GSPartners under investigation for fraud in Texas

The Texas State Securities Board has confirmed it is investigating GSPartners for “engaging in an international securities fraud scheme”.

The Texas State Securities Board has confirmed it is investigating GSPartners for “engaging in an international securities fraud scheme”.

The disclosure was made in a November 9th emergency cease and desist order, pertaining to the collapsed BitSports Ponzi scheme.

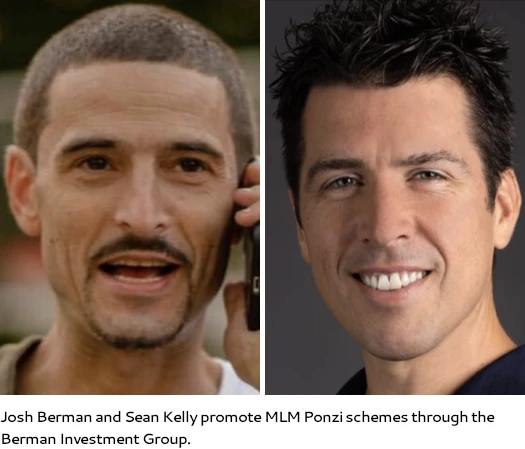

GSPartners was cited as one of the fraudulent investment schemes being promoted by respondents Josh Berman, Sean Kelly and the Berman Investment Group (BIG).

In connection with the offer of (BitSports’) Arbitrage Memberships, as described herein, Respondents Berman Investment Group and Berman are claiming they have a “100% success rate” with “every team member making money” and “no losses”

incurred by a team member.The(y) are, however, intentionally failing to disclose any information about profits or losses associated with investments issued by … GS Partners, a multilevel marketing company being investigated by th Enforcement Division for engaging in securities fraud.

GSPartners is a Dubai-based Ponzi scheme run by Josip Heit (right).

GSPartners is a Dubai-based Ponzi scheme run by Josip Heit (right).

Through “certificates”, GSPartners solicits investment in cryptocurrency on the promise of up to 5% a week.

Neither GSPartners or Josip Heit are registered to offer securities in any jurisdiction.

Earlier this month BehindMLM confirmed GSPartners is under investigation by the CFTC, SEC and Alabama Securities Commission.

Given the number of confirmed US civil regulatory investigations, it’s assumed a GSPartners criminal investigation is also underway.

Canadian authorities have also issued seven GSPartners securities fraud warnings; Ontario, Alberta (G999 and GSTrade), Quebec, Alberta, British Columbia and Saskatchewan.

Update 17th November 2023 – TSSB has filed an emergency cease and desist against GSPartners and Josip Heit.

Texas is joined by Washington, California, Alabama and British Columbia (Canada), who all filed similar GSPartners regulatory enforcement actions today.

Here’s hoping that good Christian man, Michael Dalcoe gets prosecuted!

There is hope. Jenna Ellis, the “I’m a Christian” attorney, is now a convicted felon.

Oh baby let this thing just collapse already.

All the scammers flying into Cape Town this weekend! Will be interesting to see if the great man Heit is in attendance. South Africa vying with Dubai for Ponzi Capital of the world!

I doubt Mr HT will spend money on the trip, seeing that the recruiting is starting to dry up.

Schalk vd merve and some other promoters are on a mad rush to recruit even more victims. he is currently in the process of setting up his very own scam token.

Heit will only travel to countries that don’t have extradition treaties with the USA. (ie Dubai and a few others). Beyond that don’t expect him to move anytime soon.

If you know people involved in GSP, it’s time to start reporting them to your local securities authority. Accelerate the collapse.

Wow, the crash is coming fast today. All in a matter of hours:

California

Washington

Alabama