Daisy Forex Review: Jeremy Roma heads up EndoTech Ponzi

![]() Back in 2020 Daisy AI surfaced as a Ponzi scheme pushed out by EndoTech.

Back in 2020 Daisy AI surfaced as a Ponzi scheme pushed out by EndoTech.

EndoTech pitched itself as a Israeli crypto trading bot firm headed up by Anna Becker and Dmitry Gushchin.

BehindMLM reviewed Daisy AI on December 3rd, 2020. We found a typical MLM crypto Ponzi dressed up as “equity crowdfunding”.

Since publishing our review, EndoTech has positioned itself as a firm that enables other companies to commit securities fraud.

Daisy AI is one of those companies, with Jeremy Roma emerging as the face of the operation.

In hindsight Roma was likely always behind Daisy AI, but this was masked when Daisy AI launched.

Having scammed a bunch of people and stashed a bit of ill-gotten gains away, Roma has gotten more comfortable associating himself with Daisy AI.

Roma is a US national who relocated to Dubai as part of his transition to crypto fraud. In line with his confidence in getting away with fraud growing, Roma now spends his time between Dubai and the US.

Roma’s MLM origins date back to selling coffee at Organo Gold. In 2019, a year before Daisy AI launched, BehindMLM came across Roma in Apex.

Apex was a $13,750 five-year investment crypto mining Ponzi. Apex in its original incarnation lasted a few months.

Roma tried to keep the Ponzi going with former OneCoin scammers but that didn’t last long.

Roma transitioned into crypto fraud in or around 2018 through Holton Buggs, a disgraced Organo Gold founder turned crypto Ponzi scammer in his own right.

Since its 2020 launch Daisy AI has collapsed numerous times. BehindMLM hasn’t really been tracking Daisy AI’s collapses, but we did document the “daisy token” exit-scam in 2021.

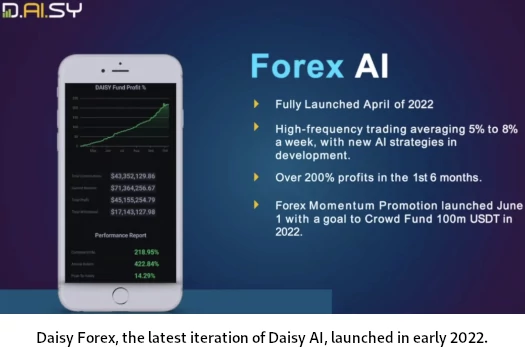

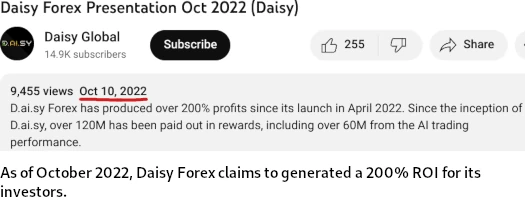

The latest incarnation is Daisy Forex, launched in or around April 2022.

This current Daisy Forex iteration is what we’re reviewing today.

Daisy Forex’s Products

Daisy Forex has no retailable products or services.

Affiliates are only able to market Daisy Forex affiliate membership itself.

Daisy Forex’s Compensation Plan

Daisy Forex affiliates invest tether (USDT) on the expectation of a passive ROI, purportedly derived via bot trading.

- Tier 1 – invest 100 USDT and receive a 50% split in trading revenue

- Tier 2 – invest 200 USDT and receive a 50% split in trading revenue

- Tier 3 – invest 400 USDT and receive a 70% split in trading revenue

- Tier 4 – invest 800 USDT and receive a 70% split in trading revenue

- Tier 5 – invest 1600 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $1600 USDT is invested)

- Tier 6 – invest 3200 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $3200 USDT is invested)

- Tier 7 – invest 6400 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $6400 USDT is invested)

- Tier 8 – invest 12,800 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $12,800 USDT is invested)

- Tier 9 – invest 25,600 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $25,600 USDT is invested)

- Tier 10 – invest 51,200 USDT and receive a 70% split in trading revenue (can be increased to 90% if another $51,200 USDT is invested)

Daisy Forex’s investment tiers are cumulative, meaning tiers must be invested into in sequential order.

Note that at Tier 10, Daisy Forex affiliates are able to continue investing in $51,200 amounts.

Equity Shares

Daisy Forex takes 5% of company-wide invested USDT and places it into an equity share pool.

This pool is paid out to investing affiliates, based on how many shares they have in the pool.

