Shelly Cullen convicted of Lion’s Share pyramid scamming

Serial Ponzi promoter Shelley Cullen has been convicted of five violations of New Zealand’s Fair Trading Act.

Serial Ponzi promoter Shelley Cullen has been convicted of five violations of New Zealand’s Fair Trading Act.

Cullen, who once declared she wanted to be “one of the biggest scammers in NZ”, is facing a fine of up to $600,000 NZD per violation.

Cullen’s legal troubles in New Zealand began in 2020. After receiving “a number of complaints”,

Cullen’s legal troubles in New Zealand began in 2020. After receiving “a number of complaints”,

the [Commerce] Commission contacted Ms Cullen on 18 November 2020 and advised her that it had opened an investigation into the scheme which the Commission believed at that time was operated by Ms Cullen.

The scheme in question was Lion’s Share, an MLM crypto Ponzi cycler run by serial scammer James Ward.

After Lion’s Share collapsed Ward went on to launch more MLM crypto scams. Ward has been quiet since the CFTC caught up with him in 2022.

The Commission held an interview with Cullen on November 24th, 2020.

At the interview Cullen lied to the Commission;

Ms Cullen stated that the scheme was not an investment scheme but rather a gifting/crowd funding programme where everyone gifts into the smart contract and the smart contract pays people out.

[Cullen] noted she was simply a participant and that the owner is anonymous just like bitcoin.

Lion’s Share’s business model saw the Ponzi scheme pitch investors on 200% and 300% returns, funded by subsequent investment.

When the Commission asked Cullen about depositing money into Lion’s Share,

she declined to answer and suggested the Commission talk to James [Ward] (the alleged creator of the scheme).

However, when asked for his contact details, Ms Cullen failed to respond.

So much for Lion’s Share’s aNoNyMoUs OwNer.

Following Cullen’s interview the Commission issued a cease and desist against Cullen in December 2020. The Commission’s order prohibited Cullen from continuing to promote Lion’s Share.

As part of the Commission’s enforcement action, Cullen was also ordered to “make a proposal for compensation and returning money” from her victims.

On 24 December 2020, Ms Cullen confirmed she had stopped her promotion of [Lion’s Share] but did not propose plans for compensation.

A month later Cullen took to social media to further incriminate herself.

On 19 January 2021 Ms Cullen posted a FaceBook live video which formed part of the evidence in which she stated:

-“I am going to make history as one of the biggest scammers in NZ”;

-“I can’t do any other projects a the moment, my lawyers got to pass everything I do”;

-“Fuck the consequences I ain’t scared”;

-“I jump scam to scam because I can. What’s the consequences $600,000 slap on the hand”;

-“The biggest penalty I will get… I don’t mind if I go to jail”;

-“I don’t have a bank account and I will say you aren’t getting my password you can lock me up”.

Ms Cullen declined any further contact with the Commission.

The Commission didn’t hear anything further until April 22nd, 2022, wherein

Ms Cullen forwarded correspondence to the Commission, the purpose of which is unclear but appears to suggest that the Commission is making a fraudulent claim for unjust enrichment.

The Commission tracked down Cullen on September 20th, 2022.

[Cullen] confirmed her email address but then disconnected the call with the Commission.

Sometime after the call Cullen fled New Zealand “and [has] not returned”.

An April 23rd, 2024 FaceBook post by Cullen suggests she is in Dubai.

“Mavie” refers to Mavie Global, another MLM crypto Ponzi on its third reboot.

The Commission noted Cullen’s promotion of Mavie Global in an April 23rd press-release;

Ms Cullen has been promoting a new investment opportunity known as ‘MaVie’, and so we are urging communities to exercise caution around this and all similar schemes.

The Commission advises it has already started sending out Compliance Advice Letters to Mavie Global promoters in New Zealand.

Mavie Global is based out of Dubai, the MLM crime capital of the world. Cullen herself fled New Zealand for Cyprus.

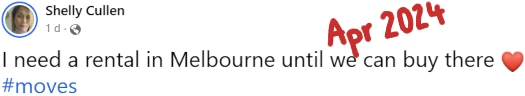

Although she’s been dodging New Zealand over the past few years, Cullen appears keen on establishing ties with neighbouring Australia.

Back in New Zealand, Lion’s Share proceedings against Cullen continued in her absence.

This culminated in an April 12th, 2024 judgment, finding Cullen guilty of five violations of the Fair Trading Act.

In handing down judgment against Cullen, Judge Skellern wrote;

I am satisfied that each element of the five representative charges is proven beyond a reasonable doubt.

Ms Cullen is found guilty in respect of each charge.

Pursuant to S40(1A) of the FTA, Ms Cullen is liable to a maximum fine on each charge of $600,000.

A sentencing date is to be allocated in consultation with the prosecutor and Ms Cullen is invited to make submissions as to sentence should she wish to do so.

From this I take it prison time is off the table. Nonetheless, Cullen faces a maximum penalty of $3 million NZD ($1.7 million USD).

Pending updates on Cullen’s sentencing, we’ll keep you posted.

Update 25th June 2024 – No update on Cullen’s June 24th sentencing as yet but the FMA has issued a Shelly Cullen securities fraud warning.

Update 26th June 2024 – Shelly Cullen has received a $5.9 million NZD judgment.

Haha she was very tough, till they came knocking.

Shelly:Cullen was also big in the Miracle Cash&Mor/ Phoenic Token/Metaterra MTRC scam

lionshare is still operating on the block chain and the smart contract will always be active.

Nothing the government can do to shut it down unfortunately. My family are still signing people up to it.

Lion’s Share is dead and has been for some time. Much in the same way a collapsed Ponzi scheme might still have an active website.

Your family are just straight up stealing from people.