What happened to the $97,279 invested in KulaBrands?

When an SEC settlement with TruCrowd came across my desk, the name rang a bell.

When an SEC settlement with TruCrowd came across my desk, the name rang a bell.

I ran a search across BehindMLM and sure enough in 2017 I’d mentioned it as an update to our KulaBrands review.

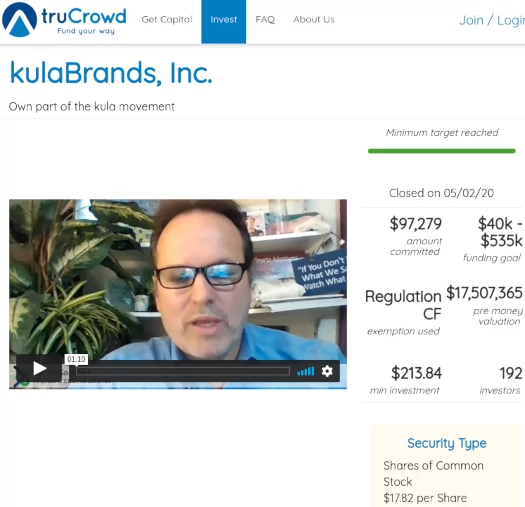

At the time, KulaBrands was using TruCrowd to flog virtual shares at $17.82 each.

To entice investors, KulaBrands touted a “pre money valuation” of $17.5 million.

As of May 2nd, 2020 KulaBrands’ share offering closed, netting $97,279 from 192 investors.

Prompted by TruCrowd’s SEC settlement, which for the record has nothing to do with KulaBrands, I thought we’d revisit KulaBrands offering and see where it’s at.

For those unfamiliar with the company, KulaBrands is run by co-founder Peter Gantner (right).

For those unfamiliar with the company, KulaBrands is run by co-founder Peter Gantner (right).

KulaBrands is essentially a crowdfunding platform, manipulated through an MLM business opportunity (affiliates vote on what to crowdfund and then do the funding).

This manipulation differentiates typical crowdfunding, by way of backers having a vested financial interest.

As to the ethics of the KulaBrands concept, legitimate crowdfunding sees projects succeed or fail based on public interest. The general concept is crappy ideas don’t get funded.

Through KulaBrands, it’s entirely possible that a crappy idea will get funded, based on projected ROIs rather than the merits of the product or service itself.

Anyway, getting back to KulaBrands’ virtual share offering; in September 2017 the company announced it was hoping to launch a $40,000 IPO.

As of January 2022, that hasn’t materialized. KulaBrands never went public.

In early 2019 KulaBrands launched HealX Nutrition, a standalone MLM CBD offering.

HealX Nutrition’s website is currently down and the company is “not processing orders”.

As noted by BehindMLM, in 2016 KulaBrands generated $33,981 in losses.

Looking at KulaBrands’ latest Annual report, filed April 2020 for the year 2019, the company generated $330,746 in losses.

That’s up from $51,374 in losses in 2018. And KulaBrands also has an additional half a million in “long term debt”.

Long story short, KulaBrands has remained unprofitable and continues to generate losses.

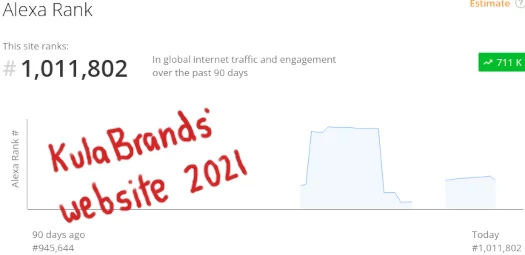

Alexa traffic estimates reveal that, throughout most of 2021, KulaBrands’ website traffic was non-existent:

KulaBrands last official Facebook post was a Christmas profile picture change on December 9th. The post prior to that is dated April 26th, 2021.

Anyone gullible enough to invest in KulaBrands back in 2017 want to weigh in? Or is that $97,279, along with whatever else people threw into KulaBrands, quietly lost?

Keep me posted as I have an intertest.