Clynton Marks denied “MTI was illegal” ruling appeal

Clynton Marks and accomplices Henri Honiball and Cecil Rowe filed an appeal against the High Court of South Africa’s “Mirror Trading International was an illegal and unlawful scheme” ruling.

Clynton Marks and accomplices Henri Honiball and Cecil Rowe filed an appeal against the High Court of South Africa’s “Mirror Trading International was an illegal and unlawful scheme” ruling.

The ruling, handed down earlier this year in April, paved the way for criminal proceedings and Liquidators going after Marks and co. [Continue reading…]

OMD Review: Film investment “click a button” app Ponzi

OMD (aka OMDCZ) fails to provide ownership or executive information on its website.

OMD (aka OMDCZ) fails to provide ownership or executive information on its website.

OMD’s website domain (“omdcz.com”), was privately registered on May 29th, 2023.

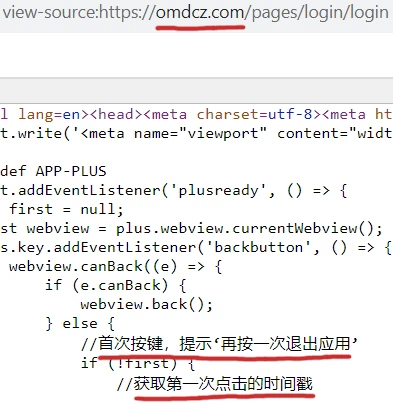

If we look at OMD’s website source-code, we find Chinese:

This suggests whoever is running OMD has ties to China.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

CashFX Group under criminal investigation in UK

A CashFX Group criminal investigation has been confirmed on the UK Police Major Incident Public Reporting Site.

A CashFX Group criminal investigation has been confirmed on the UK Police Major Incident Public Reporting Site.

As spotted by Harry Page of the FaceBook Group “CashFX (in association with EverFX) Scam – Now What!?“, Essex Police appear to be leading the investigation. [Continue reading…]

BitArbi Review: Crypto trading ruse Ponzi scheme

BitArbi fails to provide ownership or executive information on its website.

BitArbi fails to provide ownership or executive information on its website.

BitArbi’s website domain (“bitarbi.com”), was registered with bogus information on July 31st, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Prostox Review: AI trading ruse Ponzi scheme

Prostox fails to provide ownership or executive information on its website.

Prostox fails to provide ownership or executive information on its website.

Prostox’s website domain (“prostox.co”), was privately registered on July 12th, 2023.

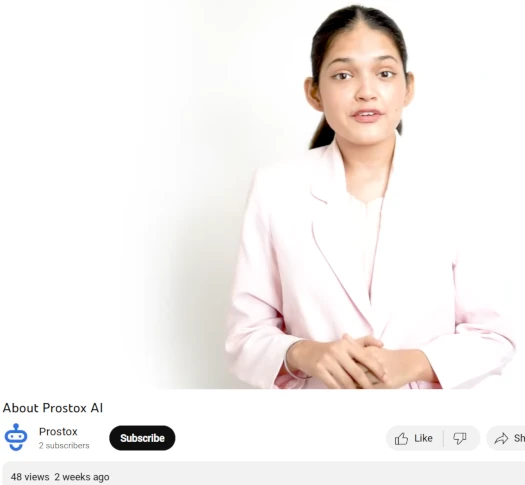

Of note is Prostox’s sole marketing video featuring a woman with a distinct Indian accent (could also be Pakistan or Bangladesh).

While not definitive, this suggests Prostox is being run by someone with ties to the India, Pakistan and Bangladesh region.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

BMcontract Review: AI trading ruse Ponzi scheme

Despite claiming it “believes in complete transparency”, BMcontract fails to provide ownership or executive information on its website.

Despite claiming it “believes in complete transparency”, BMcontract fails to provide ownership or executive information on its website.

BMcontract’s website domain (“bmcontract.io”), was privately registered on August 15th, 2023.

Despite only existing for about a week, BMcontract claims it

has a track record of providing an exceptional 99% success rate through its AI-driven trading strategies.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

CFTC secures prelim injunction against Fundsz defendants

The CFTC has secured a preliminary injunction against the Fundsz Ponzi Defendants.

The CFTC has secured a preliminary injunction against the Fundsz Ponzi Defendants.

The preliminary injunction was ordered on August 23rd, following consent motions filed on August 21st and 22nd. [Continue reading…]

Reyana Meta FX Review: Daily returns forex ruse Ponzi

Reyana Meta FX fails to provide ownership or executive information on its website.

Reyana Meta FX fails to provide ownership or executive information on its website.

Reyana Meta FX’s website domain (“reyanametafx.com”), was privately registered on July 16th, 2023.

In researching this review, I noted most of the Reyana Meta FX marketing appears to target Bangladesh.

This suggests Reyana Meta FX might be run from Bangladesh, or at the very least is focusing promotional efforts there.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Bitfinex Review: Crypto exchange house of cards

![]() Bitfinex is a well-known crypto exchange tied to tether (USDT). Turns out it’s also an MLM company.

Bitfinex is a well-known crypto exchange tied to tether (USDT). Turns out it’s also an MLM company.

Bitfinex was launched in 2012 by Raphael Nicolle. Nicolle parted ways with Bitfinex during the in early 2017.

Today Bitfinex is owned by iFinex Inc., a BVI shell company.

Names we can attach to Bitfinex include:

- Jean-Louis van der Velde (CEO) from the Netherlands

- Giancarlo Devasini (CFO) from Italy and

- Paolo Ardoino (CTO), also from Italy

To the best of my knowledge, none of Bitfinex’s executives have any prior MLM executive experience.

Being one of the oldest cryptocurrency exchanges, Bitfinex has a well-documented history:

- in June 2016 the CFTC fined Bitfinex $75,000 for failing to register itself and “offering illegal off-exchanged financed commodity transactions”

- a 2019 investigation by the New York Attorney General revealed Bitfinex hid over $1 billion in losses through Crypto Capital Corp from its investors

- in October 2021 the CFTC again fined Bitfinex $1.5 million, this time for performing “illegal, off-exchange retail commodity transactions in digital assets with Americans”

There’s a fair bit more, with Bitfinex’s Wikipedia entry making for good reading.

Read on for a full review of Bitfinex’s MLM opportunity. [Continue reading…]

LuLaRoe class-action arbitration reversed following appeal

Plaintiff Jessica Ponkey has prevailed in an appeal against a decision to close her LuLaRoe class-action.

Plaintiff Jessica Ponkey has prevailed in an appeal against a decision to close her LuLaRoe class-action.

Ponkey’s class-action was closed last year, following a Final Arbitration Award issued in April 2022. [Continue reading…]