TranzactCard collapses, rebooted as FinMore

Like every iteration before it, Richard Smith’s TranzactCard has collapsed.

Like every iteration before it, Richard Smith’s TranzactCard has collapsed.

Following disabling of DBO recruitment and member referral yesterday, a “FinMore” reboot was announced on a TranzactCard corporate call.

For the most part, FinMore appears to be a cosmetic rebranding with more fees.

- TranzactCard DBO –> FinMore Business Owner (FBO)

- TranzactCard Member (retail customer) –> Finmore Cardholder

- ZClub –> FinMore Market Place

- ZBucks –> FinCredits

FinMore Cardholders will be charged $4.95 a month for access to FinMore. “Legacy” TranzactCard members will receive access to the same service for $2.49 a month, up until March 2025.

As to what services FinMore is providing access to, it’s a standard offering of “me too” discount services from undisclosed third-parties.

The services are broken down into various categories with “Flourish” branding.

Flourish Health and Wellness

- telemedicine

- a nutrition program

- a fitness program

- weight management program

- medical cannabis savings

- medicare concierge service

- prescription discounts

- senior savings benefits

- dental savings

- medical records vault

Flourish Decision Maker

- finance tracking

- overspending corrector

- budgeting tool

Note that Flourish costs an additional $50 a month and “other Flourish bundles” will be released at some point.

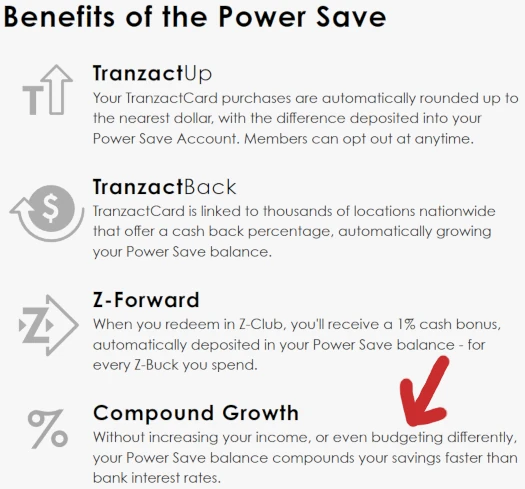

Needless to say this looks nothing like what TranzactCard originally pitched.

They’ve gone from “here’s a credit card you’ll get a 1:1 dollar match on be able to buy Nikes with”, plus a “compound growth” savings account…

…to “here’s some discount services you can get from a bunch of places”.

With Flourish costing $50 a month extra, what I’m lost on is what FinMore members are paying monthly fees for.

I get that affiliates (FBOs) can be charged for backoffice access, but what exactly are the FinMore member retail customers paying for?

On the MLM side of things, FinMore is charging new recruits $199 plus $50 annually. This is down from the $495 TranzactCard DBOs were charged.

Retail customers are being charged $50 annually plus $4.95 a month (I still don’t know why you’d sign up for this).

Commissions are paid out via what appears to be a unilevel, capped at ten levels on recruitment and nine levels for retail customers. This matches what TranzactCard was offering.

Flourish, which is new, pays $5 a month for direct referrals (FBOs and retail customers), and $3 upline nine levels (based on rank).

Pointing out the obvious, FinMore appears to be a renewed effort to disassociate from TranzactCard founder and owner Richard Smith.

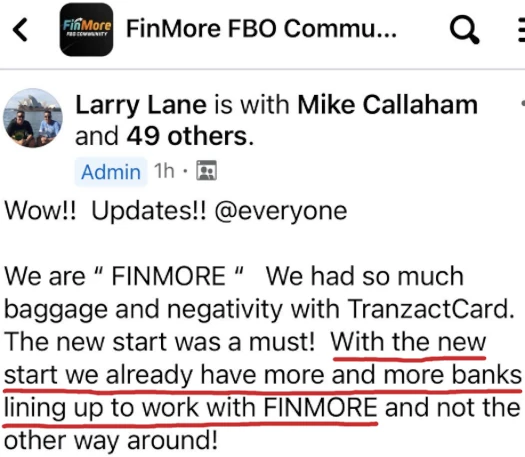

Communication from TranzactCard/FinMore distributors certainly suggests banks are being misled with the rebranding:

How long that goes undetected is anyone’s guess.

