Eaconomy Review 2.0: Third relaunch, compliance issues

![]() Eaconomy was first reviewed here on BehindMLM in May 2019.

Eaconomy was first reviewed here on BehindMLM in May 2019.

Eaconomy’s original launch collapsed in less than a year.

The brand lay dormant until is was resurrected by owner Hassan Mahmoud (right) in April 2021.

The brand lay dormant until is was resurrected by owner Hassan Mahmoud (right) in April 2021.

Eaconomy’s reboot saw the MLM company launched through Beyond Wealth.

In a nutshell you had various trading and cryptocurrency offerings. Inside the US Eaconomy only offered signals.

Outside the US the company committed securities fraud through Beyond Wealth’s “Achilles” automated trading bot.

Neither Eaconomy or Beyond Wealth are registered to offer securities in any jurisdiction.

Since covering Eaconomy’s reboot in April 2021, changes have been made to the business model.

Today we revisit Eaconomy for an update on its MLM opportunity.

The Company

Eaconomy is still run by founder Hassan Mahmoud.

We covered Mahmoud’s MLM history in our original Eaconomy review.

Eaconomy’s Products

Eaconomy markets two monthly subscription memberships:

- Elite – $149 and then $99 a month

- Elite Pro – $235 and then $149 a month

The primary difference between the two options is the automated trading bot, renamed “Aithena”.

Aithena is available through Elite Pro only. Supposedly Elite Pro is not available in the US.

Other services available through Eaconomy’s subscriptions include:

- ECA – forex trading education

- Eminus – manual signals

- Manara – AI forex trading scanner

- Hercules – “the ultimate DCA strategy that leverages A.I.”

One interesting departure from Eaconomy’s April 2021 offering is a CoinZoom wallet. This replaces Beyond Wealth’s in house “Beyond Wallet”.

Not sure what the story is there.

Eaconomy’s Compensation Plan

Eaconomy’s compensation plan pays on the sale of monthly subscriptions to retail customers and recruited affiliates.

Commissions are tied to ranks, of which Eaconomy’s compensation plan has twelve:

- Apprentice – sell and maintain three subscriptions (split 2/1 or 1/2), and generate 297 GV over a rolling four-week period

- Influencer 500 – maintain three personally sold subscriptions, generate 1980 GV over a rolling four-week period and have a total downline of twenty recruited affiliates (split 10/10)

- Influencer 900 – maintain three personally sold subscriptions, generate 3960 GV over a rolling four-week period and have a total downline of forty recruited affiliates (split 20/20)

- Influencer 1500 – maintain three personally sold subscriptions, generate 7920 GV over a rolling four-week period and have a total downline of eighty affiliates (split 40/40)

- Prodigy 3K – maintain three personally sold subscriptions, generate 14,850 GV over a rolling four-week period and have a total downline of one hundred and fifty affiliates (split 75/75)

- Prodigy 5K – sell and maintain four subscriptions, generate 39,600 GV over a rolling four-week period and have a total downline of four hundred affiliates (split 200/200)

- Icon 9 – sell and maintain six subscriptions, generate 74,250 GV over a rolling four-week period and have a total downline of seven hundred and fifty affiliates (split 375/375)

- Icon 15 – sell and maintain seven subscriptions, generate 99,000 GV over a rolling four-week period and have a total downline of one thousand affiliates (split 500/500)

- Icon 25 – sell and maintain eight subscriptions, generate 198,000 GV over a rolling four-week period and have a total downline of two thousand affiliates (split 1000/1000)

- Icon 50 – sell and maintain nine subscriptions, generate 396,000 GV over a rolling four-week period and have a total downline of four thousand affiliates (split 2000/2000)

- Mogul 75 – sell and maintain ten subscriptions, generate 594,000 GV over a rolling four-week period and have a total downline of six thousand affiliates (split 3000/3000)

- Mogul 100 – sell and maintain eleven subscriptions, generate 891,000 GV over a rolling four-week period and have a total downline of nine thousand affiliates (split 4500/4500)

GV stands for “Group Volume” and is sales volume tied to subscription fee payments.