- $200 USDT investment tier affiliates receive 1 share

- $400 USDT investment tier affiliates receive 2 shares

- $800 USDT investment tier affiliates receive 4 shares

- $1600 USDT investment tier affiliates receive 8 shares

- $3200 USDT investment tier affiliates receive 16 shares

- $6400 USDT investment tier affiliates receive 32 shares

- $12,800 USDT investment tier affiliates receive 64 shares

- $25,600 USDT investment tier affiliates receive 128 shares

- $51,200 USDT investment tier affiliates receive 256 shares

As with Daisy Forex’s investment scheme, equity shares are cumulative as higher tiers are invested into.

Note that if double investments are made from Tier 5 and higher, double the shares are allocated at these tiers.

Referral Commissions

Daisy Forex affiliates earn a 5% commission on all USDT invested by personally recruited affiliates.

Residual Commissions

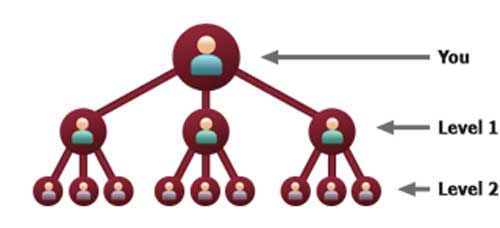

Daisy Forex pays residual commissions via a 3×10 matrix.

A 3×10 matrix places a Daisy Forex affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these first three positions into another three positions each (9 positions).

Levels three to ten of the matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

Each Daisy Forex investment tier corresponds to a separate 3×10 matrix. I.e. if a Daisy Forex affiliate has invested in each of the ten available tiers, they’ll be participating in ten 3×10 matrices.

Affiliates placed into a matrix can be directly or indirectly recruited.

Residual commissions are paid as a percentage of USDT invested by downline affiliates recruited into the matrix at each tier.

Residual commission rates are the same across all ten tiers but are increased as additional matrix levels are qualified for.

For Daisy Forex investment tier 1, affiliates earn on all ten levels of the matrix:

- a 4% residual commission rate is paid on matrix levels 1 and 2

- a 2% residual commision rate is paid on matrix levels 3 to 10

From investment tiers 2 to 10, levels 3 to 10 of the matrix must be unlocked through additional qualification criteria.

Note that as higher matrix levels are qualified for, overall residual commission rates are adjusted across all tiers.

- level 3 of the matrix is qualified for by recruiting three 3 investors and generating $1000 in downline investment volume, commissions reduced to 3% on levels 1 and 2 and 1.5% on levels 3 to 10

- level 4 of the matrix is qualified for by recruiting 6 affiliate investors and generating $2000 in downline investment volume

- level 5 of the matrix is qualified for by recruiting 9 affiliate investors and generating $4000 in downline investment volume

- level 6 of the matrix is qualified for by recruiting 12 affiliate investors and generating $8000 in downline investment volume

- level 7 of the matrix is qualified for by recruiting 15 affiliate investors and generating $16,000 in downline investment volume

- level 8 of the matrix is qualified for by recruiting 18 affiliate investors and generating $32,000 in downline investment volume

- level 9 of the matrix is qualified for by recruiting 21 affiliate investors and generating $64,000 in downline investment volume, commissions restored to 4% on levels 1 and 2 and 2% on levels 3 to 10

- level 10 of the matrix is qualified for by recruiting 24 affiliate investors and generating $128,000 in downline investment volume

If the above qualification criteria isn’t satisfied, affiliates only earn on levels 1 and 2 of their matrix tiers.

Residual Commission Matching Bonus

Daisy Forex affiliates earn a 10% match on residual commissions earned by personally recruited affiliates.

ROI Matching Bonus

Daisy Forex pays the ROI Matching Bonus via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Daisy Forex caps payable unilevel team levels at 10:

- level 1 (personally recruited affiliates) = 3.5% ROI match

- levels 2 to 10 – 1% ROI match

Pacesetter Gold Bonus Pool

Daisy Forex’s Pacesetter Gold Bonus Pool is funded with 1.8% of company-wide investment and 1.25% of company-wide returns paid out.

To qualify for a share in the Pacesetter Gold Bonus Pool, a Daisy Forex affiliate must recruit 24 or more affiliates and convince them to invest at least $128,000 USDT.

Pacesetter Gold bonus pool qualification criteria must be achieved within a Daisy Forex affiliate’s first 30 days.

Pacesetter Leader Bonus Pool

Daisy Forex’s Pacesetter Leader Bonus Pool is funded with 1.8% of company-wide investment and 1.25% of company-wide returns paid out.

To qualify for a share in the Pacesetter Leader Bonus Pool, a Daisy Forex affiliate must personally recruit three affiliates who’ve qualified for the Pacesetter Gold bonus pool (see above).

There is no limit to the amount of Pacesetter Leader Bonus Pool shares a Daisy Forex affiliate can qualify for.

