UK bank freezes Hyperverse investor’s account

![]() A UK bank has frozen a Hyperverse promoter’s account on suspicion of fraud.

A UK bank has frozen a Hyperverse promoter’s account on suspicion of fraud.

Emma Smedley is a UK-based promoter of the Hyperverse Ponzi scheme.

Smedley took to FaceBook on January 6th to “have a whinge” about her bank.

[1:34] I tried to pay for my Calendly app last night … and my card wouldn’t go through.

“Your card’s not recognized”. I was like, “recognized? It’s a nationwide card.” What a load of shit.

So anyway, this morning I rung ’em up. I’d been on the phone an hour … I got through to customer service, who just takes my details and then says, “Oh yeah I need to pass you through to another department”.

[2:19] So eventually I got through to a second person, who then proceeds to tell me, “Oh no no, I can’t deal with this. I’m going to have to put you through to the fraud department”.

I was like, “right”. So I get on there and I am interviewed like a criminal.

“Where’s this money come from?”

So I’m like, “What? Why do you need to know where my money’s come from?”

“Because that’s what we do, we investigate fraud.”

“Right well I can tell you that I wanted that transaction to go through.”

And he said, “Well um..”

“Oh and look, I don’t think it’s about a Calendly transaction that you’re worried about. It’s probably the fact that I’ve transferred money into my bank from Coinbase. And that’s what you’re interested in.

You’re not interested in the Calendly app. You want to know what I’m doing.”

So I said, “I’ll tell you what I’m doing, I’m trading. And that’s where my money comes from.”

The long and the short of it is, I can’t now get any money out of my account whatsoever that’s left in there.

They’ve completely shut down my bank account. They have restricted my online banking. In theory they’ve left me, if you want, with no money in the normal world.

[3:59] Doesn’t that just bloody well tell you why you don’t want to be around banks.

They’re not doing that for security, they’re doing that because they want to know where the money’s coming from, so they can go to the source.

Smedley’s ignorance of finance law is commendable.

Hyperverse is a reboot of the collapsed HyperFund Ponzi scheme.

Both HyperFund and Hyperverse have been singled out by the FCA for securities fraud.

Regardless of who you bank with, if you’re suspected of engaging in fraudulent activity, such as involvement in one of the largest MLM Ponzi schemes currently operating, they’re going to flag your account and investigate.

If you can’t prove to your bank the money you’re depositing into that account hasn’t come from a legitimate source (securities fraud isn’t a legitimate source), they’re going to shut you down.

When fraud departments come knocking, “We sell memberships” doesn’t cut it. Nor does hiding involvement in Ponzi schemes behind “trading”.

Once you’ve been flagged for potential fraud, on the bank’s backend a Suspicious Activity Report is generated.

This SAR report is then forwarded to regulators and/or relevant authorities for further investigation.

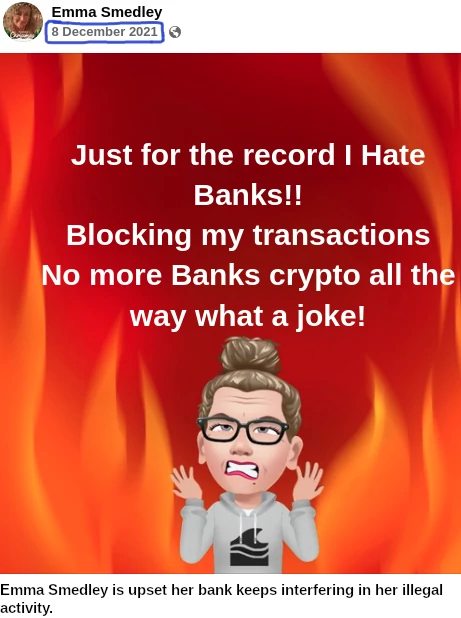

Evidently this isn’t Smedley’s first run in with her bank’s fraud department:

Smedley has been in Hyperverse for some time, dating back to beyond the recent HyperFund collapse.

Smedley is believed to be in Sharon James’ Hyperverse downline, who is in turn in Kalpesh Patel’s downline.

Kalpesh Patel is believed to be one of Hyperverse’s top net-winners. Originally from the UK, Patel has been hiding out in Dubai for some time.

In mid-December, a few weeks after HyperFund collapsed, Patel organized a hype event in Dubai for his top earners.

Emma Smedley was in attendance:

As for the company Smedley keeps; Sharon James has been promoting Ponzi schemes for years.

Stone made a name for herself as one of the top earners in the collapsed Traffic Monsoon Ponzi scheme.

