BitMobb: Darren Olayan moves Nui Ponzi scheme to Brazil

Yesterday longtime BehindMLM reader GlimDropper shared a Nui update with us.

Yesterday longtime BehindMLM reader GlimDropper shared a Nui update with us.

Through Nui International, Darren Olayan was offering 12 month crypto investment contracts.

Following a $595,000 securities fraud fine from Utah in late 2020, Olayan had been laying low.

Having abandoned his social media in December 2017 as multiple regulators launched investigations into Nui, Olayan had returned in mid January…

…to push NFTs. Hmm.

I ran a quick search on a connection between Nui and NFTs and turned up nothing. While I wasn’t able to confirm Nui International was still operating as an MLM company, I felt the new investment plans GlimDropper had shared warranted, at the very least, a review update.

And so I queued Nui for an update and proceeded to move onto putting together a review.

…but it bugged me. Why had Olayan returned to social media after two years to bang on about NFTs, when Nui wasn’t offering any?

It was here I fell down the rabbit hole of Olayan moving his Nui Ponzi scheme to Brazil.

While Nui itself isn’t offering NFTs (at least not directly and not yet), in June 2021 Darren Olayan registered the domain (“bitmobb.biz”).

There, among other things, Olayan is marketing himself as a “crypto coach” and “Blockchain Entrepreneur and Business Consultant”.

Naturally, jumping on the NFT hype bandwagon is part of the pitch.

As far as I’m aware, NFTs are just a marketing tool to Olayan.

What NFTs provided me was a springboard into Olayan’s current business operations. There’s a lot to unpack here so I’ll first provide a list of every company and entity I came across.

Below the list we’ll go through them one by one, followed by a conclusion on why any of this matters.

The Darren Olayan crypto rabbit hole as of May 2022

- BitMOBB

- DoMoreLLC

- Symatri

- Illuminex

- Bitcoin Car Money

- Kala Cup

- Nui and Nui International

- KLA Invest

- Naka Games

- Yes Bank

BitMOBB

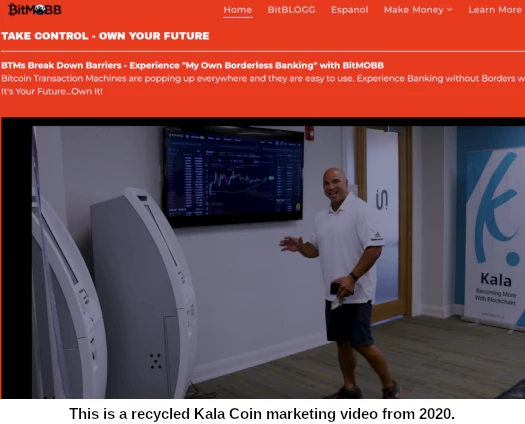

BitMOBB operates from “bitmobb.biz”. The MOBB part of the name is an acronym for “My Own Borderless Banking”.

This is a reference to crypto ATMs, which is a throwback to the old KALA ATM marketing schtick from 2020:

Other than that BitMOBB functions as a blog for Olayan to market himself and his various schemes on.

Do More Consulting

Do More Consulting is linked off Olayan’s BitMOBB website as “DoMoreLLC”.

Do More Consulting was launched in 2019 and operated from “domorell.com”. That website domain has since been abandoned.

Do More Consulting itself was short-lived. The company’s official FaceBook page was created in February 2019, only to be abandoned a few months later in May.

In late 2021 Olayan made two video posts to the page, sharing videos he’d uploaded to the recently renamed “BitMobb – Blockchain, Crypto & NFT community” YouTube channel.

As of December 2021, Do More Consulting has been abandoned again.

Symatri

Symatri is the shell company Darren Olayan launches his crypto schemes through. This began with Kala Coin (KALA) back in 2017.

Symatri is the shell company Darren Olayan launches his crypto schemes through. This began with Kala Coin (KALA) back in 2017.

Today Symatri refers to Olayan’s various attached spinoff schemes as “clients”.

These can be identified as companies using KALA, because nobody outside of Nui is using KALA.

