Philippine Global InterGold investors facing life sentence

Last month saw the Philippine SEC issue a cease and desist against Global InterGold.

Last month saw the Philippine SEC issue a cease and desist against Global InterGold.

Alongside the SEC’s warning, criminal charges were also filed against top Philippine Global InterGold investors by the Philippine National Police (PNP).

Details of the criminal case have been thus far sketchy, with specifics of the PNP’s criminal case only coming to light yesterday. [Continue reading…]

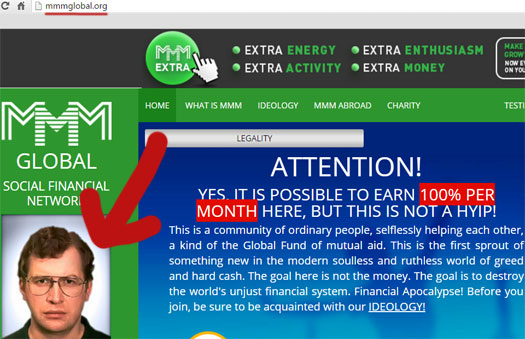

MMM Global Review: Sergey Mavrodi’s MLM BTC Ponzi cult

There is no information on the MMM Global website indicating who owns or runs the business.

There is no information on the MMM Global website indicating who owns or runs the business.

As per the MMM Global website:

There is no formal organization, no legal person in MMM. And of course there is no central bank account, no other activity in any form. Neither close, nor open. There is nothing!

The MMM Global website domain (“mmmglobal.org”) was registered on February 4th 2014, however the domain registration is set to private.

Further research reveals marketing videos uploaded to the MMM Global website blog. These videos are titled “weekly news” and feature Sergey Mavrodi.

Although not credited by name, Mavrodi’s photo also appears on the MMM Global website itself:

The “weekly news” videos on the MMM Global website are hosted on a YouTube account bearing the name “MMMGlobal”. In addition to Mavrodi’s news updates, the account has a plethora of testimonial videos.

Presumably MMM Global affiliates, the vast majority of those featured in the testimonial videos appear to be of Asian descent.

Primary countries MMM Global operates in appear to be China and India, with Alexa estimating that these two countries provide 34% of traffic to the MMM Global website.

Mavrodi (right) began using the “MMM” brand back in 1989, but it wasn’t until 1994 that it delved into Ponzi fraud.

Mavrodi (right) began using the “MMM” brand back in 1989, but it wasn’t until 1994 that it delved into Ponzi fraud.

MMM was established in 1989 by Sergei Mavrodi, his brother Vyacheslav Mavrodi, and Olga Melnikova. The name of the company was taken from the first letters of the three founders’ surnames.

MMM created its successful Ponzi scheme in 1994. The company started attracting money from private investors, promising annual returns of up to one thousand percent.

MMM grew rapidly. In February 1994, the company reported dividends of 1,000%, and started an aggressive TV ad campaign.

Since the shares were not quoted on any stock exchange and the company itself determined the share price, it maintained a steady price growth of thousands of percent annually, leading the public to believe its shares were a safe and profitable investment.

At its peak the company was taking in more than 100 billion rubles (about 50 million USD) each day from the sale of its shares to the public.

Thus, the cashflow turnover at the MMM central office in Moscow was so high that it could not be estimated. The management started to count money in roomfuls (1 roomful of money, 2 roomfuls of money, etc.).

Regular publication in the media of the rising MMM share price led President Boris Yeltsin to issue a decree in June 1994 prohibiting financial institutions from publicising their expected income.

The success of MMM in attracting investors led to the creation of other similar companies, including Tibet, Chara, Khoper-Invest, Selenga, Telemarket, and Germes.

All of these companies were characterised by aggressive television advertising and extremely high promised rates of return. One company promised annual returns of 30,000%.[citation needed]

On July 22, 1994, the police closed the offices of MMM for tax evasion. For a few days the company attempted to continue the scheme, but soon ceased operations.

At that point, Invest-Consulting, one of the company’s subsidiaries, owed more than 50 billion rubles in taxes (USD 26 million), and MMM itself owed between 100 billion and 3 trillion rubles to the investors (from USD 50 million to USD 1.5 billion).

In the aftermath at least 50 investors, having lost all of their money, committed suicide.

Several organisations of “deceived investors” made efforts to recover their lost investments, but Sergei Mavrodi manipulated their indignation and directed it at the government.

In August 1994 Mavrodi was arrested for tax evasion. However, he was soon elected to the Russian State Duma, with the support of the “deceived investors”.

