HyperFund Compliance Officer Hope Hill outed as Ronae Jull

Ten years ago Ronae Jull was marketing herself as the “Hope Coach”.

Ten years ago Ronae Jull was marketing herself as the “Hope Coach”.

As the Hope Coach, Jull stated in 2011 that she

would like to be remembered as a person with passion for joyful living that managed to successfully reach out to hurting people and helped to bring them hope and healing.

Ten years later and something has gone horribly wrong.

Jull is an executive at one of the largest MLM Ponzi schemes in operation today. She’s also signed on as an investor.

Instead of offering “hope and healing”, Jull now inflicts others with “broke and stealing”.

Jull, believed to be a resident of Seattle, Washington, recently popped up as Compliance Officer for HyperFund.

HyperFund, run by Ryan Xu and associates with links to Australia and China, is currently one of the largest MLM Ponzi schemes in operation.

Jull appears to have signed up and invested into HyperFund on or around August 2020 (I believe the actual signup date might have been a few months prior).

At the end of March 2021, Jull boasted $88,000 in HyperFund earnings. Money she’d stolen from those who invested after her.

Somewhere between March and July, Jull joined HyperFund’s executive team as Compliance Officer.

In this role Jull turns a blind eye to HyperFund’s ongoing securities law violations. She’s instead tasked with burying evidence of fraud, specifically focusing on HyperFund marketing claims.

What caught our attention was a marketing webinar last month. In the webinar Jull, appearing under the alias “Hope Hill”, claimed FTC attorneys helped draft HyperFund’s Service Agreement.

Jull also maintains HyperFund’s passive investment scheme is exempt from the Securities and Exchange Act, so long as everyone refers to it as a “membership”.

Investments are highly regulated. In order to offer an investment of any kind, or financial product of any kind, you have to meet these rules and be licensed to offer a financial product.

Because HyperFund is a membership, not an investment product, we don’t qualify for oversight of the SEC.

HyperFund recently launched a second passive investment scheme, under the common enough crypto mining ruse.

Both HyperFund’s original HU investment scheme and its crypto mining scheme are of course securities offerings.

Affiliates pool funds into HyperFund (a common entity), on the expectation of a passive return.

A Compliance Officer ignoring securities fraud and claiming US regulators were involved in the setting up of a company is strange enough. It’s even stranger coming from someone introduced as having “worked in compliance for more than a decade”.

The thing is, I’ve looked into what Jull’s been up to over the past decade – and I can’t find any evidence of compliance related employment.

Ten years ago Jull was busy marketing herself as a “prolific writer, author, counselor, and radio personality”.

Ronae Jull is the HOPE Coach, working tirelessly to help transform families.

As a mother of four adult children and three grandchildren, Ronae has walked first-hand through the challenges of parenting children of all ages and stages.

With over 20 years’ experience as a family mentor and coach, Ronae remains passionate about helping families find hope and heal from past hurts.

Towards the end of 2012 Jull began selling medical insurance. Jull claims he was first introduced to network marketing via Amway in 1979.

In January 2013 Jull had signed up for and was promoting Inspired Living Application.

A few months later it was Body FX, a fitness and weight loss related affiliate opportunity.

By the end of 2013 Jull had jumped on the dropshipping bandwagon with DS Domination.

Spamming Amazon and eBay affiliate links on social media continued until late 2016.

There’s then a gap in Jull’s online activity till late 2019, when she returned to marketing herself as a “hope coach”.

In early/mid 2020 Jull signed up and invested in HyperFund.

If anyone can point me to where Ronae Jull worked in either securities compliance of FTC Act compliance, both specifically with respect to the MLM industry, I’m all ears.

Jull’s lack of compliance experience, beyond telling other HyperFund investors to stop openly promoting the investment opportunity, explains her FTC attorney blunder.

In a followup July 25th compliance webinar, Jull appeared to walk her claim about FTC attorney involvement in HyperFund back.

When that document was drafted … it was literally sitting down with legal counsel (who were) aware of the FTC rules, and the rules governing similar in several jurisdictions around the world.

Well, by walking the statement back I mean Jull didn’t mention FTC attorneys helping to draft HyperFund documents again.

Jull appears to be making up her expertise in MLM securities and marketing compliance as she goes along.

Think about when you purchase a HyperFund membership. When you send your USDT to your deposit address, that is not a deposit account.