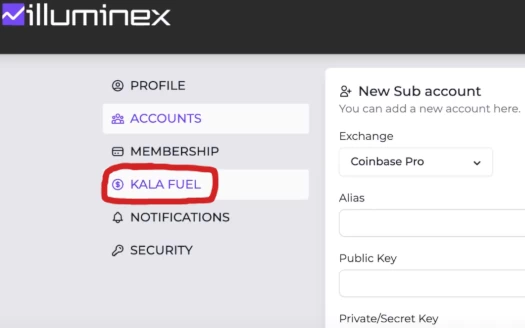

Illuminex

Illuminex is pitched as an “automated trading bot” scheme:

Illuminex is represented to be a Symatri client, meaning Darren Olayan runs it.

We can further confirm this by looking at the Illuminex backoffice, and seeing it uses “Kala Fuel”:

Kala Fuel is a “transactional token” used by companies launched under Symatri.

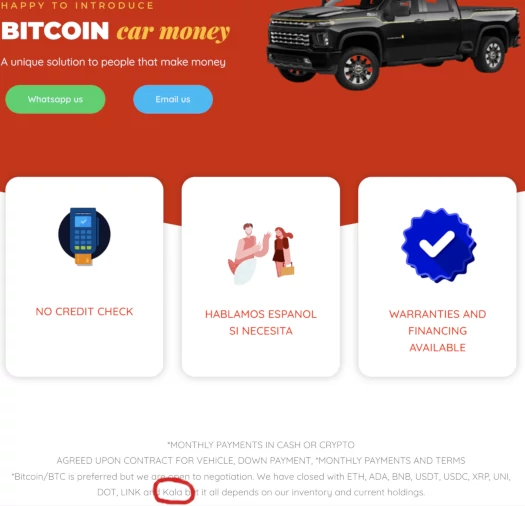

Bitcoin Car Money

Bitcoin Car Money is advertised on BitMOBB.

It’s some dodgy looking crypto car loan company that was set up in late 2021:

BitMOBB is based out of Utah and accepts various cryptocurrencies including, you guessed it, KALA.

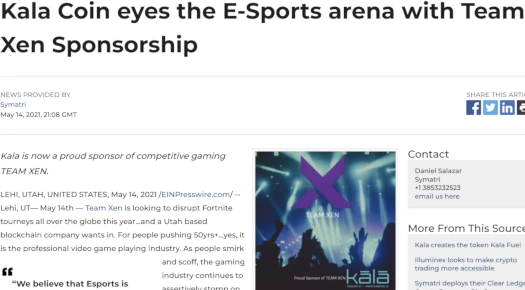

Kala Cup

Kala Cup was a lame attempt to get into gaming through Fortnite.

Last year Symatri hosted “Kala Cup”, a Fortnite tournament they set up through Rematch.

This appears to be a follow on from now defunct sponsorship of Team Xen, a Fortnite esports team:

Nui and Nui International

Nui International features in the “make money” section of BitMOBB.

At this point Nui and Nui International are one and the same. To keep things simple I’ll just Nui.

As reported by GlimDropper, Nui International continues to offer unregistered securities through its crypto investment Ponzi scheme.

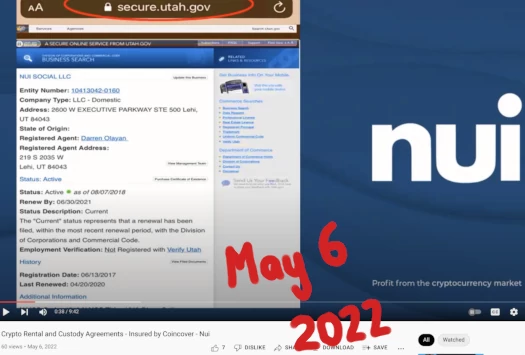

As part of their marketing pitch, Nui promoters reference Nui Social LLC, a Utah corporation belonging to Olayan:

Olayan also owns Nui International LLC, another Utah corporation. Both corporations were active at time of publication.

Nui solicits investment from consumers through two cryptocurrency contracts; Nui Rental Contracts and Nui Custody Contracts.

Nui Rental Contracts sees affiliates invest $5000 or more on the promise of 5% a month. Note that each Nui Rental Contract factors in MLM commissions earned through Nui, capped at 200% of the invested amount.

Details of Nui’s MLM opportunity are not provided.

Nui Rental Contracts expire in 12 months, regardless of whether 200% is paid out.

Nui Custody Contracts sees Nui solicit $100 to $20,000 in bitcoin, on the promise of “variable daily returns”.

Nui Custody Contracts pay Monday through Friday for 12 months. Withdrawals of returns attract a 5% fee.

Neither Darren Olayan, Nui or Nui International are registered with the SEC.

