Stable Swap Review: MLM crypto Ponzi scheme

![]() Stable Swap fails to provide ownership or executive details on its website.

Stable Swap fails to provide ownership or executive details on its website.

Stable Swap’s website domain (“stableswap.live”), was privately registered on October 26th, 2023.

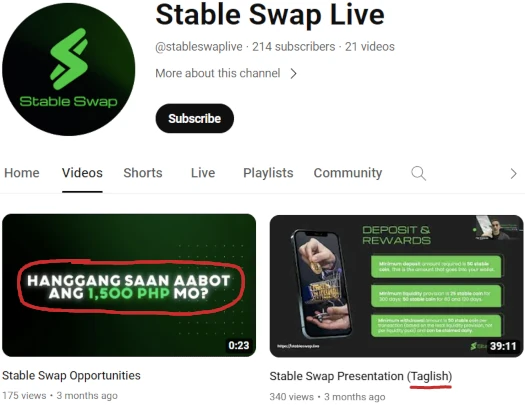

A link on Stable Swap’s website takes us to its official YouTube channel.

There we find videos in Taglish, a combination of Tagalog and English. Taglish is primarily used in the Philippines.

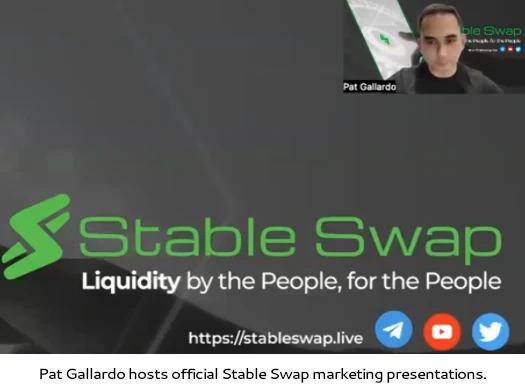

Stable Swap marketing videos are hosted by Pat Gallardo:

Gallardo has his own YouTube channel, on which Stable Swap marketing videos have also been uploaded.

Before Stable Swap, circa September 2023, Gallardo was promoting Swych.

That seems to have lasted about five months. The first Stable Swap marketing went up on January 9th, 2024.

As of March 2024, SimilarWeb tracked top sources of traffic to Stable Swap’s website as the Philippines (71%) and Australia (23%).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Stable Swap’s Products

Stable Swap has no retailable products or services.

Affiliates are only able to market Stable Swap affiliate membership itself.

Stable Swap’s Compensation Plan

Stable Swap affiliates invest USD equivalents in cryptocurrency.

This is done on the promise of advertised returns:

- Short Term – up to 0.1% a day for 60 days

- Medium Term – up to 0.2% a day for 120 days

- Long Term – up to 0.35% a day for 300 days

Note that Stable Swap don’t specify a minimum investment amount.

The MLM side of Stable Swap pays on recruitment of affiliate investors.

Referral Commissions

Stable Swap pays referral commissions on invested cryptocurrency down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 5%

- level 2 – 2%

- level 3 – 1%

ROI Match

Stable Swap pays a 10% match on dails returns paid to personally recruited affiliates.

Joining Stable Swap

Stable Swap affiliate membership is free.

Full participation in the attached income opportunity requires an investment in cryptocurrency.

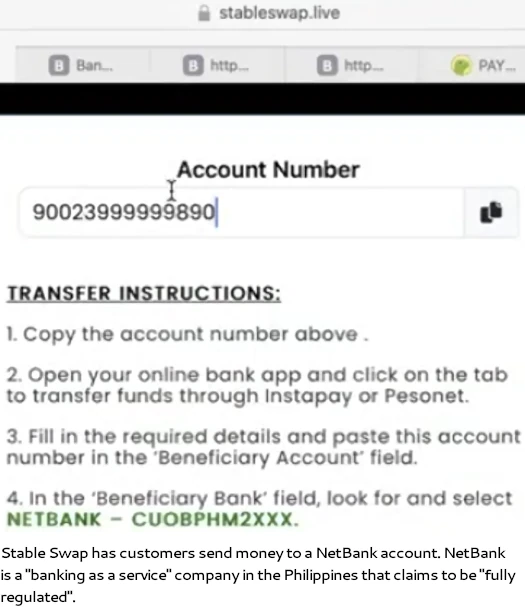

Stable Swap solicits investment in tether (USDT) and USD Coin (USDC).

Stable Swap Conclusion

Stable Swap represents it generates external revenue via “fee sharing”.

We offer attractive APRs (Annual Percentage Rates) and Referral Rewards through our business model, which is based on fee sharing.

No verifiable evidence of Stable Swap using fees of any kind of any kind to pay ROI withdrawals is provided.

An example of a verifiable evidence would be audited financial reports filed with financial regulators in countries Stable Swap solicits investment in.

Based on its website traffic, this would be the Philippines SEC and Australian Securities and Investments Commission (ASIC).

