Blockchain Alliance: AI + NFTs + metaverse MLM crypto grift

Blockchain Alliance operates in the cryptocurrency MLM niche.

Blockchain Alliance operates in the cryptocurrency MLM niche.

Heading up the company we have CEO Joshua Denne.

As per Denne’s LinkedIn profile, he is also the CEO of Blockchain Funding.

Blockchain Funding was launched in 2017 and claims to “provide cutting-edge solutions for Web3, NFT, and blockchain projects”.

At time of publication SimilarWeb tracked negligible traffic to Blockchain Funding’s website domain.

Blockchain Funding’s Instagram profile hasn’t been touched since it was created in April 2022. Blockchain Funding’s Twitter profile is blank, indicating it too hasn’t been used since it was created in April 2022.

Together with no website traffic, it appears Blockchain Funding is dead.

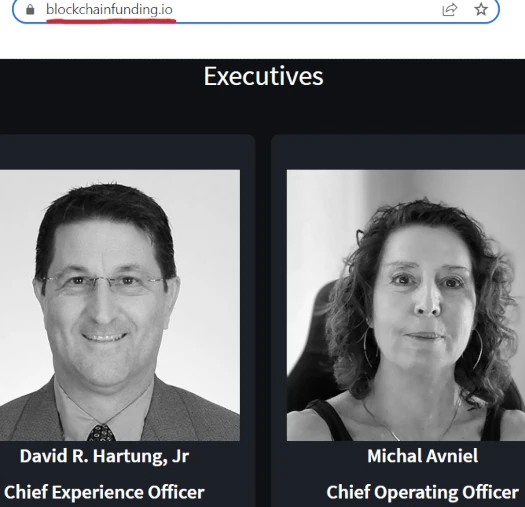

It should be noted that the same people behind Blockchain Funding are behind Blockchain Alliance:

Prior to launching Blockchain Alliance, Denne was a promoter of the Daisy Forex Ponzi scheme.

In February 2023, Denne claimed his scamming with Daisy Forex was “just getting started”:

Not sure what happened there. A month later Denne announced Blockchain Alliance’s April 2023 prelaunch.

Of note is this March 2023 Instagram post from Denne, in which he represents serial scammers Rabu Gary and Avinash Nagamah as “business partners”.

Gary and Nagamah were recently outed as top net-winners in the collapsed $500 million Traders Domain Ponzi scheme. Whether Denne was a Traders Domain investor is unclear.

Circa 2021 Denne was promoting Chris Snook’s SDK Meta “organized crime tier privacy phone” grift.

SDK Meta appears to have collapsed in early 2022.

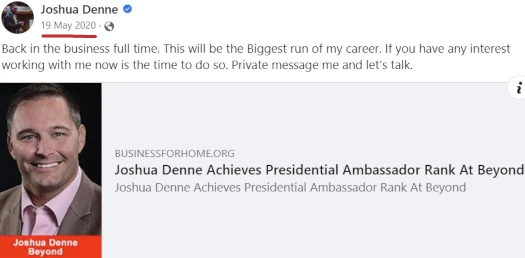

Going back further, in 2020 Denne was promoting Well Beyond.

Well Beyond came about after Jeremy Reynolds purchased what was left of MXI Corp after it collapsed in 2017.

Initially Well Beyond continued to sell MXI Corp’s Xocai chocolate supplements. In 2020 Reynolds began funneling Well Beyond distributors into Travis Bott’s Onyx Lifestyle Ponzi scheme.

Although he denies having “any power” in the company, Clif Braun was originally cited as an Onyx Lifestyle co-founder.

Braun is involved in Blockchain Alliance.

Onyx Lifestyle would eventually become Digital Profit in mid 2020. Jeremy Reynolds signed on as a Digital Profit co-founder with Travis Bott.

Digital Profit collapsed in August 2021. What was left of Well Beyond was sold off to My Daily Choice in September 2021.

As best I can tell, Denne’s descent into MLM crypto fraud began with Well Beyond.

Before he got a taste for crypto fraud, Denne made a name for himself in Seacret Direct (2011 – 2018).

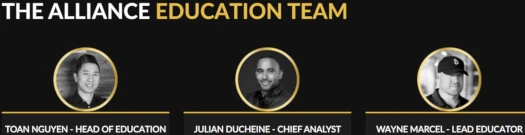

Other names I recognized on Blockchain Alliance’s corporate team include Toan Nguyen, Wayne Marcel and Doug Kyle.

Toan Nguyen is co-founder of LaCore Enterprises’ Elomir.

