rewards SEC shut down, some sixteen months later, there are still those who feel they are entitled to the money they illegally obtained.

Back in August I raised the question of whether or not Zeek’s top Ponzi pimps would be named and shamed. Specifically those who made the most money in the scheme and now refuse to pay back their victims.

Things certainly looked promising in the Zeek Receiver’s third quarter report, filed October 31st:

As of September 30, 2013, the Receiver estimates that net winner Affiliate-Investors received over $283 million in fraudulent transfers from the Receivership Defendant.

The Receiver’s litigation team continues to evaluate the most efficient and cost-effective method for pursuing fraudulent transfer claims.

As reported previously, the Receiver’s clawback litigation is likely to be a combination of individual actions, group actions, defendant class actions, and other alternative dispute resolutions as approved by the Court.

Such proceedings will establish the key findings applicable to most, if not all, recipients of fraudulently transferred funds (findings such as the existence of a Ponzi and/or pyramid scheme).

The first clawback claims are now imminent, and a lawsuit against multiple named defendants along with a class of net winners will be filed during the fourth quarter of 2013.

December was almost half way through and I was beginning to wonder if the Receiver would come through. True to his word, on the 11th of December the Zeek Receiver filed a motion for “leave to file actions and setting of initial conference”.

In the Receiver’s motion, Zeek’s top Ponzi winners who are still holding onto their money are named. Ladies and Gentlemen, courtesy of the Receiver, I give you the worst of the worst Zeek Rewards thieves: [Continue reading…]

Norway launch Lyoness “pyramid” investigation

The Norwegian Gaming Board put out a press-release today, advising that they have launched an investigation into Lyoness.

Tipped off by members of the Norwegian public, the Gaming Board plans ‘to assess whether (Lyoness) is an illegal pyramid‘.

Among other things, the Authority received information that it costs 20,000 dollars to join Lyoness. We also learned that members’ commissions mainly come from recruiting members and not from the sale of goods and services.

With Lyoness being free to join, it appears the Gaming Board are going to target the accounting unit investment scheme Lyoness run parallel to their cashback network. [Continue reading…]

Dream Life Vacation Club Review: Xplocial v2.0?

Although there’s no mention of Dream Life Vacation Club on the Xplocial website, the two companies share identical marketing copy on their respective “About Us” pages.

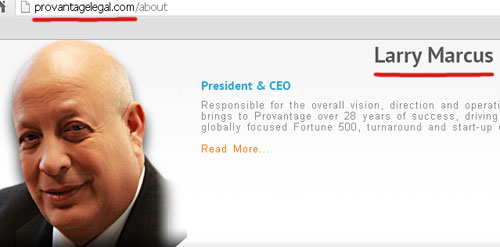

Lawrence B. Marcus (also known as Larry Marcus) heads up both Dream Life Vacation Club and Xplocial as CEO. I’ve previously covered Marcus’ MLM history over at the BehindMLM Xplocial review, with note that the company Provantage Legal (a previous venture of Marcus’) appears to have shut down.

The Provantage website was accessible when I wrote the BehindMLM Xplocial review back in July, but today the domain is parked (I’m not sure when the Provantage website was pulled).

Read on for a full review of the Dream Life Vacation Club MLM business opportunity. [Continue reading…]

TelexFree to offer Speak Asia “exit payments”?

![]()

Back when they were busy lying to the Supreme Court of India, Speak Asia planted the idea that if it was allowed to refund investors who hadn’t yet received a >100% ROI, that the authorities would permit the company to “restart operations”.

To this day there are Speak Asia investors who truly believe this is still going to happen.

With Ponzi schemes unable to pay out >100% of the money invested with them, the math plays out by paying those who haven’t withdrawn 100% yet from funds trapped in the system.

Funds trapped in the system primarily refers to money re-invested on the expectation of an even greater ROI down the track.

From a technical standpoint the Ponzi scheme counts these investors as having been paid more than what they put in, despite the reality that the actual money they invested is still locked up with the company.