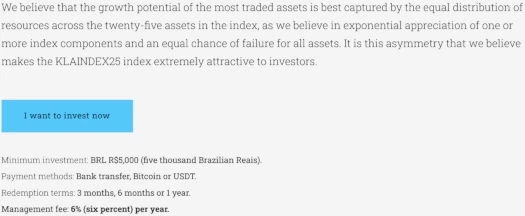

KLA Invest

KLA Invest solicits investment in bitcoin in KLAINDEX25;

an index that encompasses the main 25 largest Cryptocurrencies that make up the cryptocurrency market cap.

Any person, physical or legal, can invest in KLAINDEX25.

Minimum Investment: BRL 5,000.00 (five thousand reais).

If there is a return of up to 100% (one hundred percent) on the capital invested, KLA will be entitled to a performance fee of 20% (twenty percent) on the result.

If there is a return above 100% (one hundred percent) and up to 200% (two hundred percent) on the invested capital, KLA will be entitled to a performance fee of 35% (thirty-five percent) on the result.

If there is a return above 200% (two hundred percent) on the capital invested, KLA will be entitled to a performance fee of 50% (fifty percent) on the result.

If there is a request for liquidation of the investment before its maturity, the client will pay a fine of 20% (twenty) percent.

KLA Invest is featured in the “make money” section of BitMOBB. Right off the bat, it’s pretty obvious who’s behind it:

Olayan claims KLA Invest (also goes by KLA Capital and KLA Crypto Index), is the “first crypto hedge fund licensed in all of Latin America”.

What they did is they took two years to get a license from the CVM.

The CVM in Brazil is the equivalent to the SEC in the United States.

Olayan has gone to great lengths to represent KLA Invest is based out of Brazil and has nothing to do with him.

To that end you have KLA Capital Group Gestora de Recursos Ltda, and a Brazilian corporate address.

Naturally no executive information is provided on KLA Invest’s website. The company’s website domain (“klainvest.com”), was privately registered in July 2021.

On February 14th Olayan uploaded another of his NFT marketing spam articles to World NFT news. In the footer of the article Olayan gives away he’s behind KLA Capital Group and KLA Invest;

Darren Olayan featured in Brazil after obtaining Crypto Hedgefund license from the CVM.

Whoops.

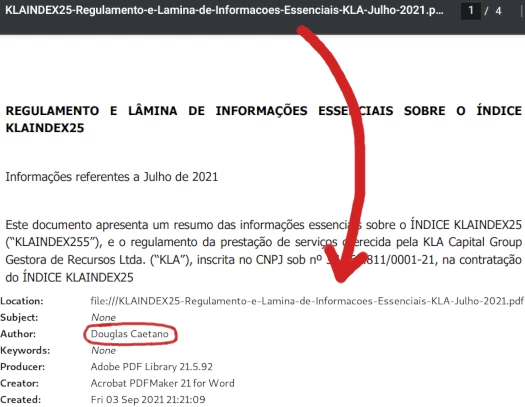

Another concrete link between KLA Invest and Nui is the company’s corporate documents (handily provided on KL Invest’s website):

As above, they were put together by Douglas Caetano.

Here’s Caetano representing Nui Social’s corporate legal team in October 2020:

Here’s Caetano, a few months ago, promoting KLA Invest in his role as legal for Nui Social:

The implication here is Olayan’s Brazilian transition has been set up with Caetano’s assistance and shell companies.

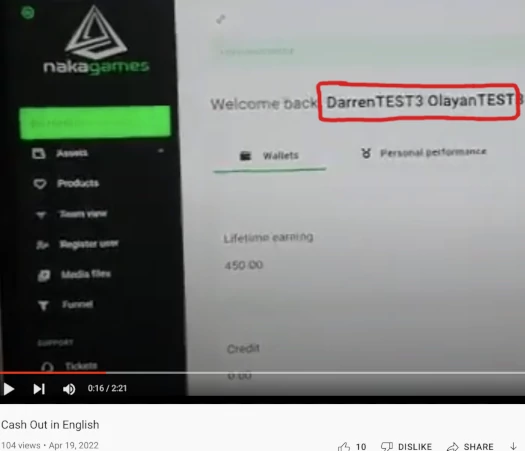

Naka Games

On January 14th, 2022, a KLA Invest marketing video was attached to a World NFT News spam article:

That video is unlisted on a YouTube channel bearing the name “Naka Games”:

Not knowing what Naka Games is, I checked out the other videos on the channel.