Forex Builder Bonus Pool

The Forex Builder Bonus Pool is funded by:

- a $500,000 Daisy Forex investment account

- 5% of all double-tier investments across tiers 5 and 10

- 4% of Daisy Forex investment across tiers 1 and 2

- 2.7% of Daisy Forex investment across tiers 3 to 10

- any unpayable residual commissions due to affiliates not being qualified for all ten levels (presumably split with the Forex Achievers Bonus Pool)

The Forex Builder Bonus Pool is paid out monthly.

Daisy Forex affiliates qualify for a share in the pool each month by convincing personally recruited affiliates to invest $5000 USDT the month prior (up to 70% can be counted from any one recruited affiliate).

For every $5000 USDT counted, a Forex Builder Bonus Pool is awarded.

- if a Daisy Forex affiliate earns 4 or more shares in the Forex Builder Bonus pool, their share amount is doubled for that month

- if a Daisy Forex affiliate earns 4 shares or more for three consecutive months, those shares are made permanent going forward

Forex Achievers Bonus Pool

The Forex Achievers Bonus Pool is funded by

- a $500,000 Daisy Forex investment account

- 5% of all double-tier investments across tiers 5 and 10

- 4% of Daisy Forex investment across tiers 1 and 2

- 2.7% of Daisy Forex investment across tiers 3 to 10

- any unpayable residual commissions due to affiliates not being qualified for all ten levels (presumably split with the Forex Builder Bonus Pool)

The Forex Achievers Pool is paid out monthly.

To qualify for shares in the Forex Achievers Bonus Pool, a Daisy Forex affiliate must have recruited 24 affiliates who together have invested at least $128,000 USDT

Once that criteria is met, Daisy Forex affiliates qualify for a share in the pool when a personally recruited affiliate qualifies for the Pacesetter Gold Bonus Pool.

Pacesetter Gold Bonus Pool shares don’t expire.

Joining Daisy Forex

Daisy Forex affiliate membership is free.

Full participation in the attached income opportunity requires a $102,300 investment.

Daisy Forex solicits investment in tether (USDT).

Daisy Forex Conclusion

The heart of Daisy Forex’s MLM opportunity isn’t all that different to what Daisy AI started with two years ago.

The ruse behind Daisy Forex’s investment scheme is still trading through EndoTech. Here’s the pitch from 2020;

(Anna Becker’s) teams of AI scientists have more than 20 proprietary AI systems in operation and serve as the AI investing backbone of trading at more than 150 investment firms across the United States, Europe and Asia.

The original trading ruse was cryptocurrency. Last year that was swapped out for forex.

Today Daisy Forex’s website has been stripped of everything except a YouTube marketing video, app download link and link to Daisy Forex’s Telegram group.

DaisyForex is tied to the US through Jeremy Roma. Outside of the US, SimilarWeb currently tracks top sources of traffic to Daisy Forex’s website as Hungary (20%), Spain (18%), Egypt (8%) and Russia (6%).

Despite representing it generates external revenue via forex trading since 2020, Daisy Forex is not registered to offer securities or trade commodities in any jurisdiction. Neither are EndoTech.

Another securities fraud violation is Daisy Forex offering virtual shares in EndoTech.

To quote Jeremy Roma from a Daisy Forex marketing presentation;

(At) Tier 10 you would have over 71,000 USDT that will be placed into the live trading.

And you will have an accumulation of shares that would exceed well over 400 shares, that you would have in EndoTech prior to the compny going public.

This nonsense has been going on for two years and EndoTech still isn’t publicly listed anywhere.

The reason Daisy Forex and EndoTech opt to commit securities and commodities fraud is because there is no trading. Or at least not enough to sustain Daisy Forex’s advertised returns.

All Daisy Forex are doing is recycling newly invested funds to pay off existing investors. As this Ponzi model has collapsed over the past two years, all Jeremy Roma has done is reboot with new smart-contracts.

As with every iteration of Daisy Forex that came before it, when affiliate recruitment dries up so too will new investment.

This will see Daisy Forex starved of ROI revenue, eventually prompting a collapse.

As I understand it previous iterations of Daisy Forex have collapsed by way of returns reducing to nothing. Then a new opportunity is launched and previous losses are glossed over.

No matter how many times Daisy Forex reboots, math is math – and math guarantees the majority of participants in Ponzi schemes eventually lose money.

Update 11th July 2023 – Daisy Forex has collapsed.

A new “Daisy 2.0” reboot has been announced. Daisy 2.0’s marketing schtick is a new crypto AI trading bot grift from EndoTech.

Thanks for this.

Quite a few people on social media pushing DAiSy and Endotech now.

Interesting. Investview’s iGenius MLM offers “CRYPTOelite powered by Endotech” but it’s far from free.

A few bits and bobs aside CRYPTOelite is the reason to spend an additional $900 for their top tier membership level. So it’s pretty easy to say that iGenius is charging $900 (plus $179.99/month) for access to the Endotech product.