The “split” requirements for ranks are binary team groupings.

E.g. Icon 9 requires a split of 375/375. This would be 375 affiliates on one side of the binary and 375 on the other.

55% of GV on each side of the binary team must be customer subscription volume.

No explicit retail customer distinction is made.

The other qualification restriction Eaconomy imposes is a 50% GV cap based on unilevel team tracking.

The above example shows a new unilevel leg created per affiliate recruited.

No more than 50% of rank qualification GV can come from any one unilevel leg

Fast Start Bonus

Eaconomy affiliates earn a $50 commission when a retail customer or recruited affiliate signs up for a subscription.

Residual Commissions

Eaconomy’s residual commissions are tied to rank and paid weekly:

- qualify at Apprentice and earn $25 a week

- qualify at Influencer 500 and earn $125 a week

- qualify at Influencer 900 and earn $225 a week

- qualify at Influencer 1500 and earn $375 a week

- qualify at Prodigy 3K and earn $750 a week

- qualify at Prodigy 5K and earn $1250 a week

- qualify at Icon 9 and earn $2250 a week

- qualify at Icon 15 and earn $3750 a week

- qualify at Icon 25 and earn $6250 a week

- qualify at Icon 50 and earn $12,500 a week

- qualify at Mogul 75 and earn $18,750 a week

- qualify at Mogul 100 and earn $25,000 a week

Rank Achievement Bonus

Eaconomy rewards affiliates for qualifying at Icon 9 and higher with the following one-time Rank Achievement Bonuses:

- qualify at Icon 9 and receive $6000

- qualify at Icon 15 and receive $12,000

- qualify at Icon 25 and receive $25,000

- qualify at Icon 50 and receive $50,000

- qualify at Mogul 75 and receive $75,000

- qualify at Mogul 100 and receive $100,000

Joining Eaconomy

Eaconomy affiliate membership is $29 and then $15 a month.

An Elite or Elite Pro subscription appears to be optional.

Eaconomy Conclusion

The legitimacy of Eaconomy as an MLM opportunity comes down to whether there are more active retail subscriptions versus affiliate subscriptions.

Given Eaconomy flopped in the past and the offering is essentially the same this time around, this is doubtful.

Eaconomy’s compensation plan sounds like 55% of binary volume on both sides must be retail volume, but that’s not explicitly clarified.

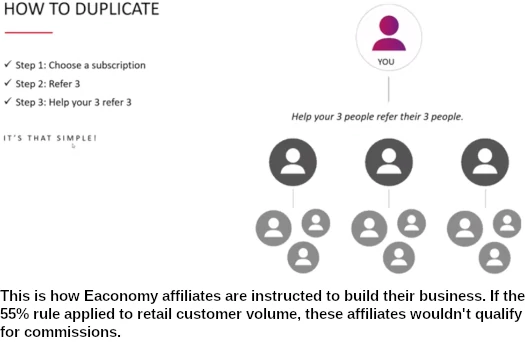

I’m doubtful here because of this slide shared in a November 2021 Eaconomy presentation hosted by Hassan Mahmoud;

Retail customers can’t refer and build a downline, so that’s an affiliate recruitment tree.

If that’s how Eaconomy affiliates are being instructed to build their business, they shouldn’t qualify for commissions.

Or at least they wouldn’t, if the 55% rule applied to retail customer subscription volume.

Pending explicit clarification, I believe “customer” in Eaconomy’s compensation plan refers to either retail customers or recruited affiliate subscriptions.

One thing missing from Eaconomy’s offering is trading results. It seems subscription commissions is the main selling point, with subscription services coming off secondary.

Eaconomy has been around for a while now. Surely it’s in the interest of consumers to provide audited trading results, both manual signals and automated?

This brings us to securities fraud. Undoubtedly Eaconomy is committing securities fraud.

Eaconomy is a US company and Mahmoud is a US resident. With respect to securities regulation within the US, that consumers outside the US are being targeted doesn’t matter.