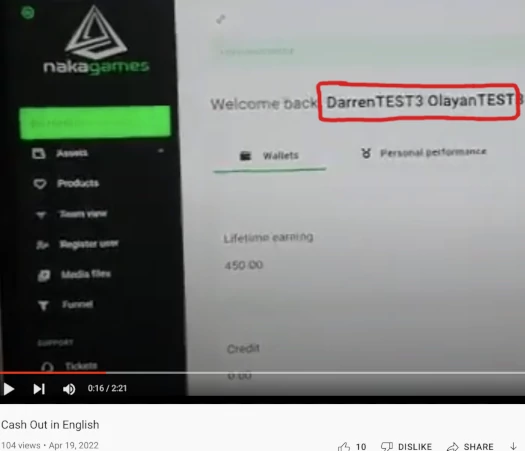

The first video uploaded to Naka Games’ YouTube channel is “Cash Out in English“.

It was uploaded on April 19th, 2022, and features Darren Olayan narrating “the cash out process”.

So Naka Games is something run by Darren Olayan that people can cash out from.

But what is it?

If you have been scammed by some crypto/mining MLM, we have a solution.

We have real smart contract technology that actually protects you this time. We use NFT technology to give you control of your network, your commissions and your business.

Putting aside the irony with mounting investor losses dating back to Divvee, Naka Games sounds an awful lot like Olayan’s failed CompChain grift from 2019.

Compchain is the world’s first blockchain created specifically for networking.

It puts the power of your personal network back in YOUR hands.

Compchain provides a safe, secure service that stores and protects your network, forever.

Built on immutable blockchain technology, Compchain allows you to lock in your network for life, and tap into new products and opportunities as they’re added to the platform.

But y’know, with added NFT and smart-contract buzzwords.

Why call it Naka Games though?

Because in addition to being a rehashed Compchain, Naka Games sees Olayan jump on the NFT gaming bandwagon.

A Rewards Platform is a Blockchain-based solution for keeping track of customer reward points, creating a shared transaction ledger between all involved brands.

I’ll leave Naka Games itself there because, let’s face it, we’re well into “nobody is ever going to use this except Nui KALA bagholders” territory.

But I will dig a little deeper into Naka Games’ affiliation with Upstream.

NAKA is affiliated with Upstream, a Horizon-powered regulated stock exchange for digital securities, eligible fan-driven assets classes will be able to trade in real-time from a user-friendly trading app.

Over on their website Upstream claims to be a securities exchange.

Upstream is a revolutionary exchange and trading app for digital securities.

Trade US & International equities all on Upstream.

Invest in US and international equities that are dual-listed on Upstream and other global marketplaces.

So uh, Upstream is registered with the SEC then I take it?

No of course it isn’t.

Who’s behind Upstream

MERJ Exchange Limited (“MERJ”) began in 2011 as the operator of the national securities market for the Republic of the Seychelles.

The exchange was born as part of the IMF backed Economic Reform Programme to diversify the country’s economy in the wake of the global financial crisis of 2009.

Horizon is a fintech company that builds and powers global securities exchanges, unlocking liquidity for traditionally illiquid asset classes.

Seychelles… seriously?

For the purpose of investor due-diligence, Seychelles provides no protection or active regulation whatsoever. It’s a purposefully chosen jurisidciton because of this.

Oh and unless you live in Seychelles, Upstream and its associated companies being incorporated and registered there is also completely meaningless.

But I digress, what does any of this have to do with Darren Olayan and Naka Games?

The “cash out” video Olayan narrates shows him cashing out “commissions” from a test account.

This is what Naka Games is selling;

We aim to unlock liquidity for investors of all levels on our investor-driven, app-based market. On the surface, NAKA offers global investors a real-time, secure, and intuitive trading app.

Under the hood, NAKA introduces what we believe to be the future of securities and NFT trading featuring some of the highest levels of transparency, accessibility, and investor protections enforced using blockchain technology.

It’s another MLM grift with even more securities fraud.

One final note, Naka Games’ website features a link to Climark in its footer. This appears to be a Brazilian digital marketing company company.

How far they’re integrated into Olayan’s securities fraud empire beyond Naka Games is unclear.

Yes Bank

Darren Olayan’s Yes Bank, not to be confused with the major Indian bank of the same name, is a planned payment processor.