That would be just like if I went to Amazon and I want to purchase something, and they accept crypto, so I’m going to pay them with my USDT.

Well, that payment for that product on that platform does not become an investment.

When you send USDT to your deposit address it’s not a deposit account. Nothing happens.

Nothing happens when you send your USDT to that address.

You don’t earn interest. There’s no daily, weekly, monthly, yearly anything. Okay? Nothing happens. It’s for a purchase only.

When you purchase a membership, what the company (HyperFund) comes back and says is, “We will give you rewards equal to three times the value of that membership that you purchased”.

That is just phenomenal.

If Amazon are soliciting deposits on the promise of a 300% return, that’s news to me.

Obviously they aren’t, so comparing HyperFund to Amazon is stupid. And how are you going to claim dumping money into HyperFund does nothing… and then in the same breath confirm you get back “three times” what you paid?

As the webinar continues, Jull’s pseudo-compliance further deteriorates.

At any point in this process you have an option, if you have at least 50 HU … that have now been paid to you, you have the option to do one of two things;

You can redeem those rewards to digital currency. You can sell that digital currency on any exchange and then you can do whatever you want with it.

Or you could, if you’ve now redeemed your rewards, converted it to digital currency, and now you’ve got it sitting on exchange, you could turn around, exchange it for USDT and send it back in to purchase another membership.

So what the company did is, “Hope, wait a minute. We’re going to make it easier for you.”

It’s a little bit of a process to redeem rewards. So rather than have to redeem, convert to digital currency, exchange it on an exchange, then send it back in to purchase more membership, what we’ll do is let you do that internally.

Now when you do this, it is not topping up or adding to your original purchase.

Nothing changes with that original purchase. That original purchase is gonna keep paying you a minimum of 0.5% per day rewards, until it reaches three X – and then it expires.

When you do a re-buy within the system … it gives you a whole new separate membership.

Deposit funds in HyperFund, collect 300% passively, paid at a minimum of 0.5% a day, with option to internally roll returns back in as new deposits. On what planet is that not an investment scheme?

HyperFund: a passive investment opportunity paying returns with made-up external revenue, policed by a compliance officer with a made-up name, spouting made-up pseudo-compliance.

There seems to be a running theme here…

Finally if you’re wondering where the alias “Hope Hill” came from, it’s the name of an online store Jull started up to take advantage of COVID-19.

Mid last year Jull was also looking to launch the HopeHill Foundation, however that project appears to have been abandoned.

Update 29th May 2022 – Turns out Ronae Jull is a convicted felon.

In 1998 Jull was indicted on multiple counts of fraud related to… wait for it, running a Ponzi scheme.

Ruh-roh!

Yeah she struck me as more of a MLM bunny than somebody on-top of MLM law, and as much as I dislike MLM those guys have my respect generally.

This woman however couldn’t legal-ese her way out of a overdue-library-book fine.

Thanks I needed a laugh.

Eh? I see Hope Hill Products, LLC being linked to from Ronae’s social media accounts.

Seems to be medical supplies – masks – spawned out of the COVID pandemic.

Yeah I just caught that. Original article addressed that at the end. Dunno where I got “Helen Hope” from.

Fixing now.

edit: Done.

Found some posts from her from years ago –

It’s always interesting how the Wealth “coaches” like this one always end up needing to do other scams or revert to dayjobs after decrying how much money she’s lost in scams over the years.

Clearly they don’t know how to make honest money easily. You’d think after 10 years she’d have learnt her lesson

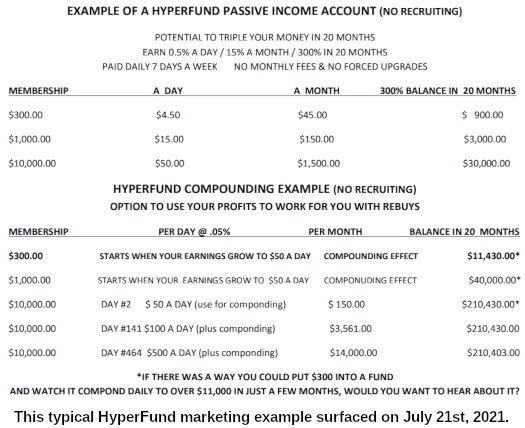

They don’t math very well, do they? On their “passive income (but it’s not a security!)” chart, the 0.5% daily returns on $300 and $1,000 are listed as $4.50 and $15.00, respectively. That’s 1.5%, not 0.5%.