Something else I haven’t seen addressed is whether $495 TranzactCard DBOs are able to claim a refund. Given what they bought into has collapsed, offering full refunds would be the legally responsible route.

Still no corporate response on the 32,000 TranzactCard accounts being breached, or what the plan is going forward.

Richard Smith “resigned” from TranzactCard corporate last November but still owned parent company TZT Holdings LLC.

It’s unclear whether Smith still owns whatever shell company FinMore has been set up behind (directly or by proxy).

Update 13th April 2024 – FinMore has collapsed.

What I was promised: heavily discounted Nikes

What I got: discount weed

Ayo I’ve been bong and switched. FTC where you at?

Larry Lane is so full of it I am shocked he can see to type. Uh Larry, banks don’t line up to do business with any company.

But wait, Rancie was spouting in January how they had banking relationships with several banks with TranzactCard, but just couldn’t disclose who they all were at the time. Guess good Ole Larry forgot aout that promise from Rancie.

Anyone taking investment advice from this dolt deserves to lose their money. But banks lining up to do business with them….. HILLARIOUS!!

God put these shmucks on earth to demonstrate to us how stupid humans are.

I’m not seeing anything that suggests TranzactCard collapsed. This is a merger with an entirely different company.

Mergers happen all the time in business to make business better for everyone involved. FinMore offers more than than what you’re leading your followers to believe.

FinMore lists essential daily goods (items needed in homes daily) as well as services in their marketplace. That puts FinMore ahead of TranzactCard’s Z Club as it currently is.

Such items and services has been the promise of TranzactCard. Now, with the merger of these two separate entities becoming one, we are seeing that happen sooner than later.

And to respond to the comment that “banks don’t line up to do business” or whatever it was, yes they do.

I know for a fact that the CFO of the largest community bank in IN came across TranzactCard last summer and immediately wanted to talk to TranzactCard about partnering up.

I am friends with his daughter. Yes, banks do line up to do business.

Other than completely failing to deliver on anything in the original pitch and not existing anymore?

Calling a collapse and reboot a merger is pure lol. Hay guys, our company didn’t collapse it just created a new company and merged with itself.

Yet here we are.

So much copium bullshit. Sorry for your loss.

Insider Randy Schroeder released a new YouTube where he explicitly states FinMore is not TranzactCard renamed but a brand new company licensing ‘technology’ from TranzactCard and the decision to create FinMore was made just a few days ago.

FinMore.com displays ‘FinMore’ and nothing more. A business search on either the Utah or Wyoming government sites returns ‘no business license’ for ‘FinMore’.

FinMore is a last minute reboot of TranzactCard. The only ‘technology’ licensed by FinMore is Tranzact’s, now disgruntled, DBOs and Members who must pay more fees and buy new Fintech merch as TranzactCard merch is a bad memory. There must be a hun retention calculus for MLM reboots somewhere.

That’s about as bad as the “iT’s A mErGeR!” dumbass above.

What, Richard Smith is leasing his own technology to himself? Surely they don’t think putting some puppets in charge of a newly created company and pretending to license to it will dupe banking partners for long?

Also what technology? All TranzactCard launched was a crappy ecom store and broken promises.

OK, hot shot, so you claim the largest community bank in Indiana did contact TranzactCard wanting to do business. Prove it. Name the bank and the CFO.

While you are at it, do tell us where in what state FinMore is licensed and registered. Time to put up or shut up.

Willing to wait and see how this turns out.

Randy Schroeder admitting Richard Smith lied about TranzactCard [2:50].

youtube.com/watch?v=ziE7zppmhcY

Schroeder repeated those lies in his own marketing. He also lied about BehindMLM’s reporting on TranzactCard.

More than the questionable details, the tone of the writing is “off”. It sounds strained, like the writer was careful to parse words.

My gut tells me it was written by someone who knows the behind-the-scenes truth and who knows she needs to pick word carefully.

It sounds resigned. There’s no hoopla or jubilation. Ithink it was written by someone who knows the end is near.

Who do I contact if this new company won’t give me my $495 back for TRANZACT card? This is not even remotely the company I signed up for.

