Canadian regulator requests GSPartners investor contact

Saskatchewan’s Financial and Consumer Affairs Authority has requested GSPartners investors get in contact.

Saskatchewan’s Financial and Consumer Affairs Authority has requested GSPartners investors get in contact.

Investors are asked to contact the FCAA’s Securities Division if they have invested with GSPartners. Always check registration first before investing.

As above, the FCAA’s request was made on their public Twitter profile on June 15th. It follows the FCAA issuing a GSPartners securities fraud warning on June 1st;

The Financial and Consumer Affairs Authority of Saskatchewan (FCAA) warns investors of the online entity GSPartners.

This entity claims to offer Saskatchewan residents an opportunity to invest in crypto assets.

GSPartners is not registered to trade or sell securities or derivatives in Saskatchewan.

The FCAA cautions investors and consumers not to send money to companies that are not registered in Saskatchewan, as they may not be legitimate businesses.

In addition to Saskatchewan, Alberta (GSTrade, G999 and GSPartners), Quebec and British Columbia have also issued similar GSPartners related securities fraud warnings.

The Central Bank of the Comoros also issued a GSB Gold Standard Bank fraud warning in June 2022.

In the midst of Canadian regulatory fraud warnings, GSPartners rebranded to Swiss Valorem Bank last month.

As of May 2023, SimilarWeb tracked Canada as the second largest source of traffic to GSPartners’ website.

The vast majority of GSPartners website traffic originates from the US (66%). Authorities there have yet to make any investigations into GSPartners public.

Through cryptocurrency “certificates”, Swiss Valorem Bank offers investors passive returns of up to 5% a week for 52 weeks.

Neither GSPartners, Swiss Valorem Bank or owner Josip Heit are registered to offer securities in any jurisdiction.

The SEC advises that securities fraud and cryptocurrency is a strong indicator of a Ponzi scheme.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure

investors into Ponzi and other schemes in which these currencies are used to facilitate fraudulent, or simply

fabricated, investments or transactions.The fraud may also involve an unregistered offering or trading platform. these schemes often promise high returns for getting in on the ground floor of a growing Internet phenomenon.

Federal and state securities laws require certain investment professionals and their firms to be licensed or registered.

Many Ponzi schemes involve unlicensed individuals or unregistered firms.

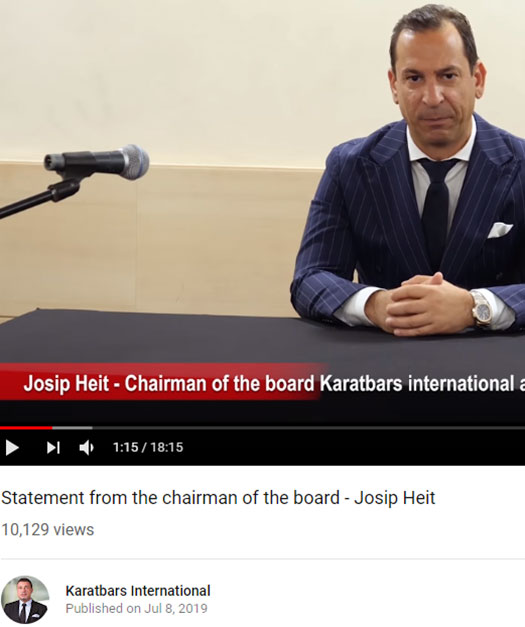

GSPartners and Swiss Valorem Bank are run by former Karatbars International executive Josip Heit.

Heit, originally from Croatia but believed to hold a German passport, runs GSPartners and Swiss Valorem Bank from Dubai.

Bots seem to have given up on G999 too. They had a pump for the Dubai event a few weeks ago but tumbleweed since

Anyone have ideas about what a collapse of Josip’s scam would look like?

Individual investors getting charged with fraud in one jurisdiction after another? Josip shutting it down overnight and disappearing with his lieutenants and all that cash? Something less dramatic?

I would suggest that from the top down, it would be a combination of a blame game, a hack and doubt sowed by all of the, affiliates themselves, jealous people and naysayers that would cause, they would say, this project to collapse and become worthless.

