Silverstar Live & Mahmouds settle CFTC fraud for $75,000

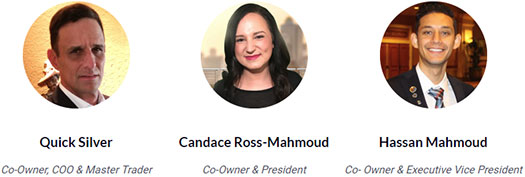

Silver Star Live and owners Hassan Mahmoud and Candace Ross-Mahmoud have agreed to settle Commodity Exchange Act violations.

Silver Star Live and owners Hassan Mahmoud and Candace Ross-Mahmoud have agreed to settle Commodity Exchange Act violations.

Silver Star Live appeared on BehindMLM’s radar earlier this year. Following analysis of the companies business model, we concluded Silverstar Live was engaged in securities fraud.

When Ted Nuyten at BusinessForHome raised the same concerns a few days after our review, serial scammer Michael Faust threatened legal action.

When the CFTC began investigating Silver Star Live is unclear. The regulator however tracked violations of the Commodity Exchange Act beginning July 2018, seven months prior to our review.

As per the CFTC’s investigation, Silver Star Live and the Mahmouds

acted as commodity trading advisors (“CTAs”) without being registered with the Commission as such, by exercising discretionary trading authority over the forex trading accounts of U.S. customers who were not eligible contract participants (“ECPs”).

Rather then defend the CFTC’s findings, Silver Star Live and the Mahmouds settled for $75,000 plus post-judgement interest.

Hassan Mahmoud and Candace Ross-Mahmoud are also ordered to cease and desist from committing further Commodities Trading violations.

It is somewhat curious that David Wayne Myer, aka “QuickSilver”, is not a respondent.

As above, Silverstar Live marketing credited Myer as a third co-owner of the company.

Following the collapse of Silverstar Live on or around March 2019, Hassan Mahmoud and Candace Ross-Mahmoud rebooted the scheme as Eaconomy.

At the time of publication Eaconomy’s website is still active.

Eaconomy is a clone of Silverstar Live and seeing as neither the company or the Mahmouds are registered with the CFTC, its continued operation places Candace and Hassan in violation of the November 4th CFTC settlement.

Whether the CFTC takes any further action remains to be seen.

you guys did a great job taking the business from peter, but you guys didnt know that petter took the business from some street kids, ran off with there money, left them behind.

this is the thing why would any of you benefit from something you all have stolen from the getto. is it because you added to the sytem.

the sad thing is you all could careless from david to candace and hassan, you all with pay sooner then later.