Scams within scams.

Hey there,

Let’s first discuss the meaning of the word “Ponzi”:

Source: Investopedia

If you have a look at Daisy’s financials (Ozedit: snip, see below)

@Marco

Feel free to provide Daisy Forex’s legally required audited financial reports filed with regulators.

Ponzi blockchain bullshit = meaningless.

Several of the Daisy websites/youtubers are claiming that “Endotech, the first partner of the Daisy Crowd Funding project is audited by Ernst And Young every 3 months to confirm that their incredible results are real!”

I was unable to confirm that these audits exist or that E&Y have anything to do with Endotech/DAISY. But hey, it sounds good!

When you ask for a proof of the EY audit, they simply say it is not a public audit.

According to the top of of the pyramid, an EY executive fell in love with Endotech and Daisy, so he immediately offered partnership.

I doubt that one of the larges audit firms would like to be mentioned on the same page as a company which offers unregulated financial service.

Even if the bot exists, they are still a non-registered company. On the other hand, I can set up a trading bot in an hour but it would be still illegal to ask for investment from others.

This whole Endotech/Daisy story looks like a tribute to Madoff.

This is scamspeak for “doesn’t exist”.

“not a public audit” = “not getting my money”. Generally, good companies use audits to promote trust / confidence in the company and show good governance / management.

Another one one the b****it bingo card?

For a laugh, here is the agenda for the upcoming Daisy event in Dubai: toldyouso2023.com/wp-content/uploads/2023/01/A4_EventShedule_rev2.pdf

Not a single substantive agenda item or named speaker. But at least everyone is invited to the closing party! … Wait… cash bar?

I’m starting to have doubts about the market-trouncing returns this group is claiming.

@Alan:

First of all: you don’t want to hear that from a Daisy/Endotech fanboy but:

The last uncredible good regulated and audited company here in my country was wirecard. German BaFin (Financial Commision), EY (public) and many more proofed a lot of trust.

And to the toldyouso-agenda: if they would pay the tickets, maybe the flights and even the bar…I think you would argument in the same direction ‘what a ponzi proof, so much money to pay their guest to come to this event’ wouldn’t you?

Registering with financial regulators in the country’s you are soliciting investment in isn’t about trust. It’s about accountability.

It’s also a legal requirement for passive investment schemes.

Audited financial reports filed with regulators = verification an MLM company is doing what it claims to be.

Thank you for this article. I’m 90% sure this is a scam, mostly because it seems impossible and un-credible to be earning so much ROI on Forex – AI or no AI. But I’m not knowledgeable enough to be certain, I don’t see concrete proof that this is a scam.

My friend has invested some money into Daisy AI and he did make a profit and did take some of the money out. Now he’s advertising this marvelous investment opportunity to me, and I almost agreed at one point.

I want to show this article to him, but as I said, I don’t see concrete proof. There’s not a single shred of proof that it’s NOT a scam, sure. But can we prove that it is?

That there is no trading going on with positive returns on almost every transaction?

You can’t prove a negative.

Ask your friend for evidence Daisy AI has registered with the top financial regulator in your country and has filed legally required audited financial reports.

If your friend can’t provide this information, you just proved Daisy Forex is a Ponzi scheme.

Of course they haven’t registered, that doesn’t prove they’re not legitimate. (Ozedit: snip, see below)

Securities fraud by definition is illegitimate. Stop making excuses for scammers.

@KryptoNoob:

Forex Traders make 5-10% per month. Experts will do 15-20% (1%/day).

@Oz: does really every post has to be snipped?

No. Just the ones that need to be.

Nobody wants to read comments overtaken by scammers peddling their bullshit.

I suspect it’s a fraud, but I see no proof. (Ozedit: snip, see #13)

Securities fraud is, surprisingly, by definition fraud.

If you’re going to ignore provable fraud and waffle on I’m going to start spam-binning.

Daisy doesn’t have to comply with US financial regulations because it geoblocks US IP addresses and therefore has no US clients!

Oh, and if you are in the US and are interested in “investing” in Daisy, just follow our easy instructions on how to use a VPN to get around the geoblock.

It’s not shady in the slightest!

Even if they do have a working product thus technically passing the ponzi test, financial services require a registration in almost all countries.

Hungary is leading the chart because unfortunately MLM is very popular here and Youtube makes it very easy to promote everything (shame on Google not caring about flags I raise).

The thing is that by law you should be registered at the Hungarian National Bank to be eligible to be a promoter and of course the product/service you promote should also be registered.

So by definition even if Endotech and Daisy have a real product, they still commit a fraud being unregistered. What is mind-blowing that the Hungarian National Bank replied to me that they are not regulating crypto 😀 Although this was more that a year ago.

