Floyd Mayweather fronts GSPartners’ 300% ROI Ponzi event

Following owner Josip Heit’s failure to show up at GSPartner’s Atlanta, Georgia event, the Ponzi scheme quickly put together a follow up in Dubai.

Following owner Josip Heit’s failure to show up at GSPartner’s Atlanta, Georgia event, the Ponzi scheme quickly put together a follow up in Dubai.

We’ve already covered MLM industry figure Eric Worre attending as a speaker. Turns out he wasn’t the only one who shouldn’t have been there.

Appearing only in promo material put out by GSPartners was Floyd Mayweather.

Mayweather has evidently signed on as a GSPartners “Brand Ambassador”. Let’s get into why that’s a problem for the US resident.

GSPartners’ Dubai event wasn’t just an excuse for Josip Heit to score photo ops with public figures, the Ponzi scheme also launched a series of new investment plans.

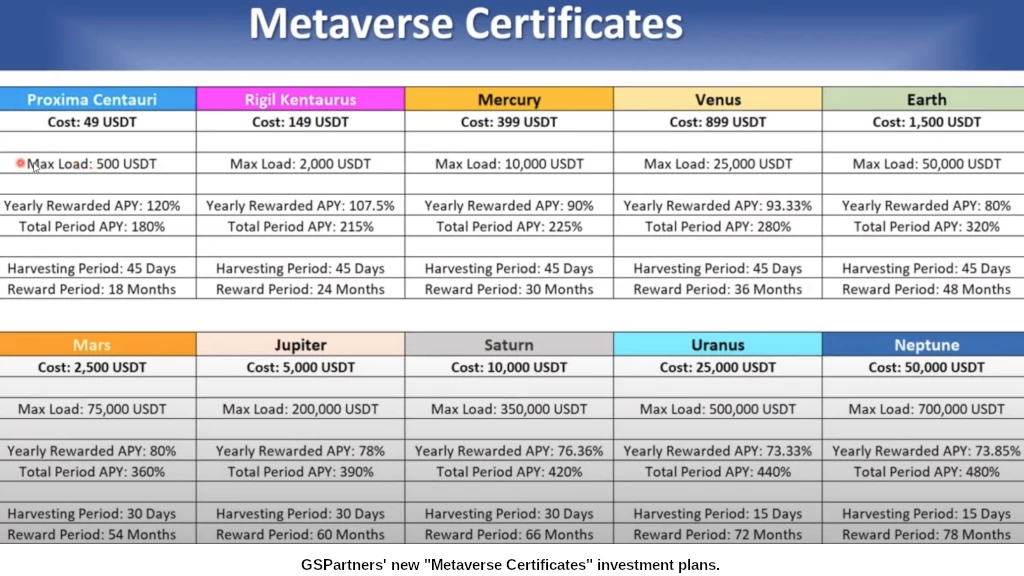

At the center of GSPartners’ new Ponzi scheme are “metaverse certificates” (click to enlarge).

Metaverse certificate investment positions start at 49 tether (UDST), and cap out at 700,000 USDT

- Proxima Centauri – pay a 49 USDT fee and then invest up to 500 USDT to receive an annual 180% ROI for 18 months

- Rigil Kentaurus – pay a 149 USDT fee and then invest up to 2000 USDT to receive an annual 215% ROI for 24 months

- Mercury – pay a 399 USDT fee and then invest up to 10,000 USDT to receive an annual 225% ROI for 30 months

- Venus – pay an 899 USDT fee and then invest up to 25,000 USDT to receive an annual 280% ROI for 36 months

- Earth – pay a 1500 USDT fee and then invest up to 50,000 USDT to receive an annual 320% ROI for 48 months

- Mars – pay a 2500 USDT fee and then invest up to 75,000 USDT to receive an annual 360% ROI for 54 months

- Jupiter – pay a 5000 USDT fee and then invest up to 200,000 USDT to receive an annual 390% ROI for 60 months

- Saturn – pay a 10,000 USDT fee and then invest up to 350,000 USDT to receive an annual 420% ROI for 66 months

- Uranus – pay a 25,000 USDT fee and then invest up to 500,000 USDT to receive an annual 440% ROI for 72 months

- Neptune – pay a 50,000 USDT fee and then invest up to 700,000 USDT to receive an annual 480% ROI for 78 months

GSPartners also announced a partnership with BDSwiss, through which the company promises daily returns.

If a GSPartners affiliate maintains a third of the max investment amount at any given tier (e.g. for Proxima Centauri 1/3 of 500 USDT = 166 USDT), for eighteen months, a 300% bonus ROI on the certificate fee paid is also paid out.

On their website, BDSwiss claims to offer “Forex and CFD investment services to more than a million clients worldwide.”

Despite the US making up the majority of visits to GSPartners’ website, and the third most to BDSwiss’ website, BDSwiss are not registered with the SEC.

That brings us to Floyd Mayweather.

You won’t find any mention of GSPartners on Floyd Mayweather’s social media accounts. There’s a good reason for that we’ll get to in a bit.

