SEC sues iPro Network, claims $26 million dollar pyramid scheme

The SEC has filed suit against iPro Network, alleging the scam and founder Daniel Pacheco stole $26 million from investors.

The SEC has filed suit against iPro Network, alleging the scam and founder Daniel Pacheco stole $26 million from investors.

In addition to iPro Network and Daniel Pacheco (right), relief defendants named in the SEC’s May 22nd lawsuit include

- E Profit Systems;

- Matthew Lopez (cited as co-manager of Fintact Payment Solutions, Fintact Solutions Group and Trident Commerce);

- Fintact Payment Solutions LLC;

- Fintact Solutions Group LLC;

- Maritus Regalis LLC; and

- Gabtta LLC

Notably iPro Network CEO Armando Contreras is not a named defendant. To this day we’re still not sure he even exists.

iPro Network surfaced in Q1 2017. The company launched amid OneCoin’s January 2017 withdrawal collapse, and thus was seeded primarily with US OneCoin investors.

iPro Network’s business model was essentially the same as OneCoin’s, except that it followed through with a public listing exit-scam.

After illegally soliciting investment in PROC on the promise of riches, iPro Network listed PROC on external exchanges.

The owners and top investors cashed out during the initial pump to 66 cents in July 2017.

Today PROC has a public trading value of 0.14 cents.

The SEC alleged iPro Network and owner Daniel Pacheco (right) committed securities fraud via the sale of “iPro Packages”.

The SEC alleged iPro Network and owner Daniel Pacheco (right) committed securities fraud via the sale of “iPro Packages”.

iPro Network’s packages were of the “education” variety, again borrowed from OneCoin.

According to the SEC, iPro Network’s

packages contained instructional materials on how to profitably engage in ecommerce, and provided purchasers with a recruitment-based compensation plan and the ability to convert “points” into a digital asset, or cryptocurrency, that IPro was disseminating to the public through the sale of its packages.

The “education package” ruse was arguably pioneered by OneCoin. The model sees an MLM company bundle Ponzi points or an altcoin with educational material.

The company pretends investors are purchasing the packages with the points/altcoin given away for free.

This however is pseudo-compliance and doesn’t fool authorities.

IPro members did not purchase IPro packages solely for the e-commerce instructional materials.

Rather, purchasers of IPro packages were paying money to IPro in exchange for the right to sell IPro packages on their own, as well as the right to receive compensation for recruiting other participants to the investment program, recruitment compensation that was not related to the sale of the e-commerce educational component of the packages to someone actually interested in using those materials.

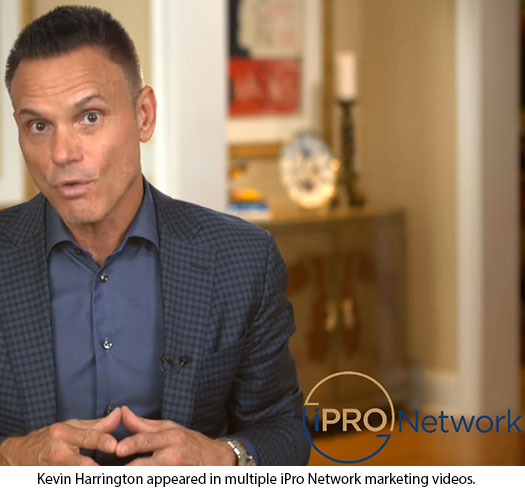

In addition to deceptively misrepresenting the iPro Network opportunity, Pacheco also recruited Kevin Harrington and attorney Scott Warren to promote the scam.

In one marketing video, Harrington announced he would keynoting an iPro Network event in California.

In the video Harrington goes on to refer to iPro Network as “an amazing new opportunity”.

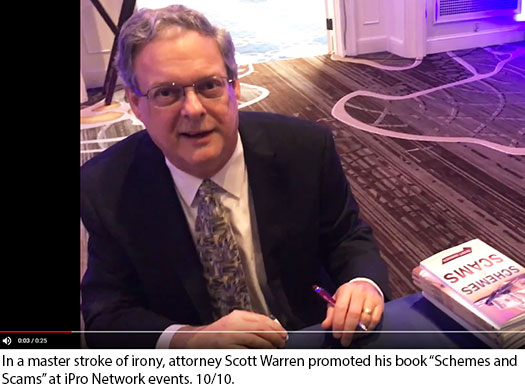

Attorney Scott Warren of Wellman & Warren LLP, was widely cited as the company’s inhouse attorney.

