My Cycler to reboot as cryptocurrency mining package Ponzi

Manos Sergakis launched My Cycler a year ago after his One World Ads Ponzi scheme collapsed.

Manos Sergakis launched My Cycler a year ago after his One World Ads Ponzi scheme collapsed.

My Cycler offers Ponzi ROIs through a five-tier matrix cycler.

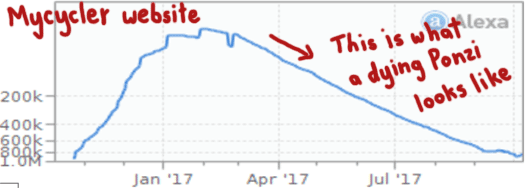

Alexa traffic estimates show a decline in My Cycler traffic throughout 2017:

What this means for a cycler Ponzi is that recruitment has slowed down such that the majority, if not all of the company-wide matrices have stalled.

In a nutshell, over the past year Sergakis (right) has stolen who knows how much money from My Cycler affiliates. He’s achieved this through admin positions and funds attached to positions trapped in stalled matrices.

In a nutshell, over the past year Sergakis (right) has stolen who knows how much money from My Cycler affiliates. He’s achieved this through admin positions and funds attached to positions trapped in stalled matrices.

Rather than cut his losses, admit the majority of My Cycler affiliates will cop a loss and do a runner, Sergakis is doubling down with a new scam.

In line with the current MLM underbelly trend, Sergakis is relaunching My Cycler as a cryptocurrency mining scam. [Continue reading…]

BTC Team Profits Review: Ten-tier matrix bitcoin gifting

![]() BTC Team Profits provide no information on their website about who owns or runs the business.

BTC Team Profits provide no information on their website about who owns or runs the business.

The BTC Team Profits website domain (“btcteamprofits.com”) was privately registered on August 19th, 2017.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Leniex Review: 360 day ROIs of up to 288%

Leniex provide no information on their website about who owns or runs the business.

Leniex provide no information on their website about who owns or runs the business.

The Leniex website domain (“leniex.com”) was privately registered on May 30th, 2017.

Leniex provide incorporation documents on their website for Leniex Inc. in New York.

This appears to be a shell incorporation purchased for $125 on July 18th. The address used to incorporate Leniex Inc belongs to a third-party office space supplier.

Alexa estimates traffic to the Leniex website exclusively originates out of Europe. The use of Telegram and corporate Vkontakte social media profile strongly suggests Leniex is being run by admin(s) in Russia or the Ukraine.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Global Domains International Review: .WS domains and recruitment

![]() Global Domains International, also known as GDI, operate in the technology MLM niche.

Global Domains International, also known as GDI, operate in the technology MLM niche.

The company launched in 2000 and is based in the US state of California.

Further research reveals the corporate address provided on the GDI website belongs to Regus. Whether GDI actually have a physical presence in California is unclear.

Heading up GDI are co-founders Michael Starr (CEO) and Alan Ezeir (President).

Heading up GDI are co-founders Michael Starr (CEO) and Alan Ezeir (President).

At least that’s according to the GDI website.

On his LinkedIn profile Alan Ezeir cites his time at GDI coming to an end as of September, 2016.

In addition to getting involved in cryptocurrency, Ezeir founded Circle Square Capital in November, 2016.

Circle Square targets technology,manufacturing, distribution and service businesses with $3 million to $50 million in annual revenue with cash operating earnings (“EBITDA”) in excess of $1 million.

Michael Starr is still involved in GDI and presumed to be running the show.

Prior to co-founding GDI Ezeir and Starr co-founded Freedomstarr Communications,

which currently maintains licenses in most of the United States for certified telecommunications services, and supports thousands of users in each state.

As far as I can tell GDI is Ezeir and Starr’s first MLM venture as executives.

Read on for a full review of the Global Domains International MLM opportunity. [Continue reading…]

MBI Ponzi scheme duped 350,000 affiliates out of $165 million

An ongoing investigation by Malaysian authorities has revealed the MBI Ponzi scheme saw 350,000 affiliates lose 700 million MYR ($165 million USD).

An ongoing investigation by Malaysian authorities has revealed the MBI Ponzi scheme saw 350,000 affiliates lose 700 million MYR ($165 million USD).

MBI was a Ponzi scheme based on GRC Unit Ponzi points.

MBI affiliates invested up to $35,000 in GRC Units, the internal value of which was set by MBI. [Continue reading…]

Ageo Product Line Review: Pay to play pyramid recruitment

Ageo Product Line, more commonly known as APL, was launched in 2011 in Kazakhstan.

Ageo Product Line, more commonly known as APL, was launched in 2011 in Kazakhstan.

Despite appearing to be a European MLM company (the company’s Terms and Conditions reference “the law of Republic of Cyprus”), on their website APL provide a corporate address in the US state of Delaware.