So I think I will try again especially that they have Forex now and we have a crypto law as well.

Wes Garner and Lisa Marie Holt are heavily involved in this.

I believe that everyone who lost money when it collapsed when it was crypto, have now had their accounts moved to the latest forex thing and numbers on the screen are going up enough to make up the loss.

It’s being used as proof that it’s most definitely not a scam.

I’ve seen a couple of people who couldn’t withdraw when it collapsed the first time saying how happy they are that they have their account back and their losses have been made up.

If all those from the first lot tried to withdraw now the ponzi would collapse again so I’m guessing there is something in place which means they have to wait a set time.

Oz you have know facts. Only allegations, they hold know merit. (Ozedit: snip, see below)

Fact: Neither Daisy AI, EndoTech or Jeremy Roma are registered to offer securities in any jurisdiction.

Fact: MLM + securities fraud = Ponzi scheme.

Address the facts or fuck off. Thanks.

Grab your popcorn: they have changed their mind, instead of being a public company now they wanna be a hedge fund. So much for the “shares” 😀

They are going to have an event in Budapest and Tokyo. I know that Dubai does not care, but in Hungary promoting an unregistered financial service is illegal (I guess having a conference can be considered a promotion).

Too bad I do not want to be involved in any investigation, otherwise I would definitely report them to the authorities.

The top Daisy promotion website (daisyapp dot com) is now also pushing Meta Force, SEC and DOJ indictments of Okhotnikov notwithstanding.

If this hedge fund really does launch in June then surely that would be fully regulated? It would have to be.

And for it to launch in the first place it would have needed to have had proper due diligence by the financial regulators including fully audited reports.

Maybe this is just another claim to get as much in as possible before disappearing in the summer, but if not, if it does in fact happen, then it would appear that it was legit all along.

You can’t undo securities fraud.

I’m in Daisy, unfortunately learning some of these things after the fact. my biggest concern is they wont show you any proof of trades. I don’t care about their strategy just show me what your trading, entries and exits.

But they wont, I’m at least hoping to pull my investment out when it doubles, if it does.

Also just chiming in to get any updates from this thread.

It’s not an investment your money is gone.

Any money you withdraw is stolen money from others who put their money in after you.

If you ‘double your money’ you are literally stealing from others.

Steph Crystal Bull is heavily involved in this and has signed up a fair few victims, she runs a puppy farm as well, making money off poor dogs who she breeds for money with no regards to their health.

She’s also involved in Camhirst 3D where they apparently have a contract to 3d print thousands of homes out of concrete. I’m really struggling as to how people are falling for that one.

D.ai.sy have mentioned KYC so I doubt think it will be long until it collapses.

Unfortunately I signed up with Daisy from the first launch and I regret bringing family and friends along with me.

I brought in enough to become a gold leader because I brought in 24+ people and almost $200k in revenue. We were suppose to have over 1M people on the first day but everything crashed and it took months to recover and the second launch resulted in us only have less than 200k members after 2 years.

The excuses are abundant and every time I ask my sponsor and I quote facts – he changes the subject and refers back to all the “shares” we own of Endotech and how crazy rich we are going to be when then they go public.

Now after their laster pitch in Dubai – if they’re going to become a hedgefund and not go public – How are we going to have these valuable shares and my millions?

I currently only have approx 25% of the total funds my whole group invested actually working for us because of the way they flipped everything over from the crypto to forex trading.

I fully expect the Forex trading to dwindle off like the Crypto trading did and then after months of decline they’ll flip us over the the new Liquid NFTs they’re pitching now as the latest and greatest.

They won’t let you get out. I’ve threatened and gotten ugly with them. Jeremy Roma will answer everyone else but has blocked me and won’t even respond to me when I post on the public telegram and the leadership gold channels. It’s hopeless.

Thank you BehindMLM for at least giving us a forum to know that we are not alone and we’re not the ones who are crazy. We are just gullible and a bit poorer.

Well, where do I start. How about bullshit. There is no proof of Ponzi or scam.

Everyone I know that’s been in since day one are very happy with their results.

There are 197,441 accounts with Daisy and there is more money in the fund than has been added from investment. With $173,000,000 contribution.. $97,000,000 withdrawal.. and $251,000,000 in profit, how does anyone define that as Ponzi.

It is a crowdfund. No securities needed. Smart contract. Endotech AI does the trading. So liddle Oz, when you come up with something legit, let us know.

My account is up over $42,000 in 8 months. I know you’ll cherry pick my comment like you have the other comments I’ve made.

MLM + securities fraud = Ponzi scheme

MLM + Dubai + investment scheme = Ponzi scheme

And Daisy AI has already collapsed multiple times before. You got in 8 months ago, in the latest iteration.

How many email addresses there are in Daisy AI’s database is irrelevant to it being a Ponzi scheme.

