DAO1 & GSPro+ confirmed as fifth GSPartners reboot

Last week BehindMLM reviewed DAO1. Based on a number of data points, we suspected it was yet another reboot of the collapsed GSPartners investment scheme.

Last week BehindMLM reviewed DAO1. Based on a number of data points, we suspected it was yet another reboot of the collapsed GSPartners investment scheme.

Today BehindMLM can confirm DAO1 is the fifth GSPartners reboot. The same people tied to GSPartners’ parent company, Gold Standard Corporation (GSB), are running DAO1 behind the scenes.

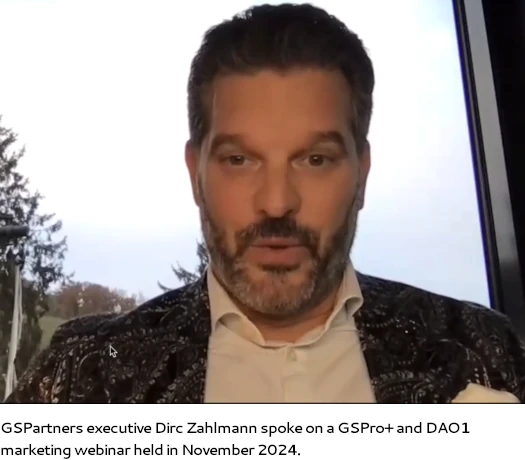

Last November DAO1 held what is believed to be its first corporate webinar for investors.

GSB executive Bruce Innes Wylde Hughes opened the webinar.

Hughes is a South African national and works as GSB’s Corporate Trainer. Hughes is also a named Respondent in standing regulatory enforcement actions from Texas, California and New Hampshire.

For what should be obvious reasons, Hughes pleaded with investors to keep the DAO1 webinar private.

We want to remind you not to edit, record or share this outside of the context it is created for. This is obviously a lawfully punishable offence.

Hughes doesn’t cite any specific laws because, well… there aren’t any.

Confirming DAO1 is just GSPartners rebooted, Hughes directs investors to direct any questions they had about DAO1 to a GSPro domain hosted email address.

In a nutshell, DAO1 is part of what Hughes refers to as “GSPro Plus”. To better understand where we’re at, here’s a list of GSPartners reboots:

- GSPartners – original fraudulent investment scheme, launched in 2021 and underwent multiple investment model reboots till it settled on “metaportfolio certificates” in 2023

- Swiss Valorem Bank – launched in mid 2023 after Canadian GSPartners fraud warnings, abandoned within a few months in favor of returning to GSPartners branding

- GSPro – second GSPartners reboot after an avalanche of US regulatory fraud warnings and enforcement orders issued in late 2023, DOA by the end of Q1, 2024

- Billionico – third GSPartners reboot launched in March 2024, effectively DOA after Texas issued Billionico fraud order in April 2024

- Auratus – fourth GSPartners reboot launched in May 2024, effectively DOA outside of a small group of promoters in Australia whose downlines carried over from GSPartners

Auratus has gone through three investment scheme iterations since launch.

First there was a “gold vault” investment scheme, then “gold points” scheme tied to Zai Cards, and finally a “storage boxes” scheme.

Now we have GSPro+, attached to which is DAO1.

Hughes doesn’t get into specifics but part of GSPro+ is selling “GSPay+ cards” for up to 7500 EUR.

GSPro+ also sells “modules” costing thousands of euros:

Through a “universal module”, GSPro+ investors are provided access to GSPartners’ collapsed metaportfolio certificates investment scheme.

US regulators have cited GSPartners’ metaportfolio certificates as a “fraudulent investment scheme” that took in over a billion dollars.

In September 2024 GSB and owner Josip Heit (right) entered into a settlement with North American regulators.

As per a September 9th executed term sheet, GSB and Heit agreed to cease and desist

offering, selling, or renewing any security in the Settling Jurisdictions without first complying with all legal requirements or exemptions for offers or sales of securities set forth in statutes, regulations, caselaw, or other sources enacted by, adopted by, or in full force and effect in the Settling Jurisdictions.

Providing consumers access to GSPartners’ metaportfolio certificates investment scheme through GSPro+ would appear to violate this agreement.

After revealing GSPartners’ metaportfolio certificates were still being pitched to consumers, Hughes brought on GSB executive Dirc Zahlmann.

Zahlmann is a GSB executive and former GSPartners CEO. Zahlmann is also a named Respondent in standing regulatory enforcement actions from Texas, California and New Hampshire.

Hughes introduces Zahlmann and DAO1 as “the next iteration of where this community can move and grow into”.