Yes, I was duped. Lesson learned. How can I get my $$ back and move on?

if they refuse a reimbursement is a legal action- or a class action a lawsuit viable?

Money back would have to come from TranzactCard at this stage.

The bong and switch would fall under the FTC’s jurisdiction. And any legal questions are best presented to a lawyer.

I must be missing something. What are the DBOs/FBOs getting for their almost $500 investment? Just access to a bunch of unspecified discounts? Is the Z Club officially dead?

$495 got you access to recruitment commissions in TranzactCard. In Finmore you get the same but for cheaper.

Sucks to have been sucked in for $495.

Imagine all of these DBO’s who purchased all of the tranzact card marketing materials!! Car wraps, biz cards, flyers, posters, signage etc… out alot more than just $500!!!

You get nothing back. Tranzact no longer exists.

Hope it’s ok that to be calm and rational on this thread!

Here’s some responses to above questions and comments. I am not employed by TZC or FM. Happy to speak to anyone privately or publicly. I can be contacted through LinkedIn or the website that bears my name.

@Lynndel “Lynn” Edgington

-I do consulting for a fintech. In fact banks can and will line up for a product or service that can increase number of accts/ amount of deposits/ number of loans/ client satisfaction etc. It is not factual that banks will not line up to do business to a company.

regarding

He could. He chose not to. This decision was based on the prediction of insane call and email volume to the bank that the announcement would bring (as was indeed the case with Bangor).

@D Micheal

-(maybe I’m crazy for suggesting this) Why not log into your back office and submit a ticket? (kind of like the mechanic asking if there is gas in the car- let’s start with the basics. Make sense?)

@LS

-If you listen to the zooms you will see and hear that that your DBO position becomes an FBO position with no loss to your genealogy.

Also this makes you a founder with later TCM multiplier. G-d willing this all works out, that will be the 2-10X income differentiator.

@Big Mac

“Imagine all of these DBO’s who purchased all of the tranzact card marketing materials!! Car wraps, biz cards, flyers, posters, signage etc… out alot more than just $500!!!”

– this article quoted Randy in a video things that cast shade. But omitted to mention his comment that if you bought branded marketing materials to submit a ticket or write to DBO support for refund or replacement with new items. Maybe didn’t fit the spin?

@JB Brown

– is this a peanut gallery potshot? Or is there a fact that you know about getting nothing? Please tell us what you know or restate it as an opinion.

I’m not a keyboard warrior The user is my real name.

You actually say that you are an affiliate without saying you are an affiliate. Centuries-old trick that sadly doesn’t work. Try harder.

Well guess what? TranzactCard/FinMore did not provide such a product or service.

Except that this decision seems to be actually based on there being no such bank in the first place. The fact that the commenter claims to know the daughter of some manager at some bank doesn’t automatically mean he told the truth.

This effectively ruins your disguise as “not being employed by TZC of FM”.

You actually say that you are a keyboard warrior without saying you are a keyboard warrior. Centuries-old trick that sadly doesn’t work. Try harder.

So did Richard create a new shell to move Tranz to? Sure seems like it. Same scam with a “secret (wink)” owner (scammer).

And you will not be refunded if you signed up for Tranz, as it’s assets were moved to the freshly created shell company.

Put the kool-aide down, Please!!

Where did And…. go?

Surely my simple questions were not too hard or difficult for him to answer since TZCard is all legitimate, and so is FinMore.

Funny how when asked to just provide simple factual answers these one-hit wonders disappear into the night never to be heard from again.

TranzactCard is fairly opaque and deceptive with lots of emotional manipulation but limited disclosure of truly important information.

No press releases on signed banks which incidentally negates the need to ask the banks about any signed deals.

Incomplete financial disclosures and no public audit by a CPA which incidentally is required to franchise in some States.

Recruiting DBOs while planning to transfer accounts to FinMore.

Demonstrably false statements by leaders such as being a franchise, having debit cards, having a bank, having an Amazon-like store, ridiculous compensation plans, and so forth.

The public draws conclusions from opaque deceptive incomplete sometimes contradictory information.