If you want to make dollar specific financial claims about Daisy AI, please provide legally required audited financial reports.

1. You obviously don’t know what a security is.

2. Saying “smart contract” doesn’t explain away non-existent external revenue generation.

Imagine being so entitled you think randoms on the internet owe you something.

Numbers on a screen. Sorry for your loss.

All I know is, if I had a winning Forex trading trading strategy, I sure wouldn’t want to dilute my profit margin by recruiting more people to use my strategy.

All of the people in Daisy should stop recruiting and watch their profits skyrocket!

People using numbers as proof should watch the Madoff series on Netflix.

Your response to my reply is so weak.. you’re the one that doesn’t understand how the entire Daisy scenario works and what Daisy is, what the crowdfund does, what Endotech achieves.. the only thing you know is everything’s a scam/ponzi. (Ozedit: derails removed)

The old yOu JuSt DoN’t UnDeRsTaNd! is perhaps the weakest Ponzi dodge of all.

Yes, I know a Ponzi when I see one. Anyone should be able to identify a Ponzi when the evidence is laid out in front of them. Thank you for pointing out the obvious.

And thank you for confirming you are unable to provide audited financial reports with respect to Daisy Forex. You and I both know why you can’t provide the requested reports, and it has nothing to do with “crowdfunding”.

You can dress investment fraud up in whatever marketing terms you wish, it’s still investment fraud.

oz does a lot of talking of scam and securities fraud come out with the facts.

The facts are Daisy Forex is committing securities fraud.

MLM + securities fraud = scam.

You already know this from the Hyper* series of Ponzi schemes you lost money in:

https://behindmlm.com/companies/hypertechs-hyperfund-cops-securities-fraud-warning-from-uk/#comment-440282

go to trust pilot.

To what, see fake bot reviews?

TrustPilot is only useful to confirm a Ponzi has collapsed as a last resort (or as broader supporting evidence).

I have been watching these platform debates for some time. I am not defending these types of platforms but to use banks and regulators as the authority standard is like (Ozedit: derails removed)

If you have a problem with securities laws and financial regulators petition your local government.

Failing which, you are defending fraud. Own it.

Considering, that the latest update is that instead of turning into a hedge fund (which obviously needs legal paperwork), they will be a web3 whatever, I am still leaning towards the fraud category. Staying in the grey area to dodge the “show me your license” bullet.

I always said to the Daisy sect that as soon as proper evidence is in place, I am happy to admit my mistake, but it seems it will never happen.

I support the idea of crypto, i.e. to own you money and investment without the need of an institution, but I am really looking forward to regulations to protect people.

You don’t need to “lean towards fraud”, securities and wire fraud are very much… well, fraud.

Also you can’t just get out of securities and wire fraud by calling yourself a hedgefund.

As for regulations, the Securities and Exchange Act has been around since 1933. Securities with or without “the need of an institution” are regulated and always have been.

Timely video from the SEC reiterating what I’ve been saying on BehindMLM for over a decade: youtube.com/watch?v=fHQuooCiDUE

Sound duck, look duck, is duck.

Thanks for the useful insight. Not being a US citizen I do not really follow SEC and unfortunately the Hungarian equivalent said Daisy is not in their scope (I was surprised).

They suggested to turn to the police if I suspect a crime, but hell, who wants to start that fight. So all I can do is to keep protect my close circle educating them to stay away.

Securities in Hungary are very much regulated by the MNB. They might tell you Daisy isn’t in their scope, in reality, like the rest of Europe, they just turn a blind eye to most crypto related securities fraud.

The US is about 4-5 years behind in timely crypto related securities fraud regulation. The rest of the world is 10-15.

Then you have the UK who wouldn’t investigate if Charles Ponzi himself rose from the dead and gave himself up.

I’m seeing people getting more desperate to recruit so I think Daisy has peaked now, though that could be wishful thinking on my part

This is a very interesting forum, so thank you. I have invested a little risk capital in this project but will not be investing more than I can afford to lose because it certainly looks and quacks like a duck at the moment.

However, I have seen no evidence, yet, that it is a fraud/Ponzi and I would be interested to read anything educational on this forum in the future that ventures beyond opinion.

I am planning on de-risking after 12 months so will let you know how that goes.

Why did you sign up and invest in Daisy AI? (for a passive return)

You can verify Daisy Forex isn’t registered to offer securities in your jurisdiction (or any jursidiction).

MLM + securities fraud = Ponzi scheme.

Ignoring the evidence Daisy AI is a Ponzi scheme doesn’t mean it’s not there. Whether you’re able to steal money over the next 12 months or whether Daisy AI collapses (again), is irrelevant to it being a Ponzi scheme.

Thanks, Oz. Certainly, ‘circumstantial’ evidence but not ‘real’ evidence. I guess time will tell.