In Zahlmann’s own words, he “created” DAO1 as

the next level that we are working on … welcome to DAO1.

We already showed you, so very soon we will introduce it to you and then you can be part of it and access everything that you have, everything that was in the past times ten.

Zahlmann presents DAO1 as an “autonomous” entity that members have control of.

Everyone decides for the whole organization. It’s a clear organizational background, no one is involved in [making] executive decisions anymore.

The most important thing is the DAO system gives you the opportunity to control what’s happening with all the other members together.

So there’s no one involved anymore, like us. There’s no one involved anymore to tell you, “OK we have to go this, we have to go this way, this way.

This is what you decide altogether as members of the DAO system.

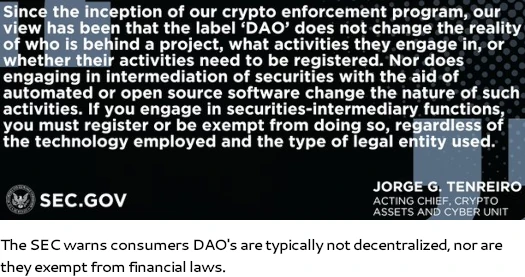

This is a common ruse used by scammers who set up DAOs. What they don’t tell you is decisions are made via vote, and typically creators of a DAO hold the most votes – usually by a large margin.

Like Hughes, Zahlmann confirms DAO1 is a GSPartners reboot.

This is the next evolvement of GSPartners, GSPro, GSPro+.

Here you can see all of your assets and everything you have done in this organization, with the organization together. So this is the next level.

The idea this time around is to avoid regulators by pretending GSPro+ and DAO1 aren’t being run by Josip Heit, Dirc Zahlmann and the rest of the still active GSB executive team.

DAO systems are already legally acknowledged through different kinds of countries, so that you can have the safe haven, let me say it that way, from the regulatory side.

It should be noted that no country with a regulated financial system makes an exemption for DAOs, or the people running them, for committing securities and/or commodities fraud.

The third speaker on the webinar was Josip Heit.

In contrast to Hughes and Zahlmann, Heit read off a PR corpo-speak script.

We introduced the GSProPloos [sic], a platform that embodies our commitment to driving progress and empowering your community.

And so on.

Addressing the elephant in the room, Heit reads a brief statement regarding allegations of fraud in the US.

We talked about our remarkable achievement we were made, including a significant milestone. The resolution of regulatory matter involving more than twenty-two US states and Canada.

I have to point out that the North American GSPartners settlement hasn’t been “resolved” as Heit claims. Complete execution of the settlement remains pending at time of publication.

Heit goes on to falsely claim the settlement “exonerates” him from “any allegations of fraud”.

After refunding investors, in the second part of the settlement

GSB Group and Mr. Heit will consent to the entry of an enforcement order that concludes they illegally offered and/or sold securities that were not registered pursuant to state law.

Additionally it should be noted that, as per Joe Rotunda, Director of Enforcement at the Texas State Securities Board, Hughes and Zahlmann are found to have “engaged in securities fraud [and] threatened immediate and irreparable harm to the public” through GSB and GSPartners.

The regulatory findings against Hughes and Zahlmann are “final and not subject to appeal”.

As with Hughes and Zahlmann, Heit confirms DAO1 is a continuation of GSPartners and the associated GSB schemes.

Today I am proud to announce that with DAO1 we are fully bringing the vision to life.

For our community, they can swap from GSPro+ to DAO free of charge and access multiple industries and their products.

By decentralizing [???] and decision making, DAO allows business to operate with total autonomy. Ensuring that assets are protected from the vulnerables [sic] of traditional centralized systems.

Having already been convicted and sentenced to prison for financial fraud in Luxembourg, why “protecting assets” is so important to Heit should be obvious.

With DAO1 we will build a platform that aligns perfectly with our mission.

This innovation gives us the competitive edge to dominate the market for the next decade. This is just the beginning.

Having only just broken it down myself last week, it is unclear whether US regulators are aware of DAO1.

Also unclear is what effect Heit, pressing forward with violating securities and commodities laws through GSPro+ and DAO1, might have on finalizing execution of the agreed GSB settlement.

Outside of North America GSB, GSPartners and Heit received regulatory fraud warnings from Canada, Australia, South Africa, the Bahamas and New Zealand.

Any country with a regulated financial market has similar securities and commodities laws to the US.

At time of publication neither Heit, GSPro+, DAO1, GSB or any of its executives are registered to offer securities or operate as a commodities broker in any jurisdiction.

