IQ Chain Review: Ormeus Global Ponzi spinoff?

Ormeus Global launched last year as a trading bot 160% ROI Ponzi scheme.

Ormeus Global launched last year as a trading bot 160% ROI Ponzi scheme.

As MLM cryptocurrency schemes are want to do, Ormeus Global also launched its own pump and dump altcoin.

Ormeus Coin began public trading around October, 2017.

After pumping at around five dollars in late November, Ormeus Coin dumped to just over a dollar.

ORME has been in steady decline since mid April and is currently sitting at around 88 cents.

Meanwhile back in March, it emerged Ormeus Global hadn’t been paying affiliates earned commissions.

Over the past month or so something called IQ Chain has emerged.

Following several requests to look into IQ Chain’s connection with Ormeus Global, today we’re taking a deeper look.

A visit to the IQ Chain website brings up nothing more than a login form.

There’s no information about what IQ Chain is or who’s behind it provided.

The IQ Chain website domain was first registered back in 2012. The registration details were last updated on April 2nd, which is likely when the current owner took possession of it.

A visit to the WayBack Machine confirms that prior to April 2018 the “iqchain.com” domain was parked.

So what is IQ Chain?

As far as I can tell it’s an attempt to rebrand Ormeus Global.

That said, the Ormeus Global website and branded social media profiles are still active (albeit abandoned since April) – so the company might be having an identity crisis.

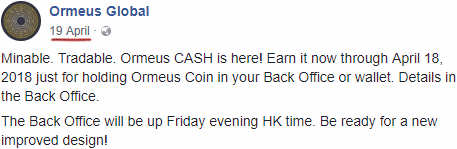

An April 19th post on the Ormeus Global Facebook profile announces the launch of “Orme Cash”.

Orme Cash isn’t publicly tradeable and as far as I can tell exists solely as tokens within Ormeus Global itself (Ponzi points).

Ormeus Global affiliates who invested in Ormeus Coin obtain Orme Cash by parking their coins with the company.

This is likely an attempt to attach Ormeus Coin to an internal points system Ormeus Global can wholly control.

They lost that control with Ormeus Coin when it went public and crashed. So Orme Cash appears to be an attempt to regain control – with the aim of manipulating the public value of Ormeus Coin.

Ormeus Coin parked with Ormeus Global cannot be sold while they are “staked”.

With that out of the way, we can now continue with a more traditional review of IQ Chain. [Continue reading…]

Zhunrize Vodaware settlements, Todd Spencer still fighting

In late 2017 the Zhunrize Reciever filed suit against Vodaware.

In late 2017 the Zhunrize Reciever filed suit against Vodaware.

Vodaware was essentially a shell company set up to assist in the operation of Zhunrize.

Ironically the company’s initial cooperation with the Zhunrize Receivership led to the Receiver uncovering it as the recipient of $2.8 million in stolen investor funds.

The Receiver’s lawsuit named Vodaware, Inc., Vodaplex, Inc., Vodaplex, LLC, Wilhelm Berger, Jeffery Todd Spencer, and Sophie Pan as defendants.

Of the three individual defendants, Todd Spencer, who was directly involved in Zhunrize’s operations as COO, was most prominent.

Not surprisingly, Spencer has decided to the fight the lawsuit in a bid to keep ill-gotten gains. [Continue reading…]

Bitdax Global Review: Token-based cryptocurrency Ponzi scheme

Bitdax Global claim to be

Bitdax Global claim to be

a Fintech institution registered offshore to provide research, financial partnerships to blockchain start ups and in housed developers in AI Application in trading.

The only reference to a corporate address is in Bitdax Global’s Terms and Conditions.

The UK address provided however belongs to Blue Square Offices, a virtual office provider.

Bitdax Global do provide names and photos of executives on their website, however these are just as vague as the company’s description of itself.

Andrew Savvides and Robert Slattery are cited as founders of Bitdax Global.

Andrew Savvides (right) appears to have a history pushing forex schemes (binary options). With Bitdax Global he’s now focusing on cryptocurrency.

Andrew Savvides (right) appears to have a history pushing forex schemes (binary options). With Bitdax Global he’s now focusing on cryptocurrency.

On his Facebook profile Savvides claims he’s living in London, UK.

Robbert Slattery meanwhile is a complete mystery. I was unable to find any external information on him, which I’m flagging as suspicious.

On the marketing front Bitdax Global is primarily targeting Africa.

At the time of publication Alexa cite Ghana (58%) and Nigeria (20%) as the top two sources of traffic to the Bitdax Global website.

Marketing material suggests Andrew Savvides personally attended Bitdax Global recruitment events in Nigeria in late May.

Read on for a full review of the Bitdax Global MLM opportunity. [Continue reading…]

Comodius Bank Review: Onix Ponzi points investment scheme

Comodius Bank operated in the cryptocurrency MLM niche and claims it was established in 1994.

Comodius Bank operated in the cryptocurrency MLM niche and claims it was established in 1994.

This is easily debunked with a quick domain check, which reveals the Comodius Bank website domain (“comodius.biz”) was only registered a few days ago on May 25th.