In 2019 a court-appointed Receiver sued James for $249,758.

James failed to defend the suit, resulting in a $303,691 default judgment recorded against her in June 2021.

Kalpesh Patel has been scamming people dating back to the notorious Zeek Rewards Ponzi scheme.

Update 11th January 2022 – Following publication of this article Smedley pulled her video. No explanation for the deletion was provided.

There was a link to the video but in light of Smedley deleting it I’ve removed it.

The problem here is not hyperverse.

When you receive money from someone you MUST have to declare it.

And if you receive money regularly from the same company or person the bank will ask you for more information.

I made trading and affiliate marketing and my bank asked me the same, sent them all the documentation about what i do and my last income declaration and they free my account.

The problem here is that that person doesn’t even know that the bank MUST know from here your money comes!!

People in Ponzi schemes don’t want to do this.

Honestly, I do thing HyperSomething is the problem here. Or rather getting publicly involved in a scam. Nobody in their right mind will say to their bank “I’ve just got paid by a Ponzi scheme”, especially when there’s a fraud warning against it. Hence the ruse of trading. And since there’s no proof of trading in a Ponzi and no trading proof on the scammer’s hands, boom. Account blocked, rants against the banking system on the Internet. Coming up next – rants about governments.

@Roberto – Affiliate marketing sounds awfully like double-speak for Multi-Level-Marketing, or pyramid selling, or Ponzi scam.

Hyperverse is a pyramid selling, Ponzi scam and therefore is the problem.

My heart bleeds for her… it truly doesn’t!

She won’t be able to get another account easily as that sort of data is shared…

EMI for her it is.

Good read! Hope more awfull UK scammers will follow:

starlingbank.com/mobile-banking-security/fraud/

I think Emma is making these stories up.

Why? Because she’s trying to tell people that regulation is bad and that their unregulated crypto scam is the way forward. It’s basically a sales tactic.

i kinda agree with Pete. these schemes operate on fear.

the more you instill the fear about how banks and the govts and whoever else is out to get you, the more you convince people to join their scheme as a way to get out of ‘their’ control and be part of an alternate economy that will be the next big thing. so they should in the game early.

see her FB posts right after. she doesn;’t seem sad that she lost her bank account.

Hmm… it would be a bad sales tactic. Telling your downlines that the promises income can be frozen by a bank… it’s not very attractive. I guess this story is more likely true.

Could be a sales tactic. I suppose if you’re able to be convinced crypto scams are the way forward you’re probably a lost cause.

Well, at least until you inevitably lose your money.

There’s also the problem of you can’t live on crypto. Nobody uses crypto because they want to be crypto rich (i.e. a bagholder), they want to be fiat rich. This requires a banking end-points.

Hello ladies and gentlemen, I am not a big networker.

Here in cryptocurrency space now one sure about source of income every government know about exchange and mining companies how they will make big profits every year no any country have power to stop world in cryptocurrency and blockchain technology space.

2019 hyper capital came with minimum membership 1 thousands dollars 2020 they just changed there name and started 500 and 300 membership package also no any more change now in 2022 came with name of hypervarse in this year with new technology metaverse with new binance chain token hvt hyperverse token.

From 3 year hyper tech no stopped single person rewards tell me any one have answers just tell me witch mining firms giving earnings data to government witch one exchange witch one cryptocurrency have any income proof ….

in mlm always done big scams but here in hyper 100k+ people’s got benefits they recovered losses I know and people also know very well about.

Many scams are against hyper reasons there shatter closing people trusting on hyper group in all mlm field people.

Here who doing against hyper they all scam supporter and also part of scams owners of scams companies…. people now choosing right ways and also joining every system after great research that’s way hyper growing every day …

I am not hyper supporter I am only common man and online researcher from 1 year I researched about hyper and all others scam who not live any more any one have comment please. Dont mind I don’t want to hurt any one best regards.

Raja

If an MLM company is offering a passive investment scheme and hasn’t registered with financial regulators, the source of income is new investment.

Um, HyperCapital collapsed. HC was literally abandoned.

Just because you don’t personally know the Chinese HyperCapital victims (those that weren’t onboarded into HyperFund), doesn’t mean they don’t exist.

Every dollar stolen in a Ponzi scheme is someone else’s loss. It’s a zero-sum equation.

Try harder then. People stealing money isn’t evidence of legitimacy.

Companies name changes doesn’t means company collapsed not good please give use good reason about scam witch scame they done with community brother always company do scam with own community 100k + members joined all community members happy from 3 year

Tell me one of mom companies (Ozedit: Snip, if you want to discuss your mom’s companies or any other company do it somewhere else.)