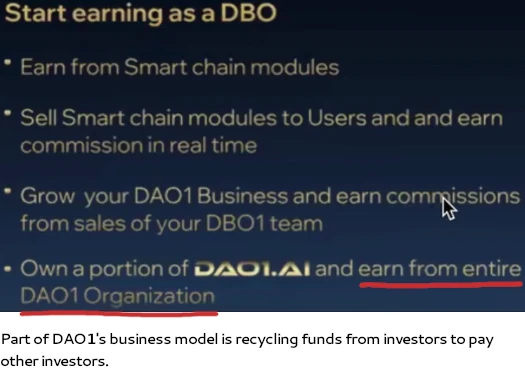

This is and remains a regulatory compliance issue, as DAO1’s business model is pitching consumers on passive returns, purportedly derived through automated trading.

Pending any further updates, we’ll keep you posted.

Imagine if that fuckwad Bruce actually dedicated as much time and energy to an actual business as he did to these reboots of reboots of scams.

He’d be a Millionaire rather than a “Corporate Trainer” bootlicker for Heit.

I imagine the TSSB are going to be all over this like a rash and criminal charges will now finally be brought.

Meanwhile, josip spent New Year’s Eve in Switzerland partying as if nothing ever happened with his new girlfriend and (of course) Alex.

Looks like I must have mismanaged my life.

OZ, you rock! Keep up the fight. I recently caught Lorien Cameron gaslighting victims into investing in DAO1 on video. You can see him lying through his teeth at youtu.be/zyhkES7qstQ.

I didn’t see the connection, but OZ did, and I’m glad to read about it—it makes a lot of sense.

I do hope that Joe Rotunda at the TSSB has been informed about Heit’s new scheme. He had an absolute fit on X/Twitter when Heit claimed in the Bloomberg article that the charges were dropped.

What is Michael Delcoe doing these days?

Whois data shows the domain is registered through namecheap but via an address- kalkofnsvegur 2, in reykjavik, iceland. Auratus.gold is also via namecheap with an Iceland address (but the exact address is redacted.) Billionico has a different registrar, but also with an address based in Iceland.

nytimes.com/2024/10/09/business/iceland-online-disinformation-identity-theft.html

Looks like the address is a virtual office well known to be connected to scams. At the same address is also the “penis museum”, which seems apt.

Namecheap uses an entity Called WPF in iceland for its whois data, who is the company who is based at that address. withheldforprivacy.com

namecheap.com/legal/domain-privacy/whois-privacy-service-agreement/

Clients who register via them and make use of WPF appear to be subject to laws in Arizona as per namecheap’s link above. Coincidently, Arizona are also on the list of states that have issued C&D orders against Heit and co.

@Oz, maybe you could bring this to the attention of the authorities to see if they can obtain registration details for all the above mentioned sites from Namecheap?

This may be additional prima facie evidence of GSP breaching the terms of their agreement with the regulators.

I can’t confirm but I suspect DAO1 is on the radar now.

10 videos for this scam have been uploaded to the new YT channel DAO1GLOBALTEAM since December 21, 2024. The speakers were well-known serial scammers such as Benni Heimberger and Dennis Loos.

postimg.cc/SnBKP7j1

youtube.com/@DAO1-GT

postimg.cc/RqhzcJZW

youtube.com/watch?v=_IO7OoORDpU

Benni Heimberger, 34 years old, supposedly self-employed for 10 years, in this video.

postimg.cc/PNW1QJVk

youtube.com/watch?v=f-27iUyc_ko

More details in these comments:

https://behindmlm.com/mlm-reviews/dao1-review-trading-bot-securities-commodities-fraud/#comment-488647

and

https://behindmlm.com/mlm-reviews/dao1-review-trading-bot-securities-commodities-fraud/#comment-488649

will investors from Israel be entitled to full refunds and what is the process?

Is Israel in North America?

You’re stuck with the “just trust me bro” GSB refund process, which as far as I know nobody has received.

New video on the YT channel DAO1GLOBALTEAM.

youtube.com/watch?v=45buUVm2FGg

In this picture the German serial fraudster Benjamin “Benni” Heimberger.

postimg.cc/s11M81GP

In this picture the other German serial fraudster Dirc Zahlmann.

postimg.cc/vDp5t52x

New video – “DAO1 Apertum Launch Yacht Party Interview With Dennis Loos”

youtube.com/watch?v=IYXuBn2rUqw

VIDEO: It’s so easy to fake the numbers …

Featuring Dennis Loos

https://www.youtube.com/watch?v=Z0dbFNZ_2FQ&ab_channel=SpookyChicken

Demonstrating how scammers might convince people to invest their money into mlm scams.