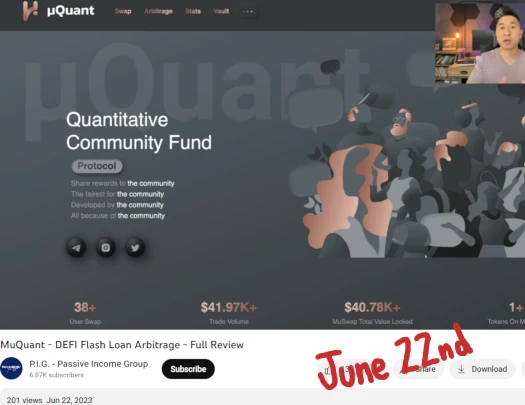

Through his Passive Income Group YouTube channel, Nguyen has been promoting MLM crypto Ponzi schemes since mid 2018.

Eight days ago Nguyen uploaded a promotional review of the recently launched MuQuant MLM crypto Ponzi scheme:

Wayne Marcel and Toan Nguyen teamed up in early 2022 to launch Definity FI Academy, a collapsed MLM crypto Ponzi scheme.

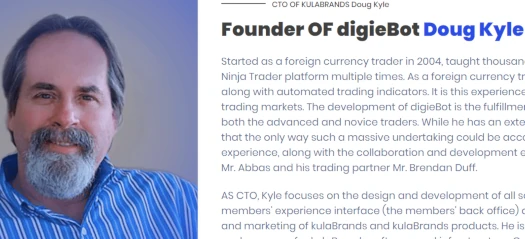

Doug Kyle is co-founder of KulaBrands.

No corporate address is provided on Blockchain Alliance’s website. On LinkedIn, Joshua Denne cites his location as Arizona in the US.

Presumably this means Blockchain Alliance is also being operated from Arizona.

Read on for a full review of Blockchain Alliance’s MLM opportunity.

Blockchain Alliance’s Products

Blockchain Alliance sells access to individual products and services through what they call “access passes”.

Products and services featured in Blockchain Alliance’s marketing include:

- digieBot Trading Account – “an automated trading bot that … executes trades automatically 24/7 without human assistance”

- nSights Trading Account – “a decentralized, semi-auto trading bot powered by digieBot Technologies Inc”

- Academy Access – “a comprehensive educational platform focused on Web3 technology”

- Alliance AI Access – “enhanced prospecting, personalized coaching, and predictive market insights”

- Virtual Event Ticket – presumably a ticket to a paid webinar

- DAO – three-tier group through which affiliates are led to believe they can vote on business related matters, but the majority of votes cast are by Blockchain Alliance executives

- Utherverse – metaverse grift

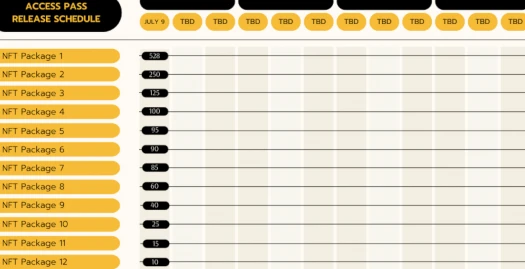

It’s worth noting that Blockchain Alliance’s marketing cites twelve access pass tiers. There are nine above with the other three presumably “TBD”.

Blockchain Alliance dresses up its product service tiers as NFTs. There doesn’t appear to be any reason for this other than “because crypto”.

On pricing, Blockchain Alliance is currently hiding this information from consumers:

From what I’ve been able to piece together, Blockchain Alliance’s access passes start at $200…

…and run into the thousands. This marketing slide suggests Blockchain Alliance access passes will cost as much as $20,000:

Access pass fees are represented to be monthly recurring subscriptions.

Blockchain Alliance’s Compensation Plan

Blockchain Alliance’s compensation plan pays on access pass sales to retail customers and recruited affiliates.

Referral Commissions

Blockchain Alliance pays referral commissions on access pass fees down two levels of recruitment:

- level 1 (retail customers and personally recruited affiliates) – 15%

- level 2 – 10%

Top Producers Pool

Blockchain Alliance takes 2% of company-wide access pas fees and places it into the Top Producers Pool.

Affiliates who generate the most amount of access pass sales volume receive shares in the pool as follows:

- top affiliate by volume – 16 shares

- second affiliate – 12 shares

- third affiliate – 10 shares

- fourth affiliate – 7 shares

- fifth affiliate – 6 shares

- sixth to tenth affiliates – 4 shares each

- eleventh to fifteenth affiliates – 3 shares each

- sixteenth to twentieth affiliates – 2 shares each

- twenty-first to twenty-fifth affiliates – 1 share each

How frequently the Top Producers Pool is paid out is unclear.