Securities fraud is very much real evidence. Ignoring the evidence Daisy AI is a Ponzi scheme doesn’t mean it’s not there.

How long a Ponzi scheme runs for is irrelevant to it being a Ponzi scheme.

Just be honest chief: “I’m a Ponzi scammer and am in Daisy to steal money. I’ll only admit it’s a Ponzi scheme and start complaining when I can’t steal money.”

No need to pretend you’re doing due-diligence when you’re not. Saves us both time.

Thanks, Oz. Can you point us towards any court cases or prosecutions? I can’t even find reporting of where people have complained of not being able to withdraw their profits.

I will retain my open mind until there is ‘real’ evidence of wrongdoing.

Again, investors should only ever invest with risk capital which, by definition, they can afford to lose.

1. Whether there are court cases or prosecutions is irrelevant to Daisy AI being a Ponzi scheme.

2. Whether investors are complaining or not is irrelevant to Daisy AI being a Ponzi scheme.

3. Whether you have an “open mind” about securities fraud is irrelevant to Daisy AI being a Ponzi scheme.

4. Securities fraud is evidence of wrong doing. Securities fraud is illegal the world over.

5. Whether you are prepared to lose money in Ponzi schemes is irrelevant to Daisy AI being a Ponzi scheme.

No court cases, no prosecutions, no complaints = no ‘real’ evidence of Securities Fraud (Ozedit: snip, see below)

False. Offering unregistered securities = securities fraud.

You can verify yourself that Daisy Forex is not registered to offer securities in your jurisdiction, or any jurisdiction on the planet for that matter.

Feel free to provide evidence Daisy Forex has registered with financial regulators and isn’t committing securities fraud.

Failing which, spam-bin and best of luck with the scamming.

My Sponsor in Hypercapital/ Hyperfund / Hypernation /whatever you wanna call it is the same person who made millions off ponzi schemes and is lucky enough to pull out “seed Capital” and then “Play with profits”, knowing full well that the platform will collapse.

He has literally made millions and continues to “profit” with these schemes. He will never admit that he knows what is happening and continues to justify that it is legit, by how much money he is making.So it must be legit right?

Tired of losing money in blackholes, I decided to start trading on my own, which he “advises” me not to do at all costs, because ” how can you go up against players in a trillion dollar industry”?

I showed him my profits from placing trades on Gold, and he is not happy at all, even coming to the defense , once again of these ponzi clowns, more recently Dr Anna Becker “who he believes the bot software she designed, is being used by OKX, which I suspect is a false claim.

I havent done any recent on that specific point, but it does sound awefully familiar to the story that hyper was punting to the followers that they owned an exchange Called Hoo (which when asked, said that they didnt even know what Hyperfund was !!) and numerous other lies such as Sam Lee and Ryan Xu who apparently mined billions of dollars worth of bitcoin making the platform unfallable.

It obviously wasnt, and as I conclude that he was just a mere face to sell the “product” Reason why I am mentioning all of this is that daisy is basically doing the same thing with reboots, tokens false connections to other companies, previous ponzi pimps who are now top tier leaders, in Daisy.

If one just ignores all of the supplied research and does their own due diligence on the leaders of these schemes, you will probably be more cautious when making an “investment”.

They are using the exact same smoke and mirrors techniques to woo new investors with all of the Tech talk, quantum computing, Bot software, Angel investment, while living nice lives in Dubai, far away from anyone they can be held accountable to or feel the need to tell the truth about exactly what it is they are doing.

Everyone just plays along, just like in GSpartners/ lydian world, who have now rebooted again, pulling in more “investors”.

They all know that they are in a ponzi, but have been doing it for so long, they know of nothing else, and the ” returns ” so good that in order to call it what it is, they will have to give up their cushy lives and probably work normal jobs.

At the request of a Daisy member, our team performed onchain analytics (Ozedit: snip, spam removed)

Who gives a toss about oNcHaIn AnAlYtIcS?

“Trust me bro becuz blockchain” isn’t an alternative to securities fraud. Legally required audited financial reports filed with regulators or Ponzi.

Our onchain analytics prove exactly (with numbers) that it is an MLM Ponzi!

(It was a pity to delete it! This is your website, you’re the Boss!)

Fuck all. Audited financial reports or Ponzi.

You’d need access to Daisy’s backend to identify every wallet used and then go from there.

These are just your words! Where is your proof?

So far, no one has been able to credibly prove that Daisy is a scam project!

Proof:

Daisy Forex is committing securities fraud.

MLM + securities fraud = Ponzi scheme.

All Ponzi schemes are scams.

Turns out Daisy Forex have invested all of the forex money in to Traders Domain.

That’s why there’s never ending momentum pack promotions.

