Billionico hires banned mutual fund rep as “elite coach”

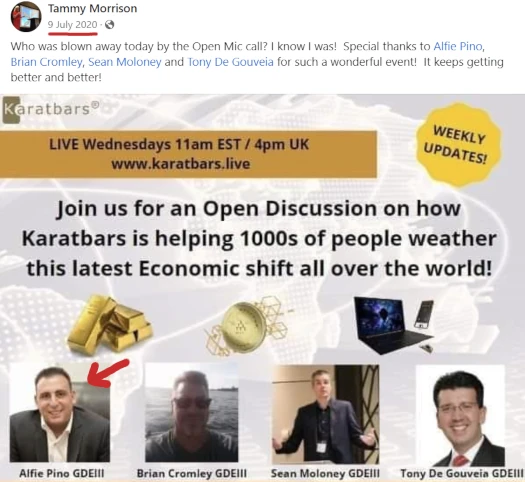

![]() On April 1st GSPartners spinoff Billionico announced it had hired Alfredo Pino.

On April 1st GSPartners spinoff Billionico announced it had hired Alfredo Pino.

An accompanying press-release claimed Pino, who also goes by Alfie Pino, had been hired to “mentor elite education teams”.

Alfie Pino has extensive coaching experience, specializing in all things cryptocurrency.

He was teaching, helping students navigate the ever-changing rapids of the blockchain industry and has now introduced Billionico to his team, extending his unique mentoring methodology and enriching the platform’s holistic approach to business education.

Upon receiving the formal invitation to join Billionico as a coach of its elite educators, Alfie Pino shifted his focus from teaching individuals to mentoring a small group of select elites and now has a unique opportunity to make a global impact.

Research into Pino reveals a scrubbed FaceBook profile and press-release spam. This piqued my interest so I dug a bit deeper.

Turns out Pino, originally from Ontario, Canada, has quite a bit of regulatory baggage behind him.

Before reinventing himself as a “blockchain technology expert”, Pino worked as a mutual fund representative for Investors Group Financial Services Inc.

Investors Group Financial Services, who now goes by IG Wealth Management, is a private wealth management firm operating out of Canada.

When Pino joined Investors Group is unclear, but by 2011 he’d managed to attract the attention of the Ontario Securities Commission (OSC).

Following an internal investigation, OSC determined Pino transfer $182,000 from Investors Group client accounts on instructions of an imposter.

Pino acted on instructions received by email and by facsimile only, without taking appropriate steps to ascertain the identity of the individuals providing the instructions.

OSC contended Pino’s actions constituted violations of of Canadian money laundering and terrorist financing laws.

As a result of these findings, OSC staff determined Pino “lacked the necessary proficiency of a securities professional.”

In an attempt to remedy this, in March 2011 OSC ordered Pino be subject to to supervision by a sponsoring firm for one year. Pino was also ordered to undertake an “Investment Funds Course”.

A few months after his supervision order expired, Pino solicited $280,000 from an Investors Group client.

An investigation by the Mutual Fund Dealers Association of Canada determined that “approximately $267,000” of the amount was misappropriated.

As reported by Insurance Portal in December 2016;

Pino repeatedly drove to the home of a recently-widowed client where he would offer investment advice.

He would then drive her to the bank in his own vehicle and instruct her to obtain bank drafts while he waited in the car.

The MFDA says he gave the client false explanations about the nature and purpose of the investments he recommended, and in fact deposited the bank drafts into a corporate account that he controlled.

“The Respondent did not provide client BC with any records, receipts or statements documenting the amounts of money that she provided to the Respondent or how the money would be invested.

The Respondent falsely represented to client BC that the money was being invested in annuities that would pay client BC a rate of return of 6.5% per year.”

Investors Group were unaware of Pino’s conduct.

Sometime after MFDA began investigating. On or around February 2015, MDFA claims Pino began “failing to cooperate with and to mislead the MFDA in its investigation”.

The MFDA’s investigation continued nonetheless, resulting in Pino being fined $400,000 and permanently banned from working as a mutual fund rep in November 2018.

Reporting on the outcome of MDFA’s investigation, Advisor wrote in February 2019;

In its penalty decision, the panel characterizes Pino’s conduct as “egregious,” noting the victim was a widow. “The respondent took advantage of her. The facts are shocking.”

A hearing panel of the Mutual Fund Dealers Association of Canada (MFDA) permanently banned Alfredo Pino, a former rep with Investors Group Financial Services Inc. in Ottawa, and fined him $400,000. He was also ordered to pay costs of $25,000.

The penalties follow the panel’s finding in November 2018 that Pino misappropriated approximately $267,000 from a widowed client to fund Trova Capital, a company he set up to invest in U.S. real estate, and that he didn’t disclose the outside business to his firm.

It also ruled that Pino “failed to cooperate with and misled the MFDA during its investigation.” In fact, it found that he was “uncooperative, misled staff, and manipulated the system.”

The panel notes that Pino “unreasonably sought” repeated adjournments in the case, and that “he was untruthful and manipulative in seeking several of the adjournments.”

As a result, the panel ruled that a permanent prohibition “is necessary to protect the public” and to prevent future harm.

