Sheik Saoud sold Ruja Ignatova a Ponzi bank license

As part of Ruja Ignatova’s quest to sidestep finance regulations and avoid regulatory attention, Sheikh Saoud bin Faisal bin Sultan Al Qassimi sold her an Emirates banking license.

As part of Ruja Ignatova’s quest to sidestep finance regulations and avoid regulatory attention, Sheikh Saoud bin Faisal bin Sultan Al Qassimi sold her an Emirates banking license.

The deal took place in September 2015 for $16 million USD.

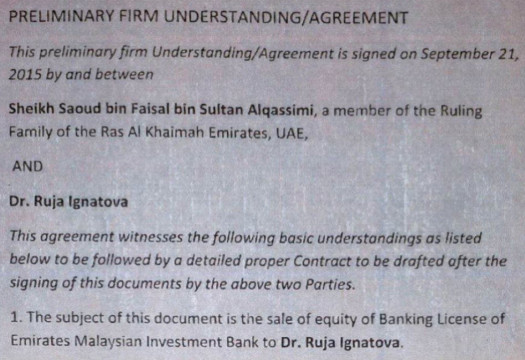

As per a co-signed “preliminary firm understanding/agreement“, Sheikh Saoud sold Ignatova the banking license for Emirates Malaysian Investment Bank.

After both parties agree on the terms and conditions Dr. Ruja will make a payment of $16,000,000 (Sixteen Million Dollars) to Sheikh Saoud.

After the payment Sheikh Saoud will assign the agreed shares and percentage to Dr. Ruja and will start the process of finding and finishing the required steps with Central Bank of the UAE for the full formation of the Bank.

To the best of my knowledge while Ignatova acquired the Malaysian Investment Bank license, no OneCoin bank was ever realized.

To the best of my knowledge while Ignatova acquired the Malaysian Investment Bank license, no OneCoin bank was ever realized.

Nine months before Sheik Saoud reached a deal with Ignatova, Emirates Malaysian Investment Bank was linked to the GetEasy Ponzi scheme.

On December 31st, 2014, GetEasy Tiago Fontoura announced;

[7:12] Our own investment private bank. It belongs to iGetMania.

Based in Dubai (and) authorized by the Central Bank of Dubai, the name (of the purported investment bank) is Emirates Malaysian Investment Bank.

We have our own bank.

Based on the acquisition, Fontoura claimed GetEasy was the “first legal investment-based MLM company”.

[7:39] You, a new partner of Get Mania, have a share of a bank.

[7:53] From the beginning of the first work day, or the second work day of January, in three, four, five days from now, no bank, no authority in the world may prevent or forbid our good work.

A month later GetEasy collapsed. Fontoura tried to do a runner but was picked up by Tunisian authorities in July.

Whether Sheikh Saoud sold the Emirates Malaysian Investment Bank license to Fontoura and GetEasy is unclear.

What we do know is two months after Fontoura’s arrest, Sheik Saoud had reacquired the license and sold it on to Ignatova.

This suggests Sheikh Saoud was selling UAE banking licenses to Ponzi schemes on the side. That’s in addition to selling diplomatic documents.

Sheikh Saoud’s financial dealings with fraudsters are likely made easier by the fact his father, Sheikh Faisal bin Sultan Al Qassimi, founded United Arab Bank.

Faisal Al Qassimi is the bank’s Chairman of the Board of Directors and largest shareholder.

The Al Qassimis are also members of the royal house of Al Qasimi, who rule the Emirates of Sharjah and Ras Al Khaimah.

Ruja Ignatova’s financial dealings with the Al Qassimis, which have only come to light recently, strongly suggest the royal family might be sheltering her.

Ruja Ignatova’s financial dealings with the Al Qassimis, which have only come to light recently, strongly suggest the royal family might be sheltering her.

After Frank Schneider warned her US authorities were closing in, Ignatova (right) disappeared in October 2017.

Along with the 230,000 BTC Sheikh Saoud paid her for OneCoin, Ignatova hasn’t been seen or heard from since.

*quietly adds UAE to list of countries I can’t travel to*

@Oz – this date definitely coincides with Sal Leto announcing that, Dr. Ruja just bought a bank…(and has over a hundred banking licenses…)

SEE: https://behindmlm.com/companies/onecoin/onecoin-claim-they-are-going-to-open-a-us-bank/

I was going to include that but Leto was banging on about a US bank.

Although he was likely talking about the same deal, I didn’t want to detract from this being a UAE bank license.

Well to Letos deference, there is a U for United in both shorts… as easy to misunderstand as adding the word Coin to anything must make it valuable… coins are valuable like tomatocoins, ponzicoins, onecoins, stupidcoins….

