Georgia fines GSPartners, Josip Heit & Michael Dalcoe $500K

GSPartners (aka GSPro), owner Josip Heit and promoter Michael Lynn “El” Dalcoe have been fined $500,000.

GSPartners (aka GSPro), owner Josip Heit and promoter Michael Lynn “El” Dalcoe have been fined $500,000.

The fine was handed down as part of an emergency cease and desist, issued by Georgia’s Commissioner of Securities on January 22nd, 2024. [Continue reading…]

New Zealand authorities seize Frank Schneider’s assets

New Zealand authorities have seized a house and $462,000 in cash.

New Zealand authorities have seized a house and $462,000 in cash.

The assets are believed to belong to OneCoin fugitive Frank Schneider. [Continue reading…]

Savings Highway Global Review: Third pyramid reboot

BehindMLM first reviewed Savings Highway back in 2012. We found a “membership” MLM company selling access to discounts.

BehindMLM first reviewed Savings Highway back in 2012. We found a “membership” MLM company selling access to discounts.

With nothing marketed or sold to retail customers, we classified Savings Highway as a matrix-based pyramid scheme.

By 2016 Savings Highway had long since collapsed. This prompted owner Steve Gresham (right) to reboot as My 1 Dollar Business.

By 2016 Savings Highway had long since collapsed. This prompted owner Steve Gresham (right) to reboot as My 1 Dollar Business.

Same business model (access to discounts and pyramid recruitment), only now membership started at $1 a month.

When My 1 Dollar Business ran its course, Gresham rebooted again as My 20 Dollar Travel Business (~2019).

This time around the only savings were travel-based. Entry membership was still $1 but was locked off from the travel discounts. Access to those discounts cost $20 or $100 a month.

Commissions were still tied to recruitment, making My 20 Dollar Travel Business another pyramid scheme.

Both My 1 Dollar Business and My 20 Dollar Travel Business ran from the domain “my1dollarbusiness.com”.

Today that domain redirects to “savingshighwayglobal.com”, the third reboot of the original Savings Highway pyramid scheme.

Steve Gresham is still running the show. According to his FaceBook profile, Gresham is based out of Georgia in the US.

Savings Highway Global’s website domain was registered in September 2020, which means My 20 Dollar Travel Business was particularly short-lived.

As of December 2023, SimilarWeb tracked ~141,000 monthly visits to Savings Highway Global’s website. The vast majority of those visits originated from the US (94%).

Read on for a full review of Savings Highway Global’s MLM opportunity. [Continue reading…]

EvoRich’s Andrey Khovratov sentenced to 5 years in prison

EvoRich Ponzi founder Andrey Khovratov has been sentenced to five years in prison. Prosecutors had asked the court for a six year sentence.

EvoRich Ponzi founder Andrey Khovratov has been sentenced to five years in prison. Prosecutors had asked the court for a six year sentence.

Following his arrest attempting to flee Russia in early 2022, Khovratov was charged with five counts of participating in fraud via organized crime. [Continue reading…]

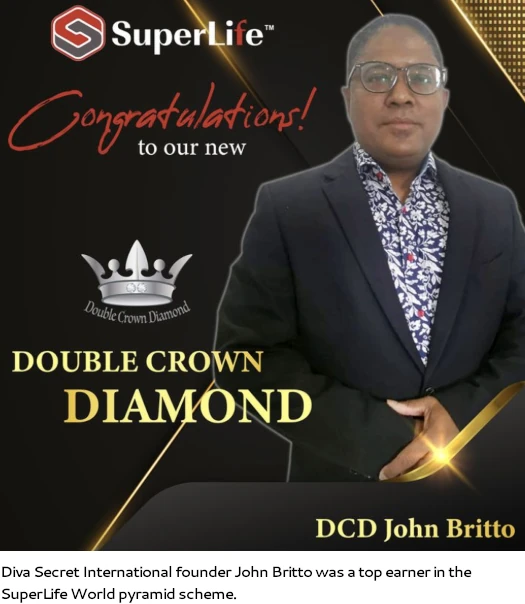

Diva Secret International Review: SuperLife pyramid reboot

Diva Secret International operates in the nutritional supplement MLM niche.

Diva Secret International operates in the nutritional supplement MLM niche.

The company is based out of Malaysia and headed up by founder John Britto (aka Prospero JB).

Britto’s Diva Secret International corporate bio details a legal background.

Britto’s Diva Secret International corporate bio details a legal background.

John Britto- LLB(London) began his career as a Legal Advisor in Statsym Berhad.

His expertise were then, in Labour Court matters where he began to love the interaction with people from all walks of life. This earned him the moniker “people’s man.”

Despite a cited “more than fifteen years” involvement in MLM, no specifics are provided.

Further research reveals that before founding Diva Secret International, Britto was promoting SuperLife World.

SuperLife World was a Malaysian MLM pyramid scheme targeting Africa.

SuperLife World abandoned its FaceBook page in September 2022. Today the company’s website is not accessible, suggesting SuperLife World collapsed around that time.

This coincides with Diva Secret International’s website domain being registered on August 3rd, 2022. Diva Secret International would go on to launch in September 2022.