Company name change, new Ponzi shitcoin, new compensation plan = collapse.

MLM + securities fraud = scam.

You don’t personally know the 100,000+ people in HyperCapital’s various Ponzi schemes so cut the crap.

That lasted what, ~10 mins?

You are trying to convince people (Ozedit: snip, see below)

I’m not trying to convince you of anything.

Fact: Hyperverse is committing securities fraud.

Fact: MLM + securities fraud = Ponzi scheme.

Ignoring facts isn’t due-diligence.

600k + from just india brother and this system came in india after starting 6 month or more research about hypercapital.

Brother first they run in Hong Kong Australia then they hit in all over the world now millions of user in hyper.

How many people join a Ponzi scheme is irrelevant to a Ponzi scheme being a Ponzi scheme.

First Ryan Xu and Sam Lee scammed the Chinese. Then they scammed the west. Now India? Then Africa?

That’d be a typical trajectory. Or are you one of Kalpesh Patel’s motherland cronies?

The more you try to counter the two facts presented to you, the deeper the hole you’re digging yourself into.

I just text about facts brother I already said I researched about system I am not bleaving any one I am only bleaving in my own research.

I researched and I never see like that mlm company government involved with them they hold first digital bank watch one running from 2017 and also Australia stock listed bank all over the world Visa master card accepted banks give us cash from cryptocurrency think about that 3 million own crypto user costomers.

Like u people’s talking against Ryan xu and same lee big media coverage always with them .

You have provided no facts that address:

In fact you’ve provided to facts at all. Just Ponzi marketing – like this absolute rubbish:

1. There is no a single government on the planet involved in HyperTech/HyperCapital/HyperFund/Hyperverse.

2. HyperTech/HyperCapital/HyperFund/Hyperverse has never held a “digital bank” (??) anywhere on the planet.

3. HyperTech/HyperCapital/HyperFund/Hyperverse has never been listed on the Australian stock exchange, or any stock exchange.

4. Visa/Mastercard have never had anything to do with HyperTech/HyperCapital/HyperFund/Hyperverse.

5. Whether it’s 3 million or 30 million, how many people are in Ponzi scheme has no bearing on it being a Ponzi scheme.

Last warning, bullshit Ponzi spam = goodbye.

Text me privately (Ozedit: snip, see below)

Big media coverage? Like liquidators hunting Xu and Lee down chasing $49 million in Blockchain Global losses?

And them running off to Dubai to hide? Yeah no worries chief.

If you can’t publicly address…

…then we’re done here. Goodbye.

Audited financials and registration with the SEC including required info.

Anything else you think you have has no bearing or relevance except to convince people with little financial acumen such as yourself and fellow victims.

Could be, but probably was not ment this way.

Emma’s Facebook post trumpeting “can’t stand banks, use crypto instead” is away.

Including the comments pointing out the banks tend to block accounts involved in Ponzi / pyramid operations.

Occam’s Razor in this case says she’s telling the truth.

Even diehard crypto bros and huns might think twice about buying a crypto token if they know that their bank might freeze their accounts as a result.

As Oz says, even crypto bros don’t want to be crypto rich, they want to be fiat rich. For practical purposes you can’t be fiat rich if the banksters won’t let you have an account.

As her post does her sales pitch more harm than good, I would assume it’s true.

@Adil Kiani You are typical of the people that buy into this. People that that least afford it and are not well-read on money. There are no HONEST high net-worth people buying into Hyperscam.

Tell you what I’m doing, and what others may want to do too: I got an invite to a Hyperscam Zoom presentation, and logged on with two different screen names that were “common” names to the people in h group. In other words, if it’s Indian, use and Indian name etc.

I pre-wrote chats for each profile with different evidence for each, like asking people to Google Steven Reece Lewis since he is made up, a link here, etc etc.

After the presentation I bombed the chats, and they ejected ME, but not the chats. Before I was ejected a woman THANKED me for caring about strangers.

We can help save at least some people. Usually the ones that can least afford to lose their money.

And another thing…

I wonder how many UK amateur investors who fall for these Ponzi scams know they have to declare their income and the source of it (anti-money laundering/proceeds of crime legislation), that they have to pay Capital Gains Tax, declare it on their HMRC tax returns, etc.

Hyperfund is a Ponzi scam.

The Financial Conduct Authority in the UK have gone so far as to formally issue a warning against the company, stating publicly the company does not have the regulatory authority.

Sorry for your financial loss!

Whatever it was Smedley was embarrassed enough to pull the post.