Stable Swap fails to provide evidence it has registered with either, meaning the company is committing securities fraud.

This is based on Stable Swap’s passive returns investment opportunity, which in any country with a regulated financial market constitutes a securities offering.

Instead of registering with financial regulators and providing audited financial reports, Stable Swap offers up baloney about “Topjuan Tech”.

First off legitimacy via association isn’t a thing. Topjuan Tech doesn’t absolve Stable Swap from its legal requirements with respect to securities law.

Secondly, Topjuan Tech isn’t registered with the Philippine SEC.

Topjuan Tech operates from the domain “topwallet.ph”. I can’t tell you when the domain was registered because the registrar’s website is down at time of publication (“dot.ph”).

Nevertheless through Top Wallet, Topjuan Tech provides merchant payment processor services.

As it stands, the only verifiable source of revenue entering Stable Swap is new investment.

Using new investment to pay ROI withdrawals would make Stable Swap a Ponzi scheme. With nothing marketed or sold to retail customers, the MLM side of Stable Swap additionally operates as a pyramid scheme.

Such to the extent any relationship between TopJuan Tech and Stable Swap exists, it appears to only be for money laundering purposes.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Stable Swap of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse the majority of participants lose money.

You clearly have not done any research on this one…

Sure I have, scroll up.

Sorry for your loss.

This article is full of lazy research and assumptions. There is no MLM structure. There is only one direct level.

The liquidity does not drain and is not dependent on new providers. The centralized side of Stable Swap (the service or product you say is not there) is called an OTC (over the counter) swapping of fiat to crypto (vice versa, P2P, remittance, etc.), handled by Top Wallet payment gateway.

All users in regulated and licensed countries MUST do a KYC or they can not use. This prevents fraud in the system (anti-money laundering & counter terrorism).

The liquidity in the system by providers is … (Ozedit: snip, see below)

Bullshit: youtu.be/lJLW6oTwsg4?si=KogPZebPHT_oPHYc&t=959

If you want to make financial representations about Stable Swap please provide audited financial reports filed with regulators. Unsubstantiated marketing bullshit is not an equivalent and will be marked as spam.

Cool story bro. Stable Swap’s primary problem with respect to regulation is securities fraud.

I haven’t lost anything, other than time by reading this hot garbage.

fintechnews.ph/61554/crypto/here-are-the-licensed-cryptocurrency-exchanges-in-the-philippines/

The Philippine Central Bank, BSP maintains a list of virtual asset service providers. So, like I said, you haven’t done any research on this one.

Stable Swap is not registered with the Philippine SEC. Feel free to provide an SEC certificate to the contrary.

Anything else will be marked as spam. Sorry for your loss.

You’re only further proving my point. Stable Swap does not need to be registered with the Philippine SEC. TopJuan Technologies Corporation does, and it is…

Stable Swap is offering securities through its passive returns investment scheme. Stable Swap needs to be registered with the SEC.

Who Topjuan Technologies is or isn’t registered with is irrelevant.

I do not have evidence that you are wrong about this site. I am not currently an investor so can be objective.

However you are clearly confused about what a Security is (especially U.S. Securities but also others). Stableswap provisions do not meet the criteria for any of the current varieties of security.

I suggest you go read up on the Howey Test. MLM + passive returns investment scheme = securities offering.

Similar schemes have been shown to fail the Howsy test. (Ozedit: snip, see below)

Feel free to name one example of a company offering passive daily returns of up to 0.35% that failed the Howey Test.

Anything else from you will be marked as spam.

Oh look, Jim Wear showed up to defend yet another scam. Jim’s track record so far is Novatech, Cryptogram, and stable trading… all of which were scams. Not a great track record is it? LOL he’s promoting scam after scam and defends them even after they collapse.

This video is 3 months old…. youtu.be/lJLW6oTwsg4?si=KogPZebPHT_oPHYc&t=959

The multiple level referral system has been scrapped now. There is 1 direct level only.

Jim Wear seems to think he’s kind of a big deal. Instead of providing requested evidence to back up his financial claims about Stable Swap, i’M gUnNa MaKe A yOuTuBe ViDeO! etc.

Good to know he’s just another butthurt serial promoter of fraudulent investment schemes.

Re. Stable Swap no longer being MLM, if anyone can provide evidence the MLM side of Stable Swap has already collapsed I’ll update the review.

I’ve provided my evidence. Three months is hardly “old”.

I’m a long time reader of behindmlm and it really opens your eyes about ‘investment’ scams.

However the research on this doesn’t seem to stand up to the usual scrutiny and quality of your reviews/investigations.

As others pointed out not the entire world is the USA. Everyone who earns off an affiliate program is involved in securities? (Ozedit: snip, see below)

This is classic “everybody loves BehindMLM, until we review your company”.

Securities fraud is illegal in every country with a regulated financial market.

Nope. You don’t get to make up a premise nobody said and then create an argument around it.

Best of luck with the scamming.