CFTC files suit against The Traders Domain scammers

![]() US authorities have finally taken action against The Traders Domain Ponzi scammers.

US authorities have finally taken action against The Traders Domain Ponzi scammers.

On September 30th the CFTC filed suit against Traders Domain FX LTD and several additional corporate and individual defendants.

While The Traders Domain itself wasn’t an MLM opportunity, the scam is of interest to BehindMLM due to several MLM Ponzis feeding into it. The Traders Domain was also promoted by several well-known MLM figures.

All up there are sixteen named defendants in the CFTC’s The Traders Domain lawsuit;

- Traders Domain FX LTD., dba The Traders Domain, St. Vincent and the Grenadines shell company

Fredirick Teddy Joseph Safranko, aka Ted Safranko (right), co-founder of The Traders Domain

Fredirick Teddy Joseph Safranko, aka Ted Safranko (right), co-founder of The Traders Domain- David William Negus-Romvari, co-founder of The Traders Domain

- Ares Global LTD., dba TruBlueFX, Saint Lucia shell company

- Algo Capital LLC, Miami shell company

- Algo FX Capital Advisor LLC, nka Quant5 Advisor LLC, Delaware shell company

- Robert Collazo Jr., co-owner of Algo FX Capital Advisor LLC

- Juan Herman, aka JJ Herman, co-owner of Algo FX Capital Advisor LLC

- John Fortini, Vice President of Algo FX Capital Advisor LLC

- Steven Likos, Algo FX Capital Advisor LLC sales rep

- Michael Shannon Sims, aka Mike Sims, The Traders Domain promoter and insider

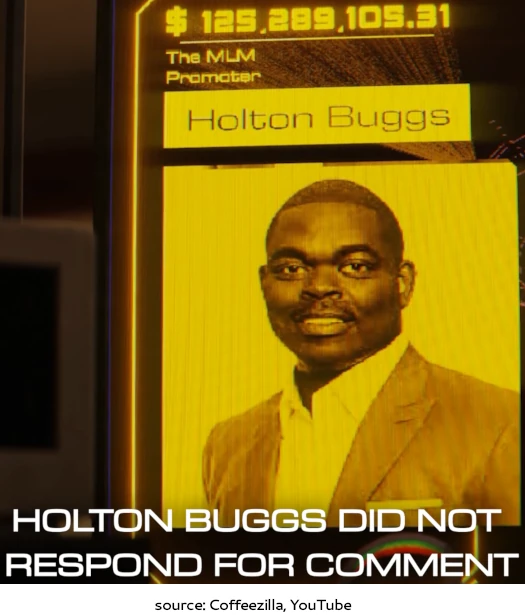

- Holton Buggs Jr., The Traders Domain promoter

- Centurion Capital Group INC, Florida shell company

- Alejandro Santiestaban, aka Alex Santi, co-owner Centurion Capital Group INC

- Gabriel Beltran co-owner of Centurion Capital Group INC, and

- Archie Rice, Centurion Capital Group INC sales rep

As alleged by the CFTC;

From at least November 2019 through present, Traders Domain FX LTD. d/b/a/ The Traders Domain, by and through its officers, employees, and agents, (“TD”) and its co-owners Frederick Teddy Joseph Safranko a/k/a/ Ted Safranko (“Safranko”) and David Negus-Romvari (“Negus-Romvari”), individually and as controlling persons of TD (collectively, the “TD Defendants”) orchestrated a multi-layered scheme to solicit funds for the purpose of trading leveraged or margined retail commodity transactions … as well as assorted other commodities, through pooled and individual accounts.

What made The Traders Domain a Ponzi scheme is the represented trading, and associated profits, was all a sham.

TD misappropriated customer funds by accepting customer money via third party bank accounts, payment processors, and crypto wallets, but failing to use at least some of those funds to trade XAU/USD and by charging commissions on purported trading profits that did not exist.

And after The Traders Domain, the fraud continued through Ares Global and TruBlueFX.