Highlighting the importance of reporting fraud to Police and your Bank. There is no shame in being a victim.

DAO1 trademark filed by “Apertum holding limited” on 26 Feb 2025. Irle Moser are the legal representation of the trademark. Apertum holding limited lists an address of Lauro de Freitas, 42706-740, BRAZIL.

I cant seem to find this address (or any) noted on DAO1 or Apertum websites.

I cant seem to find any business with that name or variations of the name in the Brazilian or business records of Bahia… Maybe there is a reader from Brazil, or someone else who can look into this?

Company’s in Brazil apparently have to provide some information for public access, so not being able to find this company could mean… ahem…

Here is the link for the trademark – trademarkelite.com/europe/trademark/trademark-detail/019148442/DAO1

It appears that the business may be registered in Portugal, not Brazil (which is noted on the trademark page). Address appears to be Rua da Alfândega 8, 9000-059, Funchal, Madeira, Portugal.

VIDEO: Apertum launch on P2B exchange by Spooky Chicken

(Ozedit: private video link removed on request)

with

Nyomi Holm @nyomiholmofficial

P2B Exchange

Josip Heit @josipht

Alex Bodi @alexbodi

Dirc Zahlmann @dirczahlmann

Dennis Loos @loos_dennis

Chloe Maxwell @misschloemaxwell

Amy Deane @the_reel_amy

Lorien Cameron @loriencameron

Amy Sayle @_wildtribe_

VIDEO: Apertum launch on P2B exchange by Spooky Chicken

public link: youtube.com/watch?v=s1ccPi95Mb0

with

Hayley Battese @the.sunnyside.up

Ella Trezise @itsellatee

Thanks for sharing with everyone Spooky Chicken. APTM at .04 cents should encourage everyone to do the calculations themselves.

Dear CONCERNED, all of Europe should come together, same as in the States. Of the many emails I’ve sent I’ve received 1 back which didn’t even answer the question.

Thanks to my upline assuring me I’ve lost all my savings. Looks like no other choice but to consolidate now. Although, they can’t get a penny more from me!

7th August I was on a global zoom meeting with founders of GSPRO+ Hughes and Dirc Zahlmann it was supposed to be the previous month but they postpone it.

I was more than disappointed, that have captured my investment for 18 months now with no end in sight. both men never spoke about releasing investors funds and entitlements from there investments they could only voice there praise and excitment of the texas court case in which Apertum won.

I am desperately wanting to get out and I suspect there are many more, I am now trying to get my funds back.

Huges and Dirc were dangling a huge carrot saying they will be a huge profitable company DAO1 and that they will be in the top 5 biggest in the world this to me is a fools ploy to keep up hype of the faithful.

but what they doing is using 100millions dollars to fund the development of DAO1 without consent of the investors who have no idea where there money is.

Each investor has there own site on a DAO1 platform and there investment is shown but that is all it is a visual of there money connected via API to live price of the EURO it feels.

its not a bank account or Escrow account the funds are not insured or anything and they are using the Apertum blockchain to create there system.

They also never answer questions.

we should unit somehow, take our concerns to each of our own Government departments that investigate fraud.

Contact intelligence services and make complainants to Apertum Foundation who are facilitating this miss use of investors money and fraud.

Look into the Texas Case all contacts for Apertum Foundation are there and contact them make complaint about GSPRO+ and that Apertum are in collusion with fraudsters. this may force DAO1 to pay out GSPRO+ Investors.

Hello,

I went to a conference in Africa and Hughes and Dirc said the same thing about GSPRO. They said they had great products like BOOM and Online gaming which never seem to have taken off.

I am just hoping that in November the TSSB wins the trial and the settling states/provinces get their refunds and this all gets settled and we can move on. Here’s hoping.

This video by Spooky Chicken answers a lot of questions.

youtube.com/watch?v=mdqx6j3UpyI.

He discusses the hidden truths about DAO1/Apertum, information they do not want you to see.

While they say they have discontinued their minebots, they keep minting new ones for themselves, and while they tell you to lock your money in the liquidity pool, they are withdrawing 10’s of thousands each month!

There is no way in Hades that these clowns are using $100 Million Dollars to fund the development of DAO1. This utter BS. The only thing they are funding with any $100 Million Dollars is their own pockets.

Sheesh people, use your brain. They would be hard pressed to pay 1/10,000th of what they claim to fund the development of a crypto platform.

These are criminals and you can’t believe a word of what they say or claim. They are all narcissists, pathological liars and sociopaths.