SEC sues two Apex promoters (Investview)

The SEC has filed securities fraud charges against two Apex promoters.

The SEC has filed securities fraud charges against two Apex promoters.

Anthony Lotito and Joseph Hagan stand accused of defrauding consumers through Apex, a collapsed passive returns investment scheme.

In addition to Lotito and Hagan, both New Jersey residents, the SEC also names their respective companies; Revolution Leasing and Scryptmob II LLC.

As alleged by the SEC;

Hagan and Lotito, through their respective businesses, ScryptMob and Revolution Leasing, fraudulently offered and sold unregistered securities as distributors for a purported sale leaseback program involving cryptocurrency related technology (“the Apex Program”).

Apex, operating as Apex Tek was a fraudulent investment scheme launched by publicly traded company Investview in 2019.

A since-deleted official marketing video on YouTube cites Jeremy Roma (right) as Apex’s founder. Roma was also a Director at Investview until 2020.

A since-deleted official marketing video on YouTube cites Jeremy Roma (right) as Apex’s founder. Roma was also a Director at Investview until 2020.

Apex’s investment scheme saw consumers pitched on returns of up to $500 a month for five years. Recruited Apex investors were told they were investing in “machines that mined bitcoin”.

The purported mining machines were bought from Apex and then leased back to Safetek, another Investview owned company Roma was President of.

In his then capacity as an Investview Director and founder of Apex, Roma hosted Apex marketing webinars.

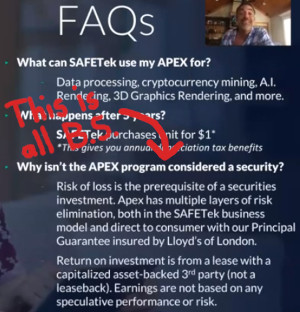

In the webinars, Roma incorrectly asserted Apex’s passive returns investment scheme wasn’t a securities offering.

In the webinars, Roma incorrectly asserted Apex’s passive returns investment scheme wasn’t a securities offering.

The SEC allege Hagan and Lotito primarily promoted Apex’s unregistered securities offering to elderly victims.

Many who invested in the Apex Program through Hagan and Lotito

were elderly, and some invested using funds in their Individual Retirement

Accounts (“IRAs”).

Through Investview’s Apex offering, Lotito defrauded his mostly elderly victims of over $2 million. Hagan defrauded his victims out of over $3.1 million.

In connection with some of these investments, Lotito and Hagan each

misappropriated a portion of investors’ money and used it to pay for their own

personal expenses.In some instances, during the Relevant Lotito Period, Lotito paid

earlier Apex Program investors with the money invested by later Apex Program

investors.

Less than a year after it launched, Apex began collapsing in early 2020.

Hagan and Lotito each knew, or they recklessly disregarded, from at least April 27, 2020, that there were problems with the Apex Program, including that there were significant delivery delays with the Apex Packs, which were necessary to generate this passive income for investors, and that monthly lease payment amounts to investors had been drastically reduced by as much as 80%.

Apex collapsing never made it into Lotito’s and Hagan’s pitch. The pair continued to market Apex to unsuspecting investors as if nothing was going on.

Eventually, Apex collapsed in June 2020. To smooth over investor losses, Apex rolled out a “COVID-19 shipping issues” exit-scam.

But even Apex’s collapse didn’t deter Lotito and Hagan (right) from continuing to defraud consumers.

But even Apex’s collapse didn’t deter Lotito and Hagan (right) from continuing to defraud consumers.

Nevertheless, Lotito and Hagan continued to offer and sell investments in the Apex Program, misrepresenting to investors that their investments would be used in the Apex Program even though the Apex Program Parent Company was no longer accepting new investments.

With no scam to direct investor funds into, Lotito and Hagan just kept the money for themselves.

In connection with these post-June 30, 2020 sales, Hagan and Lotito retained all the investors’ money and did not transmit investor money to Subsidiary #1.

Subsidiary #1 refers to Apex Tek.

Also, post-June 30, 2020, Lotito and Hagan continued to promise prospective investors that 100% of their investments were insured by the Apex Program Parent Company’s third-party insurer.

The “Apex Program Parent Company” refers to Investview.

In fact, however, as Lotito and Hagan knew, or recklessly disregarded, Lotito and Hagan would not transmit the investors’ money to Subsidiary #1 and thus the investors’ purchases would not be insured.

The Apex Program ceased to operate completely on or about September 10, 2020.

Lotito continued to offer and sell purported investments in the Apex Program from October 2020 until July 2021, despite his knowledge that the Apex Program had ceased to operate entirely.

The SEC alleges Lotito and Hagan, in promoting Investview’s Apex investment opportunity, of multiple violations of the Securities and Exchange Act.

In a lawsuit filed in New Jersey on September 20th, 2024, the SEC is seeking

- an injunction prohibiting further acts of securities fraud;

- an injunction prohibiting Lotito and Hagan from having anything to do with securities offerings;

- disgorgement of ill-gotten gains;

- civil monetary penalties; and

- an injunction prohibiting Lotito and Hagan from serving as an officer or director for a company that has securities registered with the SEC

I’ve added the SEC’s Apex promoter case to BehindMLM’s calendar. Stay tuned for updates as we continue to track the case.

