Faith Sloan confirms CashFX Group securities fraud

Serial securities law offender Faith Sloan has confirmed CashFX Group is engaged in securities fraud.

Serial securities law offender Faith Sloan has confirmed CashFX Group is engaged in securities fraud.

In doing so, she’s also confirmed repeated violation of her 2019 TelexFree final judgment.

Sloan admitted CashFX Group is an investment opportunity in an October 9th Facebook live event.

[10:04] CashFX is a platform where many people have made some money.

It’s not everyone. Y’know when you talk about the investors that are out there, I had a hard time getting quote unquote investors in. It was easier for networkers but for some, not so easy.

The networkers they didn’t like giving up 30%. Let’s say they want to come in for $100,000; they weren’t happy with 30% of that, or $30,000 going into the product, which to this day isn’t there yet.

[10:38] And then another 20% taken out on the withdrawal. When in essence that 200% (return) ends up being about 160%. So that’s about 60% in ten months, right.

So a lot of investors didn’t like that.

At [59:35] Sloan refers to CashFX Group as an “investment deal”.

That CashFX Group is committing securities fraud is not a revelation. BehindMLM pointed out securities fraud in our July 2019 CashFX Group review.

What makes Sloan’s admission of interest is her 2019 TelexFree final judgment.

As a promoter of the TelexFree Ponzi scheme, Sloan was sued by the SEC for fraud in 2014.

The case played out for five years, concluding last year in a $778,455 final judgment.

As part of the judgment Sloan was prohibited from violating Section 5 of the Securities Act.

Under Section 5 of the Securities Act of 1933, all offers and sales of securities must be registered with the SEC or qualify for some exemption from the registration requirements.

As a general rule, MLM companies running passive investment schemes do not qualify for registration exemption.

Neither CashFX Group or owner/operator Huascar Lopez are registered with the SEC. In violation of her TelexFree judgment, Sloan has committed securities fraud by promoting CashFX Group since mid 2019.

Neither CashFX Group or owner/operator Huascar Lopez are registered with the SEC. In violation of her TelexFree judgment, Sloan has committed securities fraud by promoting CashFX Group since mid 2019.

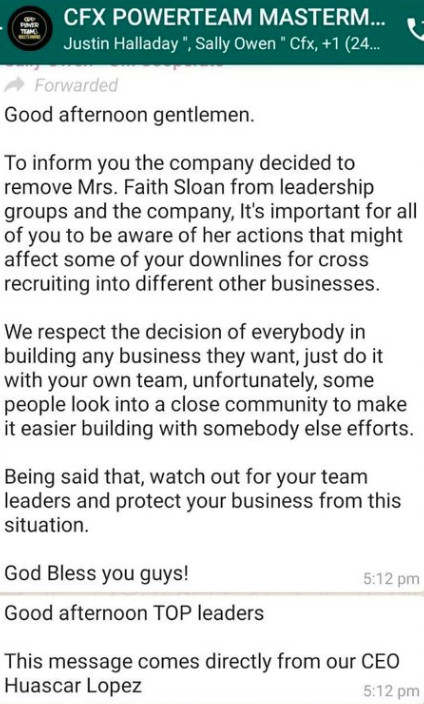

If you’re wondering what prompted Sloan to confirm CashFX Group’s securities fraud, it appears two days she was terminated for cross-recruitment. Accounts set up for Sloan’s mother and daughter have also been terminated.

Sloan claims she wasn’t directly informed of the account terminations.

Instead she found out when a message, purportedly circulated in a CashFX Group WhatsApp group a few days ago, was shared with her by CashFX affiliates.

A few weeks back Sloan began promoting QubitTech, another passive investment MLM opportunity.

As with CashFX Group, neither QubitTech or CEO Greg Limon are registered with the SEC.

Since Sloan’s TelexFree final judgment was handed, she has and continues to make a mockery of it.

BehindMLM first documented Sloan continuing to commit securities fraud through Cloud Token, two months after the judgment order was made.

By October 2019 Cloud Token affiliates began experiencing withdrawal problems.

Those, like Sloan, at the top of the Cloud Token Ponzi quickly abandoned ship. It wasn’t however until May 2020 that Cloud Token officially collapsed.

After Cloud Token Sloan focused on CashFX Group. Now that’s over it’s QubitTech.

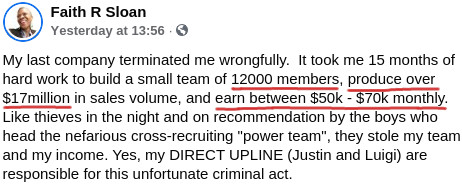

Sloan’s Cloud Token earnings are unknown. In her CashFX Group Facebook live video, Sloan discloses she had a downline of 11,000 affiliate investors.

[18:18] I get about $50,000 to $70,000 a month in CashFX.

As claimed by Sloan, the 11,000 investors in her CashFX Group downline collectively invested over $17 million dollars.

Sloan states she’s now “doing well” via “another deal” with QubitTech.

[44:20] With QubitTech, in five and a half weeks, I’ve made $90,000.

To date the SEC has failed to follow up on Sloan’s ongoing TelexFree judgment violations.

How is this ponzi still going . I have never seen a company with out a product keep taking in cash lol just crazy.

Faith Sloan has NEVER met a ponzi/pyramid scheme she didn’t like!

How she, and a number of other well known scammers, are not sitting in a prison cell somewhere is beyond belief…

Wow, ironic. She’s fine with stealing from her downline; not so keen on having her downline stolen from her.

Typical scammer logic. They think working hard at running a scam == earning the money they stole.

You see similar attitudes from professional burgulars: “Hey, I had to break into that house and haul all the valuable stuff out, and some of it was heavy. It’s MINE now. I EARNED it!”

How many times, and how many ways, does this woman have to flaunt her clear contempt of court before the court DOES something about it?? C’mon, SEC and DOJ, do your damned jobs and lock this woman up!

Faith Sloan, Luigi Bruni and Justin Halladay. The Clown Posse.

These three fought against each other after cloud token then teamed up again to promote this scam. Now they are moving to QubiTech so you know it’s a scam.

Cashfx has recently been using a so-called and ‘well-known’ British billionaire and entrepreneur, Jojar Dhinsa, as a major marketing event.

He is endorsing CashFX. He is apparently the CEO and founder of an international business services company, Athlone Group who are valued at US24 billion (very shady source).

Information on both Jojar and Athlone Group are very hard to come by. CashFX state that Jojar’s legal team have carried out detail due-diligence (lol).

All the usually self-athoring web pages such as linked-in and wikipedia contain information but that’s about it.

Athlone is registered in kazakhstan. It’s clearly all bs meant to encourage new investors to send more cash into this ponzi.

I reckon the Alrhone has been created to create a story about this so-called billionaire.

I can’t find any information from reliable sources on both Jojar and Athlone. Anyone have any info on this?

1. Legitimacy via association isn’t a thing.

2. British billionaires aren’t interested in MLM Ponzi schemes.

3. If you can’t very marketing claims, assume they’re bullshit. This is a safe bet in the MLM Ponzi space.

Thanks, Oz. Yep agreed.