Global Pool

Blockchain Alliance takes 3% of company-wide access pass volume and places it into the Global Pool.

The Global Pool is paid out quarterly and qualification appears to be tied to access pass sales volume.

Specific details were not publicly available at time of publication.

Joining Blockchain Alliance

Blockchain Alliance affiliate membership appears to be free.

Affiliates are required to click a “I want to be an affiliate” checkbox when signing up.

Blockchain Alliance Conclusion

Blockchain Alliance’s principals have a lot of fraud-related heavy baggage.

As I understand it Blockchain Alliance was ready to launch some time ago. The launch was delayed so “AI” buzzwords and NFTs could be rammed into the business model and marketing.

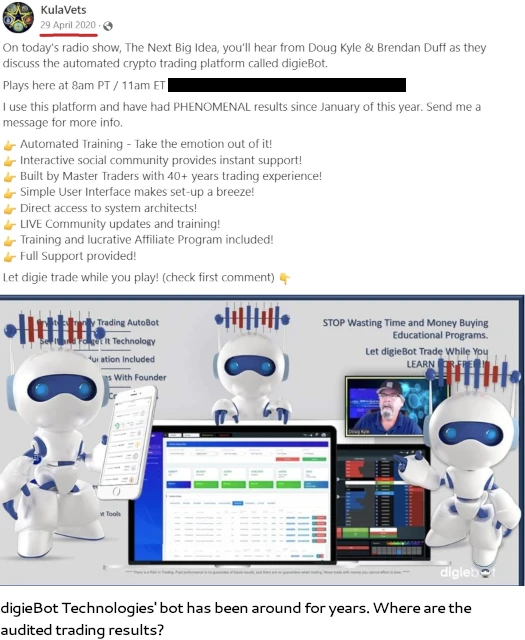

That is of course all fluff. At the core of Blockchain Alliance’s MLM opportunity is a passive returns trading bot.

Having never heard of digieBot Technologies Inc, I went and looked them up:

Surprise surprise, it’s run by Blockchain Alliance’s Trading Team CEO, Doug Kyle.

Kyle’s digieBot Tech accomplices, Mudasser Abbas and Brendan Duff, feature alongside him on Blockchain Alliance’s website.

If you’re wondering what happened to the other KulaBrands co-founder Peter Gantner, he’s of course “secretly” involved in Blockchain Alliance.

You won’t find Gantner mentioned on digieBot Tech’s or Blockchain Alliance’s websites or marketing materials.

It’s worth pointing out that, at least according to Gantner’s LinkedIn profile, the digieBot Tech trading bot grift has been going on since January 2018.

That was over five years ago. Where are the audited trading results?

Speaking of audits, it goes without saying that the passive returns offered through Blockchain Alliance’s trading bots constitutes a securities offering.

With Joshua Denne and Blockchain Alliance being based out of the US, this requires registration with the SEC.

A search of the SEC’s publicly available Edgar database reveals neither Blockchain Alliance, Joshua Denne, digieBot Tech, Doug Kyle or Peter Gantner are registered.

digieBOT Tech is mentioned in a 2019 KulaBrands filing but that’s part of the company’s failed IPO attempt. It does not disclose KulaBrands offering securities through its automated trading bot.

Recently we’ve also seen the CFTC go after MLM automated trading bot schemes. Although not as clear cut as securities fraud, failing to register with the CFTC might also trigger commodities fraud violations.

Although the link is currently disabled, I also couldn’t help but notice “staking” in Blockchain Alliance’s website footer:

This potentially opens the door for a “staking” style crypto Ponzi in the future (I didn’t see any mention of one in researching this review).

Attached to Blockchain Alliance’s securities and potential commodities fraud is a pseudo-compliance MLM compensation plan.

Retail and affiliate Blockchain Alliance participates sign up with the same form. The only difference is Blockchain Alliance affiliates click a checkbox.

If this remains the same it goes without saying the company is going to be affiliate-heavy. This will result in Blockchain Alliance furthering their fraud by operating as a pyramid scheme.

Between securities and commodities fraud and passive returns being offered through a five-year old automated trading bot, how Blockchain Alliance ultimately pans out will likely be a repeat of Digital Profit.

Rigged trades in favor of those running the scheme, with everyone else losing out.

Update 16th January 2025 – Following Blockchain Alliance’s collapse in or around January 2024, Utherverse founder Brian Shuster has filed suit alleging RICO Act violations.