In an attempt to lend legitimacy iPro Network, Warren attended and spoke to investors at company events.

In the video above, believed to have been recorded less than a month before iPro Network collapsed, Warren states he’s

looking forward to getting down (to Colombia) with iPro and opening up the country, making it smooth and grow quickly.

The SEC alleges iPro Network, Pacheco and the relief defendants committed securities fraud.

Together, the iPro Network defendants stand accused of stealing around $26.5 million from investors.

The math behind iPro Network’s compensation plan dictated that 41.5% to 45.5% was supposed to be set aside for commissions and bonuses.

Forensic analysis by the SEC reveals that during operation of iPro Network between January 2017 to August 2018, the company only paid out 29.3% of invested funds.

So where did the money go?

During operation of iPro Network, Daniel Pacheco

- spent ~$2.5 million on a luxury home in Redlands, California;

- transferred ~$1.952 million to Accept Success Corporation, a shell company registered in his daughters name;

- transferred ~$2 million to E Profit Systems LLC, a shell company under his control; and

- spent ~$150,000 to purchase a Rolls Royce luxury car.

The SEC allege

Pacheco’s misallocation of resources left insufficient IPro funds available for the payment of commissions and bonuses owed to IPro investors.

Through his Fintact companies, relief defendant Matthew Lopez received approximately half of the $26.5 million iPro Network took in.

$250,000 of that is traceable to Lopez’s personal gain (personal bank accounts and a car purchase).

The rest of the balance remains unaccounted for.

Both Pacheco and Lopez’s use of investor funds for their personal gain hastened iPro Network’s inevitable collapse.

iPro Network officially collapsed in March 2018 and ceased business operations shortly thereafter.

Pacheco attempted to resuscitate the Ponzi scheme by launching iThrive Network in the second half of 2018.

iThrive Network was short-lived and collapsed shortly after launch.

Daniel Pacheco stands accused of running iPro Network as a “fraudulent pyramid scheme”.

The SEC alleges the PRO Currency component of iPro Network packages were an investment contract.

Seeing as neither iPro Network, Pacheco or any of the relief defendants were registered with the SEC, iPro Network’s investment contract offering constitutes securities fraud.

The SEC are seeking judgment and civil penalties against iPro Network, Daniel Pacheco and the relief defendants.

As part of those judgments, Pacheco and Lopez will be subject to disgorgement of funds obtained through iPro Network’s business operations.

Speaking on the case, Wein Layne, Director of the SEC’s Los Angeles office, stated

We allege that Pacheco hid an old fraud under the guise of cutting-edge technology.

He enticed investors by offering them the opportunity to speculate in cryptocurrency, when in fact he was simply operating a pyramid scheme.

Stay tuned for updates on the case as we receive them.

Update 1st September 2020 – Over four million in default judgments have been handed out to defendants Matthew Lopez, Maritus Regalis LLC and Gabtta LLC.

Update 23rd December 2022 – Daniel Pacheco has settled his iPro Network fraud case with the SEC.

I’ve added mention of Kevin Harrington and attorney Scott Warren to the article.

The next time someone attempts to convince you securities fraud is legal because “why would XXX risk their reputation…”, you can point them here.

Good stuff right here! And so the wheels of Justice begin to grind slowly, but finely.

It is my belief that:

Matthew Lopez was a resident and local of Half Moon Bay, CA, which was the inspiration and origin for the name “MoonLearning.”

It additionally serves to reason that “Trident Siam Trading Company” originated with Lopez’s idea, and further collaborations developed under both names and territories of operation (primarily Asia and the America’s).