Yes Bank operates from the domain “yesbankbrazil.com.br”. That domain was registered in April 2021. The registration updated in March 2022 and the current holder website is fairly new.

Jackson Amaral Erohin is listed as the domain owner. Erohin runs J&F Capital, a Brazilian management and consulting company.

Beyond that I don’t know what his tie to Olayan and Nui is.

What I do know is YesBank, despite not having launched yet, is advertising KALA integration:

This reveals Olayan’s hand in the company, either wholly or partially.

Here’s Yes Bank described in Olayan’s own words;

[2:40] The bank is called Yes Bank. And guess what? Kala is one of the cryptocurrencies that they are carrying, along with bitcoin and ethereum …

… You’re talking about a bank that has a bank account, and savings account, and checking account. The ability to do everything that banks do.

However we’re providing a lot of the blockchain technology, the wallet technology, the insurance technology. And of course kala is in there.

[4:11] I told you guys. I said what happens if we literally had a bank using our wallet technology, our insurance, and carrying our crypto?

Do you understand what you can do when you have those capabilities?

Oh yeah, I’m gonna deposit my kala and then I’m gonna transfer it to bitcoin. Or Brazilian reals or dollars or whatever.

Can you see that? Can you imagine what’s going to happen? Especially when they already have the whole card, Visa, MasterCard system in place.

It’s a bank guys. I’m not just making this up. It’s a bank.

So uh, any takers who owns Yes Bank Brazil? Needless to say Olayan and Nui don’t hold any banking licenses that I’m aware of, in Brazil or elsewhere.

Why does any of this matter?

I’ve been documenting Nui’s origins as Divvee since 2016. I first caught wind of Darren Olayan’s securities fraud in 2017.

Olayan confirmed he knew he was violating US securities law in 2018.

Six years after Divvee’s launch and despite multiple regulatory investigations…

…Olayan is still at it and the crypto bro bullshit is as thick as ever.

If anything after laying low for a while after the Utah fine, Olayan is back at it and expanding.

Brazil is a big part of Olayan’s renewed crypto crime wave. I figure the gamble is reside in the US but scam Latin Americans and fly under the regulatory radar.

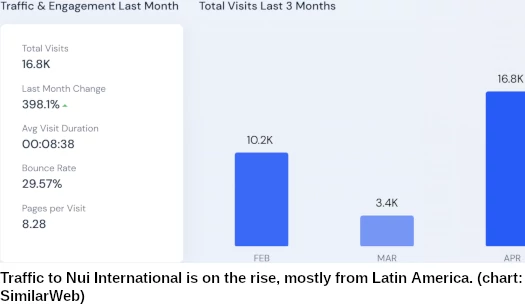

As I write this SimilarWeb ranks traffic to Nui International as coming from Brazil (27%), Colombia (25%), (Italy (17%) and Portugal (14%).

And it’s on the rise…

Traffic to the other components of Olayan’s Ponzi scheme is, at this stage, negligible.

Where does it end? And perhaps more importantly, who’s still falling for this garbage?

Update 19th June 2022 – Naka Games appears to have additional ties to a Russian MLM Ponzi factory.

Update 24th December 2023 – The cited YouTube video featuring Douglas Caetano representing Nui’s legal team has been marked as private.

This article originally contained a link to the YouTube video. Owing to it being marked as private, I’ve now disabled the previously accessible link.

Welp, that’s my blockchain quota for the week. What day is it again?

Oh fuck…

Darren Olayan is the Energizer Bunny of bullcrap.

I remember his pre-launch sales pitch that kala was “pre-compliant” with the SEC. Four states Securities actions later NUI abandoned the US and went International, VPNs required for US investors.

I remember Nui selling Kala mining rigs for $3.5K when you could buy the exact same hardware on Amazon for $260.

I remember Nui International selling kala for eight cents apiece to the developing nations while the exchange price was closer to 0.002.

I remember other things and have forgotten a bunch more.

Speaking of exchange prices today’s Kala price is $0.005744. Pert near everyone who invested in Kala has lost money, except Darren Olayan.

No wonder he smiles so much.

@Glimdropper

Hello..what the latest do you have on Darren Olayen so far.

The trending thing now I found out is that NakaGames plaform. Do you have anything on that?

Naka Games was addressed in the article.

Hello, my name is Elaine Tanaka, I’m Brazilian and I’ve been living in Japan for 25 years. last week I was invited to join Nui Internacional.

I decided to research and found not very good news in Brazil and now with you.

