GSPartners securities fraud D&R order from California

GSPartners has received a securities fraud desist and refrain order from California.

GSPartners has received a securities fraud desist and refrain order from California.

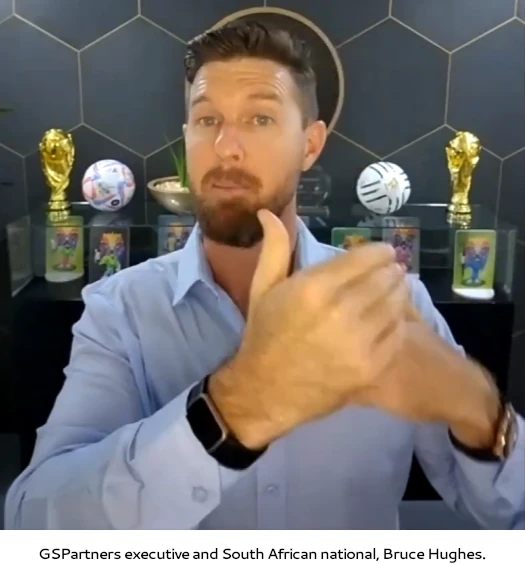

The Department of Financial Protection and Innovation’s November 16th order names GSPartners, owner Josip Heit and executives Bruce Innes Wylde Hughes and Dirc Zahlmann as respondents.

As per DFPI’s order;

Beginning at least as early as 2023, GSPartners offered and sold securities in the form of investment contracts in California through general solicitations on its website.

GSPartners referred to these investment contracts as “Certificates,” “MetaCertificates,” “Elemental Certificates,” and “Success Certificates” (collectively, Certificates).

Under Swiss Valorem Bank branding, BehindMLM reviewed the then latest iteration of GSPartners’ MetaCertificates back in May.

GSPartners held itself out as an investment platform.

The purported purpose of the securities offerings was for GSPartners to use investor funds to trade in the forex market and to invest in a diverse collection of real-world industry sectors, including real estate, fintech, payments systems, renewable energy, supplements, and gaming, which in turn would generate returns for investors who purchased Certificates.

As part of their investigation, DFPI honed in on GSPartners’ representation it had “partnered with a specific forex broker”. The unnamed broker is believed to be BDSwiss.

According to GSPartners, this broker would provide services to GSPartners’ investors, including trading and managing investor funds deposited into GSPartners via Certificates.

Investors were told that this broker was one of the largest in the world, was licensed, regulated, and had a trustworthy reputation, and that purchasing GSPartners’ Certificates would give investors exclusive access to this broker’s experience and knowledge.

GSPartners was purportedly able to pay such high returns on the Certificates in a sustainable manner because of the profitable

trades conducted by this broker’s expert traders. However, GSPartners’ representations were false.In reality, no such partnership existed, and the purported returns were not being generated by the broker managing and trading GSPartners’ investors’ funds.

DFPI confirming GSPartners is not generating external revenue as represented, blows a wide open hole in its Ponzi ruse.

Also a violation of California law is GSPartners and Heit (right), representing it to be a bank.

Also a violation of California law is GSPartners and Heit (right), representing it to be a bank.

GSPartners, through its website and marketing, represented that it was a regulated bank.

For example, in addition to using the term “bank” in the name Swiss Valorem Bank, GSPartners also represented that it was a “licensed bank with a solid balance sheet and digital custody insurance.”

GSPartners also represented that it was “revolutionising the banking industry,” that its “innovative approach to banking combines the best of both worlds, offering cutting-edge digital solutions alongside the stability and security of traditional banking,” and that it could be “trusted” because it was a “fully regulated bank.”

GSPartners also claimed to “deliver attractive returns in digital assets markets in a safe and fully regulated way,” and touted its “strict adherence to regulatory framework as is required of a licensed banking and securities dealer.”

And finally we have securities fraud, by way of GSPartners not being registered to offer securities in California.

The Certificates offered by GSPartners were securities that were neither qualified nor exempt from the qualification requirement under the CSL. The Department has not issued a permit or other form of qualification authorizing GSPartners to sell these securities in California.

Albeit indirectly, DFPI also references retaliatory litigation filed by GSPartners targeting BehindMLM.

GSPartners made efforts to prevent the dissemination of any negative information about GSPartners and its investments.

GSPartners initiated litigation in the United States and Europe to suppress criticism of its investments, particularly against websites and social media content that described GSPartners as a Ponzi scheme or a fraud.

GSPartners branded the creators of these websites as “criminals” and threatened to take action against anyone “found to be spreading this illegal content.”

Summing up GSPartners’ violations of Californian law, DFPI writes;

In connection with the offer or sale of these securities, GSPartners, Heit, Hughes, and Zahlmann made, or caused to be made, untrue statements of material fact and material omissions to investors and potential investors, including but not limited to the following:

a. falsely representing that GSPartners was partnered with a particular forex broker to provide services to GSPartners’ investors, including trading and managing investors’ funds deposited into GSPartners;

b. representing that GSPartners was a licensed bank while omitting the fact that its “license” was granted by a fictitious regulator (Comoros);

c. using the terms “bank” and “banking” while omitting the fact that GSPartners was not licensed to engage in the business of banking in California and that investor funds were not FDIC-insured;

d. misrepresenting the expected profits and risk of loss; and

e. failing to disclose that the offer or sale of GSPartners’ securities was not qualified in California.

