FomoEX Review: 300% ROI eOracle HyperFund mega Ponzi

FomoEX operates in the cryptocurrency MLM niche. The company fails to provide a corporate address on its website.

FomoEX operates in the cryptocurrency MLM niche. The company fails to provide a corporate address on its website.

Heading up FomoEX is Stephen Meade (President) and David Hung (CEO).

Stephen Meade (right) is an unknown in the MLM industry. Over the past few years he’s reinvented himself as a crypto bro.

Stephen Meade (right) is an unknown in the MLM industry. Over the past few years he’s reinvented himself as a crypto bro.

Meade’s crypto bro adventures appear to have culminated in MonetaPro, a failed cryptocurrency ecommerce platform.

Over the past two years or so Meade has also jumped on the podcast bandwagon.

The last episode of “The BullsEyeGuy” was uploaded to YouTube on September 23rd, 2021. It has 11 views.

FomoEX’s website credits David Hung as

FomoEX’s website credits David Hung as

Owner of the largest Filecoin farms in Singapore, Hold mining farm in Singapore and USA. [sic]

Other than that there’s not much out there on Hung. He appears to be another crypto bro with nothing much else going on.

Based on his appearance in a FomoEX marketing video, and Chinese-language spam articles talking up his ties to FileCoin, Hung is believed to have ties to China.

This tracks with FomoEX running on a Shanghai time commission schedule.

On Facebook Stephen Meade represents he is based out of California in the US.

FomoEX recently held a prelaunch event in Dubai. Both Meade and Hung were in attendance.

Whether the pair have taken the precautionary measure of relocating there yet though is unclear.

Dubai is the MLM scam capital of the world. The emirate’s lack of regulatory enforcement sees it attract MLM scammers from all over the world.

At least for now, FomoEX has chosen Dubai to launch its business operations from.

On the pseudo-compliance side of things, FomoEX pretends it is based out of the British Virgin Islands in its website Terms of Service:

GOVERNING LAW

These Terms of Use shall be governed by and construed in accordance with BVI law.

BVI is another hidey-hole with no active MLM fraud related regulation. Because of this it a favorite jurisdiction for scammers to incorporate shell companies in.

Read on for a full review of FomoEX’s MLM opportunity.

FomoEX’s Products

FomoEX has no retailable products or services.

Affiliates are only able to market FomoEX affiliate membership itself.

FomoEX’s Compensation Plan

FomoEX solicits investment in cryptocurrency on the promise of advertised returns.

- Package-1 – invest $100 and receive up to 10% a month

- Package-2 – invest $300 and receive up to 11% a month

- Package-3 – invest $500 and receive up to 12% a month

- Package-4 – invest $1000 and receive up to 13% a month

- Package-5 – invest $5000 and receive up to 14% a month

- Package-6 – invest $10,000 and receive up to 15% a month

- Package-7 – invest $25,000 and receive up to 16% a month

Returns are paid up to 300%, after which reinvestment is required to continue earning.

FomoEX solicits investment in USDT, ECN and MOF:

- 100% of the required investment amount can be made in USDT

- up to 70% of the required investment amount can be made in USDT, the remaining 30% can be made in ECN or MOF

The MLM side of FomoEX pays on recruitment of affiliate investors. Note that FomoEX affiliates must have an active investment to earn MLM commissions.

FomoEX pays monthly returns and MLM commissions in F-USD.

F-USD is an internal shit token. It is worthless outside of FomoEX.

Affiliates convert F-USD into USDT (1:1) in their FomoEX backoffice for withdrawal.

FomoEX Affiliate Ranks

There are six affiliate ranks within FomoEX’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Bronze – generate $50,000 in downline investment volume

- Silver – generate $100,000 in downline investment volume and have two Bronzes in your downline (one in two separate unilevel team legs)

- Gold – generate $250,000 in downline investment volume and have two Silvers in your downline (one in two separate unilevel team legs)

- Ruby – generate $500,000 in downline investment volume and have two Golds in your downline (one in two separate unilevel team legs)

- Diamond – generate $1,000,000 in downline investment volume and have two Rubys in your downline (one in two separate unilevel team legs)

- Black Diamond – have three Diamonds in your downline (one in three separate unilevel team legs)

Recruitment Commissions

FomoEX affiliates earn a 5% commission on 50% of funds invested by personally recruited affiliates.

