Faith Sloan already violating her $778K TelexFree Ponzi judgment

![]() On June 3rd a $778,455 final judgment was entered against Faith Sloan.

On June 3rd a $778,455 final judgment was entered against Faith Sloan.

Sloan’s judgment was part of the SEC’s case against TelexFree scammers, who collectively stole over $3 billion from their victims.

As part of the judgment, Sloan is “permanently restrained and enjoined” from committing securities fraud.

Trouble is that while her attorney was engaging the SEC, Sloan was and continues to openly commit securities fraud.

As per Sloan’s ordered Final Judgment, she’s been ordered to pay

As per Sloan’s ordered Final Judgment, she’s been ordered to pay

- $650,334 in disgorgement (returning the money she stole from TelexFree victims);

- $120,621 in prejudgment interest; and

- a $7500 civil fine

Part of what Sloan owes will be immediately settled by her attorney surrendering $30,000 held in escrow.

A Bank of America account in Sloan’s name holding $1058 will also be emptied out.

Sloan has fourteen days from June 3rd to satisfy the remaining $747,397 judgment.

In light of Sloan’s final judgment the scheduled trial, which would have given Sloan the opportunity to clear her name and prove she isn’t a Ponzi scammer, has been cancelled.

With respect to what Sloan can and can’t do, the order stipulates Sloan is “permanently restrained and enjoined” from “violating Section 5 of the Securities Act”.

That is to say Sloan is prohibited from offering or selling unregistered securities in any capacity.

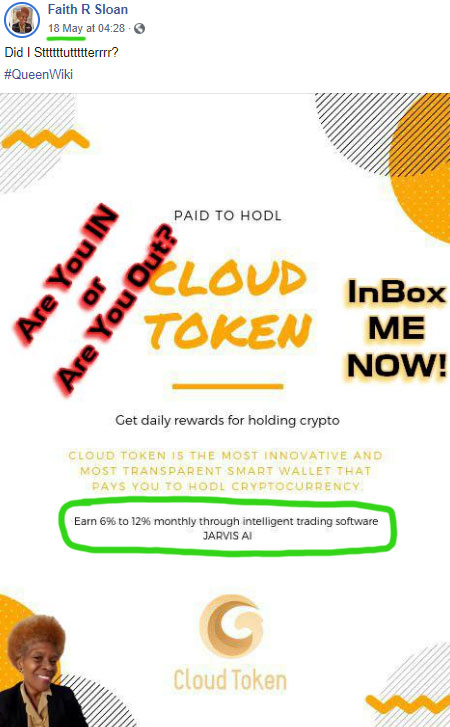

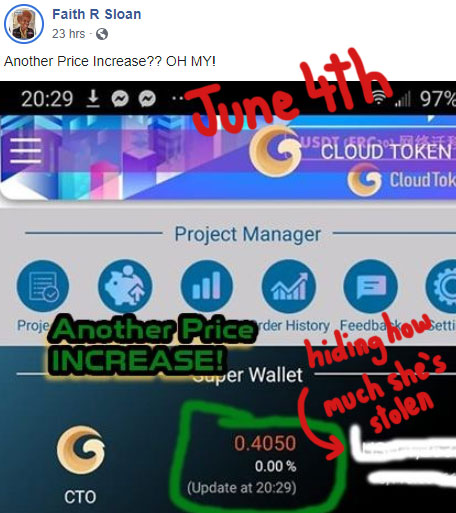

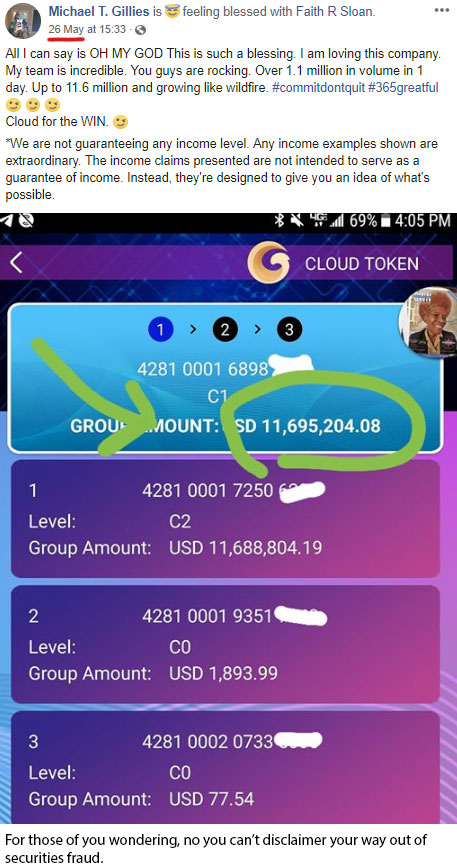

Among other suspect schemes, before, during and now after her final judgment, Sloan has been promoting Cloud Token.

As per Cloud Token’s business model, affiliates invest with the company and receive CTO. Investment is made on the the expectation of a passive return.

This return is achieved by Cloud Token arbitrarily increasing the internal value of CTO tokens, allowing affiliates, like Sloan, to cash out.

Cloud Token is not registered to offer securities in any jurisdiction it operates in. As a promoter of Clout Token, Faith Sloan is not registered to offer securities with the SEC either.

Cloud Token represents it generates external revenue through trading, supposedly through their “Jarvis AI” bot.

To date however Cloud Token has not registered itself with a financial regulator in any jurisdiction it solicits investment in.

Nor have Cloud Token affiliate investors been provided with evidence of external revenue actually being used to pay affiliates (filed audited accounting).

Upon receiving withdrawal requests from affiliate investors, Cloud Token simply pays them with subsequently invested funds.