After making the subsequent connections, I believe these served as two of the most prominent payment channels for Onecoin victims to remit payments to I-Pro Network’s predecessor Ponzi, connected by OC scammers Sal Leto, Jason Richard Mangan (and JRM’s wife, whom I believe 1st registered the I-Pro and/ or Pro-Coin names, in Colorado [or Utah? I forget] – but whose name was later removed; if I recall correctly).

To the best of my recollection, on or around January 17, 2017 Sal Leto called a “Leadership meeting” over Zoom with then Top Onecoin U.S. Affiliates to announce that he’d negotiated a deal directly with Ruja Ignatova, acquiring the complete U.S. database for all Onecoin IMA victims whom the company abandoned.

Ken Labine said that he was on the call (invited by Sara McGhee, but would hold out on that “opportunity,” later finally exiting Onecoin for good with the Dagcoin spin-off, under his buddy, Kari Wahlroos).

Comically, Tom McMurrain was offered a position to help build I-Pro Network and Pro-Coin, but his own Ponzi reputation, Ponzi conviction, and Ponzi consistent history became plastered all over the earliest I-Pro forums and he was given the Nigel Allan treatment and had to later develop his own personal Ponzi scam fraud to helm, CoinMD.

And all the familiar old wheels and spokes were rotated, tightened and readjusted, just as the Playbook taught.

I’m a bit disappointed not to see Sal Leto and Maurice Katz’s names listed in the allegations but I suppose good ol’ Danny may have a song or two to sing.

But it is good to see Danny get the three letter dopeslap he most richly deserves.

That was the one that boasted for a while they were “backed” by some dude from the Shark Tank, right?

@K. Chang – yes. David Harrington is he (the Shark Tank guy)

Kevin Harrington. It’s right there in the article! You guyzzzzzzz!

What does this mean for the crypto PROC? I see after the Case to sue them by the SEC was posted it’s really been tanking.

And isn’t their new thing called Dnero from the ithrivenetwok? and is it involved in any way in the case?

PROC will remain as worthless as ever. Even though it’s publicly listed PROC has effectively been Ponzi points for a while now.

iThrive Network is/was run by Pacheco so it’s #RIP too.

Dnero sounds like PROC 2.0, won’t go anywhere either. The SEC didn’t name iThrive or dnero in their lawsuit.

That said it’s pretty obvious iThrive Network will disappear as the SEC’s lawsuit progresses.

Finally!! The dominos are falling for OneCoin & iPro. I can’t believe it took so long, being that the idiots were running it out of USA!!

Thank you for excellent reporting Oz and everyone else who keeps the truth flowing.

Kevin Harrington is Chris Phillips partner who went to jail from midtown partners ! I wonder why everyone goes to jail but him?

Wow. I’m one of the “abandoned” people that bought an educational package from OneCoin a few years ago.

I recently was wondering why the focus shifted from OneCoin to ProCurrency so quickly a while back…guess this article nails it. I guess I got my “educational package” after all…

Great research and data presented in this article! The Truth shall set us free.

@AdamBadgley – have you contacted the Plaintiffs in the largest Class Action Lawsuit in MLM history?

Might want to get in on that!

So now this Dnero app – how is he being allowed to do this while he has the court case ongoing?? I’m so confused!!!

The court hasn’t allowed or not allowed him to do anything. This is a civil case pertaining to iPro Network.

Myself and many of my friends all got scammed from this company. Please include me in this class-action lawsuit.

The SEC’s complaint is a civil action. It has nothing to do with a class-action lawsuit.

Hi, does anybody anybody has any info about new sofwer, new company, Sal Leto and Bill Waynne are launching in theyr brand new company Auvoria prime where they basicaly giving the same softwer for trading like in Eaconomy which collapsed like a week ago over internal fight.

I have pretty much the feeling not to do any bussines where Sal Leto is involved by reading all of this.

Thanks.

Ah Auvoria Prime, so that’s the name of Sal’s new scam. Thanks, that gives me something to go on.

I covered Eaconomy’s collapse yesterday.

The Guy mentioned above: Daniel Pacheco, looks a LOT like the Kareem Maradona from the NEW SCAM that Sal leto has started calle Auvoria Prime. BUT Kereem does not have a beard or mustache.

Not sure if its the same person but they look very similiar.

Definitely not the same person.