In addition, TD, and later it’s successor in interest Ares Global d/b/a/ Trubluefx (“Trubluefx”), misappropriated customer funds by failing to return customer funds despite repeated attempts by thousands of customers to access and/or liquidate their accounts.

TD and Safranko also falsified trading records, and the TD Defendants failed to register as required under the Act.

As previously stated, The Traders Domain wasn’t MLM but did incentivized recruitment through direct referral commissions.

Not only did the TD Defendants directly solicit customers, the vast majority of whom lived in the U.S., but they also engaged other individuals and entities (“sponsors”) to solicit U.S. customers on TD’s behalf-with each sponsor acting like a spoke extending from the TD hub.

This is where well-known MLM figures, who definitely should have known better, enter the picture.

In addition to the many sponsors spread all over the United States and internationally, the TD Defendants recruited the “Sponsor Defendants” ( collectively with the TD Defendants and Trubluefx, “Defendants”), four distinct groups named in this complaint which drove the largest number of customers and funds to the TD Pool:

(i) Algo Capital LLC (“Algo Capital”) and Algo FX Capital Advisor, LLC (“Algo FX”), now known as Quant5 Advisor, LLC, by and through their officers, employees, and agents ( collectively, “Algo”), Robert Collazo, Jr. (“Collazo”), Juan Herman (“Herman”), John Fortini (“Fortini”), and Stephen Likos (Likos) (collectively, the “Algo Defendants”);

(ii) Michael Shannon Sims (“Sims”);

(iii) Holton Buggs (“Buggs”); and

(iv) Centurion Capital Group, Inc., by and through its officers, employees, and agents (“Centurion”), Alejandro Santiestaban a/k/a Alex Santi (“Santi”), Gabriel Beltran (“Beltran”), and Archie Rice (“Rice”) (collectively, the “Centurion Defendants”).

Mike Sims and Holton Buggs are of interest here. The other individuals and companies I’m not familiar with.

Mike Sims, a central figure in the related OmegaPro MLM crypto Ponzi, is believed to have stolen $84 million through The Traders Domain.

Holton Buggs is an MLM veteran dating back to Organo Gold. Circa 2018 Buggs began transitioning to MLM crypto fraud.

This culminated in Buggs launching the Meta Bounty Hunters series of Ponzi schemes. Buggs is believed to have stolen $125 million through The Traders Domain.

Alongside his MLM crypto fraud scamming, Buggs owns and operates iBuumerang. Buggs cannibalized iBuumerang and fed distributors into his fraudulent crypto dealings.

The CFTC groups Sims and Buggs as “Sponsor Defendants”.

Although the Sponsor Defendants each intended the funds they solicited from customers to be traded in the TD Pool, at least some Sponsor Defendants purported to be soliciting for their own pools or “hedge funds.”

The Sponsor Defendants solicited funds for the TD Pool even though each knew or should have known that TD was not trading the funds as represented.

Each of the Sponsor Defendants became aware ofred flags that put them on notice that TD was not a legitimate trading operation.

The Sponsor Defendants faced a choice: cease promoting TD in light of the alarming information they knew or follow the strong financial motivations they had to ignore the red flags and continue to collect generous commissions on the purported trading.

Each of the Sponsor Defendants chose the latter. The Sponsor Defendants actively downplayed the red flags and continued to solicit customers, helping to create the false impression that customers were participating in legitimate trading even as the scheme was on the brink of collapse.

Each of Sponsor Defendants knowingly made oral and written fraudulent and material misrepresentations and omissions on social media, via text messages, by telephone, and in person to potential and existing customers that they knew or should have known were false.

The Sponsor Defendants misappropriated customer funds, including by accepting funds intended for trading into bank accounts they controlled and/or collecting commissions on customer profits despite that the Sponsor Defendants knew or should have known that TD was not trading the funds as purported.

Some of the Sponsor Defendants also commingled customer funds and most were not registered as required under the Act.

Safranko … established relationships with other sponsors, including Sims and Buggs. Safranko communicated with Sims and Buggs via telephone and/or messaging applications.

