GSPartners’ new super secret XLT securities fraud brochure

GSPartners affiliates have conceded the company is committing securities fraud.

GSPartners affiliates have conceded the company is committing securities fraud.

Unfortunately they’re of the mistaken belief that hiding securities fraud makes it less illegal.

As per GSPartners marketing webinars doing the rounds, the company has released a XLT investment brochure through its GSWealth backoffice.

As above GSWealth is tied to GSB Gold Standard Pay KB, a Swedish shell company owned by Josip Heit.

GSPartners affiliates who have invested in the Ponzi scheme have access.

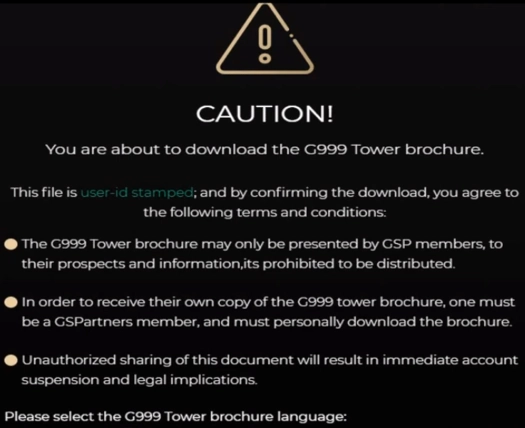

The forty-seven page brochure is titled “G999 Tower brochure”:

As above, GSPartners is determined that nobody outside of invested affiliates gains access to it.

Why? I’ll let a GSPartners affiliate explain, as per an October 3rd marketing video;

[6:40] This offer is structured in a way to protect all parties.

…

Now protect from what? To protect from people um um um, thinking or or or accusing us of selling an unregistered security.

This is not a grey area, this is very black and white.

Indeed it is. BehindMLM has repeatedly called out GSPartners’ securities fraud. It’s great to see investors, and by extension GSPartners itself, finally acknowledge its unregistered securities offering.

[7:18] Josip has spent not just hours and not just days, but weeks … and actually months on structuring this offer to ensure that everything is done legally and in compliance.

So it’s not something that is open to the outside world. That anybody can come (and) acquire XLT from anywhere and take part in it.

Here’s the thing about securities fraud. Whether you do it out in the open or through secret brochure’s it’s still securities fraud.

[9:09] The regulators don’t care what the reason is. They don’t care if it’s a utility for G999, they just want to know if you’re selling an unregistered security.

The only way to offer a security legally is to register with financial regulators, and provide them and consumers will audited financial reports and full disclosure.

Full disclosure being the opposite of what Heit is doing with GSPartners’ XLT investment scheme.

[7:44] By no means can this document go into hands of people that you don’t know.

Not operating legally and filing disclosures leads to reputable companies sending you cease and desists, having to set up sham banking licenses because you fail the slightest scrutiny, relocating to crime dens like Dubai, and setting up shell companies to hide your actual business operations.

GSPartners is open to the public and through investment in GSPartners, members of the public gain access to the XLT investment scheme.

The key takeaway there being that GSPartners is available to the public.

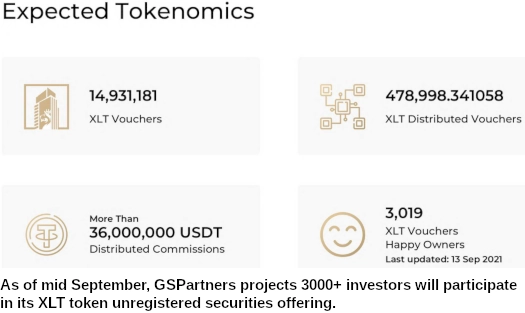

At the time of publication GSPartners has sold 3.15 million XLT out of the 70 million it created out of thin air.

GSPartners’ XLT investment fraud scheme is operated through JJJ Holdings (a shell company owned by Josip Heit), and SAAS Properties.