Damn! Avinash Nagamah and Rabu Gary are starting to make the likes of Igor Alberts look like a choir boy with all the scams their involved with lol. And are my eyes deceiving me, or is that not Travis Bott in that photo too?

Black Diamond Avinash and Rabu are heavily promoting both DAISY and Holton Bugg’s Ibuumerang Ellev8 trading platform. What I don’t understand is, if you can invest with DAISY, whereby some imaginary bott makes you obscene amounts of profits without trading at all, then why would anyone pay $179 a month to subscribe to the Ibuumerang Ellev8 where they claim they’ll teach you to become an expert Forex trader lol.

DAISY crypto to DAISY Forex and now back to crypto…….WTF is going on with Holton, Travis, Avinash, Gary and company. Pick one f*****g scam and stick with it FFS!

mUlTiPlE sTrEaMs Of ScAmMiNg!

Absolutely! But why aren’t these guys ever investigated or even better, charged with anything?

I mean even Jordan Belfort did 22 months in prison for stealing only $200 million lol. It seems like the authorities are more focused on the Wallstreet crooks and overlooking the massive scams and corruption in MLM companies.

I’m guessing the likes of Avinash Nagamah and Rabu Gary will always get away with shit as they box clever and only ever seen as representative’s and not owners of companies.

But what about the likes of Holton Buggs? He’s clearly the owner of Ibuumerang and Meta Labs Agency who flogged all those worthless bullshit NFT Bounty Hunters. So how and why is he still out there able to continue to basically steal from everyone?

Maybe with his involvement with the Traders Domain Shitshow they’ll do something this time……. but I wouldn’t hold my breath lol.

Monitoring of Belfort’s fraud began in 1989. He was indicted in 1999.

These days things move quicker but not that quick. Identifying fraud takes little time if you know what you’re looking for.

Preparing a bulletproof case with exhaustive supporting evidence to steamroll a defense attorney takes much longer.

Oh Wow! Thanks for that as I clearly did not know it took that amount of time. Damn!

I guess that means Onwards and Upwards on the scam front then, as by the time they get to the bottom of one case, the crooks will have moved onto several others. Or just rebooting whatever they currently have under a different bullshit name.

How you manage to keep up with all these crooked companies on this site is beyond me, but thank you again for keeping us all informed and educated.

Gizmo, Let me see if I can help you. For law enforcement/regulatory agencies to start an investigation requires “victims.” Victims that will file complaints with them providing all the details of how they were victimized.

One complaint will not trigger an investigation. It takes multiple complaints from multiple victims to start an investigation.

When a program operates in multiple countries, it becomes even more complicated. Laws differ by countries. Some countries say that if a company does not have a physical address in their country, they cannot take any action. OneCoin was a perfect example of this claim.

The average time it takes to fully investigate a prorgram to decide if they are indeed operating illegally or not, can take up to 18-24 months. Sometimes it is a shorter time period, or it can take longer. That is just the average.

Hoped this helped.

Thank you both and now see and understand how difficult it is to get these crooks.

I don’t understand why any of the victims wouldn’t file a complaint though. Other than embarrassment of being suckered into a scam or maybe just don’t know where or how to file a complaint.

However, I can fully understand how difficult it is to find some of these scammers, as they seem to be sometimes operating in several different countries and more often than not, no actual address listed anywhere.

Funnily enough though, Ibuumerang does list an actual address. But if you look it up on Google Maps, it directs you to a GameStop store in a shopping plaza in Houston Texas lol.

Can’t seem to find an address for DAISY anywhere, but they did however post a video the other day of their new offices wherever they are as it didn’t say lol.

Well, it was actually a video of Endotech not DAISY. BTW, are these 2 companies one and the same, or 2 separate companies?

Anyhow, no actual address and the video showed about 4 small offices with about 8 employees using laptops fine tuning trading algorithms at the new HQ nerve center.

So nothing to worry about here folks, your money is in good and safe hands with DAISY lol.

EndoTech = securities fraud factory

Daisy AI/Forex = branch of EndoTech run by US national Jeremy Roma from Dubai

They are embarrassed, indeed. They lost all the money already and legal aid is mostly costly so they can’t get any help.

Any free services will have limited powers and limit themselfs to advise where to head next.

So I Googled Blockchain Alliance and this is the first link that popped up lol

blockchainalliance.org

at one stage, the hypertechgroup was also punting that they were affiliated with a type of blockchain alliance group, same name, and also that they owned the hoo exchange, which turned out to be false.

be careful about what you hear on zoomcalls and read on mlm websites, especially crypto mlm’s.