What if… alekseypetrovvv did steal the DBO/Member database files and TranzactCard did not backup the database, plausible incompetence.

TranzactCard would need to rebuild the database by requesting DBOs/Members re-enter their KYC personal information and credit cards but in FinMore to avoid disclosing the breach and their incompetence.

TranzactCard would also ask DBOs for their personal information in order to send 1099s. What if…

Jeff Sterns,

Thanks for your reply, so let me ask you since you are willing to have a discussion about banks lining up to do business with a compamy.

You do know the requirements of a “community bank” and the type of buesnnesses they can have as clients, right?

Larry Lane specifically stated that the largest “community bank” in Indiana had courted doing business with TranzactCard. So explain to all of us how TranzactCard would meet the requirements to do business with a community bank, largest or not in Indiana.

Further please tell how any bank would even know about TranzactCard, unless someone from TranzactCard contacted them? So how are all these banks “lining up” to do business with them when they don’t even know they exist.

Which leads to my next question, if all these banks are “lining up” to do business with them, why wouldn’t they want to be known they were courting doing bueiness with TranzactCard or for that matter FinMore?

Funny how after all these banks lining up to do business with them not one has agreed to be their bank. Now you don’t suppose that during their due diligence they found out TranzactCard and now FinMore are not legal companies, but just all smoke and mirrors?

Look forward to your reply.

And… did reply and confirmed he wouldn’t disclose any names. Unfortunately this was buried in paragraphs of abuse so spam-bin.

If anyone in or attached to TranzactCard starts banging on about banks but can’t provide you verifiable information, assume they’re lying.

The shit hit the fan!!! First they promise a card prelaunching almost a year ago, never happened!! and it is not happening with this new shell company or merger. If it walks like a duck, quacks like a duck…it may be a duck..

What happened with the $495 that thousands paid? more than 30 million dollars! and now they have to signup again for $199?

And the claim that they will have more banks lining up with a company like Finmore thatDOES NOT have a track record, it was registered in WY just less than 2 months ago by THE SAME regiter that did Tranzactcard…..

Peter Rancie stated that the same “Trust” that owns TranzactCard also now owns Finmore.

Does anyone know who the beneficiaries or trustees are? Can anyone verify/prove that Richard Smith is at the bottom of all this? Or should I say at the top? LOL.

TranzactCard –> TZT Holdings LLC –> Richard Smith

There are no other known owners or beneficiaries.

@Oz

Finmo LLC->Finmo Holdings LLC->Richard Smith?

Jeff Sterns,

I do want to clarify from my prevoius response directed to you. I gave Larry Levine credit for both statements, i.e. banks were lining up to do business with TranzactCard and the largest commmunity bank in Indiana reached out to them to do business.

Larry only referenced banks were lining up to do business with TranzactCard, and the poster And…. was the one who claimed the largest community bank in Indiana was seeking to do business with TranzactCard. My apologies.

@Kir

I said that I am not an employee. I was a DBO/ now FBO. How/ why else would I have interest/ knowledge in/of any of this?

Good job using “seems”. Seems a lot of opinion gets stated as fact on here.

I have no connection to nor any idea about that commenter.

No disguise. I’m not employed by them lol.

OK I’ll try harder. I’m not a big shot hiding behind a made up, anonymous name and a keyboard. I’m easily found, accessible and open to discussion and public debate (one-on-one or group zoom, recorded or not, fine to have it posted).

To me, hiding behind that stuff is what defines a keyboard warrior.

(Ozedit: derails removed)

@Lynndel “Lynn” Edgington

No harm done! Anyone willing to look at themselves and own their s*** is a good man in my book. (Ozedit: derail removed)

Ignoring voluminous waffle – the number of times “Finmore” got caught outright lying, whilst maintaining a fanbase of rabidly subservient drones like Sterns is impressive.

Seems to be a strong case of Sunk Cost fallacy. Fact is – they are breaking the law. You seem to find it apt to believe anything supportive of your stance ignoring that little factoid

@AntiMLM

I liked that- a good one. I’m trying (best a human can do) to remain objective because if it works and is real I like the concept.

If not, I can walk. The investment was small enough (dinner for 6) to not be world ending and for those that I introduced it to that are in a tighter spot- not so large I can’t bail them out if needed.