I remember when the story was floated that Ruja and OneCoin were going to be buying multiple banks in the U.S.

While we poo-pooed the idea since we knew there was no way in Hades she would be able to get buy a U.S. bank, let alone many banks as claimed due to her German felony conviction for fraud.

What is even more interesting is her felony conviction in Germany typically would prohibit her from ever owning a bank anywhere in the major banking world. Obviously not in Dubai.

Seems like OneCon embarked on a bank bying spree in late 2015.

– Arementa bought the JSC Capital Bank in autumn 2015:

(old.cbw.ge/banking/capitalbank-gains-profits/)

-In late 2015. there was a rumour that OneCoin acquired Hermes Bank in St Lucia: https://behindmlm.com/companies/onecoin/onecoin-affiliates-lying-about-hermes-bank-acquisition/

I think this could be true, or at least it’s undeniable that they did have some relationship with OneCoin.

There is a Hermes themed British entity which coincidentally or not has Ruja’s moneyman as the UBO:

opencorporates.com/companies/gb/08342224

‘Hermes’ is a pretty commmon name, but Hermes bank did have Hermescard section: web.archive.org/web/20160914194421/http://www.hermesbankonline.com/hermes-card

And going through the filings of the UK entity, one can see that it has a shareholder entity in NZ:

HERMES HOLDINGS INTERNATIONAL LIMITED

opencorporates.com/companies/nz/3708655

From the NZ business registry filings, it can be seen that there is Mr Breidenbach again, and he personally acquired 90% of NZ entity shares is March 2016:

app.companiesoffice.govt.nz/companies/app/ui/pages/companies/3708655/22492960/entityFilingRequirement?backurl=%2Fcompanies%2Fapp%2Fui%2Fpages%2Fcompanies%2F3708655%2Fdetail

And in March 2017, the ownership was tranfered completely to St Lucia legal person.

(app.companiesoffice.govt.nz/companies/app/ui/pages/companies/3708655/detail)

The Meridian Place Chock Estate address is the same as the addrss given to Hermes bank:

Hardly a coincidence! The bank even had a branch office in Bulgaria, of all the possible places in the world: de.share-your-photo.com/728cef1d63

(The address seems to be linked to KPMG Bulgaria)

From the UBO details of UK Hermescard Limited, I think it can be inferred that Ruja’s moneyman Breidenbach owns Hermecapital in St Lucia, and therefore likely the bank too.

– Armenta and his sidekick William Morro acquired bank in Zambia late 2016 after they destroyd the Georgian bank. And after they destroyed the Zambian bank, they acquired a British PLC Moneyswap in 2017:

https://behindmlm.com/companies/onecoin/onecoin-fraud-sars-featured-in-fincen-files-leak/#comment-429136

OneCoin funds were also routed to IMS Marketing at Bank of Africa Ltd. A curious choice?

boatanzania.com/history/

OneCoin was playing bank ping pong throughout 2015.

We were following them around the world as accounts were opened and promptly closed. That’s what prompted “what if we buy our own banking license?”

Clearly the main business of OneCoin was money laundering…it may have been even more profitable than Ponzi scheming if there was cartel or sanctioned funds involved and may explain why the loss estimate is so varied 4-16 billion.

The larger part could simply have been laundered funds. And if investigations were as defective as the Dubai one – it is all quite possible.

Some major banks were involved Mellon NY. Deutsche Bank and perhaps United Arab Bank – where we know Greenwood has an account.

@Lyndel “Lynn” Edgington

Remember, Lynn, “the wheels of justice grind slowly, …blah, blah, blah.

If I recall correctly, Ruja was not CONVICTED for her misdealings, fraud and embezzlement with Waltenhoffen Gusswerks, GmBH, until mid-April of 2016.

This was during almost the same in which Onecoin sales were peaking out at around $60,000,000 a week (!)

@ Tim Tayshun

Yes, you remember correctly. The newspaper article about the trial appeared on April 13, 2016.

share-your-photo.com/6708ea807d

@ Semjon

The imprint of Hermes Bank with telephone numbers from Saint Lucia and Great Britain:

share-your-photo.com/b0f821e132

And this sounds as if Ruja Ignatova put it personally:

share-your-photo.com/521e958f2b

True, and she wasn’t convicted, she pled guilty. She even lied to the court as to her job, income and where she was living; which the court never verified the information was true.

All they cared about was she paid the fine.

POA Ruja to Sheikh Al Qassimi – it is genuine:

jlevy.co/wp-content/uploads/2021/05/POA-Ruja-to-Sheikh-1.pdf