GSPartners & Josip Heit under federal investigation in US

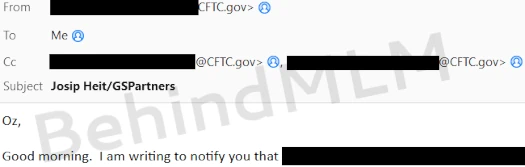

BehindMLM can confirm that GSPartners and owner Josip Heit are the subjects of multiple federal and state regulatory investigations in the US.

BehindMLM can confirm that GSPartners and owner Josip Heit are the subjects of multiple federal and state regulatory investigations in the US.

Investigations we’re aware of include the CFTC, SEC and Alabama Securities Commission.

Unfortunately due to the non-public nature of US regulatory investigations, we can’t provide any specifics. What I can tell you is I’ve personally spoken with Senior Trial Attorneys putting together one of the cases.

Confirmation of these investigations is significant, as the majority of GSPartners investors are US residents.

Typically BehindMLM wouldn’t report on non-publicly verifiable information but I find myself in a precarious position – more on that later today.

Generally speaking and independent from my communication with US regulators, here’s what each agency is likely to be examining.

The CFTC investigating GSPartners & Heit

The CFTC is a federal US regulator that primarily investigates commodities fraud.

With respect to GSPartners, this will likely pertain to the representation that, through its “metaverse certificates” investment scheme, profit is generated via forex trading, real-estate and renewable energy.

GSPartners pitches passive returns on its commodities offering as high as 5% a week.

At no time has GSPartners, Josip Heit or any of GSPartners’ associated shell companies been registered with the CFTC.

This on face value constitutes commodities fraud.

The SEC investigating GSPartners & Heit

Although simplified, an often cited rule of thumb on BehindMLM is “MLM + passive investment scheme = securities offering”.

The SEC is a US federal regulator that primarily investigates securities fraud.

To establish a securities offering, an MLM company must be proven to be offering consumers an investment contract.

Under US law, the existence of an investment contract is determined via the Howey Test.

Under the Howey test, an “investment contract” exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

Broken down, under the Howey Test you have “the investment of money … in a common enterprise … with the expectation of profit … to be derived from the efforts of others”.

With respect to GSPartners’ metaverse certificates investment scheme:

- GSPartners solicits investment in tether.

- GSPartners investors invest into GSPartners directly, making it a common enterprise.

- GSPartners markets its metaverse certificates scheme on the promise of weekly returns, creating an “expectation of profit” among investors.

- GSPartners’ metaverse certificates scheme is entirely passive for investors. Any profits received are derived solely “from the efforts of others” (the various external revenue ruses GSPartners presents to investors).

Upon satisfying the existence of an investment contract, a securities offering is established. MLM companies offering securities to US residents need to be registered with the SEC.

Beyond registration, periodic filing of audited financial reports is a legal requirement. This is the only way to verify that an MLM company claiming to engage in revenue generating activities is doing what they claim to be.

At no time has GSPartners, Josip Heit or any of GSPartners’ associated shell companies been registered with the SEC.

This on face value constitutes securities fraud.

The SEC warns consumers that unregistered companies engaged in securities fraud are likely to be Ponzi schemes.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes in which these currencies are used to facilitate fraudulent, or simply fabricated, investments or transactions.

The fraud may also involve an unregistered offering or trading platform.

These schemes often promise high returns for getting in on the ground floor of a growing Internet phenomenon.

Ponzi scheme organizers often use the latest innovation, technology, product or growth industry to entice investors and give their scheme the promise of high returns.

Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

The Alabama Securities Commission investigating GSPartners & Heit

Whereas the CFTC and SEC conduct civil investigations, the Alabama Securities Commission’s cases are both civil and criminal in nature.

Also whereas the CFTC and SEC are likely to be investigating GSPartners at a company level, state regulators typically also hone in on local promoters.

Any action brought by the ASC could include civil and criminal charges, going after GSPartners promoters targeting residents of Alabama.

Closing thoughts

While we’re able to confirm multiple US regulatory investigations into GSPartners at this stage, this shouldn’t be taken as a definitive list. There might very well be other US investigations we’re currently not aware of.