Additionally, on a number of occasions, Safranko participated in telephone and video conferences with potential or existing customers that Buggs was soliciting.

On at least one occasion, Safranko traveled with Buggs to Dubai in connection with TD.

Like the other Sponsor Defendants, the TD Defendants paid Buggs and Sims commissions based on the customers that they recruited for the TD Pool.

Specific to Mike Sims;

Beginning in at least September 2021 through present (the “Relevant Sims Period”), Michael Sims fraudulently solicited customers to deposit money for the purpose of participating in pooled trading of leveraged or margined XAU/USD by his “hedge fund” by making material misrepresentations and omissions to prospective and actual customers.

In fact, Sims was using customer funds to participate in the TD Pool despite the fact that Sims knew or should have known TD was not trading customer funds as it purported.

In addition, Sims misappropriated customer funds and failed to register as required under the Act.

Pursuant to this scheme, at least 42 Sims customers deposited no less than $22 million for the purposes of trading leveraged or margined XAU/USD.

After working with other sponsors to solicit customer for TD, beginning in at least September 2021, Sims began soliciting customers for his own “hedge fund,” through telephone calls, text messages, messaging apps, and in-person meetings.

Sims made numerous fraudulent misrepresentations and omissions about:

(i) the ownership and operation of the trading business,

(ii) the profit and risk associated with the purported trading, and

(iii) ability and timeliness of customer withdrawal requests.

From the outset, Sims told prospective customers that he was soliciting funds for his hedge fund.

Sims claimed his hedge fund had been in operation for more than 10 years and employed a team of experienced traders to trade leveraged or margined XAU/USD on behalf of its customers.

These statements were false.

Sims was not soliciting funds on behalf of a hedge fund. Sims did not own any “hedge fund” let alone one that had been in operation for more than 10 years and employed a team of traders.

Neither Sims, personally, nor any hedge fund or other entity owned by him traded any funds on behalf of customers.

Rather, as Sims later admitted to a customer, he was a sponsor that recruited customers for the TD Pool.

Finally, in addition to misrepresenting the identity and location of the trading operation, Sims also omitted to tell at least one prospective customer that he would be charging commissions, and sizeable ones at that.

Only after this customer received his first account statement did he notice a sizeable withdrawal from his account.

When the customer questioned Sims about the withdrawals, Sims informed him that there would be “daily and monthly commissions” which would range from 40-50%.

Sims did not explain who would be receiving these commissions, nor what percentage Sims himself would take.

Sims also made misrepresentations to prospective and current customers about the timeframe and ability to withdraw their funds allowing the scheme to proceed for months after it initially began to unravel.

When customers asked Sims about the status of these withdrawal requests, Sims repeatedly made excuses for delays and provided false statements about the timing of the withdrawals.

Sims also attempted to dissuade customers from taking withdrawals from their accounts.

Later, Sims stopped responding to the customers communications seeking information about the pending withdrawal.

In addition to the other indications of fraudulent TD activity about which Sims knew or should have known, Sims demonstrated his knowledge that TD was engaged in potentially illegal and problematic activities by directing potential customers to disguise their funding payments.

Despite the fact that Sims knew or should have known that TD was not trading customer funds as purported, Sims directed millions of dollars in customer funds to the TD Pool, and misappropriated customer funds by taking sizable commissions. Sims’ commission ranged from 40-50% of the purported trading profit.

Specific to Holton Buggs;

Beginning in at least February 2021 continuing through present (the “Relevant Buggs Period”), Buggs fraudulently solicited customers to deposit money for the purpose of participating in the TD Pool by making material misrepresentations and omission to actual and prospective customers.

Buggs solicited customers for the TD Pool despite the fact that Buggs knew or should have known TD was not trading customer funds as it purported

In addition, Buggs misappropriated customer funds and failed to register as required under the Act.

Pursuant to this scheme, at least 517 Buggs customers deposited no less than $54 million for the purpose of trading leveraged or margined XAU/USD.