He argued that the government, not MMM, was responsible for people losing their money, and promised to initiate a pay-back program. The amount ultimately paid back was minuscule compared to the amount owed.

In October 1995, the Duma cancelled Mavrodi’s right to immunity as a deputy. In 1996, he tried to run for Russia’s presidency, but most of the signatures he received were rejected. MMM declared bankruptcy on September 22, 1997.

While it was believed that Sergei Mavrodi left Russia and moved to the United States, it is possible that he stayed in Moscow, using his money to change apartments regularly and employ a group of former special agents.

With the help of a distant relative he started Stock Generation Ltd., another pyramid scheme.

Despite a bold-letter warning on the main page that the site was not a real stock exchange, between 20,000 and 275,000 people, according to various estimates, fell for the promised 200% returns and lost their money.

According to U.S. Securities and Exchange Commission, losses of victims were at least USD 5.5 million.

Mavrodi was found and arrested in 2003. While in custody, Mavrodi was given until January 31, 2006 to read the documents in his fraud case against him (The criminal case consisted of 650 volumes, each 250-270 pages long).

At the end of April 2007, Mavrodi was convicted of fraud, and given a sentence of four and a half years.

Since he had already spent over four years in custody, he was released less than a month later, on May 22, 2007.

He later went on to creating yet another pyramid scheme called MMM-2011. (Wikipedia)

MMM-2011 saw the introduction of “Mavro” Ponzi points.

In January 2011, Mavrodi launched another pyramid scheme called MMM-2011, asking investors to buy so-called Mavro currency units.

He frankly described it as a pyramid, adding “It is a naked scheme, nothing more … People interact with each other and give each other money. For no reason!”

Mavrodi said that his goal with MMM-2011 is to destroy the current financial system, which he considers unfair, which would allow something new to take its place.

MMM-2011 was able to function openly as Ponzi schemes and financial pyramids are not illegal under Russian law.

In May 2012 he froze the operation and announced that there would be no more payouts.

In 2011 he launched a similar scheme in India, called MMM India, again stating clearly that the vehicle is a pyramid. He has also launched MMM in China.

He was reported to be trying to expand his operations into Western Europe, Canada, and Latin America.

As of September 2015 it had spread rapidly in South Africa with a claimed 1% per day or 30% per month interest rate scheme and warnings from both the South African and Russian Communist Parties for people not to participate in it.

Mavrodi’s latest Ponzi fraud iteration saw MMM Global launch last year. Amid ongoing financial instability in China, MMM Global is currently being heavily promoted there as a vehicle to launder dirty money out of the country.

Due to inaction on behalf of Russian authorities, Mavrodi remains at large.

Read on for a full review of the MMM Global MLM business opportunity. [Continue reading…]

5 Dollar Gem Review: $185.7 million dollar cash gifting

There is no information on the 5 Dollar Gem website indicating who owns or runs the business.

There is no information on the 5 Dollar Gem website indicating who owns or runs the business.

The 5 Dollar Gem website domain (“5dollargem.com”) was registered on the 7th of July 2015, however the domain registration is set to private.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

My Secret Fortune Review: $5 five-tier matrix cycler

![]() There is no information on the My Secret Fortune website indicating who owns or runs the business.

There is no information on the My Secret Fortune website indicating who owns or runs the business.

The My Secret Fortune website domain (“mysecretfortune.com”) was registered on the 27th of May 2015, with John Dierksmeier listed as the owner. An address in the US state of Texas is also provided.

John Dierksmeier (right) first appeared on BehindMLM’s radar back in late 2011, as the Founder and President of MaxeVida.

John Dierksmeier (right) first appeared on BehindMLM’s radar back in late 2011, as the Founder and President of MaxeVida.

MaxeVida was a matrix-based opportunity which saw affiliates retail a capsule-based supplement.

MaxeVida seems to have collapsed sometime in 2012, with Dierksmeier (right) then going on to launch Only20Bucks.

Again based on a matrix compensation plan, Only20Bucks was a recruitment-driven feeder for iClubBiz (in which Dierksmeier was an affiliate).

iClubBiz itself was an autoship-centric recruitment scheme launched in 2013.

2014 saw Dierksmeier get into coffee, with the launch of Cafe Nopal.

On the affiliate side of things, Dierksmeier has been involved with New Earth(reboot of Simplexity Health), Xerveo (formerly Ferveo), CeraCoat Direct (nanotechnology coating) and more recently GoBig7 (a Penny Matrixreboot).