By the time MDFA had fined and banned Pino, the disgraced mutual fund rep had reinvented himself as a crypto bro through Karatbars International.

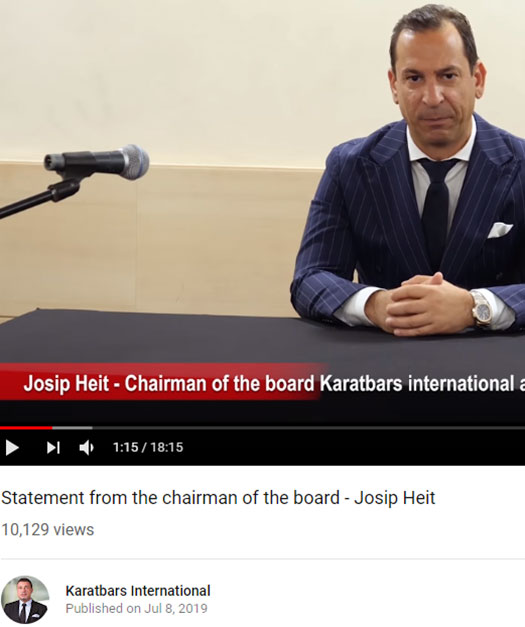

Originally a gold-themed pyramid scheme, Karatbars International transitioned to cryptocurrency fraud in 2018.

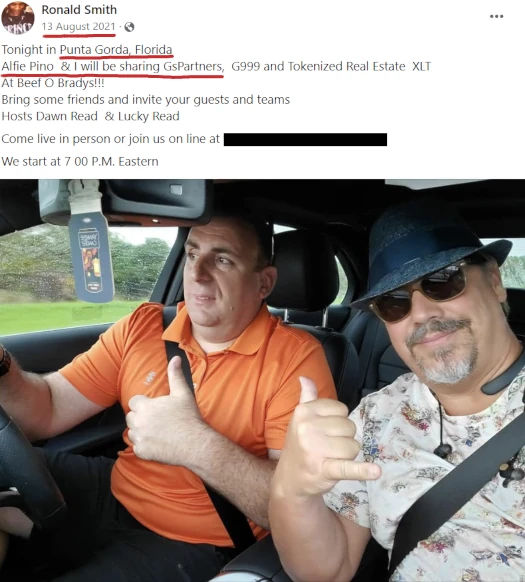

After joining Karatbars International, Pino relocated from Canada to Florida in the US.

Karatbars International imploded in early 2018, resulting in a split between owner Harald Seiz and Chairman of the Board Josip Heit.

Heit went on to launch GSPartners. Pino stuck with Karatbars International after it collapsed but eventually followed.

GSPartners attracted the attention of Canadian regulators in early 2023. Later in the year US regulators would go on to characterize GSPartners as a “fraudulent investment scheme”.

By December 2023, GSPartners and Heit had received fraud warnings from six Canadian provinces, eleven US states, South Africa and Australia.

In 2024 Georgia fined GSPartners and Josip Heit $500,000 for securities fraud. Massachusetts listed GSPartners as a “crypto scam”.

New Zealand and the UK also issued their own GSPartners related securities fraud warnings.

GSPartners collapsed in mid December 2023. A failed GSPro reboot followed but failed to gain any traction.

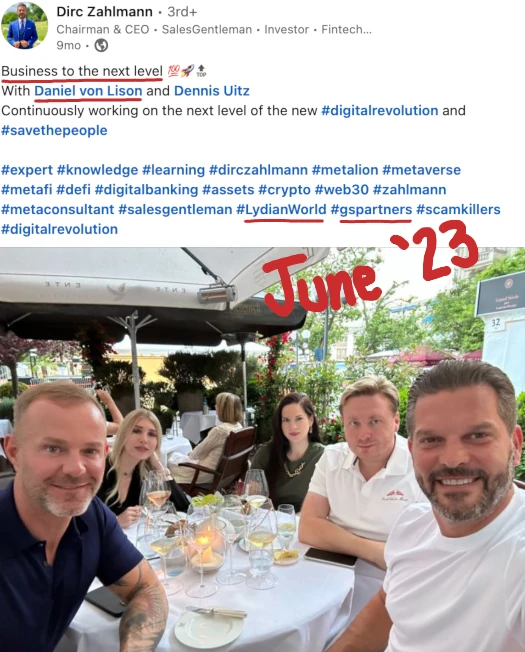

Earlier this year GSPartners promoters began spruiking Billionico, a spinoff company registered to Josip Heit’s lawyers in Germany.

Billionico is fronted by Daniel Lison, an associate of GSPartners executive Dirk Zahlmann (who also came over from Karatbars).

Initially believed to be a backdoor for US GSPartners investors, that’s now up in their following confirmation from Josip Heit that parent company GSB Gold Standard Corporation is abandoning the US altogether.

what Billionico thus intends to launch on April 19th is unclear. What we do know is Billionico is hiring banned mutual fund reps found to have stolen client funds.

Whatever Alfie Pino intends to teach Billionico’s “select elites”, it’s probably not worth the ticket price.

Great culture fit. You’re gonna go far, kid.

Thieves gonna thief.