Around February 2021 , Buggs purchased a trading education company, and despite not being a licensed trader, began expanding the company beyond training and education.

Buggs built upon his already large network of MLM businesses and industry acquaintances to begin soliciting customers for the TD Pool.

Several months after the purchase of his trading company, Buggs began operating as a “sponsor” to solicit customers for the purpose of trading XAU/USD and then directed their funds to the TD Pool.

Using his existing MLM businesses and the associates affiliated with them, Buggs held out the opportunity to participate in his “private trading hedge fund” through his “private broker” as a reward for hitting certain sales tiers in his other MLM businesses.

Once associates hit the “emerald” level they were given the opportunity to participate in the trading via Buggs’ “private broker,” creating an aura of exclusivity.

Buggs concealed the identity of TD until associates reached the higher “diamond” level and executed a non-disclosure agreement.

Buggs also solicited prospective customers beyond his pre-existing MLM network through in-person events. For example, in early 2022, Buggs invited approximately fifteen prospective customers to a dinner meeting in San Diego, California.

Similarly, in 2022 Buggs attended a conference in Miami, Florida, during which he solicited at least two customers for the commodity pool.

During the Relevant Buggs Period, Buggs fraudulently solicited customers through, telephone, messaging apps, and in-person events such as conferences and dinners- to deposit money for the purposes of trading leveraged and margined XAU/USD despite the fact that he knew or should have known that TD was not trading the funds as purported.

Using his MLM businesses and network of industry connections, Buggs touted the incredible returns that the commodity pool generated through leveraged or margined trading ofXAU/USD.

He told prospective customers that the commodity pool had an “incredible winning streak” and claimed that it “never had a losing month”.

Buggs boasted to a business associate by text that “I HA VE A MONEY PRINTING MACHINE.”

In some instances, Buggs used the Trading App to show prospective customers the purported XAU/USD trading history and accounts that he controlled with “balances” of approximately $80 million and $650 million.

These assertions about incredible gains were on their face, unrealistic and unattainable.

Buggs knew or should have known that these purported trading returns were false.

In 2021 , at least one prospective customer told Buggs that he had conducted a background check on Safranko and was concerned about the negative information and reviews he had seen online.

When assuring this prospective customer about the TD and Safranko warnings that he raised, Buggs made additional fraudulent statements.

Buggs reassured this customer that he traded “right beside [Safranko]”; that Buggs was “in control of [his customers’] funds. ”

These statements were false and misleading. In fact, Buggs did not trade his own customers’ funds, nor was he in control over the funds purportedly sent to TD.

And, despite knowing about the various warnings about and negative reviews of TD and Safranko, Buggs continued to solicit new customers for the TD Pool and failed to tell current customers about those warnings and negative reviews.

Buggs continued to make false assurances about the ability of customers to withdraw funds even after customers began to experience significant withdrawal difficulties and delays in the Fall of 2022.

In February 2023, when one customer contacted Buggs to inquire about the delay in obtaining his withdrawal, Buggs falsely assured him that “withdrawals have steadily gone out” from TD.

Buggs knew or should have known that this statement was false: Withdrawals had not steadily gone out since August 2022.

In an effort to insulate himself from claims that he was complicit in a fraudulent scheme, Buggs also claimed to a complaining customer that he also “had not withdrawn my trading profits as they sit in TD.”

Buggs knew that this statement was false : While regular customers withdrawals had been stalled for months, Buggs, and his family, had taken at least a million dollars in purported trading profits from TD accounts during this time period.

Buggs knew or should have known that TD was engaged in illegal and fraudulent conduct because, as an agent of TD, Buggs was directing potential and current customers to disguise the purpose of their funding payments and countries of origin.

Buggs, himself and through his assistant, instructed potential and current customers to conceal the purpose of these deposits by directing that they use certain opaque language in the wire transfer memorandum.

For example, he instructed one customer that the deposit should say “services (ONLY!)” and if the wire “reference include[ d] anything else, the wire will be returned & the related account closed. No exceptions!”