Residual Commissions

FomoEX pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Residual commissions are paid as a percentage of monthly returns paid to affiliates.

- levels 1 and 2 – 5%

- level 3 – 4%

- level 4 – 3%

- levels 5 to 15 – 2%

Note that to earn on each level a corresponding number of affiliates with active investments must be recruited.

E.g. to earn on level 1, one investing affiliate must be recruited.

To earn on up to level 5, five investing affiliates must be recruited and so on and so forth.

FOMO Linear Commissions

FomoEX places everyone who joins into a company-wide compensation structure.

The structure itself isn’t all the clear:

Practically speaking whatever the specific structure is, it still functions as a company-wide straight-line downline.

FomoEX feed this straight-line into a binary team.

Fomo linear commissions are paid 10% of new investment matched on both sides of the binary team. weekly from funds invested after you once placed in the line.

To qualify for Fomo Linear commissions, each affiliate must personally recruit at least three investing affiliates.

FOMO linear commissions are capped at three times the maximum they earn in returns and MLM commissions.

There also appears to be an arbitrary weekly cap that FomoEX set each week.

I believe a new Fomo Linear commissions position is created each time a FomoEX affiliate reinvests.

Leadership Pool

FomoEX takes 8% of company-wide investment volume and places it into six Leadership Pools.

Leadership Pool qualification is tied to rank:

- the Bronze Pool is made up of 1% and is distributed equally to Bronze ranked affiliates

- the Silver Pool is made up of 1% and is distributed equally to Silver ranked affiliates

- the Gold Pool is made up of 1% and is distributed equally to Gold ranked affiliates

- the Ruby Pool is made up of 1% and is distributed equally to Ruby ranked affiliates

- the Diamond Pool is made up of 2% and is distributed equally to Diamond ranked affiliates

- the Black Diamond Pool is made up of 2% and is distributed equally to Black Diamond ranked affiliates

Joining FomoEX

FomoEX affiliate membership is tied to a $100 to $25,000 initial investment.

FomoEX solicits investment in USDT, ECN and MOF.

Conclusion

BehindMLM came across FomoEX as a reboot of the collapsed eOracle Ponzi scheme.

This was a few days ago and since then there’s been a fair bit of confusion as to who’s actually behind FomoEX.

This is mainly attributable to FomoEX’s integration of ECN and MOF, the respective Ponzi tokens used by eOracle and HyperFund.

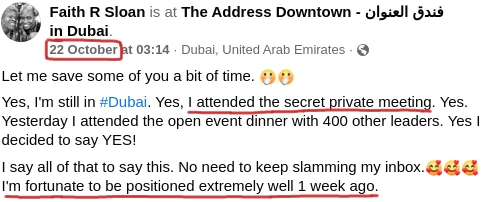

To that end when FomoEX held its closed-door prelaunch event in Dubai earlier this week, word quickly spread that Sam Lee was in attendance.

Sam Lee (believed to be an Australian citizen, right) is part of HyperFund owner Ryan Xu’s posse of crypto bros. Most of them fled to Dubai earlier this year.

Sam Lee (believed to be an Australian citizen, right) is part of HyperFund owner Ryan Xu’s posse of crypto bros. Most of them fled to Dubai earlier this year.

Lee is officially credited as CEO of HyperFund.

While they’re happy to keep the nature of the financial relationship between FomoEX and HyperFund secret, the company soon realized recruitment would tank if FomoEX was marketed as a replacement.

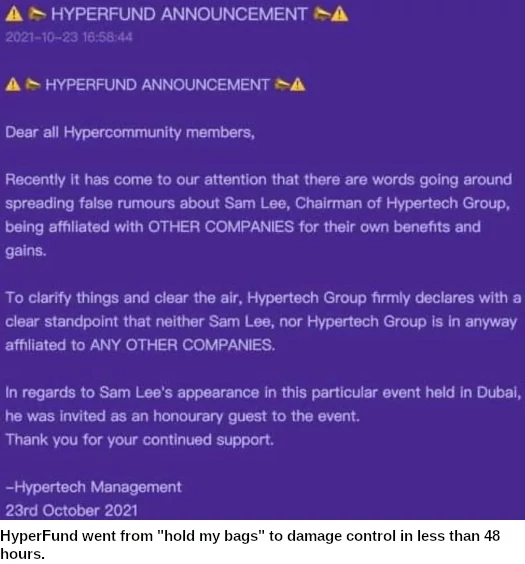

Cue an emergency notice pushed out to the HyperFund affiliate backoffice on October 23rd:

Things are a bit different at eOracle, where FomoEX is being pitched as “phase 2” of the Ponzi scheme.

