Go9Tro Review: Forsage smart-contract Ponzi clone

Go9Tro provides no information on its website about who owns or runs the company.

Go9Tro provides no information on its website about who owns or runs the company.

Go9Tro’s website domain (“go9tro.io”) was first registered in August 2019. The private registration was last updated on September 10th, 2020.

In the about section of its official YouTube channel, Go9Tro provides an address in Japan.

Further research reveals this address belongs to WeWork. WeWork is an unrelated co-working location provider.

The first video uploaded to Go9Tro features a Chinese video description:

Without reading too much into this, it suggests whoever is behind Go9Tro is from south-east Asia.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Konstantin Ignatov released from prison on $500,000 bond

OneCoin CEO Konstantin Ignatov is scheduled to be sentenced on May 14th, 2021.

OneCoin CEO Konstantin Ignatov is scheduled to be sentenced on May 14th, 2021.

In the meantime, a January 28th filed appearance bond reveals Ignatov has been released on a $500,000 surety. [Continue reading…]

NRGY Review: DeFi + MLM = same old Ponzi schemes

With the MLM niche being the cesspool that it is, you’ll typically have a hard time getting to the bottom of who’s behind what.

“Decentralized” has become a term scamming admins hide behind so as not to reveal themselves.

NRGY token, another smart-contract Ponzi scheme, is no different. [Continue reading…]

BitcoLoan Review: Lending Ponzi with token exit-scam

![]() BitcoLoan provides no information on its website about who owns or runs the company.

BitcoLoan provides no information on its website about who owns or runs the company.

BitcoLoan’s website domain (“bitcoloan.com”) was first registered on July 4th, 2020. The private domain registration was last updated on October 28th, 2020.

Alexa currently ranks the top two sources of traffic to BitcoLoan’s website as India (20%) and the US (17%).

BitcoLoan’s official Twitter account places the company in Sydney, Australia.

None of these countries are likely candidates for where BitcoLoan is being operated from.

The first video uploaded to BitcoLoan’s official YouTube channel was on January 28th, 2021.

It’s a testimonial video from “Wendy”, who has a distinctly European accent.

Wendy is sitting in a left-hand drive car, so that rules out Australia and India.

Have a listen to “Craig”, “Melanie” and an official BitcoLoan tutorial video.

Update 22nd July 2021 – I had linked to several BitcoLoan vidoes hosted on their official YouTube channel above.

Sometime in the past 24 hours these videos have been marked private, so I’ve had to remove the links.

The company’s website is still up but I’m noting BitcoLoan’s official Facebook page has also been wiped. /end update

In case it wasn’t obvious, BitcoLoan is most likely being operated from Russia or the Ukraine.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

iHub Global Review: Helium Network Token mining

iHub Global provides no information on its website about who owns or runs the company.

iHub Global provides no information on its website about who owns or runs the company.

As I write this, iHub Global’s website is little more than a marketing video and affiliate login button.

Privacy Policy, Terms & Conditions and Disclaimer links at the bottom of the website are disabled.

iHub Global’s website domain (“ihub.global”) was privately registered on December 3rd, 2020.

Further research reveals iHub Global has an official Vimeo channel. This channel isn’t linked on iHub Global’s website.

Marketing videos on iHub Global’s Vimeo channel are hosted by Chuck Hanson (right).

Hanson refers to iHub Global in the possessive but doesn’t disclose his official position within the company.

Another name I recognized in iHub Global’s marketing presentations was Rick Cotton (aka Richard Cotton).

Cotton (right) first appeared on BehindMLM as the co-founder and CEO of eXfuze.

Cotton (right) first appeared on BehindMLM as the co-founder and CEO of eXfuze.

This was back in 2013. In 2019 eXfuze rebranded as KZ1. By this stage Cotton was no longer CEO but retained a controlling interest in the company.

In response to BehindMLM’s published KZ1 review, Cotton appeared in the comments to discredit our research.

You pretty much missed the mark on 50% of your findings.

At one time I would come to your site and it was reputable but honestly I do not believe that to be the case anymore.

After addressing the points Cotton made with evidence, Cotton only returned to spit the dummy.

In his comments (circa 2019), Cotton claimed he was “still actively involved” in KZ1. Whether that’s still the case is unclear.

In iHub Global Cotton seems to be in charge of creating marketing funnels. As with Chuck Hanson, Cotton’s specific role within the company isn’t disclosed.

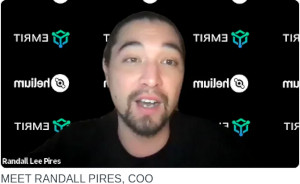

The only executive disclosed in iHub Global’s marketing material is COO Randall Pires.

The only executive disclosed in iHub Global’s marketing material is COO Randall Pires.

Pires doesn’t have an MLM history but is a co-founder of Emrit. Emrit appears to be iHub Global’s hardware supplier.

Read on for a full review of iHub Global’s MLM opportunity. [Continue reading…]

29,000 TelexFree victims have still not filed payment info

![]() A motion filed by the Trustee reveals around 29,000 TelexFree victims have still failed to provide payment information. [Continue reading…]

A motion filed by the Trustee reveals around 29,000 TelexFree victims have still failed to provide payment information. [Continue reading…]

CashFX Group securities fraud alert in New Brunswick, CA

New Brunswick’s Financial and Consumer Services Commissions has issued a securities fraud warning against CashFX Group. [Continue reading…]

New Brunswick’s Financial and Consumer Services Commissions has issued a securities fraud warning against CashFX Group. [Continue reading…]

Beurax securities fraud warning from New Brunswick, CA

![]() Roughly two weeks prior to its collapse, New Brunswick’s Financial and Consumer Services Commission issued a securities fraud warning against Beurax.

Roughly two weeks prior to its collapse, New Brunswick’s Financial and Consumer Services Commission issued a securities fraud warning against Beurax.

Unfortunately this one slipped under the radar until I came across it today. [Continue reading…]

Teqra CFO Jan Haagen outed as Russian actor in 8 hours

Earlier today BehindMLM published its Teqra review.

Earlier today BehindMLM published its Teqra review.

Based on the rented office template we’ve seen time and time again, we held strong suspicions that Teqra CFO Jan Haagen was a hired actor.

Within eight hours of publication a reader confirmed Haagen was indeed a Russian actor. [Continue reading…]

Forsage XGold Review: Lado Okhotnikov’s 4th Forsage Ponzi

![]() Forsage XGold is part of Lado Okhotnikov’s stable of Forsage branded Ponzi schemes.

Forsage XGold is part of Lado Okhotnikov’s stable of Forsage branded Ponzi schemes.

According to his Facebook profile, Okhotnikov is based out of Moscow, Russia.

Okhotnikov (right) describes himself as “the king of decentralized MLM”.

Okhotnikov (right) describes himself as “the king of decentralized MLM”.

“Decentralized MLM” being code for crypto Ponzi schemes.

Launched in April 2020, by September or so Forsage had gone into decline.

This prompted Lado to launch Fortron, the same smart-contract Ponzi recycled with TRON.

After publishing our Forton review last September, I figured that was the end of Okhotnikov’s smart-contract recycling.

Recently however I was contacted by a reader informing me they’d been pitched on new Forsage spinoffs.

Today we’re looking at Okhotnikov’s fourth Forsage company; Forsage XGold. [Continue reading…]