I can’t speak to most of last year but, outside of Cameroon, whatever recruitment in Africa Diva Secret International was able to capture has since died out.

As of December 2023, SimilarWeb tracked top sources of traffic to Diva Secret International’s website as Cameroon (31%), the Philippines (25%), the US (16%), South Africa (11%) and Thailand (9%).

Outside of the US and South Africa, Diva Secret International recruitment appears to be stagnant.

Read on for a full review of Diva Secret International’s MLM opportunity. [Continue reading…]

The Stone Fund Review: 20% a day MLM crypto Ponzi

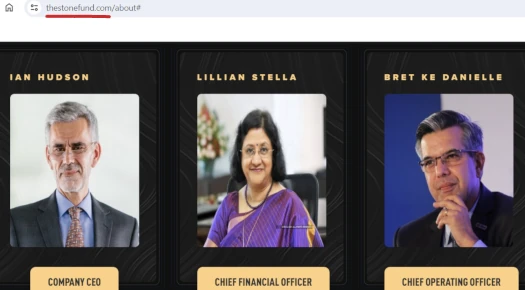

The Stone Fund fails to provide verifiable ownership or executive information on its website.

The Stone Fund fails to provide verifiable ownership or executive information on its website.

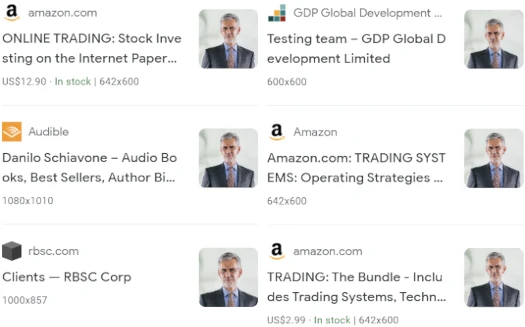

While The Stone Fund does claim its CEO is “Ian Hudson”…

…the photo used to represent Hudson is a stock photo used on dozens of websites.

From this we can ascertain that The Stone Fund’s “Ian Hudson” doesn’t exist. I didn’t bother looking up to the other two.

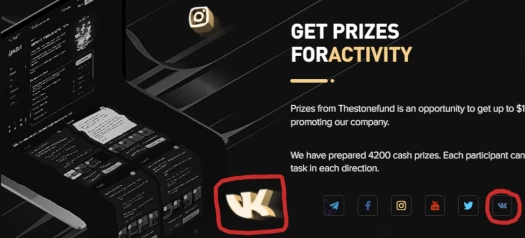

The Stone Fund’s website domain (“thestonefund.com”), was privately registered on July 24th, 2023.

In an attempt to appear legitimate, The Stone Fund provides a corporate address in the UK on its website.

The provided address is attached to multiple businesses. This lends itself to the address actually belonging to a company selling virtual office addresses.

While not definitive, vKontakte social media links appearing on The Stone Fund’s website suggests ties to Russia.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Altera Global Review: Boris CEO MLM crypto Ponzi

![]() Altera Global fails to provide verifiable ownership or executive information on its website.

Altera Global fails to provide verifiable ownership or executive information on its website.

Altera Global cites “Geoff Walker” as… well they don’t actually say what. He’s just on their website.

Walker not only doesn’t exist outside of Altera Global, the person playing him appears to have been dressed up in a wig and glasses.

Over on YouTube we have videos featuring Walker. The person playing him has a Russian accent, confirming Walker is a Boris CEO.

Amusingly, in another Altera Global marketing video, Walker has been dubbed over with an American accent.

Hiring actors to play CEOs and dressing them up in disguises is a typical calling card of Russian scammers.

Altera Global’s website domain (“altera-global.com”), was privately registered on August 11th, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Jeremy Reynolds at center of LGreen recovery scam

US national Jeremy Reynolds has emerged at the center of LGreen’s recovery scam.

US national Jeremy Reynolds has emerged at the center of LGreen’s recovery scam.

Following LGreen’s collapse last week, the Ponzi scheme is now plying investors up for a recovery scam.

At the center of this scam within a scam is the promise of access to withdrawals again, for a fee. [Continue reading…]

Titan369 Review: 300% ROI MLM crypto Ponzi

![]() Titan369 fails to provide ownership or executive information on its website.

Titan369 fails to provide ownership or executive information on its website.

In fact as I write this, Titan369’s website is marked “coming soon”.

On a separate “platform” subdomain, Titan369 affiliates are able to sign up and log in.

Titan369’s website domain (“titan369.io), was privately registered on October 15th, 2023.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

S19antminers Review: AI crypto mining ruse Ponzi

S19antminers fails to provide ownership or executive information on its website.

S19antminers fails to provide ownership or executive information on its website.

S19antminers’ website domain (“s19antminers.com”), was registered in August 2023. The private registration was last updated on January 8th, 2024.

In an attempt to appear legitimate, S19antminers provides a UK corporate address and links to the company registration for “Stash Networks Limited”.

Stash Networks Limited was registered in the UK in November 2021. It is unlikely to have anything to do with S19antminers.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]