Meanwhile, the daily return on $10k is correct at $50.00, and the numbers in all the other columns are correct.

Then on the “compounding” chart the “daily returns” column header says .05% instead of 0.5%, (all the table entries match 0.5%). Oops.

They can’t even keep their own bullshit straight.

To be fair, it’s hard to keep track when all the numbers are made up.

(Well, I have no motivation to be fair with these a-holes, but I digress.)

What’s especially screwy is that they got the difficult math correct. Compounded daily at 0.5%, $10,000 grows to $20,000 after 141 days and to $100,000 after 464 days, as implied in their fantasy chart.

So they can do logarithms, but they screw up multiplying by 0.005 and don’t know how to write “one-half percent” in decinal form?

Pretty bush-league.

Only thing i can say is why would Amazon Prime do a full documentation on the Founder of Hyperfund?

Obviously you haven’t taken ANY time to do actual research on the Founder or CEO. Take some time and DO YOUR RESEARCH.

I assume you don’t think Binance is an exchange or OKEX or HOO either which he either owns outright or have part ownership in. Sad that you focus on such trivial things.

If you can’t address HyperFund being a Ponzi scheme, you’ve already lost.

1. Legitimacy via association isn’t a thing.

2. Amazon Prime is a subscription service. It didn’t do “a full documentation” on anyone.

Ryan Xu is a serial scammer who has three Ponzi schemes under his belt. Everything else is irrelevant marketing noise.

Again, legitimacy via association isn’t a thing. What Xu does or doesn’t own has nothing to do with HyperFund being a Ponzi scheme.

I agree. Gullible investors spouting trivial marketing points whilst ignoring the Ponzi elephant in the room is rather sad.

Like the law,regulation meant to protect idiots like yourself,and impossible ponzi math?

Yeah so sad

PS. Binance DELISTED Xu’s Hcash ages ago due to issues

Did you even bother looking? binance.com/en/support/announcement/1ab2e9f3b5584185b03d5a785fe306c7

Excerpt:

Ohnoes you brought up HCASH, another elephant in the room.

Crypto bros don’t talk about past failures. Just fork it and pray number go up.

You’re not in the slightest worried that your compliance has been outed as using a fake name and fabricating a CV of false experience and that she’s also been proven to be involved in previous scams?

Hell if Xu’s own history and actions isn’t a big red flag, fake compliance lady will probably not make a dent haha.

I guess we shouldn’t be surprised. I mean investors with this mindset are the actual target market for these Ponzi Schemes.

She stole close to a million dollars from us years ago. I have all documentation of such. This lady has scammed many many people. Very sad.

Hi Sheryl,

Could you possibly share that info might be worth sending to the executive team and exposing Jull or Hope.

Let’s see what they say.

Would you have the dossier of files on Jull or hope …

I’m wondering why there is nobody that fill a complaint to the SEC? Just publishing information here will not stop it.

The marketers are feeling safe. Even Bitcoin Rodney will do an event with Ryan Xu and Akon in the US.

Bit bold to claim to know nobody has filed a complaint with the SEC.

As for holding events in the US, that’s a roll of the dice.

Not like the HyperFund Ponzi is inconspicuous. You might get away with it, or the DOJ might pull a Konstantin Ignatov on you.

Why would Binance delist HyperCash If Ryan Xu And Collin Star Actually owned 3% Binance?

4 Pillers Of (HyperCapital /Hyperfund/ HyperTech/ HyperVerse / Who Knows Next?) Was DigitalX. Who Gave Hyperfund a Cease And Desist Order For Using Their name to promote the ponzi.

blockchain global also collapsed. collinstar capital.. theres no office in collin street melbourne.

all made up companies and exchanges to launder money..

these idiots couldnt raise 20 million to list their business in the Australian stock exchange. Tried to raised funds didnt work. Started this Ponzi MLM

Excellent work. Very convincing.

DF vanished this morning. I lost all my money.

Hope Hill listed in the Telegram group did not delete her account as all the others did when the site went down. . It might not be the same person.

Hope Hill is absolutely Ronae Jull and was absolutely in DF Finance.

I saw one of her DF Finance marketing videos confirmed this with my own ears.