Nui is deceiving many people here in Japan! Japanese and Latinos who live here.

Hi, I’m from Brazil too, Nui scams thousand brazilians, holding their money and don’t pay anymore for 3 mouths.

Now the excuses is a audit and he blame the users!! Nothing to do. Money lost. How to stop this guy?

You’ve already given your money to a Ponzi scammer. What exactly are you trying to stop?

@Joao

You can try to alert local medias, journalists and see where that goes. Warn friends and family, name and shame the people in charge of the scam.

The best you can do is trying to prevent people from falling in these scams schemes so awareness is the key.

So share Oz’s article as much as you can, translate it in Portuguese perhaps?

The NUI recently blocked the payment of her investors in Brazil, citing four excuses, one of which was that the platform was experiencing high traffic and now it is taking over affiliates because they are buggy in the payment system.

Now the company is asking for 45 to 60 days for an audit to be carried out to find out what the system failure was.

Well, we know that this is just another excuse for them to capitalize and escape.

KLA Capital Group Gestora de Recursos Ltda does not have any authorization from the regulatory body.

Hello, I’m a Nui investor and I’m desperate about this whole situation. I have money invested and I have family members that I recommended to invest and we have been unable to withdraw it for 5 months due to the audit excuse.

They said last week that the audit was over but they did not talk about the dates for releasing the withdrawals.

What could be done to help communicate to the US government what is happening with this scammer Darren?

I’m calling the authorities here in Brazil to open a police investigation but Darren and the people involved have to be arrested!! You have to go to jail and return people’s valuables.

justice.gov/action-center/report-crime-or-submit-complaint

sec.gov/tcr

Damn man… how did you get so much evidence against this scammer Darren Olayan?

There are thousands of people here in Brazil who have recently been scammed by NUI and they continue to deceive people… can you help me report or spread the word to the churches that this son of a bitch attends and still uses to deceive people and say that he is a Mormon and cares about the community and family!!

A guy like that is the scum of humanity… man.. please help me put this guy in jail.

There are people who sold their houses and put the money in this bastard’s hands.

BehindMLM has been tracking Olayan’s shenanigans since Divvee. Things fell off when he migrated the Ponzi to Brazil as everything was in Portuguese and I couldn’t get to the bottom of it.

Nobody in Brazil seemed to care until after Nui collapsed there. I’ve left it because again there’s nothing to go on except victims crying after the fact.

BehindMLM ranks for a search on Darren Olayan so not sure why nobody in Brazil did any due-diligence.

But during the time of Divee, did he commit fraud and not return investors’ money? Do you have this information? How does he manage to avoid going to jail? Don’t the laws in the US work against fraudsters?

If you scroll up and click on the Nui folder under the article title you can read about Olayan’s exploits from start to finish.

Hello friend,

I would like to suggest an update to your article. Darren and his brother Curt Olayan, along with the “Brazilian president” Rodrigo Silva, have finalized the scam with Nui.

They left all investors with nothing – there is no more back office, no site… nothing exists anymore! Now, they are accusing each other (Darren, Rodrigo, and the developers), claiming that the company was stolen. They are creating a smokescreen to confuse people.

However, there is already a lawsuit being filed by more than 1,000 people directly in the USA. This time, these scammers are going to jail!

Proof? Much like Nui migrating and operating in Brazil itself, the collapse is very light on verifiable evidence to report on too.

Also private citizens can only file civil suits. No jail time.

Old news but new to me:

fxnewsgroup.com/forex-news/cryptocurrency/nadex-bans-head-of-cryptocurrency-firm-symatri/

If Darren doesn’t pay the investors… just wait and you will see that he and others will be arrested!! Wait.

Hey there, administrator, quick question: In the US, there are a lot of cases of financial pyramids and Ponzi schemes too, right? Don’t the criminals, thieves, and scammers get arrested?

Not “a lot” but every now and then. Getting arrested depends on who takes action, either the DOJ, CFTC, SEC and/or FTC.

New Site????

Darren Olayan:

gmg.me/news/gmg-marketing-toolbox/744845

New Site Darren Olayan?

stryde.me/news/overcoming-the-labor-shortage/744845

Growth Marketing Group looks like some shitty marketing services as opposed to an MLM opportunity. Stryde is a marketing funnel dressed up as a blog.

Olayan appears in the footer of the website as a “Senior Advisor”. I think at this point Olayan has demonstrated anything he’s involved in is best avoided.