Re this conversation- I must admit that i do get sucked into exchanges where opinions are getting stated as fact a heavy attachment to the outcome. (Ozedit: derails removed)

I may change my handle to subserviant drone. I like that one.

There are a lot of angry right-wing boomers in TranzactCard who can’t come to terms with it collapsing.

Firstly nobody cares about your politics, it’s irrelevant. Fuck off back to FaceBook.

TranzactCard absolutely collapsed. What launched last year collapsed under the weight of Richard Smith’s lies.

Although FinMore is still likely owned by Smith through shenanigans, it is a reboot of nothing that was offered in TranzactCard’s original launch.

Seems Richard Smith closed out TranzactCard LLC for the 2023 Tax Year keeping the net cash while transferring the clients, the obligations, the pile of worthless Z-Bucks to FinMo LLC for the 2024 tax year.

Me and 2 other members of my family signed up as DBOs and spent a lot on banners, printed materials, marketing merchandise that all became useless.

My spouse requested a refund and the company declined saying it had been passed the alloted time to cancel. But we never agreed to the FinMore comp plan/business model.

We signed up for something all together different. If anyone decides to get a class action lawsuit going, please count us 3 in.

Sorry to hear you got scammed. Tranzact now Finmore should have been easy to see it was a scam just by researching the ongoing scammers that built it!

I really really HATE these mlm influencers that promote these scams one after the other and don’t care that they are hurting the inexperienced ones.

Now these same influencers are pushing Finmore like nothing bad happened with tranzact!

Why do these influencers or leaders in mlm continue to promote this crap? Because they are at the top and are making money or already made enough money ( those $500 checks) to cover themselves. Greedy and dishonest people.

In what can not possibly come as any surprise to anyone following this saga but FinMore has blown through another deadline, their February 15th launch date.

An inauspicious beginning from such a flawed foundation.

FinMore reminds me of nothing so much as the efforts to resuscitate Richard Smith’s R Network after they were forced to admit that the RevCard would never launch.

They lost their key marketing focus. Their “IT” thing was no longer a real thing.

So what they did was pile together a bunch of “usual suspects” MLM product offerings and tried to stir that slurry into something affiliates would pay enrollment and monthly fees for.

That’s all you really need for a MLM, affiliates paying in each month and a thin small percentage of them can cash out.

That been the story from Divvee to Nui to Digital Vault to R Network to TranzactCard to Finmore. Richard Thomas Smith was the through line in those first five failed MLMs and I’m sure he’s in the woodpile somewhere when it comes to FinMore.

The key takeaway is that under one guise or another Richard Smith’s MLM “empire” has defrauded tens of thousands of people out of money for almost a decade all the while lining the pockets of a very small group of frequently repeat promoters.

TranzactCard added new faces to the grift but it didn’t change the overall story much at all or so it seems to me.

Jeff Sterns, you said you do consulting work for fintech, but your profile on LinkedIn does not mention this at all.

All you have your profile is that you are an experienced salesman, manager, coach, leader, mentor with a demonstrated history of working in the automotive industry, especially Loanify. Are you saying your being able to offer loanify services is fintech?

So what type of fintech consulting have you done and who were your clients?

This is a MUST watch from a MLM survivor and staunch provider of content relating to the cult that comprises MLM’s.

She does show BehindMLM in her videos so she has been here as well taking in your researched content.

This video goes over Tranzactcard “becoming” Finmore.

(Ozedit: removed link to inaccessible video)

Just tried to access it and it has been taken down already.

Interesting… because I posted it immediately after pulling it up to ensure it was still viewable.

If you can find Julie Anderson where she is wearing an orange pullover, that is the video… it is over 2hrs long. Sorry the link I shared didn’t work.

It works for me, but you can also copy/paste this and it just came up for me (again, the one where Julie Anderson is wearing an orange pullover). Hope it works for you…

I’m watching their launch night comp plan stream.

Sad.

The customer buy in price point not only doubled but they tacked on $4.95/month for friggen All Cards.

TranzactCard TCMs cost $25, FinMore FMs run $50 plus.

This is a penny ante comp plan.