What Josip Heit got for the undisclosed sum of money he paid Mayweather, was an appearance at the Dubai event (including grand entrance photo-op), dinner with Floyd, a “live interview” (which I haven’t seen anywhere), and Mayweather wearing a Lydian World t-shirt at the boxing event he was also in Dubai for.

Why does any of this matter?

In November 2018 the SEC sued Floyd Mayweather for failing to disclose payments from three cryptocurrency companies.

The SEC’s orders found that Mayweather failed to disclose promotional payments from three ICO issuers, including $100,000 from Centra Tech Inc.

The SEC order found that Mayweather failed to disclose that he was paid $200,000 to promote the other two ICOs.

The SEC sued Centra Tech eight months earlier in April, alleging the company

orchestrat(ed) a fraudulent initial coin offering (ICO) that raised more than $32 million from thousands of investors last year.

The SEC’s complaint alleges that Sohrab “Sam” Sharma and Robert Farkas, co-founders of Centra Tech. Inc., masterminded a fraudulent ICO in which Centra offered and sold unregistered investments through a “CTR Token.”

In parallel proceedings, the DOJ filed criminal charges were filed against Centra Tech’s co-founders.

Mayweather didn’t contest the SEC’s lawsuit. Instead he settled for $300,000 in disgorgement, plus an additional $300,000 fine with $14,775 in prejudgment interest.

Here again we have Mayweather again fronting a fraudulent investment scheme, albeit more discreetly from his camp – likely due to his previous SEC run-in.

GSPartners and their promoters, again the majority of whom are based in the US, have no qualms about splashing Mayweather around as the face of their cryptocurrency Ponzi scheme.

Stated at the time of Mayweather’s settlement by Enforcement Division Co-Director Steven Peikin;

Investors should be skeptical of investment advice posted to social media platforms, and should not make decisions based on celebrity endorsements.

Social media influencers are often paid promoters, not investment professionals, and the securities they’re touting, regardless of whether they are issued using traditional certificates or on the blockchain, could be frauds.

Josip Heit’s MLM crypto investment fraud began with Karatbars International.

After KaratGold Coin flopped, Heit went on to launch GSPartners. After GSPartners’ G999 Ponzi scheme ran dry, Heit bungled a series of failed projects in Dubai (what happened JOne Tower rentals?).

That culminated in Lydian World and the current Metaverse Certificate Ponzi scheme, run through LYS token.

GSPartners continues to manipulate G999’s public trading value, but otherwise the token has been abandoned.

Like Eric Worre, Floyd Mayweather should know better.

At time of publication SimilarWeb attributes the US as the largest source of traffic to GSPartners’ website (57%). It’s a similar story for Lydian World’s website, with the US contributing 62% of traffic.

Neither GSpartners, Lydian World or owner Josip Heit are registered with the SEC.

Karatbars or karat gold and GS partners still owe me 123grams of gold that I bought and 294 000 G999 supposed coins.

The gold never existed (never trust anybody who does not charge a storage fee for gold bullion) and the G999 is an utterly worthless shit-coin that has no utility. Both were Ponzi scams from day one.

There are plentiful reputable gold bullion dealers out there. Karatbars was never one of them.

BDSWISS it’s a well known broker for schemes. In the past they had a lot of affiliates promoting forex signals groups that promised big gains, but all of them didn’t made a profit from trading.

The forex signals were used to force newbies open trades which resulted in commissions for the affiliates.

As the CMVM, the Portuguese SEC started investigating and taking measures, they had to close the affiliates and stopped accepting clients in Portugal.

One thing I didn’t touch on was GSPartners promoters banging on about BDSwiss having 1.6 million active trading clients.

BDSwiss’ website gets less than 150K visits a month.

It’s funny to see them use celebrities as a pocket pulling magnet schemes at several of these fly-by-night operations.

They’ll even go so far as to give folks misleading information all in the name of “just give us your money”.

Floyd was robbed of a gold medal at the 1996 Olympics and was awarded a bronze medal due to unethical and corrupt judging.

The irony.

If all authorities know this is a Ponzi scheme, why do they get to continue doing business? Is this why Josip Heit didn’t show up in ATL?

Would US authorities have showed up as well to confront him in an effort to protect US citizens from losing more money?

Anyone is free to break the law. Whether regulators come after them is on regulators. I can’t speak for the authorities.

Most likely. Being the head of a Ponzi scheme primarily targeting US residents typically doesn’t end well. Makes it a hell of a lot easier if you show upon the DOJ’s doorstep.

Impossible for anyone but the DOJ to confirm. And they won’t.

My landlord is now making $2500 a month and trying to sell me on it.

They’ll have invested a bunch of money and are “making” numbers on a screen. Ask them when they invested to gauge how desperate they are.

You could also kindly ask how it is working out now… Seeing magical numbers that they can either not access (if US based) or only in small amounts with huge costs; and probably some extra hurdles and delays to slow the draining of funds.

Hope that Ed didn’t fall for the FOMO on this scam.