2015 has seen Dierksmeier launch Nopa Vida, 2×2 Wealth and EcoPlus Network.

Nopa Vida saw affiliates purchase matrix positions and get paid when subsequently recruited affiliates did the same.

2×2 Wealth was a matrix cycler, again paying affiliates to purchase a matrix position and recruit others who do the same.

EcoPlus Network is a $25 a month matrix-based recruitment scheme.

Alexa traffic estimates on the Nopa Vida and 2×2 Wealth websites suggest both have since collapsed. EcoPlus Network was only recently launched, with My Secret Fortune marking Dierksmeier’s fourth known MLM launch this year.

Read on for a full review of the My Secret Fortune MLM business opportunity. [Continue reading…]

EcoPlus Network Review: $25 a month matrix positions

![]() There is no information on the EcoPlus Network website indicating who owns or runs the business.

There is no information on the EcoPlus Network website indicating who owns or runs the business.

The EcoPlus Network domain was registered on the 25th of October 2015, with John Dierksmeier listed as the owner. An address in the US state of Texas is also provided.

John Dierksmeier (right) first appeared on BehindMLM’s radar back in late 2011, as the Founder and President of MaxeVida.

John Dierksmeier (right) first appeared on BehindMLM’s radar back in late 2011, as the Founder and President of MaxeVida.

MaxeVida was a matrix-based opportunity which saw affiliates retail a capsule-based supplement.

MaxeVida seems to have collapsed sometime in 2012, with Dierksmeier (right) then going on to launch Only20Bucks.

Again based on a matrix compensation plan, Only20Bucks was a recruitment-driven feeder for iClubBiz (in which Dierksmeier was an affiliate).

iClubBiz itself was an autoship-centric recruitment scheme launched in 2013.

2014 saw Dierksmeier get into coffee, with the launch of Cafe Nopal.

On the affiliate side of things, Dierksmeier has been involved with New Earth (reboot of Simplexity Health), Xerveo (formerly Ferveo), CeraCoat Direct (nanotechnology coating) and more recently GoBig7 (a Penny Matrix reboot).

2015 has seen Dierksmeier launch Nopa Vida and 2×2 Wealth.

Nopa Vida saw affiliates purchase matrix positions and get paid when subsequently recruited affiliates did the same.

2×2 Wealth was a matrix cycler, again paying affiliates to purchase a matrix position and recruit others who do the same.

Alexa traffic estimates on the Nopa Vida and 2×2 Wealth websites suggest both have since collapsed, likely prompting the launch of EcoPlus Network

Read on for a full review of the EcoPlus Network MLM business opportunity. [Continue reading…]

Bankruptcy Judge rules TelexFree a Ponzi scheme

![]() One of the primary hurdles in establishing a claims process for TelexFree victims, was obtaining legal certification that TelexFree was a Ponzi scheme.

One of the primary hurdles in establishing a claims process for TelexFree victims, was obtaining legal certification that TelexFree was a Ponzi scheme.

To that end the TelexFree Trustee filed a motion in October. In it, Stephan Darr requested a Judge rule on whether or not TelexFree operated a Ponzi scheme. This in turn would render them liable to pay out claims, for which the Trustee had attached a proposed “net equity” process.

On November 25th Judge Hoffman ruled on the matter, declaring TelexFree to be a Ponzi scheme. [Continue reading…]

OneCoin enforce withdrawal KYC, financial troubles?

As it stands, OneCoin affiliates are waiting upwards of four weeks for withdrawals to be processed.

As it stands, OneCoin affiliates are waiting upwards of four weeks for withdrawals to be processed.

Support are purportedly not responsive and messages regarding withdrawals are routinely deleted from OneCoin’s Facebook page.

Now, in yet another move that distances OneCoin from legitimate cryptocurrencies, OneCoin are demanding identification documents before withdrawals are processed. [Continue reading…]

2SL Start Living Review: $50 and $397 Lifestyle Packages

2SL Start Living operate in the travel MLM niche, with the company claiming on its website to be

2SL Start Living operate in the travel MLM niche, with the company claiming on its website to be

headquartered in Bentonville, Arkansas (and) incorporated both in the United States and Colombia.

James Ward is credited as the CEO and co-founder of 2SL Start Living, with H. Smári Gröndal and Gudmundur S. Jonsson also credited as co-founders of the company.

James Ward (right) first popped up on BehindMLM’s radar in 2010, as the CEO of LGN Prosperity.