It’s not entirely clear what they’re paying commissions on outside of membership fees but the dollar signs are small.

Recruit the living piss out of this is the only way to make anything at all.

AH but they have Flourish Packs to sell. Good luck with that.

This is a conceptually failed MLM desperately flailing to retain the affiliate base from when they were selling Richard Smith’s tapestry of lies.

This call lacked any of the pomp and circumstance one might expect of a MLM company launch day call, everyone seemed a little tired.

Finmore is just a trademark operated by Flourish Direct LLC as described in Finmore ‘Terms of Service’.

finmore.com/terms-conditions/

Both Flourish Direct LLC as well as Flourish Direct Holdings LLC registered with the Wyoming Secretary of State January 24 2024.

The company office location is shown as 680 South Cache Street Suite 100, Jackson WY 83001.

wyobiz.wyo.gov/Business/FilingSearch.aspx

The Flourish Direct LLC as well as Flourish Direct Holdings LLC business location is a virtual office operated by Mountain Business Center, LLC.

unitedvirtualoffice.com/wyoming/jackson-690-s-highway-89

Finmore beneficial ownership and even the actual business location are completely hidden from the public and members. Finmore appears to be ScamMore.

@RAZ

…and, when I did my initial research for TZT Holdings llc, the exact address came up – i.e. Mountain Business Center LLC is a clearing house (license provider) for what clearly appears to be a TZT “remake” from “you know who”.

HOW is the FTC not getting or already involved in shutting this continued crapshow down?!

A pyramid “scheme” involves a matrix (i.e pyramid) of 3 gets 3 and they get 3 and so forth (in TZT’s instance). 21 levels of this exceeds the population on the globe or thereabouts.

Because of this, as OZ and others have pointed out, it is impossible to last when recruitment is the driving factor with both TZT and now FinMore i.e. F’inMore, i.e. F’in (fu%king) MORE (of the same ol same ol).

Fin More (F***in More of the same!). LOL So true!

Eric Allen and Peter Rancie held a call tonight.

Big Nothing Burger.

No FinMore Store yet. Soon, real soon.

The promise of the FinMore Debit Card was revived but expectations of an arrival date were tempered yet again. Peter mentions the second quarter of 2024?

Too much reliance on marketing tropes. For all their talk of “social impact” the solution they offer to people in economic distress is for them to join a multi level marketing scheme where the overwhelming majority of participants loses money.

Some social impact.

As a side note the author of the Flourish Academy “Soft Skills” module was revealed to be DL Wallace of simplysuccess dot com.

I couldn’t find out what Mr. Wallace charges for his courses and I did look a little. But FinMore is paying out on ten levels from the $50/month they are charging for his course so suffice to say DL is charging alot less than $50/month.

Mild hint of scandal in DL Wallace’s past. In the early 2010s Wallace was a cofounder along with NFL Hall of Farmer Dion Sanders, in a pair of charter schools in the Dallas Fort Worth area of Texas called Prime Prep Academy (Prime Time being Sanders’ nickname as a player).

This was a good natured effort for a highly successful athlete to “give back” by offering what he hoped would be a quality educational and athletic environment for under privileged youths.

Good natured but poorly administered, the schools were closed in less than three years for multiple manifest reasons, some of which Dion Sanders lays squarely on DL Wallace. One Tweet in particular:

The above being quoted in this article from 2014:

bleacherreport.com/articles/2130924-prime-prep-academy-co-founded-by-deion-sanders-reportedly-shut-down-by-state

Is there a chance I have the wrong DL Wallace? No.

Just look at any of the many photos of him on his simplysuccess dot com website then watch this video:

youtube.com/watch?v=JUekcLcL4gY

Same guy.

Thanks for the update.

I’m treating FinMore as all but collapsed. Like R Network it’ll either disappear after a drawn out period of people eventually leaving, or Smith will sell it off (ala Nui and R Network).

The money was made during TranzactCard recruitment, which was based on complete BS marketing lies. Exactly the same as R Network (we all predicted this because obvious fraud from the same fraudster with a history of fraud is obvious).

I requested a refund through FinMore and they instructed me that I must request the refund from Tranzactcard! Bait and switch! Fraud!

