FinMore collapses, Nelo Life “complete distraction” blamed

What’s left of the Richard Smith’s Tranzact Card to FinMore grift has collapsed.

What’s left of the Richard Smith’s Tranzact Card to FinMore grift has collapsed.

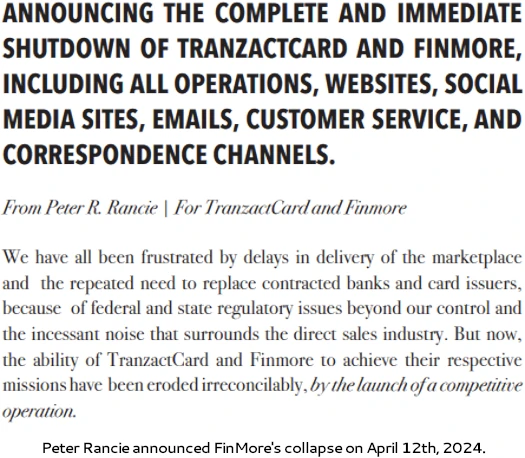

In an email sent out a few hours ago, frontman Peter Rancie “announc[ed] the complete and immediate shutdown of TranzactCard and FinMore”.

While Rancie (right) “doesn’t blame” newly launched NeloLife for TranzactCard’s and FinMore’s “mistakes”, he does state the its launch is the reason TranzactCard and FinMore were unable “to achieve their respective missions”.

While Rancie (right) “doesn’t blame” newly launched NeloLife for TranzactCard’s and FinMore’s “mistakes”, he does state the its launch is the reason TranzactCard and FinMore were unable “to achieve their respective missions”.

Rancie attributes previous TranzactCard and FinMore blunders, which given Richard Smith’s history should have and were obvious, to “federal and state regulatory issues beyond our control”.

Rancie also cites “the incessant noise that surrounds the direct sales industry”, which as it pertains to TranzactCard and FinMore largely revolved around said “federal and state regulatory issues”.

BehindMLM covered TranzactCard and FinMore exhaustively, beginning with our June 2023 TranzactCard review.

Bottom line? I’m not 100% on TranzactCard committing securities fraud but I’m smelling smoke. And that smoke is thick given Smith’s past brushes with securities fraud.

Smith, who has a criminal securities fraud conviction, solicited $495 payments from thousands of “Digital Branch Office” affiliates.

The solicitation was based on numerous misrepresentations, including at one point the involvement of Donald Trump, Barack Obama, the RNC, DNC and LeBron James.

Following due-diligence into Smith, TranzactCard’s planned US banking services were terminated in September 2023. This marked the end of the business, however solicitation of $495 DBO’s continued on promises of new banking channels.

TranzactCard and FinMore named Bangor Bank as a replacement towards the end of 2023, however this was promptly denied by the bank.

The deception continued through the announcement of FinMore, a reboot in name only. Richard Smith still owned parent company TZT Holdings LLC.

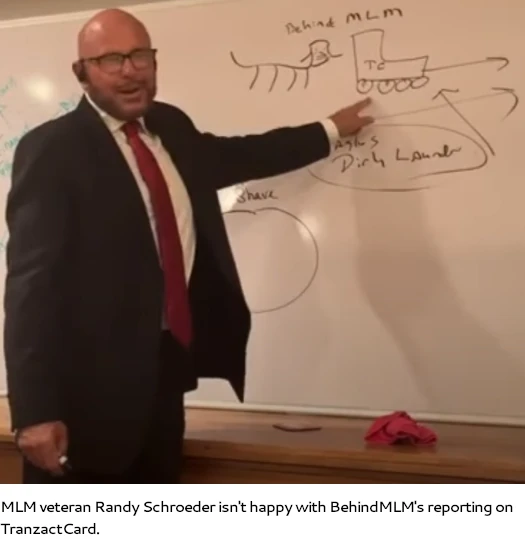

As happens often, BehindMLM received criticism for covering TranzactCard and FinMore. Notably, MLM veteran Randy Schroeder had a meltdown over our reporting in September 2023.

Characterizing BehindMLM as a “dog chasing a train”, Schroeder falsely claimed BehindMLM had been paid to report on TranzactCard and FinMore.

Schroeder was very public in spreading misinformation with respect to BehindMLM’s reporting. To the best of my knowledge Schroeder has never publicly acknowledged this or taken responsibility.

Instead, as TranzactCard and FinMore collapsed around him, Schroeder went on a “delete the evidence” spree and began promoting Nelo Life.

