Court orders up to $555 million of Laurie Suarez’s assets frozen

![]() The Supreme Court of Australia has ordered assets belonging to or under the control of Laurie Suarez be frozen.

The Supreme Court of Australia has ordered assets belonging to or under the control of Laurie Suarez be frozen.

The order permits a dollar amount of up to $555,174,472 to be frozen. This figure was reached based on investor claims against Suarez.

I don’t have specifics on the case, but at some point a group of Laurie Suarez’s victims filed suit against him in Australia.

As per a March 26th paywalled article from The Courier Mail;

Mr Suarez – who has previously served jail time for fraud, has been banned from managing corporations and was once a witness in a high-profile murder case – is being sued by some of the 30-plus investors who allegedly ploughed more than $5m into the schemes on the promise of huge returns.

Supreme Court Judge Thomas Bradley this month handed down orders freezing Mr Suarez’s assets up to the value of $555,174,472.04 – the amount the investors allege they are owed.

He has also been ordered to provide a list of his worldwide assets, including their location.

If I’m not mistaken, Suarez’s victims are claiming imaginary returns offered through Suarez’s various Ponzi schemes. And for some reason the Supreme Court of Australia is playing along.

To be clear: Laurie Suarez, a convicted felon, is a serial scammer who deserves to be stripped of every last dollar he’s stolen.

To be clear: Laurie Suarez, a convicted felon, is a serial scammer who deserves to be stripped of every last dollar he’s stolen.

The problem is the $555 million being claimed doesn’t exist.

BehindMLM first came across Suarez as part of The Berlin Group’s “Recycle Bot” Ponzi back in 2018.

After a few brief Recycle Bot reboots, we had RB Global Crypto Bank, a racist rant bemoaning the collapse of another Ponzi Suarez was tied to, RB Global Coin, Recycle Bot Crypto Growth Bank and XEMXLink,

XEMXLink launched in 2021 and collapsed by the end of the year.

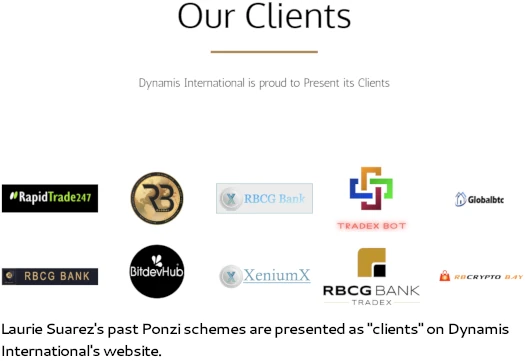

Despite mounting victim losses across multiple Ponzi schemes, The Courier Mail reports Suarez went on to launch Dynamis International.

As of March 2023, here’s how Suarez’s latest scam is going;

Dynamis International was placed in liquidation earlier this month and the lawsuit against the company has been temporarily stayed.

One interesting tidbit about the Australian SC class-action is that one of the Plaintiffs is a former partner in crime of Suarez’s.

Gold Coast professional musician Kristen Linehan … claims in court documents to be owed more than $8.2m.

She said she came to know Mr Suarez as a director of Recycle Superbot.

Ms Linehan alleged that during a live video chat, Mr Suarez complained that members were “not towing the line” [sic] by reinvesting profits into the scheme and “an accountant would be reworking the amounts owing to each member to a figure that was fair and reasonable”.

She said she made four successful withdrawals totalling $US1072 from her Gold account before October 2021 but later discovered her balance had inexplicably dropped from an estimated $A111,868.48 to $US15,000.

Ms Linehan said she also invested in other platforms promoted by Mr Suarez and ended up working for his company Dynamis International, which is also being sued.

She said she was the company’s only employee and she and Mr Suarez both worked from home and communicated via phone, text and email.

Seems Suarez and Lineham had a bit of a fetish thing going on;

Ms Linehan claims that while working with Mr Suarez to attract bitcoin investors, she referred to him as “Sensei” and he called her “Grasshopper” – an apparent reference to the 1970s cult classic TV show Kung Fu.

If you’re wondering how we got here, a civil class-action claiming over half a billion dollars against a serial Ponzi scammer, it’s due to Australian authorities doing absolutely nothing about Suarez.

Despite over a half-dozen scams launched over five years – to date Australian authorities have taken no action against Suarez and his accomplices.

Typically Australia is used by offshore scammers abusing ASIC’s rubber-stamp registration of Australian shell companies.

With Laurie Suarez we have an Australian national already convicted of fraud, continuing to scam Australians out of millions – and still nothing.

Not really sure how the Suarez SC class-action will ultimately play out but if there’s any further updates we’ll keep you posted.

He also got ordered to pay one of his victims 2.4millions back through court.

Is that typo in the source? If so, that deserves a [sic]. It should be “not toeing the line”. It’s like a soldier in formation is supposed to stand with toes on a painted line. Not toeing the line means disobedient.

Anything in a green box is from The Courier Mail so it would indeed seem to be a typo from the source. They’re quoting someone else so not sure if The Courier Mail’s source made a mistake too.

This grub had myself and my employees that worked at his house believe him too. We believed him enough to have our friends and family contribute too.

OTC deals is what he calls them. Where people come to him to sell BC at a lesser rate to access the funds immediately.

He says the people are like junkies and he has generated texts to back up his lies.

I too was asked to run the operation at a figure of $100K per month on top of all my earnings.

$3.5M off accrued earnings only too be told I’m blocked by his lawyer for threatening behaviour for asking the question, when will we ever see this money?

I too had the unfortunate mix up with both Recycle bot and RB Global crypto Bank. Both I lost my money on with promises to pay out money.

Rbgc website was open one day and then closed the next and I was unable to withdraw any amount. I wish I could claim but have no direction to chase this up.

I have heard that he is bankrupt. Would anyone possibly have the creditor details that are involved with the bankruptcy case?

I lose my money to make me stressed full life.

He’s at something bad again… Company Number 674080230