Perhaps even be creative and blame the big players in the crypto and trading, industry that can move markets to be the cause of the coins/nft/tokens etc to lose value by shorting the g999/valorem bank /lydian world project, with large amounts of leverage resulting in the sudden loss of value, should this project ever go public, but there is that option of an excuse, nonetheless, because no one ever really does any sort of due diligence.

I can also foresee the blame being shifted on the AI trading bot for making a few bad trades, with everyone;s investment or whoever is placing the trades on the affiliated trading platform.

Also a server crash would be highly likely, funds stolen most probably, all of the typical rug pull excuses, in that case , Alex may be the fall guy.

Seeing that all of the leaders have already relocated to Dubai. A possible scenario may arise where Josip just goes missing/life in danger/ kidnapping possiblity and the system will go into automatic security mode and security protocols will kick in should josip not log in for more that 24hrs.

System will freeze , therefore funds will be inaccessible, dashboard/system will be offline until josip is found.

By that time he will be happily retired with a new identity somewhere in a nice place, living a beautiful life.

Nothing will happen to the rest of them as long as they stay there in dubai.

All of the shocked and highly disappointed subleaders, how dare they ,will redirect the followers to the next scam or make a new one from off-the-shelf software and become the new leaders, and the cycle will continue, because these people are always looking out for the next best opportunity to make money quickly.

If the SEC/DOJ file before GSPartners and Swiss Valorem Bank collapse, that’ll be a quick collapse and then wait for the inevitable arrests (could take years).

If GSPartners and Swiss Valorem Bank collapses because of inevitable math, whatever the excuses are expect a long drawn out exit-scam. This is the norm for larger crypto schemes these days.

From what I hear their focus seems to be on China and Asia now probably because the soil is becoming to hot elsewhere.

They had the first couple of meetings in Peking last week and then they moved onto Hong Kong this week.

Maybe Heit can meet up with Harald Seiz in Thailand for an old boys reunion?

Here they are “pre” launching in India to a very bemused-looking crowd

youtube.com/watch?v=-cWn-M4xTNY

New victims outside of the US and Canada have to be found because the original certificate investment plans expire late 2023.

Not everyone is going to drink the “perpetually higher ROIs plans” kool-aid, and withdrawals are going to increase.

Juggling the math requires exponential new investment, which GSP/SVB isn’t going to get from the US/Canada.

In that case , they may have to be forced to block withdrawals from accounts that are not recruiting in other countries where recruitment has dried up.

I am in contact with an SA affiliate who swears he is passively making over 1/4 bar per month.

I am not ceratain about his initial “investment” I know he has amassed some followings from all the previous ponzis but imagine not being able to withdraw, and instead, decide to “compound your earnings” for 36 months.

They will have to block withdrawals, because recruitment is not necessary ( so they say ) and one can just sit back , relax and let the mining certificates do the work for you?

Brendan and his team are working incredibly hard though, in order to keep this thing going for as long as possible in SA, with regular , packed venues being had, frequently.

Yeah, on a screen. Math is math and you can’t withdraw more than is invested.

Can’t say whether GSPartners will go the blocked withdrawals route. Won’t know until it happens.

I know it just numbers – he should know too, coming from karatbars.

Im sure the mentality now is… pretend we dont know its a ponzi , knowing it will collpase but make as much as we can in the meantime, move on the the next ponzi, get in early, tell everyone else to stay plugged in and compound, while we make weekly withdrawls.

bunch of arm chair hackers throwing out suppositions. You dont know the structure of GS partners and what keeps them compliant in 170 countries.

ive been paid every week and every month on time according to the smart contracts. So have the other 560,000 ppl that are a part of Gs.

Dont you think you’d hear directly from someone who has money IN GS if they haven’t recieved the $$ in the smart contracts?

How many scammers have a BANK LICENSE? I’ll help you. ZERO.

There is no “structure” that legalizes securities fraud in any country.

Numbers on a screen != getting paid.

By the time “hOw Do I gEt My MoNeY bAcK?” makes an appearance in the comments it’s too late.

Also you’re inferring that a Ponzi scheme that hasn’t collapsed yet isn’t a Ponzi scheme. This is false.

You’re inferring GSPartners has a bank license. This is also false.