Jon McKillip headed up today’s Saturday Training.

We are a month and a half into FinMore and they still don’t have the FinMore Store online yet. Soon, real soon.

They cranked out a commission run. No current customer value to anything yet so all pay tied directly to recruiting.

Lots of blather about their tacked on Flourish offering. They needed something to sell even if it makes no sense compared to what else they we promising, and Flourish it is.

As Oz stated above FinMore is collapsing, we’re in the unnecessarily long death spiral. It would be interesting to know the Similarweb numbers for finmore dot com.

Randy Schroeder Jumps Ship:

If I may request that Oz add NeloLife to the review queue.

Hat tip to YouTuber Julie Anderson for the breaking news.

Imagine bullshitting your way through life, and when it predictably turns to shit you just slink out the back door. tHe PaSt Is BeHiNd Us.

Door is always open for an apology Schroeder.

NeoLife is an MLM company. I wonder if NeloLife will run into problems if they’re also marketing supplements.

Industry insider Troy Dooly has sobering words about the future of FinMore:

youtube.com/watch?v=w1jlEzIPfOU

Schroeder isn’t the only name to leave the company, Dooly of course doesn’t name them. He mentions the departure of some execs that haven’t been made public yet.

Troy generally speaks in terms of pom poms, here he’s pointing out red flags in his own fashion.

NeloLife LLC registered in Wyoming

Filing ID 2024-001424395

Type Limited Liability Company – Domestic

Initial Filing 03/12/2024

Addresses are all a registered agent

No real ownership listed

@Glimdropper

I watched a couple Julie Anderson videos that two others are none other than top recruiters ERIC ALLEN (watch her video of him saying “he just needs to do the right thing and step back” – “servant leader” my ass!) and LARRY LANE.

Scott Kufus also has a couple videos out. Bait, switch, repeat…

Ten days later and still no FinMore Store. Soon, real soon.

Peter Rancie was on another Saturday call.

Peter says the FinMore store will finally be open on April 10th.

He also states that the FinMore debit card will be available “this summer.” This is yet another shifted goalpost as this summer takes us squarely into the third quarter of the year.

The FinMore facebook group is on near communications lock down. Posts complaining about how the All Cards platform is not properly rewarding promised FinCredits are deleted or closed to new comments.

Which is ironic because of today’s call we were all told just what an amazing success the All Cards platform really is.

On the dawn of it’s third month FinMore doesn’t nearly have it’s day one crap together.

FinMore’s storefront – 430712-b2.myshopify.com/

It’s just a Shopify template with random dropshipped products.

Meltdown in the FinMore FBO Cumunity:

imgur.com/4aLi7hb

This had been the official TranzactCard/FinMore affiliate facebook page now they are saying that no one of the FinMore corporate will even see the (Many) complaints being posted there.

Which of course means that affiliates need to stop posting complaints.

The beatings will continue until morale improves I guess.

Five day till the FinMore Store. They need to hit this one out of the park.

Well it’s April 10th and no surprise, no FinMore Store.

Soon, real soon.

Peter Rancie CYA:

That’s the first half of his email, I only have it in PDF form and copy/paste to the comment box requires more format adjustments than I’m willing to do from here.

What a crock of shit.

There has been a social media “civil war” but it had almost nothing to do with Nelo Life. The main Finmore affiliate facebook group started blocking “less than suitably glowing” comments and disaffection flamed up into a FinMore/TranzactCard Refund Group and a FinMore Class Action Lawsuit group. With growing memberships.

This was all based on the many and endless failed promises of FinMore/TranzactCard and Peter Rancie.

Erick Allen fired back with a video in the affiliate facebook group pushing back sharply on the notion that Nelo Life killed FinMore. He spills some tea and he expresses confidence that Peter wont sue him.

Peter ends his email with “in due course, you may expect” a fully fleshed out company that has it ducks in a row before they start pilfering millions of dollars worth of affiliate signup money and are left with absolutely nothing to show for it, another time.

At least that’s how I read it.

Finmore is NO MORE!

Heads up. Peter, Mylen and Richard are rebooting TranzactCard under another name . ( Right after the election riots settle down ) According to Peter Rancie on a recent update call.