So, the company pays nothing to these investors, uses the funds they initially invested and continue to re-invest to pay out those who haven’t re-invested yet, and then hopes the authorities will give them a free pass (“hey we paid out everyone!”).

The whole scheme hinges on the company being permitted to suck new investors in to make up for the deficit created by paying real money out, and also to some degree that those who were paid out will reinvest, re-trapping the money back into the system (with it ultimately getting paid out to earlier investors as intended).

Sooner or later of course the sustainability problems of a Ponzi scheme will still kick in and trigger a collapse. Of course nobody talks about that though, with the company only selling the idea that those who didn’t withdraw 100% of what they put in will get paid.

Speak Asia were the first company I’d heard of floating this idea, although it kind of fell apart when the Supreme Court decided the company was wasting its time.

Now, perhaps aware of the fact that Speak Asia’s deception won the company about twelve months of delays as things played out in court, TelexFree have begun to float a similar-sounding idea. [Continue reading…]

Lucrazon Global Review: Ecommerce revenue-share?

Lucrazon are based out of the US state of California and are set to launch in early 2014.

The company advises on its website that it is headed up by CEO and Founder, Alex Pitt (below right, also credited as “Alexy Pitt”).

Alex is a payment industry veteran for 20 years. He has developed technology such as payment gateways, electronic gift card platforms and specialized reporting systems that allowed his previous company, NMC, to become one of the largest Merchant Service Providers for Concord EFS utilizing BYPASS Front End, Concord Front End and Back End, as well as First Data platforms.

During his leadership, NMC’s portfolio grew to a $1.8 billion, providing services to Baja Fresh, McDonalds, Burger King, MonaVie and other major corporations.

Further research into Pitts’ MLM history turned up nothing. This may or may not be due to claims Pitt is from Russia and using an alias.

These claims popped up in different locations but I personally was unable to verify them. As it stands, apart from the mention of Monavie on the Lucrazon website itself, I was unable to ascertain whether or not Pitt has been involved in any other MLM companies. Lucrazon would appear to be Pitt’s first MLM venture on the executive side of things.

Read on for a full review of the Lucrazon MLM business opportunity. [Continue reading…]

Wings Network Review: Cloud-service BBOM reboot?

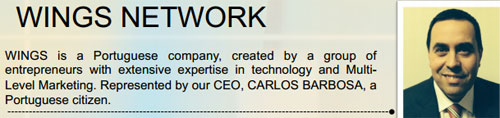

There is no information on the Wings Network website indicating who owns or runs the business.

The Wings Network website domain (“wingsnetwork.com”) was registered on the 9th of November 2011, however the domain registration is set to private.

Why this information isn’t provided on the Wings Network website I can’t say, but the company’s compensation plan names a “Carlos Barbosa” as CEO.

As above, Wings Network simply refers to Barbosa as a “Portuguese citizen”.

Further research reveals Barbosa to have a strong affiliation with the Ponzi scheme BBOM. Below you can see a website advertising tickets to BBOM presentation Barbosa gave, promising an R$800 a month ROI.

See the details of this cheap Franchise in Carlos Barbosa Rs Rio Grande Do Sul where you can initially invest R $ 600,00 in Bronze Plan, R $ 1,800.00 in Silver Plan and $ 3,000.00 in Gold Plan.

BBOM was a $300 – $1500 Ponzi investment scheme that was shutdown by Brazilian authorities earlier this year.

An additional point of note is a template on the Wings Network website that appears to assign the affiliate account details of a “Joao Carlos Andrade”.

Andrade’s details are automatically entered in if no sponsor details are provided when a new Wings Network affiliate signs up.

On his LinkedIn profile, Andrade (using the name “John”) advises he also lives in Portugal, is a “senior advisor” of Wings Network and “diamond” investor in BBOM:

Read on for a full review of the Wings Network MLM business opportunity. [Continue reading…]