Comodius Bank provide a list of executives on their websites. While the photos appear modified such to the extent they aren’t basic stock image uploads, the people represented clearly don’t exist.

Click on any the Twitter profiles of any of listed executives and you’ll find all of the accounts are newly created in May, 2018.

And as at the time of publication, none of the profiles have any content published to them.

So far we have

- a company that didn’t exist a week ago pretending it’s been around for twenty-four years

- generic Anglo-saxon names for its executives

- generic executive photos stolen from who knows where and

- bogus executive social media profiles

Comodius Bank aren’t off to a very good start.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

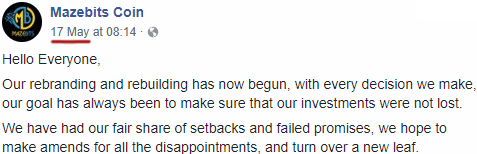

Mazebits Review: Bitfinite ICO lending Ponzi reboot

Mazebits provide no information on their website about who owns or runs the business.

Mazebits provide no information on their website about who owns or runs the business.

The Mazebits website domain (“mazebits.co”) was privately registered on January 25th, 2018.

Further research reveals Mazebits marketing material citing the company as a “rebranding” of the Bitfinite ICO lending Ponzi scheme.

This is supported by content on official Mazebits social media profiles, detailing a conversion of Bitfinite BFC points into Mazebits MZBC points.

Hoping to follow in BitConnect’s footsteps, Bitfinite launched as an ICO lending Ponzi clone in late 2017.

Bitfinite went on to collapse in early 2018. Like every ICO lending Ponzi scheme, Bitfinite’s anonymous owners made off with the majority of invested funds.

This resulted in widespread losses among Bitfinite investors.

Mazebits is a continuation of the scheme run by the same anonymous admins.

Read on for a full review of the Mazebits MLM opportunity. [Continue reading…]

MBI International founder Teddy Teow charged with financial fraud

The Bank of Malaysia has charged MBI International Ponzi boss Teddy Teow with two counts of financial fraud. [Continue reading…]

The Bank of Malaysia has charged MBI International Ponzi boss Teddy Teow with two counts of financial fraud. [Continue reading…]

Avalon Life abandons Canadian IPO, blames affiliates

![]() Avalon Life started out in 2016 as an AVLX altcoin investment scheme.

Avalon Life started out in 2016 as an AVLX altcoin investment scheme.

AVLX didn’t go anywhere and was abandoned about a month after launch.

In mid 2017 Avalon Life rebooted as a Dash mining opportunity.

A few months later Dash was abandoned in favor of mining Pura Vida Coin.

By all appearances, Pura Vida Coin appeared to be Avalon Life’s second attempt to launch an altcoin.

By late 2017 Avalon Life appears to have quietly abandoned Pure Vida Coin.

Marketing material for a “Bitsurge token” first appeared on Avalon Life’s YouTube channel on December 11th, 2017.

This appears to coincide with CEO Tom Koller being replaced by Thomas Graf.

Avalon Life also switched its website domain to an .io variant, on which Graf is credited as the company’s founder and CEO. [Continue reading…]

Westland Storage Review: Crypto Ponzi with WLS token exit-scam

![]() Westland Storage provides no information on its website about who owns or runs the business.

Westland Storage provides no information on its website about who owns or runs the business.

The Westland Storage website domain (“westlandstorage.com”) was first registered in 2005.

The registration was last updated on May 9th, 2018 but provides no information about the domain’s owners.

A visit to the Wayback Machine confirms the current version of the Westland Storage website went live on or around April 27th, 2018.

Prior to that the Westland Storage domain redirected to an unrelated storage business in Michigan.

This coincides with Alexa reporting an uptick in traffic to the Westland Storage domain from early May.

Despite existing for less than a month, on its website Westland Storage claims to have generated $33.5 million in annual profit for over 8000 investors.

In an attempt to feign legitimacy, Westland Storage provides an incorporation certificate for “Westland Storage LTD”.

Westland Storage LTD was incorporated in the UK on February 1st, 2018.

UK incorporation is dirt cheap and for the most part unregulated. It is a favorite for scammers looking to incorporate dodgy companies.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Bitworld Center Review: 300% ROI bitcoin mining and trading Ponzi

Bitworld Center provide no information on their website about who owns or runs the business.

Bitworld Center provide no information on their website about who owns or runs the business.

The Bitworld Center website domain (“bitworldcenter.company”) was privately registered on April 2nd, 2018.

Further research reveals multiple affiliates claiming Bitworld Center is a “Brazilian company” operated by Macio Silver.

Possibly due to language barriers, I was unable to find anything further on Silver.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

CryptoRound Review: Cryptocurrency mining daily ROI Ponzi scheme

CryptoRound provide no information on their website about who owns or runs the business.

CryptoRound provide no information on their website about who owns or runs the business.

The CryptoRound website domain (“cryptoround.biz”) was privately registered on May 20th, 2018.

CryptoRound provide a bogus UK incorporation certificate for “CryptoRound Investment Pvt. Ltd.” on their website.

Legitimate UK incorporation certificates are bad enough. Fake UK incorporation certificates all but confirm the fraudulent nature of an MLM business.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]