Research reveals the Delaware address provided actually belongs to IncServ, who on their website provide a “corporate formation” service.

This suggests that APL exists in the US in name only.

APL is headed up by Founder and President, Sergey Sergeevich Kulikov (right).

APL is headed up by Founder and President, Sergey Sergeevich Kulikov (right).

On his VKontakte social media profile, Kulikov cites the corporate address for APL as Moscow, Russia.

Why a Russian MLM company decided to incorporate itself as a shell company in the US is unclear.

As per Kulikov’s APL corporate bio, APL was founded due to a disagreement with management of an MLM company Kulikov was an affiliate of.

At the age of 17 Sergey learnt about MLM business.

He built such a structure in a month that even experienced multi level marketers do not always manage to build in a year.

His earnings were rapidly growing until one day senior staff members of that company deprived the ambitious student of the major part of the structure.

Sergey couldn’t tolerate that kind of injustice.

He quitted [sic] the company and decided to build his own MLM company where no partner would face injustice and unfairness from a leadership.

The MLM company Kulikov references isn’t mentioned by name. And possibly due to language-barriers, I was unable to research it myself.

Read on for a full review of the Ageo Product Line MLM opportunity. [Continue reading…]

MinerWorld CEO attributes Paraguay CNV warning to “misinterpretation”

![]() One would think it’s pretty hard to misinterpret “Your company is not registered with us or authorized to conduct business in our country”, but that’s exactly what Miner World’s CEO is claiming. [Continue reading…]

One would think it’s pretty hard to misinterpret “Your company is not registered with us or authorized to conduct business in our country”, but that’s exactly what Miner World’s CEO is claiming. [Continue reading…]

iGlobAd Review: Shopping mall ads = $103 per click?

iGlobAd operate in the advertising MLM niche and claim to be “based in London, UK”.

iGlobAd operate in the advertising MLM niche and claim to be “based in London, UK”.

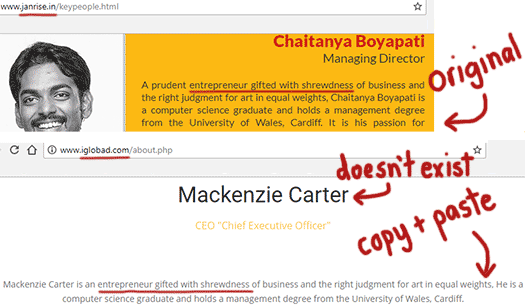

The company cites Mackenzie Carter as CEO, however this person doesn’t appear to exist.

Mackenzie Carter is a generic enough name in and of itself. iGlobAd provide no photo of Carter and his corporate bio is copy and pasted from Janrise Advertising and Branding:

iGlobAd has incorporated itself in the UK as “I Glob Ad Limited”, however as far as legitimacy goes a UK incorporation certificate isn’t worth the paper it’s printed on.

The ripping off of an Indian advertising firm’s copy and use of a shell UK incorporation strongly suggests whoever is running iGlobAd is likely based out of India.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

MacroCoin now being pushed as IMP Europe, same pump and dump

Tracking MacroCoin is a game of cat and mouse.

Tracking MacroCoin is a game of cat and mouse.

The company continues to come up with new business names to market itself, all under the same UECB Group banner.

With MacroCoin abandoned and the MLM opportunity website shut down, IMP Europe has emerged as the new name of the company. [Continue reading…]

Shuang Hor Review: Lingzhi mushroom supplements grown in-house

Shuang Hor began as Double Crane Enterprises in 1987.

Shuang Hor began as Double Crane Enterprises in 1987.

The company is based out of Taiwan and was founded by “a group of Taiwanese entrepreneurs”.

In 1996 Double Crane Enterprises was “restructured” and renamed to Shuang Hor.

I’m not sure why, but in Taiwan the official company website is still branded Double Crane Global.

The company seems to otherwise be known as Shuang Hor in English, so from here on out to avoid confusion I won’t be using Double Crane Global.

Since 1996 Shuang Hor has branched out into Japan, Thailand, Singapore, Brunei, Hong Kong, Indonesia and Myanmar (operating as Double Crane Co.).

The Shuang Hor website (Taiwan) identifies Ku Ping-Chia (right) as CEO of the company.

The Shuang Hor website (Taiwan) identifies Ku Ping-Chia (right) as CEO of the company.

Beyond a name and Chinese language marketing video, Shuang Hor provide no information on Ping-Chia.

Likely due to language-barriers, I was unable to turn up any third-party information myself.

On their website Shuang Hor cite a commitment to “honest management, stable growth, and zero-criticisms in the past 30 years”.

Read on for a full review of the Shuang Hor MLM opportunity. [Continue reading…]