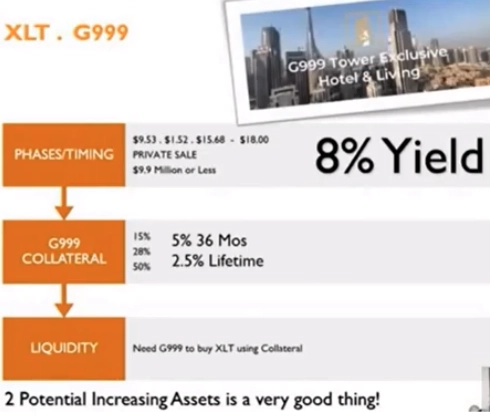

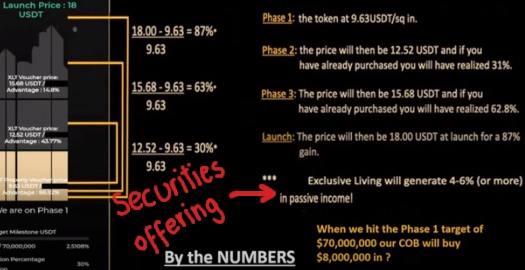

As per the linked marketing video above, GSPartners continues to sell XLT tokens to affiliates for $9.53 to $18 each.

Affiliates must first invest in G999 tokens, acquired again from GSPartners.

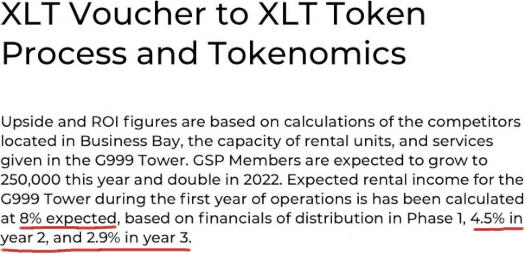

This is done on the promise of an 8% yield, something something 5% a month for 36% months, 2.5% lifetime… it’s not really clear.

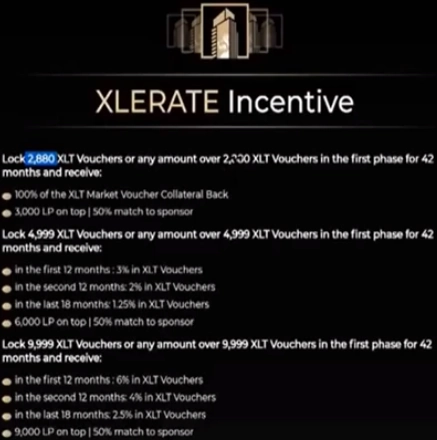

The slide above details specific XLT token investment contracts, which reward affiliates with higher passive returns over time.

- invest in and park 2880 XLT or more with GSPartners for 42 months, and receive 3000 LP + your initial XLT investment amount

- invest in and park 4999 XLT or more with GSPartners for 42 months and receive a 3% XLT ROI each month for the first twelve months, a 2% XLT ROI each month for the second twelve months, a 1.25% XLT ROI each month for the last 18 months and 6000 LP + your initial investment back

- invest in and park 9999 XLT or more with GS Partners for 42 months and receive a 3% XLT ROI each month for the first twelve months, a 4% XLT ROI each month for the second twelve months, a 2.5% XLT ROI each month for the last eighteen months and 9000 LP + your initial investment back

Legacy Points (LP) is another layer of investment tokens within GSPartners.

GSPartners affiliates who previously invested in G999 tokens fixed contracts have already experienced widespread losses.

G999 debut public trading at $0.0063 back in February. G999 pumped to $0.021 and proceeded to dump to its lowest $0.0023 value in August.

G999 is currently trading at $0.006.

Since inception GSPartners has failed to register with any financial regulators.

The company continues to commit securities fraud in every jurisdiction it operates in.

Update 19th April 2022 – The YouTube channel hosting the cited October 3rd GSPartners marketing video has been terminated.

As such I’ve removed the previously accessible video link.

It is done. Boris, summon Alex!

…

You wanted to see me sir?