From the perspective of FinMore and TranzactCard corporate, Here’s Peter Rancie on Nelo Life;

The ability of TranzactCard and Finmore to achieve their respective missions have been eroded irreconcilably, by the launch of a competitive operation.

As a result of this last factor, most digital communications channels have been polluted with a social media civil war that is still escalating.

Rather than investigate or accuse any individual or group of individuals who may have founded or migrated to this new competitor with crossrecruiting, or breaches of non-disclosure agreements, or other possible contract violations, both TranzactCard and Finmore will cease all operations immediately.

Instead of getting on with the work of TranzactCard, for most of 2024, the changeover to Finmore has taken precedence. This migration was requested by the Field Leadership Council, not initiated by corporate.

The new, competitive entity was swiftly created by, and promoted by, a number of the same leaders who had advocated moving to Finmore. It was launched even before Finmore had the chance to release its store and commissionable products.

In hindsight, the last months of activity have been a complete distraction on all fronts. It’s time to end the social media civil unrest and the ensuing mayhem. The social impact and commercial objectives of TranzactCard and Finmore cannot be fulfilled in this environment.

Note: The new, competitive entity has never been part of TranzactCard/Finmore. Of course, there are multiple potential or actual conflicts of interest embedded in these happenings; the crossover activities of certain field leaders, the crossover of legal counsel, and the crossover of the technology team, to name a few.

While all of these items are subject to further consideration by outisde [sic] legal counsel, no accusation is made herein.

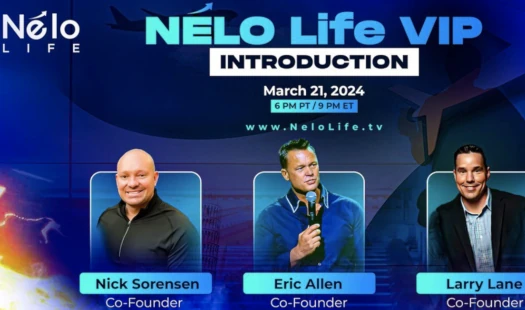

Nelo Life emerged as an attempt to “cash grab” what was left of TranzactCard and FinMore’s promoters last month.

The FinMore “leaders” Rancie cited as creating FinMore are Nick Sorensen, Eric Allen and Larry Lane.

Orkan Arat is the fourth Nelo Life co-founder, however this information was initially hidden from consumers.

Rancie mentioning “the crossover of the technology team” suggests Arat may have also been involved in TranzactCard and FinMore.

Analysis of Nelo Life’s compensation plan saw BehindMLM raise concerns it was a pyramid scheme. As more about Nelo Life’s business model came to light, we later expressed securities fraud concerns.

This prompted a response from Eric Allen on March 31st. While Allen stated he “actually agree[s] with the vast majority of” BehindMLM’s research, what we’d published about Nelo Life was “completely untrue”.

This echoed criticism BehindMLM had previously received over our TranzactCard and FinMore reporting.

Following TranzactCard and FinMore’s collapse, Peter Rancie states there “will be no further correspondence from either entity”.

Richard Smith cashed out and rode off into the sunset last year. As it stands we don’t know how much Smith misappropriated from consumers via deceptive marketing and misrepresentations.

What we do know is at least 48,000 credit cards were filed with TranzactCard and FinMore. At $25 and $495 a pop, this likely resulted in a windfall running well into the millions.

Pending any further updates, we’ll keep you posted.

I uncovered some things about Eric Allen going down a rabbit hole. I provided the information to Julie Anderson as she does video reviews.

Here it is from what information she was given. Guess what, Eric Allen WAS a founder 5yrs ago and in an early Nelo Life video says he never thought he would be a founder of an MLM.

In the video he did 5yrs ago, GUESS WHAT??!!… he uses the words “co-create”, “Trust, Transparency, Transformation”, “ecosystem” and the SAME buzzwords and catch phrases he is doing 5 yrs. later in Nelo Life. You can NOT make this stuff up.

Nelo Life is ALSO a recycle of something Eric did a couple of times with different MLM including TZT and Finmore. They also launched earlier as I warned them to scam quickly because their time was limited on the 10ish reports I filed with the FTC naming all players in TZT/Finmore/Nelo Life.

Here is the video Julie did (please allow this to be seen OZ, or at least have people go to @julieanderson videos – she supports and uses your content so I hope you allow the same for hers on yours – teamwork).

youtube.com/watch?v=TSKlEA8zXCs

Yahoo!…….Good news! I just listened to a 2 hour update Zoom from Jeremy Jenkins! The “Social Impact Mission” of TranzactCard and Finmore is NOT dead! Peter and Richard have reunited and are teaming up to resurrect Finmore from the dead! When it returns this summer it will be better than ever! Just trust, believe and be patient! With Richard and Peter teaming up again, ……..What could go wrong? LOL

They still owe me $1326, as my TZ card got hacked. Im still going after them with the MN Attorney General’s office and a couple other state agencies!