Other customers were similarly instructed that in order to participate in the pool through Buggs, that they must wire funds with the memo line for “Services.”

Buggs also instructed TD customers to take deceptive steps when funding their TD account through cryptocurrency. When customers opted to fund TD accounts with cryptocurrency, they were asked their country ofresidence in the TD account set-up instructions.

Buggs and/or his assistant instructed US customers that they should choose “crypto” of their country of origin, rather than the USA.

Instead of heeding or investigating the numerous red flags signaling that TD was a fraud and not engaged in legitimate trading, Buggs downplayed the warnings and continued to solicit customers for the TD Pool, collecting millions of dollars in commissions on purported trading profits.

Buggs misappropriated some TD customer funds by accepting TD a portion of customer funds into bank accounts he controlled and using those funds for personal use.

For example, although he started with a bank account balance of approximately $45,000, between April 11-13th, Buggs accepted four wires from TD customers each including memo lines incorporating the word “Services,” totaling $370,000.

Buggs did not wire or otherwise transfer these funds to any known brokerage or trading entity. Buggs also took in an additional $110,000 from another source into the account.

On April 14, 2022, Buggs used all or some of the $370,000 to wire $465,000 to a third party with a memo “Balance for Lambo.”

In another example, at the end of April 18, 2022, Buggs had a balance of approximately $70,000 in his bank account.

Buggs accepted wires, each of which with memo lines including the description “Services,” from three customers totaling $545,000 into this account.

Buggs failed to transfer the funds to any known brokerage or trading entity. Two days after the customers wired the funds to Buggs’ account, Buggs wired $350,000 for the purchase of a condo.

Buggs also misappropriated TD customer funds by taking sizable commissions on purported trading profits when he knew or should have known that profits reflected in the TD Pool account were false.

The Traders Domain collapsed in late 2022, generating millions in consumer losses.

In the fall of 2022, the scheme began to unravel, and customers began to experience extreme withdrawal delays and/or were unable to withdraw their funds.

To persuade customers that the withdrawal issues were not an indication of fraud, the TD Defendants provided numerous, conflicting excuses for the delays-including, in June 2023, announcing that TD had been acquired by Trubluefx.

The TD Defendants falsely assured customers that their funds were safe and withdrawals would be processed. Notwithstanding the significant withdrawal delays, the Sponsor Defendants ignored or downplayed the withdrawal issues and continued to solicit funds from new and existing customers to be traded in the TD Pool.

These misstatements allowed Defendants to continue their fraudulent scheme for more than six months and bilk customers out of millions of additional dollars.

At least some of Defendants’ conduct is ongoing-upon information and belief, the majority of customer funds have not been returned.

Unless restrained and enjoined by this Court, Defendants will likely continue to engage in acts and practices alleged in this Complaint and similar acts and practices.

The CFTC cites “no less than $283 million” in The Traders Domain losses across “at least 2046 customers”. Based on leaked investor data, The Traders Domain is estimated to have taken in around $3.3 billion.

During the Relevant Period, TD directly and … through the Sponsor Defendants, caused no less than $180 million in customer funds to be deposited into bank accounts held in the name of various third-party entities that TD controlled through a TD agent who was the signatory on these accounts.

None of these third party entities were firms that engaged in trading. None of the funds deposited in these third party bank accounts were ever sent to TD or any other firm that engaged in trading.

Instead, TD directed its agent to use customer funds deposited into the third-party bank accounts to make payments unrelated to trading and to make Ponzi-style payments to other customers.

In its filed lawsuit the CFTC alleges fraud across multiple violations of the Commodity Exchange Act.

The CFTC is seeking an injunction against The Traders Domain defendants, prohibiting further violations of the Commodities Exchange Act.

If granted, the injunction will also bar The Traders Domain defendants from having anything to do with commodities trading in the US.

Additionally, disgorgement of ill-gotten gains, full restitution of investor losses, pre-judgment and post-judgment interest and a civil monetary penalty are also sought.