James Ward (right) first popped up on BehindMLM’s radar in 2010, as the CEO of LGN Prosperity.

LGN Prosperity marketed travel vouchers, with each voucher generating a position in a matrix 2×2 cycler.

Vouchers could be purchased by affiliates or retail customers, with affiliates paid $600 when all six positions of the matrix they were in were filled.

Following months of affiliates not getting paid, in mid 2011 LGN Prosperity morphed into LGN International.

This name-change brought on the addition of commissions paid on travel services booked through LGN.

LGN International eventually collapsed in mid to late 2013, with Ward heading up iBizWave as CEO and co-founder in early 2014.

During the launch of iBizWave, Ward declared:

iBizWave will greatly surpass what was accomplished with LGN, and change tens of thousands of lives along the way.

iBizWave combined a matrix binary hybrid compensation plan, with an online “marketing software platform”.

iBizWave’s platform appeared to be mostly powered by WordPress, which left a question mark over the retail viability of their $50 to $750 packages.

Ward himself referred to affiliates buying into iBizWave as a “$675 investment”.

The iBizWave website is still online today (rebranded to “MyBiz Toolbox” at some point), however Alexa traffic estimates suggest the opportunity has long since collapsed.

A year and a half later after iBizWave’s launch sees Ward return to the travel niche with 2SL Start Living.

The question: Is retail actually viable in 2SL Start Living, or is this yet another recruitment-driven matrix opportunity?

Read on for a full review of the 2SL Start Living MLM business opportunity. [Continue reading…]

Instant Pay Christmas Review: $5 to $800 cash gifting

There is no information on the Instant Pay Christmas website indicating who owns or runs the business.

There is no information on the Instant Pay Christmas website indicating who owns or runs the business.

The Instant Pay Christmas website domain (“instantpaychristmas.com”) was registered on the 7th of November 2015, with Optimus Dale listed as the domain owner.

Optimus Dale is a pseudonym of Sherm Mason, with Instant Pay Christmas marking Mason’s fourth MLM launch this year alone.

Mason first popped up on BehindMLM’s radar as the admin of Magnetic Builder, a $29.95 recruitment scheme.

Since February 2015, Mason has launched:

- Paradise Payments (February 2015) – a $2 to $1000 cash gifting scheme

- Magnetic Gratitude (April 2015) – a $580 matrix-based Ponzi scheme

- Summer Fun Matrix (July 2015) – a $22 three-tier Ponzi scheme and

- 3×9 Millionaire Machine (September 2015) – a $3 in, $435 million dollars out Ponzi scheme

As at the time of publication, Alexa traffic estimates suggest Paradise Payments, Magnetic Gratitude and Summer Fun Matrix have all but collapsed.

3×9 Millionaire Machine still appears to be chugging along, with Nigeria being the scheme’s number one source of website traffic.

An overall decline however has likely prompted Mason to launch a new scheme, which brings us to Instant Pay Christmas.

Read on for a full review of the Instant Pay Christmas MLM business opportunity. [Continue reading…]

Saivian Review: $125 in, $5 to $3000 daily ROIs out

The Saivian website domain (“saivian.net”) was registered on the 30th of October 2015, however the domain registration is set to private.

The Saivian website domain (“saivian.net”) was registered on the 30th of October 2015, however the domain registration is set to private.

Identified as President of Saivian on its website is John Sheehan.

As per Sheehan’s Saivian corporate bio:

As per Sheehan’s Saivian corporate bio:

Mr. Sheehan achieved success in complex organizations such as, network marketing, retail and non-profits.

John has worked and sold products to mlm companies, owned wireless stores in 6 states and have set records in membership and donations for non-profits.

Despite these claims, I was unable to find any specific information on Sheehan’s purported MLM history.

Of note is that his Saivian profile photo was the same used on his LinkedIn profile. A Google image search still ties the image to Sheehan’s LinkedIn profile, however the profile itself was recently deleted.

An additional point of interest is Saivian’s Marketing Director, Steve Gewecke.

Gewecke first popped up on BehindMLM’s radar back in 2012, as a VIP Founder of US Utility Direct.

Who owned US Utility Direct was never disclosed, with the company failing to launch on its advertised June 30th, 2012 launch date.

In August 2014 Gewecke resurfaced as the President of MyNyloxin.

MyNyloxin saw affiliates pay between $300 and $1500 for affiliate membership, with commissions paid out when they recruited new affiliates.

Today the MyNyloxin website domain is unresponsive.

Read on for a full review of the Saivian MLM business opportunity. [Continue reading…]