Injunction granted in Tori Belle non-compete class-action

Back in May Class Plaintiff Suhanna Jens filed a class-action against Tori Belle in Washington.

Back in May Class Plaintiff Suhanna Jens filed a class-action against Tori Belle in Washington.

The case hasn’t gone well for Tori Belle, with both default judgment and an injunction granted against them recently.

Plaintiff Jens’ proposed class-action was filed on May 5th in the Superior Court of Washington, King County. [Continue reading…]

Tupperware fined $900K for Fuller Mexico autoship fraud

The Mexican division of House of Fuller has been fudging its autoship sales orders.

The Mexican division of House of Fuller has been fudging its autoship sales orders.

In August 2021 parent company Tupperware disclosed the fraud in an SEC filing. This prompted the SEC to open an investigation. [Continue reading…]

Joseph Cammarata bails on iGenius’ NDAU, “too volatile”

![]() One of Joseph Cammarata’s initiatives as Investview’s CEO was integrating it into iGenius’ MLM opportunity.

One of Joseph Cammarata’s initiatives as Investview’s CEO was integrating it into iGenius’ MLM opportunity.

To that end the company put out a June 2021 press-release;

Investview … is shifting its attention to ndau. The company, which has seen new highs in monthly gross revenues and net profits in Q1 2021, is betting on ndau to help fuel continued growth.

“Ndau enables individuals to participate in long-term holding of a digital currency without having to worry about such a wide range of volatility,” Investview Director of Finance Mario Romano said.

“I am confident that with our shared client-centric principles and passion for innovation and growth, Investview, LevelX and Prodigio will prove to be a winning combination for Investview and our customers,” said Investview’s Joseph Cammarata, who was named CEO in late 2019.

Following his arrest on criminal fraud charges, Cammarata pled with a court to let him liquidate his NDAU holdings.

Contrary to marketing representations Investview and iGenius made to their distributors, Cammarata told the court NDAU is too volatile to hold. [Continue reading…]

Joseph Cammarata hit with superseding indictment

![]() Former Investview CEO Joseph Cammarata has been hit with a superseding indictment.

Former Investview CEO Joseph Cammarata has been hit with a superseding indictment.

The indictment is dated September 8th, and adds wire fraud and money laundering charges to Cammarata’s alleged rap sheet. [Continue reading…]

Success Factory falling apart, Igor Alberts flees to Dubai

Success Factory is a marketing spinoff for DagCoin, a OneCoin clone launched by former investor Nils Grossberg.

Success Factory is a marketing spinoff for DagCoin, a OneCoin clone launched by former investor Nils Grossberg.

DagCoin collapsed earlier this year, leaving investors bagholding yet another worthless Ponzi coin.

To keep the grift going, Success Factory pivoted to automated forex trading.

Thus far this has failed to gain traction outside of recruitment in a few third-world countries (Ghana is being pillaged pretty hard at the moment).

Behind the scenes, Success Factory itself appears to be on the verge of collapse.

Top earners Igor Alberts and Andrea Cimbala, also husband and wife, are believed to have abandoned Success Factory and fled to Dubai. [Continue reading…]

SunSolar Ponzi collapses, pulls “swears to Jesus” exit-scam

The SunSolar “click a button” app Ponzi has collapsed.

SunSolar affiliates began reporting withdrawal problems a few weeks ago. It appears not every withdrawal was blocked, suggesting SunSolar was being selective about who could withdraw.

SunSolar responded to withdrawal complaints with a message “swearing to Jesus” that withdrawals were still open. [Continue reading…]

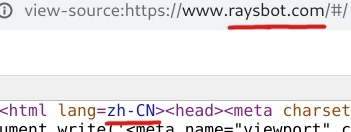

RaysBot Review: Trading themed “click a button” app Ponzi

RaysBot fails to provide company ownership or executive information on its website.

RaysBot fails to provide company ownership or executive information on its website.