New products coming out back to back.

That’s why the returns are less than 1% week now.

Can’t confirm but I wouldn’t be surprised. Romain and Buggs were/are butt-buddies back in the day.

Daisy is currently still crowdfunding and while they are still crowdfunding nobody can withdraw their initial investment as its needed to make enough money for the next stage, the hedgefund stage.

At the moment you can only withdraw your profit.

After crowdfunding is over they will look at the company going public.

The initial crypto side didn’t do well, hence the change to forex which was doing much better.

All those who put their money in crypto since Daisy launched have now automatically had their investment transferred to forex.

Now the new ai is ready they are moving everything back to crypto trading.

The hedgefund date, so when crowdfunding is over, was June but has now moved to September 1st.

So you can’t get your initial investment back until September 1st.

Recruitment has slowed considerably, some very desperate so called ‘leaders’ trying desperately to recruit.

Daily percentages have been a bit rubbish recently.

Clearly they are trying everything to stop people withdrawing money, there are even pop ups when you attempt to withdraw any profit telling you that you need to be compounding for at least 12 months to get the most money.

Clearly postponing the hedgefund until September is just to stop people attempting to withdraw their initial investment.

Which would be impossible as there is no money left.

Wouldn’t be shocked if it crashes soon due to the struggle to recruit.

I’ve reached the point where I’ve lost all sympathy for the victims,Daisy has enough of a history to show its a scam yet people still hand over their money.

I saw something about blockchain sports where they will buy real players or something. Partnered with FIFA they are apparently. I think that’s another Endotech project something to do with liquid mining.

It’s a shitcoin, obviously.

I’m wondering if Daisy will phoenix again after it collapses this time. Wouldn’t surprise me given the history.

People are stupid enough it seems.

I’m among the earliest of investors with daisy, they have blocked me for no reason with some of the old folks who invested too.

i don’t make comments in the platform, only read messages to follow through, yet i got restricted, they also stopped me from warning members in the platform, i can’t anybody.

DAISY is the biggest scam now, back off

I was introduced to Daisy by a very good friend of mine that has made quite a bit of money. I stress the fact that I haven’t signed up but doing my due diligence.

So I started doing research on the company and stumbled on this article and youtube videos, etc. All this negative energy. (Ozedit: snip, see below)

MLM Due-diligence isn’t negative or positive, it’s either based on facts or not.

Your due-diligence into Daisy and EndoTech ignores the fact your friend has stolen money through it. It’s concerning but irrelevant with respect to your own due-diligence.

Where you start is verifying neither Daisy or EndoTech are registered to offer securities in your jurisdiction. Upon confirming they aren’t, congratulations; you just confirmed Daisy and EndoTech are committing securities fraud.

MLM + securities fraud = Ponzi scheme.

This is where your due-diligence ends. Anything else is noise.

Just heard they raised $540MM for the trading technology. Additionally, they claim over 1200% ROI with zero losing months over the last 1.5 years. Endotech claims to be a billion-dollar company.

Is it truly a Ponzi or do they have something amazing?

Instead of asking us, why not ask where you heard the claims from to provide verifiable evidence?

Kinda silly to expect other people to verify claims you heard elsewhere and passed on without question.

After tomorrow you will have exactly 2 more months to add to your Daisy account if you choose to do so. If not the door will be closed and continue to compound for members only. No new members will be coming in on the crowdfunding model.

You can explore all the other options and scams on the planet. What people will eventually understand is that slow and steady wins the race.

the owner of this site alleged that Daisy needs new members to come in to Daisy to keep the platform viable… if that was actually the case Daisy would not be stopping new members from joining after February 20 …..would they.?

Every previous iteration has petered out once the new shiny reboot has been launched. Where exactly do you think your “compounding” revenue is going to come from?

Canadian regulatory fraud warnings have started to trickle in. Roma knows how this ends.

But daisy AI is not closing the doors yet and (Ozedit: snip, see below)

Regardless, the Ponzi scheme has collapsed. You’re on borrowed time and returns and withdrawals will dwindle out next year.

When exactly a Ponzi scheme collapses is irrelevant to it being a collapsed Ponzi scheme.

First and last warning, recruitment spam = spambin.

They will probably shut it down before then (if it’s not already shut down) and are just trying to take advantage of FOMO.

Many friends in this scam. Convicted fraud felon Angel Lee is one of the early promoters using a British frontman named Richard so he doesn’t end up in jail again.

This fraud can’t end soon enough. The Daisy “coin” is way down to one penny, they were touting it to be this huge thing.. Classic pump and dump.

Replying to Susie.

Do you have details on the “Convicted fraud felon Angel Lee”. I’ve tried looking up his record, but can only find a LinkedIn profile for him.

Which state was he convicted in, and what was the crime? Many thanks.