In the meantime, the SEC’s Apex promoter lawsuit raises further questions about Investview and Jeremy Roma.

While Investview referenced Apex Tek and Safetek in its SEC filings, it didn’t register the Apex investment scheme as a securities offering.

Having now gone after two Apex promoters for “fraudulently offer[ing] and [selling] unregistered securities as distributors” of Apex, the bigger question is when will the SEC go after Investview?

And potentially, pending settlement or trial, what role Lotito and Hagan might play as cooperating witnesses?

Jeremy Roma ditched Apex Tek, SafeTek and Investview shortly after Apex collapsed (August 2020).

After stealing who knows how much from consumers through Apex, Roma scurried off to Dubai to launch Daisy AI a few months later.

In partnership with EndoTech, a purported Israeli securities fraud factory fronted by Anna Becker and Dmitry Gushchin (aka Gooshchin), Roma continued to defraud consumers over multiple Daisy collapses.

It should be noted that after Apex, Investview also continued its securities fraud with CryptoElite.

CryptoElite brought Investview’s company iGenius and EndoTech together. Although never publicly confirmed, it’s believed the iGenius/EndoTech deal was brokered by Jeremy Roma.

Investview disclosed it had been subpoenaed by the SEC in relation to potential iGenius related securities fraud in November 2021.

As of May 2024, the SEC’s investigation into Investview and iGenius is confirmed to be ongoing.

The last iteration of Daisy AI’s EndoTech series of unregistered securities offerings collapsed in late 2023. A “Blockchain Sports” reboot was launched but didn’t go anywhere.

Against the backdrop of widespread Daisy AI victim losses, Roma’s latest grift is BioLimitless.

BioLimitless presents itself as a cookie-cutter MLM supplement company selling a $300 a month probiotic supplement.

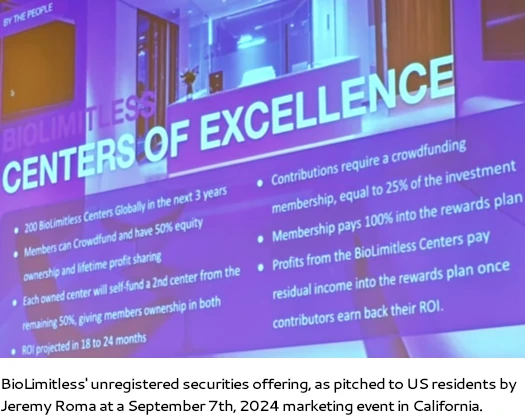

On the backend however, Roma and BioLimitless are pitching US resident consumers on unregistered securities tied to “BioLimitless Centers of Excellence”.

Neither BioLimitless or Jeremy Roma are registered with the SEC. Instead, on September 16th, 2024, BioLimitless Centers of Excellence, Inc., a Delaware shell company, filed a Form D Notice of Exempt Offering of Securities.

BioLimitless Centers of Excellence, Inc.’s filing cites:

- Eric Nepute as a Director;

- Jeremy Roma as a Promoter; and

- CJ Mertz as an executive officer

The filing details BioLimitless hoping to raise $20 million for “profit share”. $1 million of funds invested by consumers will be set aside to pay Nepute $50,000 a month and Mertz $30,000 a month.

Considering Roma’s recent BioLimitless in California saw him pitch US resident consumers on “50% equity” shares for $500, and a “ROI projected in 18 to 24 months”, BioLimitless attempting to skirt US securities law through a Form D is concerning.

Following Roma falsely representing Apex wasn’t a securities offering in 2019, BioLimitless’ doing the same with its “50% equity” passive returns investment scheme isn’t surprising.

Whether the SEC is investigating Roma as part of its Investview investigation or otherwise remains unclear.

Update 18th January 2025 – Investview has settled Apex fraud allegations with the SEC for $375,000.

I hope the L’Affaire Apex was not the only reason for the SEC requesting documents from Investview this year. If so, they are effectively letting iGenius off the hook for the other frauds. Yikes.

Investview’s original SEC subpoena was received in Nov 2021. This fits with them providing the SEC with documents in 2022.

In the 2024 followup, Investview said the followup was in relation to the 2022 production.

The 2022 production pertained to iGenius, which means it post-dated Apex. Apex could be part of that investigation (the scope of the SEC’s Investview investigation is unknown), but so far they seem to have only contacted Investview re. iGenius.

Waited 2 years to get my money back. WTF is going on here!

I get regular calls/emails from scammers who say they can get my money back which is yet another scam. But I’ve realised victims get re-scammed as I’m now on a fucking scammers list.

Unfortunately reselling of investor details is common. This often ties into KYC exit-scams.

You won’t be “getting your money back”, that’s not how Ponzi scheme math works. Any specific questions regarding victim redress in SEC filed cases should be brought up with the SEC.