They are using fake reviews and ratings on trust pilot now to get more members.

OneCoin honed the art of fake TrustPilot reviews. That a large portion of the stuff posted said OC is a scam and the admins didn’t care when directly complained to was revealing.

Debatable. The proceeds of crime aren’t taxable; your liability is for restitution to your victims and criminal penalties to the Crown.

Trading Ponzi shitcoins is subject to CGT but there’s a £12k-odd annual allowance (after losses are deducted) that realistically almost no bro or hun will get anywhere near.

You have got to see this fraudster who is claiming to make it big. He avoids the tax system (HMRC) and sells the hyperverse / hyperfund lifestyle @justin.badar Just Badar. He is claiming to make 2,000gbp a week.

With his cheesy, sleazy salesmen technique. Avoid this guy as he has promised people in another forex company IM MASTERY aka IML and he loves MLM.

Didn’t the Proceeds of Crime Act 2002 (“PCA”) give them the power to enforce just that?

If hyperverse is a scam why cant i find any stories from investors who have lost their money online ?

Because by the time Ponzi victims complain it’s too late.

Victims complaining does not determine whether an MLM company is operating as a Ponzi scheme. Recycling invested funds to pay returns does.

Adil Kiani – so sorry for your loss…

Also Rob – hope you learn from this…

Even my bulgarian barber is in this ponzi hyperverse. shilling it to his clients…

hyperverse is getting more and more popular here.

@Oz, you wrote

but they don’t sell securities, they ask for a membership fee (Ozedit: pseudo-compliance removed, see below)

And

but I don’t think that’s the right definition. To me, a Ponzi scheme is when top people recruit many, and those many recruit also many, where the top lines receive commissions on what their downlines pay. (Ozedit: snip, see below)

Membership fees don’t pay returns, investments do.

Calling an investment a “membership fee” doesn’t change what it is. It’s pseudo-compliance and doesn’t provide an exemption from securities and finance law.

You can verify yourself there is no exemption for calling a securities offering a “membership” in the Securities and Exchange Act.

A Ponzi scheme recycles newly invested funds to pay returns. You described a pyramid scheme, which is also part of Hyperverse’s business model.

As Oz corrected you, the definition of a Ponzi is using newly invested funds to pay off earlier investors.

The “recruit many” model you described is a pyramid scheme. MLM Ponzis are hybrid Ponzi/pyramid schemes, with pyramid recruitment and Ponzi money flow.

“MLM + securities fraud = Ponzi scheme” is not a definition, it is a statement of logic. If an organization is MLM, that makes any deals it offers public offerings. If the organization offers to take some of your money and give you more money back, they are offering a security.

If they have not registered with the proper authorities and make public audited financial reports, they are committing securities fraud. The only reason they would commit securities fraud is because they are running a scam, and that scam is going to be a Ponzi scam.

Why? Because if they were really generating revenue from other sources, they would have no problem with running their scheme legally.

They are not, therefore they are Ponzi-schemers.

And it doesn’t matter if they claim to be selling memberships, or education packages, or pieces of amber, or slivers of gold taped to a piece of plastic, or some new shitcoin, or whatever.

It also doesn’t matter if they only accept and only pay out in cryptocurrency. It’s still securities fraud.

And MLM + securities fraud = Ponzi scheme.

QED

its a ponzi run for the hills LOL.

Emma Smedley is still trying hard to convince (prospects) that this Hyperverse scheme is the way forward.

Her downlines are pushing hard and fast for investors using not so ethical means. She makes claim that it is normal for funds within this scheme to be frozen and for investors not to have access or be able to withdraw.

I’m shocked at how many people seem to be completely brainwashed and have invested great sums believing this is their ‘pension’.

Considering this has been the case since HyperFund collapsed in late December, she’s not wrong.

For most of Hyperverse affiliates haven’t been able to withdraw. It’s a long drawn out exit-scam.

This is all of course within Hyper*. Definitely none of this is normal in a legitimate business.

Andy Vining AKA Grandpa Crypto still promoting this Ponzi scheme.

snipboard.io/voL1nS.jpg

snipboard.io/GPtdkH.jpg

I feel very torn because his reasons for wanting to make money are valid, but his chosen method sucks.

Technically he should be locked up for obtaining money by fraud and deception. The trouble is, I think he may genuinely believe that Hyper*** is actually a genuine way to make money. It makes me feel sick.

Andy Vining AKA Grandpa Crypto now boasting that he’s roped in ALL of his family into Hyperverse…

snipboard.io/7ZVuiw.jpg