RaysBot’s website domain (“raysbot.com”), was privately registered through a Singapore registrar on August 27th, 2022.

If we look at the source-code of RaysBot’s website, we can see it is localized to Chinese:

In an attempt to appear legitimate, RaysBot provides incorporation certificates for various shell companies in Singapore, Australia, Canada, the US and the UK.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Adivah Tech Review: EnviFX forex platform securities fraud

Adivah Tech provides no company ownership or executive information on its website.

Adivah Tech provides no company ownership or executive information on its website.

Adivah Tech’s primary website domain (“adivahtech.com”), was privately registered on August 28th, 2022.

Adivah Tech also owns “adivahtradingacademy.com”, however the domain is currently parked.

The Adivah Trading Academy domain was first registered in September 2021. The private registration was last updated on September 15th, 2022.

Adivah Trading Academy’s official FaceBook page was created on May 8th, 2021. I believe this was the intended original name for Adivah Tech.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

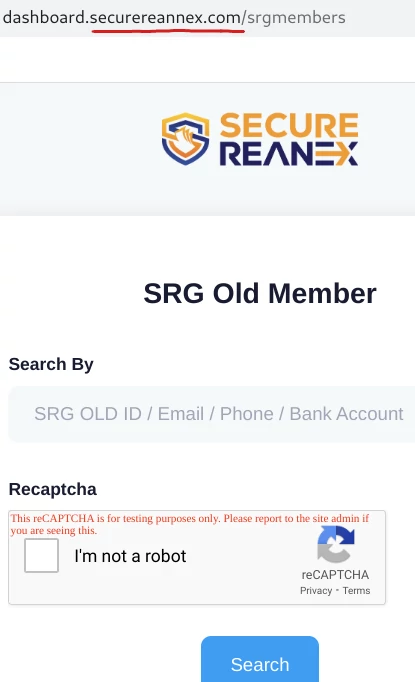

Secure Reannex Review: B4U Global & SR Group rebooted

Secure Reannex fails to provide company ownership or executive information on their website.

Secure Reannex fails to provide company ownership or executive information on their website.

They also consistently fail to spell their company name correctly in logo branding.

Secure Reannex’s website domain (“securereannex.com”), was privately registered on June 27th, 2022.

Further research reveals Secure Reannex promoters marketing it as a reboot of B4U Global and SRG.

B4U Global was a Ponzi scheme pitching monthly returns of up to 20%.

Launched in 2020, B4U Global appears to have collapsed around mid 2021.

Heading up B4U Global was CEO Saifur Rehman Khan (right).

Heading up B4U Global was CEO Saifur Rehman Khan (right).

Khan was arrested by Pakistani authorities after B4U Global collapsed.

B4U Global victim losses were initially pegged at ~$46.7 million USD.

As of March 2022 Khan was in custody with a bail hearing pending. Pakistani authorities are squabbling over who should be leading the case.

SR Group appears to be a short-lived reboot of B4U Global. “SRG” stood for “Saif ur Rehman Group”.

Secure Reannex appears to be a clunky attempt to keep the “SRG” initials branding going.

Victims of both B4U and SR Group are now being funneled into Secure Reannex:

The integration of the SR Group investor database into Secure Reannex makes it a third reboot of B4U Global. Seeing as Khan is in custody, it’s assumed his accomplices are behind Secure Reannex.

Secure Reannex’s official marketing presentation cites “Ken Barbaros” as the company’s CEO.

Barbaros doesn’t exist outside of Secure Reannex’s presentation. He’s believed to be represented by an actor or stolen profile photo.

SimilarWeb currently tracks 100% of Secure Reannex’s website traffic from Pakistan.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Helo Corp announces plans to abandon Vyvo MLM opportunity

Vyvo’s parent company Helo Corp has announced plans to “discontinue the Company’s network marketing operations globally”. [Continue reading…]

Vyvo’s parent company Helo Corp has announced plans to “discontinue the Company’s network marketing operations globally”. [Continue reading…]