As previously noted, the CFTC’s The Traders Domain Complaint was filed under seal on September 30th.

The CFTC requested the Complaint be kept under seal so as to

allow the Commission to

(1) obtain a Statutory Restraining Order freezing Defendants’ assets, prohibiting destruction of records, and authorizing the Commission’s immediate inspection of uch records and

(2) serve relevant financial institutions with the Court’s Statutory Restraining Order to effectuate the asset freeze, without notice ot the Defendants.

The court granted the CFTC’s seal motion on October 1st.

On October 3rd, the court granted the CFTC’s request for an ex-parte statutory restraining order against The Traders Domain defendants (freezing of assets etc.). A Temporary Receiver was also appointed.

There is also good cause for the appointment of a Temporary Receiver to take control of all assets owned, controlled, managed or held by Defendants, or in which they have any beneficial interest (“Defendants’ Assets”), so that the Temporary Receiver may preserve assets, investigate and determine customer claims, determine unlawful proceeds retained by Defendants and amounts due to customers as a results of Defendants’ alleged violations, and distribute remaining funds under the Court’s supervision.

On October 11th, the CFTC filed a motion with the court requesting the case be unsealed. The court unsealed the case later the same day.

While it’s far too early to get into specifics, it’s assumed clawback litigation will be filed against The Traders Domain’s top net-winners at some point.

Many of The Traders Domain’s top net-winners are MLM company owners or top company distributors/affiliates.

It should be noted that the CFTC previously filed a lawsuit targeting Tin Quoc Tran’s SAEG Ponzi scheme. Ted Safranko and Mike Sims are named defendants in the suit.

Safranko, who is believed to have gone on the run since the CFTC’s SAEG lawsuit was filed in February 2023, copped a $3.8 million default judgment in September 2023.

Mike Sims settled the CFTC’s alleged SAEG Ponzi fraud charges for $250,000 last month.

Finally, the biggest MLM Ponzi I’m aware of that fed into The Traders Domain was OmegaPro (estimated $4 billion in consumer losses).

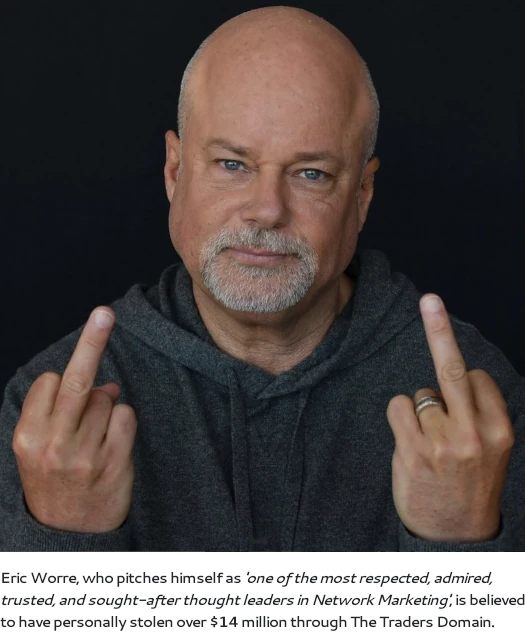

Mike Sims and Eric Worre were directly tied to OmegaPro. Sims as a co-founder and Worre as OmegaPro’s Official Strategic Coach.

OmegaPro collapsed in late 2022, shortly after The Traders Domain collapsed.

OmegaPro co-founder Andreas Szakacs was arrested in Turkey in July 2024. Dilawar Singh, last known to be living in Spain, has gone underground.

Whether there are pending criminal charges in relation to The Traders Domain is unknown.

A Show Cause hearing on the CFTC’s filed TRO motion is scheduled for October 29th. Stay tuned for updates as BehindMLM continues to track the case.

Update 13th November 2024 – The show cause and preliminary injunction hearing has been continued to December 12th.

Holton Buggs has also filed for dissolvement of the The Traders Domain Receivership.

Update 7th January 2025 – Citing the need to “depose key witnesses and narrow… contested issues before the Court”, on December 30th the parties requested the January 6th preliminary injunction be continued.

