BeOnTel Review: BeOnPush’s half-assed attempt at Ponzi resuscitation

BeOnPush was a Ponzi scheme launched in 2015 by Ferki Demirovski.

BeOnPush was a Ponzi scheme launched in 2015 by Ferki Demirovski.

Under the guise of having something to do with advertising, BeOnPush affiliates invested up to $10,000 on the promise of a 150% ROI.

After roughly a year of scamming, BeOnPush collapsed earlier this year in June.

Facing a massive 150% ROI liability on every $1 invested into BeOnPush, Demirovski (right) wiped existing ROIs owed through BeOnPush and converted investment positions into virtual shares.

Facing a massive 150% ROI liability on every $1 invested into BeOnPush, Demirovski (right) wiped existing ROIs owed through BeOnPush and converted investment positions into virtual shares.

Demirovski claimed affiliates would be able to recoup their losses in BeOnTel, a yet to be launched reboot scheme.

Today BehindMLM takes a look at and reviews the BeOnTel MLM opportunity. [Continue reading…]

Gary Bessoni settlement sees $175,000 returned to Zeek Ponzi victims

Back in mid 2015 the Zeek Rewards Receiver sued Gary Bessoni and his companies Peak USA and Peak Impact.

Back in mid 2015 the Zeek Rewards Receiver sued Gary Bessoni and his companies Peak USA and Peak Impact.

Through Peak USA and Peak Impact, Bessoni flooded Zeek Rewards affiliates with bogus email leads. This was central to perpetuation of the Ponzi scheme, as Zeek affiliates required an ever-increasing amount of bogus accounts to dump generated bids onto.

The Receiver initially sued Bessoni for $3.3 million. In a court filing dated November 7th, the Receiver reveals the matter had been settled for $175,000. [Continue reading…]

My Advertising Pays plans second Ponzi reboot this month

![]() My Advertising Pays initially launched in 2013. The business model was simple: My Advertising Pays affiliates invested $49.99 on the promise of an advertised $60 ROI.

My Advertising Pays initially launched in 2013. The business model was simple: My Advertising Pays affiliates invested $49.99 on the promise of an advertised $60 ROI.

By the end of 2015 My Advertising Pays began to show signs of collapse. The company kept itself afloat however by paying US affiliates a fraction of the $60 ROI it owed them.

In an attempt to evade the SEC, the company also announced it was leaving the US and setting up shop in the UK. [Continue reading…]

John Oliver’s Last Week Tonight exposes “pyramid scheme” MLMs

In line with the nature of Last Week Tonight, this is more of an entertainment piece as opposed to BehindMLM’s regular coverage.

In line with the nature of Last Week Tonight, this is more of an entertainment piece as opposed to BehindMLM’s regular coverage.

In the latest episode of Last Week Tonight, an Emmy award-winning weekly news and current events show aired on HBO, host John Oliver discusses MLM.

Oliver begins the segment with the familiar MLM cliché; “I would like to talk to you about an exciting opportunity. I just need thirty minutes of your time”. [Continue reading…]

OneCoin under investigation in Vietnam

If you thought OneCoin’s quarter of a million Euro investment packages sounded dodgy enough on their own, get a load of how OneCoin is marketed in Vietnam. [Continue reading…]

If you thought OneCoin’s quarter of a million Euro investment packages sounded dodgy enough on their own, get a load of how OneCoin is marketed in Vietnam. [Continue reading…]

OneCoin lose Cyprus bank account, Bank of Africa & UOB remain

Four days ago we reported on OneCoin’s Singapore UOB bank account appearing to be frozen. To continue to process affiliate investments, OneCoin opened up an account with Hellenic Bank in Cyprus.

Four days ago we reported on OneCoin’s Singapore UOB bank account appearing to be frozen. To continue to process affiliate investments, OneCoin opened up an account with Hellenic Bank in Cyprus.

Less than a week later, it appears Hellenic Bank has terminated the account. [Continue reading…]

PIF4All Review: Adcredit chain-recruitment

![]() The PIF4All homepage identifies Don Harrison and Joe Freyaldenhoven as co-admins of the company.

The PIF4All homepage identifies Don Harrison and Joe Freyaldenhoven as co-admins of the company.

The FAQ section of the PIF4All website lists “Raymond Joseph Freyaldenhoven” as sole owner and admin of the company.

An address in Arkansas is also provided and is presumably where Freyaldenhoven is running PIF4All from.

An address in Arkansas is also provided and is presumably where Freyaldenhoven is running PIF4All from.

Other MLM opportunities Freyaldenhoven is currently promoting or has promoted in the past include InCruises (travel memberships), United Games Marketing (sports app), My Paying Ads (Ponzi scheme), KaratBars (pyramid scheme), Ads Clicks Profits (recruitment) and Strong Future International.

Read on for a full review of the PIF4All MLM opportunity. [Continue reading…]

Easy Cycler Review: Five-tier matrix cycler Ponzi

There is no information on the Easy Cycler website indicating who owns or runs the business.