There isn’t any pushback from eOracle on this because their Ponzi scheme has already collapsed. Twice in fact.

HyperFund is likely on its way to collapse but isn’t quite there yet – hence the notice.

Like I said, the financials between FomoEX, eOracle and HyperFund are shrouded in mystery.

What is clear however is that top earners in eOracle and HyperFund were preloaded into FomoEX:

Stephen Meade and David Hung appear to have been plucked from obscurity. Whether they’re just front men or actually running FomoEX is unclear.

Seems a bit odd two crypto bros would randomly meet up in Dubai to launch a successor to two failing MLM Ponzi schemes.

This could also be part of a wider exit-scam, in the hope eOracle and HyperFund executives might dodge regulatory heat.

Certainly with respect to HyperFund, regulators around the world have started to take notice.

Behind securities fraud notices are investigations, the results of which have yet to play out.

How regulators will tackle the plague of MLM Ponzi schemes and scammers hiding out in Dubai remains to be seen.

In the meantime there is nothing remarkable about FomoEX. It’s your standard MLM crypto Ponzi scheme.

Invest crypto, get back 300% of some bullshit token that took 2 minutes to set up.

The MLM side of FomoEX is a pyramid scheme, paying on recruitment of new affiliate investors.

Like any Ponzi scheme, this works until withdrawals exceed new investment.

Having merged their fraudulent schemes together, either eOracle, FomoEX and HyperFund will triple collapse at that point. Or we’ll see a new migration.

How convoluted the Dubai MLM crypto Ponzi sphere gets is a work in progress.

One final point I want to address is the virtual shares Stephen Meade is marketing FomoEX with.

[0:20] We’ve created a cool plan, and we’ll show you how to potentially participate in an IPO of the mining company.

(We’ll) give you a chance to earn shares very early in the company without cost.

You’ll be able to accumulate them through the compensation plan that’s been created.

FomoEX pretends returns are generated via mining. I believe this is the tie in to David Hung’s supposed FileCoin fame.

What’s missing is registration with financial regulators and audited financial reports.

At time of publication Alexa ranks top sources of traffic to FomoEX’s website as the US (29%), India (17%) and Russia (12%).

This makes sense, seeing as the US and India are the top sources of investment into HyperFund and eOracle respectively.

Neither FomoEX, Stephen Meade or David Hung are registered to offer securities in the US or India. Or anywhere in the world for that matter.

As previously stated, top eOracle and HyperFund earners have already been preloaded into FomoEX.

Members of the public can sign up now but can’t throw their money away until October 28th.

Update 10th November 2021 – Indian authorities have identified a trio of scammers they claim are behind FomoEX, Espian Global and eOracle.

The arrested suspects are Raghavendra, Nagaraju and Shivamurthy. All three reside in Bangalore, India.

Update 7th June 2022 – FomoEx has deleted their YouTube channel.

This review did have two linked videos from their channel. In light of the deletion, I’ve disabled the previously accessible links.

It’s also worth noting that traffic to FomoEx’s website has tanked:

Combined with the arrests above, FomoEX’s website is still up but the attached Ponzi scheme is probably over.

Isn’t Faith Sloan under some sort of order from TelexFree not to pimp scams??…or has that expired??..

Yep. Sloan signed a settlement with the SEC prohibiting continued promotion of unregistered securities.

Sloan: *goes back to promoting unregistered securities a few months after signing TelexFree settlement*

SEC: …

So, this FOMOEX is a scam? I know I invested in ECC, EIFI AND PANDAINU, with nothing gained from either of these.

I am doubtful about investing since I got this in my email spam folder, what’s the absolute truth?

The “absolute truth” is in the review. Read it.

Oz, you made a typo

Other than that, very curious to see this whole Hyperfund thing play out.

Thanks for catching that! I’m trialling a new grammar check, let’s see how that goes.

Automaticc canning After the Deadline really screwed me over. It was integrated and nothing is remotely as good.

Your review looks one sided and more like a paid arrangement.

I was expecting to read more about Filecoin, is it a coin, is there a mining center, its ties with Hung, Does he have anything to do with Filecoin?