Sit, sit. Today is a great day. After JONE humiliation and Ukraine embarrassment do you know what is it I do down here?

When you asked for a shipping container of lube and tissues… I figured-

…I began working on my greatest creation yet.

I thought I was your greatest cr-

Silence! Behold Alex, GSPartners’ new secret XLT brochure.

I see all these stupid “smart-contract” scams and think, “What is so smart about them? Everyone can see how steal money.”

Is not smart at all. So I invent world’s first cryptocurrency SECRET CONTRACT!

Sir… it is a masterpiece.

Art of the state security! 9000 gigabit transaction hashkeys! Blocknode chainmaster encryption! Alex, if you try to un-ow-thorized access your eyes turn to ash!

Do you want me to send someone down here to clean up all these empty bottles and tissues?

Yes Alex! No longer will the world laugh at worthless G999! They will say, “Josip, you are so handsome. Not like wide-head Harald. How did you put all this together *and* keep it secret?!”

And Alex, is only beginning! Next year we will erect giant statue of me on top of

MovenpickG999 Tower! Once all of UAE use G999 I rule Dubai with iron fist!Fist me Josip!

What?

Um… sir? Sorry to interrupt but-

Quatsch Boris! can’t you see me and Alex are celebrate? What, what is it?

Your brochure sir… it’s all over the internet.

Yes of course you can have my ow-toe-gra… WHAT?!?!

One of GSPartners leaders put it on Facebook. Is now on YouTube and BehindMLM.

I… see. Boris, come over here and read this.

“X-L-T tohken, secret contract by Josi–ARGHHH MY EYES IT BURNS IT BURNS ARGHGHGHGHAHBLBL!”

Send someone down to clean up this mess.

How I going to make videos with this face!? What have you done Josip!

Alex come. We have work to do…

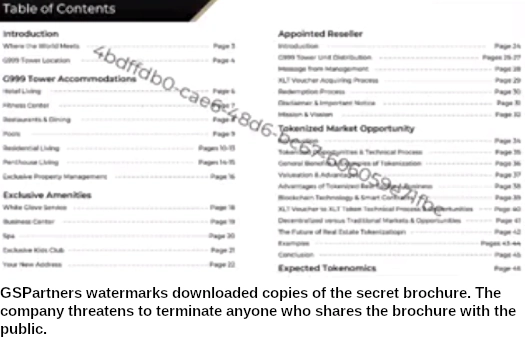

A reader graciously sent in the secret brochure. Added some slides from it for clarity.

This stuff isn’t state-secret,it’s sales documentation,lol watermark,why so skittish Goldshitpartners?

You shitting yourselves that the proof-of-securities-fraud leaked?

Or to only offer the security to an extremely select group of people.

If I form a window cleaner company 50/50 with my mate Dave, and then borrow £1,000 from my uncle Derek at 8%pa, that’s two securities offerings but not ones the regulator will take any interest in.

If I put an advert in the paper asking the general public to loan me their money at 8%pa or buy shares, now the regulator may take an interest (if they can be bothered).

I sense the pseudo-compliance angle here is that if any regulators come nosing around, GSP will attempt to claim “it’s a private offering, look at all this super secret squirrel stuff we did to keep it private”.

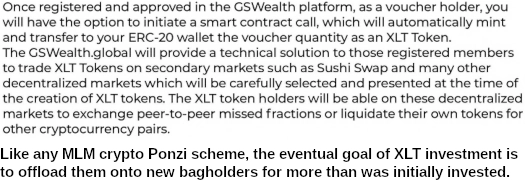

This is of course flimflam because any MLM or pyramid or Ponzi scheme has to be offered to as many people as possible, to satisfy its insatiable appetite for inflows, before it exhausts the pool of suckers and collapses.

But it means that regulators are unlikely to take any notice unless evidence of it being promoted to the public is shoved under their nose.

Of course it’s flim-flam, GSPartners has been soliciting investment from the public since launch.

Layering a second XLT Ponzi on top of your original “open to the public” G999 Ponzi isn’t a private offering.