Mintage Mining marketing claims are a mess

For the past few months Mintage Mining and their affiliates have heavily marketing their passive mining ROI opportunity as being SEC compliant.

For the past few months Mintage Mining and their affiliates have heavily marketing their passive mining ROI opportunity as being SEC compliant.

Then there was the whole Jones Day SEC lawyers nonsense, despite the SEC using in-house counsel in its regulatory lawsuits.

As good a sign as any the SEC is asleep at the wheel when it comes to MLM cryptocurrency fraud, to date the regulator hasn’t addressed Mintage Mining’s claims.

The two of which we referenced above are just the tip of the iceberg…

In a conscious effort to distance themselves from similar MLM cryptocurrency investment opportunities served cease and desists over the past six months, Mintage Mining’s affiliates are making all sorts of marketing claims.

Today we take a look at how one prominent affiliate investor has recently been pitching the company.

Scott Brewster first popped up on BehindMLM’s radar through promotion of Bitqyck.

Back in March, Brewster justified Bitqyck’s unregistered securities offering by claiming the company intended to operate offshore.

With recent confirmation of a US regulatory investigation into Bitqyck (turns out moving your illegal business offshore doesn’t fool regulators), Brewster has begun promoting Mintage Mining.

Mintage Mining, part of Nui, sees affiliates invest in mining contracts on the promise of a weekly passive ROI for 52 weeks.

Neither Nui, Mintage Mining or any of the company’s principals are registered with the SEC to offer securities in the US.

Despite this being the precise reason USI-Tech was served a cease and desist by Texas last December, Brewster claims Mintage Mining is “totally different”.

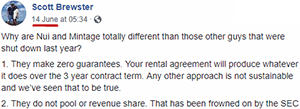

In a Facebook post dated June 13th, Brewster runs through a list of ten points differentiating Mintage Mining from “those other guys”.

In a Facebook post dated June 13th, Brewster runs through a list of ten points differentiating Mintage Mining from “those other guys”.

Why are Nui and Mintage totally different than those other guys that were shut down last year?

1. They make zero guarantees. Your rental agreement will produce whatever it does over the 3 year contract term.

Any other approach is not sustainable and we’ve seen that to be true.

USI-Tech and “those other guys” were served securities fraud cease and desists because they were offering unregistered securities to US residents.

Whether any guarantees regarding income and/or ROI payments were made is immaterial to the fact securities fraud was being committed.

2. They do not pool or revenue share. That has been frowned on by the SEC.

With respect to cryptocurrency investment schemes, the SEC “frown” on securities fraud.

The technicalities of how money is funneled on the back-end hasn’t been a point of contention in any MLM securities fraud cease and desist or litigation I’ve covered.

All the SEC does is look at whether a security is being offered, and whether the party making the offer are registered to offer securities in the US.

In the case of Mintage Mining a passive ROI on an investment (no matter how it’s derived) is a security.

As stated previously, neither Nui, Mintage Mining or any of its principals are registered to offer securities in the US.

3. Each Wednesday, your results are yours.

You have zero restrictions and aren’t lured into or asked to purchase additional rental agreements.

4. There is no ongoing cost.

5. There is no need to team build.

Again, not a point of contention in any MLM securities fraud cease and desist or litigation I’ve seen filed.

6. They are building a world class BlockChain that’s already attracting Fortune 500 companies.

These corporations do exhaustive research into partner viability studies.

A prominent factor in each of the MLM securities fraud cease and desists handed out since USI-Tech has been a lack of disclosure to investors.

If Mintage Mining is “building a blockchain” and “attracting Fortune 500 companies”, this needs to be disclosed.

Why hasn’t it?

Because “building a blockchain” takes all of a few minutes with “out of the box” scripts. And there are no Fortune 500 companies interested in attaching themselves to an MLM company openly committing securities fraud.

It’s not rocket science.

7. They are launching Kala as their coin that should increase in value because of the proof of use.

(Wal Mart is accepting it through their REACH program and much more.)

A five second Google search will reveal Walmart is most certainly not accepting Nui’s Kala tokens.

What I believe Brewster is referring to is this marketing spiel from Nui corporate;

Earn Kala Through Online Shopping: Later this year, Symatri will open their Retail Rewards program that allows CORE members to earn Kala every time they purchase items or services at one of their online partners.

Some of these partners include Walmart, Best Buy, Amazon, Home Depot, and hundreds more!

What this actually refers to is a simple e-commerce platform through which Nui will dump pre-mined Kala tokens onto affiliates who make purchases through it.

None of the “partners” have actual partnership agreements with Nui or Mintage Mining, anyone can sign up as an e-commerce affiliate.

8. They are based in Utah and the founders are community leaders there and quite well respected.

Other than confirming a US company with US founders is committing securities fraud, not sure what emphasizing Utah is.

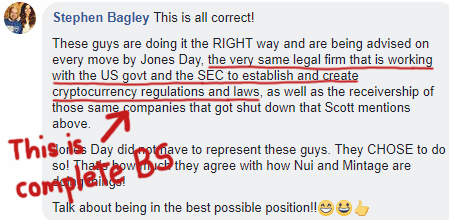

9. They are working with the nation’s preeminent cryptocurrency law firm.

The lead attorney was actually appointed by the SEC to handle the receivership of some of these defunct companies.

(Think he knows what to avoid and why? He’s consulting daily with these guys.)

This is a bit better than “our law firm are SEC attorneys”, but still misleading.

The term “cryptocurrency law firm” is meaningless, seeing as there’s no specific cryptocurrency legislation in the US.

Cryptocurrency investment schemes like Mintage Mining fall under securities law.

The lawyer in question Brewster refers to is Mark Rasmussen, a partner as Jones Day.

Rasmussen was appointed Receiver by a court in an ICO securities fraud lawsuit earlier this year.

As a Receiver Rasmussen is not trying the SEC’s case, nor is he directly involved in the SEC’s securities fraud litigation.

That’s not to say Rasmussen isn’t versed in US securities law. But whether he is or isn’t is ultimately irrelevant.

Anyone can look at passive cryptocurrency ROI scheme cease and desists and see there’s no material difference between what Mintage Mining are offering.

10. They are leaders in the business community in Utah and even sponsor the professional Rugby team there.

Legitimacy by association? Cmon Brewster, amateur hour much?

These are just a few of the reasons that Nui and Mintage are completely different than any other business that has ever been in this space.

If you hear otherwise, do your own research and you’ll be quite pleased.

By all means do your own research… which should start with what I’ve provided above as a foundation.

With respect to Mintage Mining, that foundation shouldn’t have to extend too far beyond whether the company is registered to provide a passive investment opportunity.

Given what is happening with Bitqyck, Mintage Mining and Scott Brewster obviously know the answer to these questions. They just don’t care.

Update 12th July 2018 – On July 11th the Texas Securities Board issued Nui and Mintage Mining with a securities fraud cease and desist.