The court granted the motion later the same day. The Traders Domain preliminary injunction hearing is now scheduled for January 24th.

Update 27th April 2025 – As at the time of publication a preliminary injunction is now in place for all The Traders Domain defendants.

Following discussions between the parties, on March 28th the court has scheduled a mediation hearing for May 28th, 2025.

Update 10th December 2025 – It’s looking like John Fortini and Steven Likos are going to settle.

Fortini has been given until February 25th, 2026 to file a notice of settlement. Likos has until March 9th, 2026.

Holy ShT

about time ……

Thankfully never got caught up in this.

Just think of the glorious clawback litigation that is sure to follow.

How much of that potential $14 million will Eric Worre end up getting to keep?

Eric Worre should have been charged as well, and also in OmegaPro.

Respected, admired, trusted, sought-after thought leader in Network Marketing my assets.

Invested $160k

Lost $$160k

The photo of Eric Worre flipping the bird, real or not, is perfect. It’s as if he’s flipping off the millions of people who bought his book, the hundreds of thousands who’ve attended his trainings, and those people he brought into OmegaPro. It’s as if he’s saying, “F**K YOU SUCKERS, and thanks for your money!”

After reading this article (Great job, Oz!), I did a search on “eric worre flipping the bird”. Then I clicked on “images”. Low and behold, there’s dickhead Eric, shirtless for all the world to see, in bicep flex mode, adorned with his new tattoos.

Then I did a search on “eric worre shirtless”. Saw photos from 2013 when Eric was losing weight. Big mistake on my part, as I use a large curved 34″ monitor.

Seeing shirtless Eric made me sick to my stomach. My dog Boomer heard me gagging, he looked up saw the photo, then Boomer shit on the floor. Damn, now my eyes hurt.

My eyes have been scarred for life. Once you see Eric shirtless, you can’t un-see it. And those godawful tattoos??!!! I’m surprised he doesn’t have his nipples pierced as well.

I’ve said it before and I’ll say it again –– the network marketing industry will be a better place when Eric “I walk on water” Worre is gone from it.

Photo is absolutely real. Worre posted it on Instagram shortly after OmegaPro collapsed.

Actually the picture of Eric flipping the bird with both hands was his way of bragging about his IQ and respect for his followers. His being that great respected, admired, trusted, sought-after thought leader in Network Marketing.

Real Class Eric, real class.

Shame on the people that run these ponzis and promote them to take advantage of the naive and unknowing. At the same time, when will people wake up and realize that if something appears to be too good to be true, it probably is?

I will do all I can to keep my integrity and I hope that for the rest of you. We need some examples for others to follow.

Eric Worre… I hear his name as someone that people idolize but he does appear to be just another snake oil salesman.

Here is the full list.

Have they posted yet a place where people can request their money back once the clawbacks come in???

The Complaint just dropped. Give it a few weeks at least.

And that’s for a Receivership website. Claims process is 1 year away minimum. The bigger the Ponzi, the longer the regulatory legal process takes.

Unless I missed it I can’t believe Jeremy Roma is not on that list. He ran with Buggs in Organo Gold and did several things with Rabu Gary. I believe Roma and Gary go all the way back to when they did Pre-Paid legal.

Roma was likely too busy running his own Daisy Ponzis. If Roma invested in The Traders Domain it was low key.

Algo capital, Robert collazo and HIS WHOLE LITTLE CLAN KNEW IT WAS ALL FRAUD AND CONTINUE TO ACCEPT MONIES FROM INVESTORS.

According to lawsuits, Jullian Cruz, algo capital’s chief tech officer knew it was all a Ponzi scheme.

They’re all scammers. The hammer of justice will soon echo judgement day in court for all of these criminals.

According to this post, I made $1.6 Million from promoting Traders Domain. Nothing could be further from the truth. I have NEVER promoted a Ponzi scheme – this one or any other one – and I have not made a dime from Traders Domain.

