GSPartners stops manipulating G999, trading value plummets

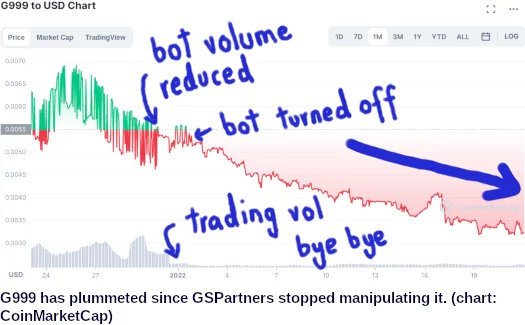

GSPartners has stopped whatever they were doing to peg G999’s public trading value at around 5 to 7 cents.

GSPartners has stopped whatever they were doing to peg G999’s public trading value at around 5 to 7 cents.

Consequently G999’s trading volume and value has plummeted.

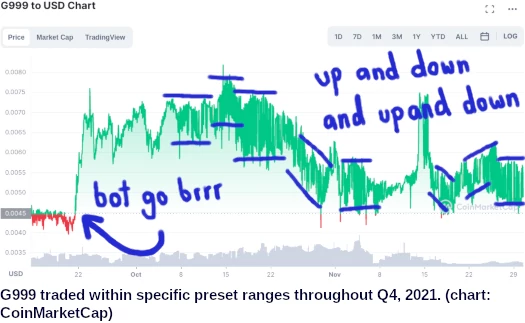

The last round of blatant G999 manipulation began around October 2021.

If you look at G999’s public trading chart, you can see whatever manipulation was going on aimed to kept G999 within a set value range.

The bot bought G999 till it hit a programmed roof, then sold till it hit a programmed floor.

This pattern creates the odd up and down pattern you see on the chart. It also artificially inflated G999’s daily trading volume.

The manipulation continued until January 1st, wherein GSPartners abandoned their strategy.

Three things immediately happened:

- the swing trading manipulation stopped;

- actual daily G999 trading volume was revealed to be less than $50,000; and

- G999’s public trading value plummeted.

G999 has continued to decline throughout January, although volume has pushed close to $100,000 at times.

Still, without intervention from GSPartners, G999 overall remains in decline. In less than a month G999 has lost about 40% of its manipulated 2021 value.

This likely won’t change unless the manipulation bot is started up again, or new victims are recruited into GSPartners.

G999 was a spinoff of Josip Heit’s work on Karatbars KGC Ponzi shitcoin.

When KGC flopped in mid 2019, Heit, as Karatbars’ Chairman of the Board, was tasked with fronting angry investors.

Sometime towards the end of 2019 Heit split from Karatbars. He went on to launch GSPartners, taking a significant number of top Karatbars investors with him.

With G999 going nowhere GSPartners has gone on to launch a number of subsequent shitcoins.

Over the past six months there’s been JONE, XLT and LL.

LL is attached to Lydian Lions, GSPartners’ attempt to jump on the NFT bandwagon.

Based on website traffic analysis from Alexa, the US makes up the largest percentage of visitors to GSPartners’ website (40%).

US recruitment of investors is led by Georgia resident Michael Dalcoe.

Despite offering securities to US residents through GSPartners, neither GSPartners, Josip Heit or Michael Dalcoe are registered with the SEC.

Since the rest of the Crypto market is down are they manipulating the system with a bot also???

The crypto market being down now, has nothing to do with GSPartners running a G999 bot throughout Q4 2021.

Such to the extent the general crypto market is manipulated (tether/usdc print scam etc.), that’s a discussion for somewhere else.

Thought Josip had this domain seized yet here you are still in business.

Some info from a recent Zoom call. Heit seems a bit on edge

youtube.com/watch?v=mNvEkazF68c

00:12:50 Gets off to a bad start when someone posts some words about Alex, he got a bit upset

1:40:48 Heit talks about a target of 3,000,000 members this year and the same number of miners (whatever that means) for them to see the coin go up

1:42:55 some frustration about the numbers on screen since the G999 bot was switched off. Heit is not happy about the daily number anymore, it may have been the reason Alex had it in place, something to keep the chairman of the board happy.

1:54:40 G999 tower opening in June. Could swear they said it would be open at the end of last year but slipping targets are the name of the game with this stuff

2:08:20 As per your suggestion members will be able to pay subscriptions with G999 but come with the condition that there must be 30,000 active members. Gives them a get-out clause I suppose

2:26:25 They are going to ‘sue’ coinmarketcap as they have a warning on their G999 listing.

My heart bleeds for him. It truly doesn’t!

He will never sue anybody. If he did, he would be exposed before a judge as a criminal running a Ponzi scam. But nobody has ever said Josip is bright!

Whole lotta copium on that call.

Ignore the USD value, we didn’t lose many satoshis!

Looks like January was a failed experiment. Someone has fired up the manipulation bot again for February…

Something has gone wrong with the Alex-O-Matic again. Maybe it’s got a form of Y2K bug and it could not deal with a year rollover?

I think they’re trying to make it less obvious now they’ve been called out on it.

BehindMLM is pretty widely read and leads to awkward questions being raised. So I’m told.

Ruhroh, the G999 wash trading bot has been turned off again to reveal less than $5000 a day in actual trading volume and a $0.002 trading value (i.e. everyone who invested lost money).

Looks like LYS tipping $50 is the drain threshold for now.

This is from the comments on CMC:

I couldn’t find anything further on this so no article. GSPartners abandoned its social media accounts back in June.

Wash trading bot back on, but with greatly reduced volume (~$10,000-$20,000).

Let’s see if this works…

Back to the ~$100,000 wash trading volume amount again.

Things are kicking off in the comments section here.

coinmarketcap.com/currencies/g999/

Michael Dalcoe and a few others are trying to defend the scam but none are answering the real questions. BehindMLM gets a mention.

“The author is a lying propagandist and should be held accountable in court for his libilist statements.”

LYS is approaching $5 and G999 has been in the toilet since launch. G999 wash trading bot was turned off a few months ago.

Kinda waiting for LYS to completely collapse or bottom out at less than $1 before publishing an update.

Pretty much everyone who invested in GSPartners has lost money, except for your Michael Dalcoes in the US and the South African scammers.

Portugal recruitment was short-lived and now they’re trying to rebuild with new victims in the US, Canada and SA.

Once those metaverse certificate returns are due, lol.

From the CoinMarketCap comments:

Copium lololol.