I mean something concrete. Not the shabby write-up that you have here. With what you did here, its possible you’re one of those who fell out with Hyperfund or e-Oracle.

If Filecoin Mining Company is a none existing company, then it will confirm your take on e-Oracle and Hyperfund. But if they’re existing and reputable, then its illogical for them to be associated with scammers.

So please avoid being tagged a FUDder or disgruntled fellow and lets see result of a good research.

EOracle did pay their affiliates 150% returns, How can you say Eoracle collapsed?

Atleast they gave some returns on investment.

My initial research notes did flag looking into Hung’s FileCoin claims.

I soon realized FomoEX has nothing to do with FileCoin though so didn’t bother. If you can point out where FileCoin fits into FomoEX’s compensation plan I’ll revisit.

Otherwise legitimacy via association isn’t a thing. FileCoin is irrelevant with respect to FomoEX due-diligence.

Because it did.

The usual suspects who get in early getting paid doesn’t change the fact that eOracle disabled withdrawals because it collapsed.

Show us proof that filecoin is real and connected to FomoEX….

If you can’t then you are the FUDer…

We’ll wait…

Any prediction when HyperFund will collapse?

I want to tell my friends to start withdrawing or they will hold their empty bags.

I have a standard six-sided dice in my hand. If you can tell me how many times I need to roll it before I hit a 6, I will answer your question.

The time it takes for any Ponzi scheme to collapse is completely random.

All that is known is that it will happen eventually, because the pool of potential suckers is non-infinite.

Over 99% of people in Ponzi schemes lose money and the chance that your friends are in the <1% is almost nil, unless they were in it from the beginning.

That should be all the reason they need to withdraw now. That and the fact they are scammers participating in a fraud (whether or not they lose money).

How we can belive that fomoex are real company and how we satisified that its not a fraud can you give a garenter.

FomoEX committing fraud has nothing to do with it being a “real company”.

FomoEX markets a securities offering. FomoEX isn’t registered to offer securities in any jurisdiction.

Securities fraud = fraud. That much I can guarantee.

News: indianexpress.com/article/cities/bangalore/three-arrested-over-cryptocurrency-chain-link-scam-in-bengaluru-7611400/

Holy crap, Indian authorities already arrested the FomoEX scammers?

Proactive regulation feels weird…

I’d bet these are the eOracle scammers too. Wonder if a warrant is out for Karn Dwivedi yet.

Confirmed the FomoEX scammers are also behind Espian Global and eOracle.

Wonder how far back the investigation begun and whether it’s just India…

I am not sure about FomoEX yet, but I have been doing my own due diligence, as I am tired of reading negative reviews just to be sent to the writer’s business opp. So boring! yawn

Anyway,I wanted to point out to your readers, that Stephen Meade seems to be a lot more successful than you make him out to be. I was listening to him here in this interview. (link below). I found this by “Googling” Stephen and wikipedea links.

Some links went nowhere but I found this one and I thought it was worth pointing out that he actually seems to be pretty knowledgable with regards blockchain technology.

I like to take the term “scammers” as a challenge to find out the truth as it seems that word is used far too loosely these days!

Here is the article I found if anyone is interested. (Ozedit: spam removed)

will you publish this?

Stephen Meade being a blockchain bro (as stated in the review) and knowing crypto jargon, doesn’t change the fact FomoEX is committing securities fraud because it’s a Ponzi scheme.

Also Meade knowing blockchain jargon doesn’t make him successful. Crypto is full of failed entrepreneurs who reinvented themselves as blockchain bros.

String of failed blockchain schemes and then an MLM crypto Ponzi. We see it all the time.

If you can establish how Meade knowing blockchain bro buzzwords changes FomoEx’s business model, sure.

Did your due diligence include reading up on the arrest of the actual scammers behind fomoex??…

https://behindmlm.com/companies/fomoex-ponzi-admins-arrested-in-india-eoracle-too/

This biggest scam in 2021-22. in this scheme, leaders only made money in this scheme.

the founder focuses only on leaders’ benefits. how many people suffering over the past 5months. but leaders are absconded with their families and enjoying in overseas.

The government is unable to help out with this because we invested in USD. when we asking our money back they tell unwanted stories.

Article updated noting FomoEx deleting their YouTube channel.

Website traffic has also tanked.