Scarecrow (RK), Dangit, I wasn’t going to make any more posts on here – although, as Oz pointed out, I do agree with the majority of what he writes – but what you are referring to from 5 years ago is the 501c3 charity that my wife and I ran.

Coincidentally, we have funded the entire organization and take zero salary and gave every single penny to our charity partners around the world. Feel free to investigate.

Just in case someone comes across this post, it’s a shame you would just fabricate something to justify whatever rationale you have for demonizing me.

Again, I was a TZT/Finmore rep who paid $495 just like you. No ownership, no special deals. Nelo Life is a completely separate entity with a separate mission.

Yes shame on me for trusting so much without verification. Still grateful for all the amazing people who came into my life the past year and for all the learning lessons.

I wish you nothing but success and happiness regardless of your fascination with my demise.

Eric, if (RK) are initials that you think I am, you are incorrect.

Fabrication? I didn’t fabricate anything. You are using the SAME “buzzwords/phrases” you did with GGC.

You set it up in a matrix fashion of getting 3 people (to avoid monthly fees). With Nelo Life you are having people “donate to their local cause” (boy does that make me feel warm and fuzzy inside).

I assume you also watched Julie’s video? As far as your “transparency” claim: Why was “The Big O” a secret? Who is the company and people that own/run your investing algorith Bot?

Also, answer the questions from others that were posted on here, please. You claim transparency, give it!

I don’t have a fascination with your demise. I have a disgust for the amount of people that lost money with TZT/Finmore and will also lose with this.

For instance, if everyone of legal age to join Nelo Life in the USA did (~200,000.000 people) – that equates to only ~1526 full matrixes (pyramids).

200,000,000 (people) divided by 131,070 (full matrix) equals 1526 people with downlines. If 10,000 people joined (on day ONE!!!) – only 15.26% of people can have full downlines.

Another thing – you said you had the CREAM OF THE CROP for every position within Nelo Life. People that were the best of the best. YET… there was an issue on day ONE and your comment – “you break it and we will fix it”.

Why did something need to be fixed when you have the best people writing code, creating programs, operating all aspects of your company, etc.??

People are reading this… many. You want to be forthcoming and put people’s mind at ease… be TRANSPARENT and answer these and other questions. If you don’t, you are hiding or up to something. Simple as that.

Eric Allen, please provide independently audited financials of your “charity”. Put up or shut up with this mythical claim of the “every single penny” went to charity recipients.

You can start with the FEIN number, annual tax filings, state licensure or corporation registration verification, independently verified affidavits of money transfers to charity partners or even a listing anyone can see on charitynavigator.org.

Receipts from verified sources, or it never happened.

Thank you in advance for your compliance. I know that’s a scary word for anyone in the mlm scam universe, but try your best. You made the claim, YOU back up this “every single penny” story.

I saw the video of Eric’s travel company from 2019???? I don’t remember the exact year.

Anyway, it was set up as an MLM with a compensation plan. I don’t remember him saying it was a nonprofit but I wasn’t listening for that information.

I assumed the company failed due to COVID lockdowns but now I see him 100% denying it exists.

Eric what about that viral video that we all have where it has you clearly saying. If you are not happy with paying the $25 to join let me know and I(you Eric) will refund you.

What email should people be sending their refund requests to to get that sorted out?

Jeremy Jenkins promises the eventual relaunch of the Revcard/Tranzact/Finmore concept in the first few minutes of this video:

youtube.com/watch?v=HJxvGvXL6k4

No timeline given, just a promise that it wont launch until its really ready. Gee, ya think?

I am not interested in going forward with this “venture” in fact I would rather have my fee returned to me for the DBO enrollment of $495 — whi can I speak to about this?

In Aug 2023 I went forward and joined what I thought was a legitimate company only to discover that it is not! Where do I go from here?

FinMore collapsed five months ago. And you’re running around now demanding a refund?

Your money is gone. Sorry for your loss.

Wow. I guess we had it all wrong! I just watched a YouTube video by Troy Dooly, “The Beachside CEO.” He explains everything in the video called “Who is Eric Allen-Really?”……

Troy really cleared things up by proving what an honest, upright, transparent, husband, father, Christian hero that Eric truly is. I guess some of us owe him an apology. LOL