As a result of committing securities fraud and operating illegally, DFPI has ordered

GSB Gold Standard Bank Ltd. d/b/a GSPartners, GSP, and Gold Standard Partners, Swiss Valorem Bank Ltd., GSB Gold Standard Corporation AG, Josip Heit, Bruce Innes Wylde Hughes, and Dirc Zahlmann … to desist and refrain from the further offer or sale of securities in California, including but not limited to investment contracts known as Certificates, unless and until the qualification requirements of the CSL have been met.

GSPartners is currently gearing up to hold a marketing event on November 18th in Cape Town, South Africa.

It’s expected, in violation of multiple state-level desist orders issued today, that at the event GSPartners will further violate US securities law.

In addition to California, Washington, Alabama and Texas have all taken regulatory action. BehindMLM also recently confirmed ongoing CFTC and SEC investigations into GSPartners.

Tough day for GSP. Washington, Alabama, Texas and California…all in one day.

Actually, it’s been a tough day for the ignorami who “invested” their money in GSP. They’re the ones shitting in their pants right now because they see the wheels coming off.

Heit, Innes, Hughes and Zahlmann knew this was coming for along time. In fact, Heit has probably been planning his NEXT scam because he knew this would happen.

Shame on these people and the affiliates who knew this would be the ultimate outcome.

I know people who’ve been making 6-figures monthly. They’ve been in ponzis before and they, too, knew this would happen. They’re either psychopaths or they’re simply evil.

Finally , and what about schalk VD Merwe and bruces sidekicks? Would love to see how this one evolves, Brendan Erpe Jones anywhere ?

They will probably all disappear from social media and return with the next scam when the dust settles.

Wisconsin joins the list: x.com/wis_dfi/status/1725545173604557061?s=46&t=dYtn17CiqnmzraFttzExTQ

Many scammers have one account on Instagram, but Dirc Zahlmann has three!

instagram.com/dirc.metalion/ with 1,771 followers

share-your-photo.com/6eb6bbcf0e

instagram.com/salesgentleman/ with 9,675 followers

share-your-photo.com/a3d58065fd

instagram.com/dirczahlmann/ with 100,000 followers

share-your-photo.com/ff23802391

On his website zahlmann.com he lists offices in Switzerland, United States, United Kingdom and Malaysia:

share-your-photo.com/7c2650e991

His company Zahlmann Consulting International GmbH in Tübach, Switzerland, was founded in November 2019 with CHF 20,000. He named Hochheim am Main in Germany as his place of residence. The management team consists of three people:

Rolf Peter Sonderegger, Dirc Zahlmann und Sabine Zahlmann.

share-your-photo.com/32d8b47059

moneyhouse.ch/de/company/zahlmann-consulting-international-gmbh-11653868541

The legal notice on zahlmann.com is correct, but the contact details are missing:

share-your-photo.com/d3fb3cc84b

I have found a telephone number elsewhere, but it is not from Switzerland, but from Frankfurt am Main in Germany:

share-your-photo.com/3e5299a920

To be continued.

Zafao World AG was founded in Zug (Switzerland) on September 14, 2023.

The Chairman of the Board of Directors is Dirc Zahlmann and the German Felix Honigwachs is a member of the Board of Directors. The share capital is stated at CHF 100,000.

moneyhouse.ch/de/company/zafao-world-ag-12164025761

More details about Felix Honigwachs in the following comments:

https://behindmlm.com/companies/gspartners/gspartners-rebrands-as-swiss-valorem-bank-after-fraud-warnings/#comment-466132

https://behindmlm.com/companies/gspartners/gspartners-rebrands-as-swiss-valorem-bank-after-fraud-warnings/#comment-471787

Addition to comment #5.

Dirc Zahlmann spreads his lies simultaneously on two portals:

zahlmann.com (updated on March 31, 2023) and dirczahlmann.com (updated on May 15, 2023).

Strange. 100% of visitors to dirczahlmann.com come from Australia?

share-your-photo.com/fb3f8a3aca

Where does Dirc Zahlmann really live? He mentions places like Hochheim am Main, Wiesbaden and Frankfurt am Main.

This imprint from December 2013 already mentioned Frankfurt am Main and his current telephone number. I think the public prosecutor’s office will find him in Frankfurt.

share-your-photo.com/8cb5bab8da

web.archive.org/web/20131206150445/http://zahlmann.com/startseite-deutsche-version/impressum/

Dirc Zahlmann on Facebook. The account is empty!

share-your-photo.com/a5f5ebf30e

facebook.com/dirc.zahlmannlion

On YouTube, Dirc Zahlmann announced a new video for every Sunday and Tuesday, but he uploaded the last video on September 28, 2021. He started on July 11, 2021.

The 23 videos available on his channel were apparently not very attractive to his audience, as he only has 131 subscribers.

I just watched the last video where he claims that he has been in sales for 27 years and has successfully completed 400 projects.

He does not advertise products or companies on this channel. He concentrates on his role as a consultant. He does this very well. He speaks very professionally and has a very pleasant voice. This makes him appear very credible to the audience. He would have convinced me too if I hadn’t known that he makes a lot of money with Josip Heit and other scammers.

His way of communicating with people certainly makes it easy to lure new victims into this or any other scam.

No one can verify anything he says about his alleged successes because he doesn’t mention any names or companies. This fact should make every person who watches his videos skeptical.

share-your-photo.com/b8065726d3

youtube.com/@dirczahlmann-derumsatzgara6831

Felix Honigwachs also of south african origin, is known for registering companies hiring business to provide services for him and then disappearing.

These people need to be stopped too many of us are falling for these ponzi schemes and loosing our hard earned money.

(Ozedit: request for personal information removed)