Outside the US Eaconomy is committing securities fraud in every jurisdiction Elite Pro subscriptions are being sold.

There doesn’t appear to be any geographical restrictions on Eaconomy’s website.

As far as MLM due-diligence goes, this is an impassable red flag.

Any MLM company marketing automated trading by law has to provide you with audited financial reports and disclosures.

One last thing is downplaying Beyond Wealth seems suss.

Much was made of Eaconomy being rebooted through Beyond Wealth earlier this year.

Beyond Wealth owner Jeremy Reynolds sold the company to My Daily Choice in September.

This could be the reason Beyond Wealth has been dropped from Eaconomy’s marketing.

Still, if My Daily Choice is now behind Eaconomy’s securities fraud – that needs to be disclosed.

Ditto if it’s some other merchant. Again I’m doubtful on this because the offered services are for the most part identically named. And if the name’s have been changed, then the offered service is the same.

In conclusion, Eaconomy still has too many red flags to take seriously as an MLM opportunity.

When you’ve already had one run-in with US regulators, you’d think compliance would be at the forefront of Eaconomy’s offering.

Yet Eaconomy has compliance issues that need to be addressed, which for some reason haven’t and continue to be ignored.

Update 8th August 2024 – Up until recently Eaconomy was operating from the domain “eaconomy.io”. Today that domain is abandoned without explanation.

Eaconomy seems to have rebooted on “eaconomy.best”, set up in or around February 2024.

Eaconomy’s current website contains broken social links and an AI robo marketing video. There is no mention of Hassan Mahmoud.

Service products featured on Eaconomy’s website are Eminus and Manara.

Eminus offers “trade ideas”. Manara is an AI grift, again offering trade ideas. No pricing is provided.

As of July 2024, SimilarWeb tracked ~175,000 monthly visits to Eaconomy’s website. The majority of Eaconomy’s website traffic is from the Philippines (27%), the UK (10%), Columbia (9%), Finland (8%) and the US (7%).

Update 14th April 2025 – After returning to its .IO website domain, Eaconomy collapsed around late March 2025.

Hassan Mahmoud has rebooted Eaconomy as Iqonic.

OMG!! Not again. Hassan and Candace Mahmoud have failed to pay commissions to affiliates everytime and I can see it happening again.

They closed the previous companies, kept the money and said tough luck to affiliates, despite making promises.

They were sued by the CFTC, cftc.gov/PressRoom/PressReleases/8071-19, and I can’t believe people will trust people that are willing to lie, cheat, and steal.

Please do yourself a favor and avoid this eaconomy scam like the plague.

Since late 2021 Eaconomy’s Aithena robot was performing very well with around 6% monthly and very low drawdown.

Provided one invests 3000 USD INTO THE BROOKER OF OWN CHOICE, the fees are paid by those results. Anything extra is extra income.

There are other much appreciated services bundled in that i didn’t try, but have red many good reviews/testimony’s about.

It is growing very big in Sweden right now. Maybe Mahmood’s people have learned something.

Can we get another updated review, please?

What’s there to update?

The initials of the year are now “A.I.”

Everyone who promoted all the other failed forex mlms are now promoting this as the “A.I. opportunity of a lifetime which will change the game forever.”

This time around, it’s automated forex trading using A.I. “unlike anything you’ve ever seen before.”

They’re saying Eaconomy will “wipe out all other forex mlms hands down.”

I believe we’ve heard this all before.

Nothing new.

I’m pretty close to adding an “AI + MLM = scam” rule to BehindMLM’s reviews.

The marketing grift is real.

How can Forbes put Mahmoud on the cover of Forbes Mauritius (issued 29th of August) ???????? Or is it also fake?

Forbes putting anyone on the cover isn’t what you think it is.

https://behindmlm.com/companies/ruja-ignatovas-onecoin-forbes-cover-a-paid-advertisement/

Pay a fee, get your PDF to deceive people with and that’s that. There is no actual magazine.

Brief update on the current state of Eaconomy.