There is no information on the Easy Cycler website indicating who owns or runs the business.

The Easy Cycler website domain (“easycycler.com”) was registered on the 26th of October 2016, however the domain registration is set to private.

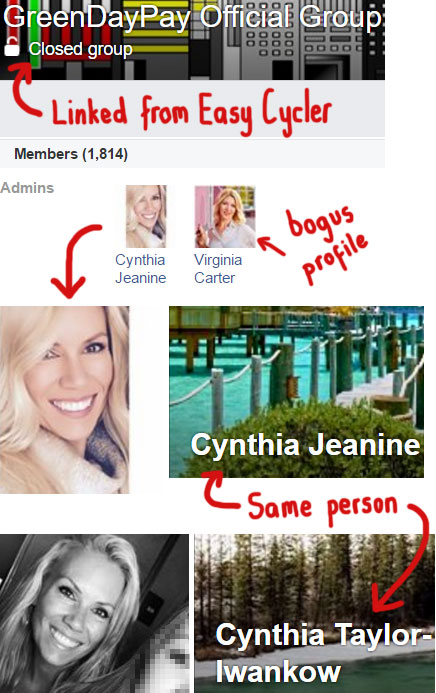

The official Facebook group link off the Easy Cycler website brings you to a group titled “GreenDayPay”.

GreenDayPay was launched back in August and offers Ponzi ROIs of up to 5.6% a day.

Alexa traffic statistics suggest affiliate recruitment for GreenDayPay bottomed out towards the end of October, likely prompting the launch of Easy Cycler.

The GreenDayPay Facebook group lists two admins, Cynthia Jeanine and Virginia Carter.

The Virginia Carter account appears to be bogus. The account was created back in 2009 but has no content, which is typical of fake profiles put up for sale. Furthermore, at least one of the profile images used in the account has been stolen from elsewhere.

The Cynthia Jeanine account appears to belong to Cynthia Taylor-Iwankow:

Taylor-Iwankow is based out of Canada and seems to use the “Cynthia Jeanine” account only for marketing MLM underbelly schemes. The Taylor-Iwankow account is used as a personal profile.

On her LinkedIn profile Taylor-Iwankow claims she has ‘12 yrs experience in the direct sales industry.‘

This began with Norwex (green cleaning and personal care) back in 2003, after which Taylor-Iwankow joined It Works! in 2011.

Taylor-Iwankow was still promoting It Works! and cites herself as a Presidential Diamond Leader on her LinkedIn profile.

Over the last ten months or so however that appears to have fallen apart, with Taylor-Iwankow taking up residence in the MLM underbelly.

On February 27th, Taylor-Iwankow made the following announcement:

I’m soo dang pumped with the new path I’m travelling. Life is about to get AMPED!!

Multi-stream income is most definitely paying off in a BIG BIG way!!

Fraudulent schemes Taylor-Iwankow has promoted since then include BitDonix (cash gifting), Stiforp (pyramid scheme), ZarFund (cash gifting), My 24 Hour Income (Ponzi scheme), My Paying Ads (Ponzi scheme), GiftoBit (cash gifting), Leased Ad Space (cash gifting), RevCoin (Ponzi scheme), Coince (Ponzi scheme), My Ad Story (Ponzi scheme), Freedom5 (Ponzi scheme), Ultimate RevShare (Ponzi scheme), Uni RevShare (Ponzi scheme), Capital7 (Ponzi scheme), Fort Ad Pays (collapsed Ponzi scheme) and MMM Global (collapsed Ponzi scheme).

Read on for a full review of the Easy Cycler MLM opportunity. [Continue reading…]

Daniel Filho’s mental competency sees criminal trial postponed till 2017

Last we checked in Daniel Filho, mastermind of the DFRF Enterprises Ponzi scheme, was scheduled to stand trial on November 7th.

Last we checked in Daniel Filho, mastermind of the DFRF Enterprises Ponzi scheme, was scheduled to stand trial on November 7th.

With proceedings less than twenty-four hours away, I decided to check the case docket and see if the trial was still on.

Turns out it isn’t, primarily due to ongoing concerns about Filho’s mental competency. [Continue reading…]

BitLine Review: Two-tier bitcoin cash gifting

There is no information on the BitLine website indicating who owns or runs the business.

There is no information on the BitLine website indicating who owns or runs the business.

BitLine is created by very experienced team of it developers and network marketers.

They decided to launch new opportunity for others by giving IT system and educational system. Previously used educational system resulted in bringing over 2000 new people within a few weeks.

That means you have very well tested and proven to work, duplicatable system.

The BitLine website (“bitline.club”) was registered on the 25th of September 2016. The domain appears to have been registered with bogus details pointing to a French location.

Mikolaj Grzaslewicz is credited with “consulting” in the registration, with an address in Poland also provided.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]