Whenever it happens, civil and potentially criminal fraud charges will be filed and made public. BehindMLM will of course be reporting on and tracking the various cases.

With the SEC and CFTC investigating, there’s a high probability the DOJ might also be running its own federal criminal case. The scope of GSPartners and fraud perpetrated against US residents would certainly warrant it.

I expect beyond GSPartners and Josip Heit (right), GSPartners executives and insiders will also be targeted.

I expect beyond GSPartners and Josip Heit (right), GSPartners executives and insiders will also be targeted.

In the meantime, where does this leave GSPartners investors?

GSPartners showed the first signs of collapse in September 2023. This occured by way of unexpected withdrawal delays.

In an attempted cover up, investors who publicly discussed the delays had their funds seized and accounts terminated.

A few weeks later, on October 1st, GSPartners disabled weekly returns for investors who had been withdrawing. In order to reinstate their weekly returns, these investors had to deposit around 27% of their initial investment.

This effectively “reset” anyone who had invested in the past six months or so. It also wiped out anyone who didn’t want to cough up another ~27% of their initial investment.

A few days after this announcement, GSPartners then rolled out a mandatory 50% withdrawal fee. Following backlash from investors, this was scaled back to as low as 12.5% for GSPartners’ earliest metaverse certificates investors.

New investors on GSPartners’ latest investment plans are still slugged with the 50% fee.

For anyone familiar with MLM Ponzi schemes, what is happening is obvious.

If you’re a GSPartners investor reading this, you already know the mantra: Your money is gone – squirreled away by Heit to who knows where.

You also know that numbers on a screen are meaningless if the withdrawal gates are closed, as has happened twice already.

As your money is stolen from you through a complex MLM Ponzi web of lies, you can either sit quietly or take action.

Complaints can be filed with the CFTC, SEC and ASC on their respective websites.

Update 2nd November 2023 – Somewhat related to GSPartners being under investigation, is BehindMLM under threat due to Josip Heit’s abuse of international and US courts.

Update 16th November 2023 – The Texas State Securities Board has also confirmed it is investigating GSPartners for securities fraud.

You beauty.

There’s a followup to this but it’s going to take me a while to put everything together. It’s an important update, bear with me.

That’s great news. We are still hoping that US citizens Ron Pope and Justin Halladay are under criminal investigation for their role in the $2b CashFx fraud.

Nice one!

HERE WE GOOOOOOOO.

I’ve been reading this book for over 2 years and now for the final chapter.

Great – guess it wasn’t those pesky YouTubers’ fault after all. Keep ’em coming, Oz.

And the thieves Andrew Eaton, Bruce Hughes and Brendon Earp-Jones get away again just like they did on Karatbars, Lifestyle Galaxy and all the other ponzis they have been involved in!

I do sincerely hope Michael Dalcoe gets prosecuted for securities and commodities fraud!

Josip Heit already deleting videos that he was the Chairman of the Board. Remember, he was also never the Chairman of the Board of Karatbars.

Remember it good.

Social Media scrubs initiated. And recovery shcemes.

Good.

and the tumble begins.

And as if by magic, most of Michael Dalcoe’s GS Partners’ videos are no longer on his Youtube channel.

Where can we send videos and pictures which are not on any website yet ?

Contact button is on the top right of every page.

You can’t attach anything to the contact form but let me know what it is and we’ll go from there.

What can we do to make more south africans aware of this. I know fsca is very slow and ignores emails. Is there any other route we can take to prevent any one else falling for their nonsense.

I know that money web covered MTI at the peak of the scheme. Not sure why no local news is covering Gspartners, as they must surely be much bigger than anything else or there.

THESE PEOPLE ARE VULTURES……. I SEE KARMA COMING….. I live in Washington State.

Just so happens the CRYPTOCURRENCY MEETUP COORDINATOR happens to be a GSPARTNERS AFFILIATE . Get these people out of a position where vulnerable people are trying to learn about Cryptocurrency, only to be ambushed by a GSPARTNERS AFFILIATE.