Thus in addition to offering unregistered securities, Cloud Token also operates as a Ponzi scheme (wire fraud).

By promoting Cloud Token Sloan is in violation of her TelexFree final judgment order.

Whether the SEC takes any further action against Sloan and/or Cloud Token remains to be seen.

Certainly the more pressing of the two potential defendants would appear to be Sloan.

Entering into final judgement with securities fraud perpetrators, who continue to openly commit securities fraud before, during and after judgment proceedings, is not a good look for a regulator.

N.B. The SEC’s press-release states

The original summary judgment amount was $1.2 mill. The filed final judgment order however only adds up to $778,455.

Not sure why there’s a discrepancy but I’m going with the filed order.

how come the sec doesn’t give the electric chair a scammer that makes thousands of people lose money?

How can we report this to the SEC directly?

I live in a fantasy world where the Department of Justice says, “we’ll take it from here”.

Faith Sloan has been selling one Ponzi scheme after another to any and all suckers for about 15 years that I am aware of.

Until law enforcement recognizes that the referral pimps are the engine that drives the problem, nothing will change.

SD

it was better the Middle Ages, when these crooks had arms and legs amputated and burned like witches.

Agreed. And that “problem” is endless-chain recruiting which is the practical definition of MLMing.

So, the best we can do to reach the masses is educate and warn them about the method, as well as the individual companies and pimps.

Too many people think “MLMs” are each different. Firstly, they are not MLMs. They are companies that use the MLMing method; hence, same CON GAME under a different name using a variety of products or pseudo products to perpetrate the fraud.

Not to mention Cloud Token (CTO) is not even listed as a bona fide Cryptocurrency on any public blockchain.

Imagine my surprise to find the adage to be true. Once a conman/woman always a conman/woman because the temptation to con people is more appealing to them than actual work!

Cloudtoken is just one of a string of things Sloan has promoted while still being restricted from doing so. Remember Dubli?

Can I be advised please! Are the participants claims being discounted?

That a participant can look for a person willing to wait a little bit longer to compensate him at a discount!

There’s a few companies buying up claims for a fraction of what will eventually be paid out.

Oz This implies that all is not lost, what we need to do is to be patient a little longer!

Thank you!

WAGALO you are the warm little center that this world crowds around!! thank you!! XD

Thank you Andrew!

Behindmlm, As if there’s an effort by the trustee through court to weed out net winners, heralding the thinking of compensating the claimants?

Is it advisable and prudent to discount these claims other than waiting a little bit longer?

You’ve waited this many years, might as well stick it out unless you really need some money now.

Oz thanks very much for the advise! I can see some sense in your assertion!

Because there is no point of loosing 12 percent of my claims (which represents the time I have been patient) yet it could be around the corner that these claims will be made good!

2020 godrey. 2020.

Slowly rumbling along. The Trustee is getting rid of zero dollar claims (people who filed a claim and failed to respond to requests for more information).

Hearings will be held on the fifteen motions (250 claims in each) on September 24th.

Also hearings to disallow net-winner claims on October 2nd and 10th.

thank you! hopefully December 25 will be the best x-mas ever!

no it wont. there will be no distribution this year. lolz

Can anyone research whether she is in custody or not or just rumours going around Facebook.

There is no official word as to Sloans’ whereabouts, just rumour and unsubstantiated stories.

I haven’t been able to confirm anything wrt Sloan’s possible arrest/detainment. All I can confirm is her personal Facebook page is down.

Not going to speculate as it may be nothing. Waiting and watching.

Faith R Sloan was picked up on November 4th for breaking her agreement with the SEC. She is banned from promoting scams and is promoting scams.

Her family told my buddy this directly. Her Facebook account was also seized as proof.

Excuse me, November 6th.

Sloan’s Facebook page is back, so uh ???

Oz, she was released with new court case I am told. She got her Facebook account back yesterday and that makes me assume she has joined the choir and is singing like a bird on Cloud Token!

An arrest would be DOJ related, which would be a new case.

Anything to do with the SEC is civil. The only arrests I’ve seen are for contempt.

Anyway if there’s a new case it’s only a matter of time before it’s made public. Not convinced myself.

faith sloan settled for 31k w/ tustee….

kccllc.net/telexfree/document/1440987190508000000000008

Yeah they really need to follow up on the “thou shalt not in the future” injunction stuff. Cash FX is clearly another unregistered securities offering…

these guys got it right.

you sell drugs………you get ritch, but you get busted, you go away for life.

you steal…………….you get ritch, but you get busted, you go away for along time.

you do ponzi schemes however………… you finna get Rich, and if you get busted, you get to keep scamming and getting ritch.

anyone out there considering a career in crime. ponzi is the way to go, profitable, and safe from any real” prosecution, just slaps on the wrist and keeep oooooon scammin’ bababy.

ponzi is the new pork barrel.

Faith’s new gig from Linkedin:

Not so much a new gig. FRS Associates = Faith Renee Sloan Associates.

Probably a shell company she runs the money side of promoting scams through her Queen Wiki FB group through.

They’re digging up the failed Super One Ponzi scheme from mid 2018. Guess things are pretty bleak out there.

Faith Sloan is promoting the Forsage scam now too. I heard her introducing a video presentation for that.

How do you get help from the FBI if you have been scammed by one just like this woman ?

fbi.gov/contact-us

Not a guarantee they’ll “help you”.

Faith sloan found a new scam to pitch…she’s doing zoom calls for Metafi Yielders…

3% daily run by an Aussie in Perth who claims to be an accountant and programmer but the Now What fb group discovered that he’s actually a cook/chef in real life and not a very good one!!…

She is also promoting cotps scam along with known scammer Shohan and Mike Lucas.