1. Please let me know where you got this ridiculous information from

2. Please remove my name from this list. Many on this list are known scammers. I have NO association with ANY of them. However since my information is totally invalid I wonder if there are other innocent people on your list.

This is now my 2nd attempt asking you to correct this libelous post!

The source of the information is The Traders Domain leaked database.

Said database has an entry for your email address and an associated $1.6 million balance. How much of that you withdrew is irrelevant to your participation in The Traders Domain.

Get involved in a Ponzi scheme = scammer. While you are free to deny your involvement, there is nothing to correct Alan.

Go on Alan, for the record – I dare you:

“My name is Alan Noble and I never invested anything into or had anything to do with The Traders Domain.”

Did I put some money into Traders Domain, thinking it was a valid trading investment? Yes. Do I still have a balance over there, that I can’t access just like 1000s of other people? Yes. You live and learn!

However your article clearly implies that I promoted Traders Domain and made $1.6 Million from either the investment and/or promoting it.

I have not received ANY income from Traders domain nor did I promote it to a soul! Yet, you list me along with active promoters of the scam.

Was every innocent investor with Bernie Madoff a “scammer”? No.

So once again, unless you have proof that I actually received ANY money from Traders Domain or proof that I promoted the “investment” to a single person, then please remove my name from this libelous article.

Thank you for confirming you are a Ponzi scammer. That is all this article documents (or rather the list of MLM related Traders Domain scammers, in which you are included).

Legally you might not be as culpable as The Traders Domain’s operators and top promoters, but we both know why you joined The Traders Domain. You hoped to steal a bunch of money – and that makes you just as much as a scammer as everyone else on the leaked list.

Anything beyond that is irrelevant within the context of this article and the leaked list of The Traders Domain Ponzi investors. Any fallout as a result of your Ponzi scamming is a “you” problem.

It doesn’t imply so much as quote The Traders Domain’s own leaked database at collapse confirming as much. Own your thievery, attempted or otherwise, and “a noble purpose” hypocrisy, Alan.

It should be clear to your readers that “getting involved in a Ponzi Scheme” as a VICTIM is very different to getting involved as a promoter.

Thanks to my success in legitimate Network Marketing I have many investments. This one turned out to be foolish. Thankfully I did not invest anything close to $1.6 Million. That just happens to be a balance, that can’t be accessed. You live and learn.

However, your reasoning implies every single person who invested with Bernie Madoff was a scammer.

Unless you have proof of income received either though the “investment” or through promotion then your article should have a very sperate delineation between victim and scammer. It does not.

I couldn’t give a crap about Bernie Madoff unless he was running a Ponzi scheme a bunch of MLM veterans who should have known better joined and/or promoted.

If you joined and invested into The Traders Domain you are a scammer. Not withdrawing the money you stole through The Traders Domain just makes you a bad scammer.

Promotion of The Traders Domain was closed-door. You can confirm this by sharing how you were recruited and by who.

There were no victims in The Traders Domain, only net-winners and net-losers.

Tell me Alan, what was it about The Traders Domain being shadily promoted in private that allegedly led you to believe it was a “valid investment”?

Was it The Traders Domain not being registered with the SEC? Or perhaps it was The Traders Domain not being registered with the CFTC?

You can start “living and learning” by accepting your role in The Traders Domain instead of trying to hide your fraud.

Finally you seem to be confused about the article you’re commenting on. Nowhere in the article proper are you cited as a scammer. You aren’t even mentioned.

So how much did you invest to passively grow your balance to $1.6 million before The Traders Domain collapsed?

And you expect anyone to believe you figured this was a legitimate investment the whole time? Bitch please.

Bernie Madoff had a legitimate investment firm,and licenses, books and his returns were not ridiculous, by all accounts his victims were victims. Madoff committed fraud and cooked the books.

Investing into fucking traders domain – no legitimate business, no licenses, no bookkeeping, obscene returns – is an obvious con. Not even attempts at legitimacy.

Comparing the two to try prove victimhood is dishonest. You were at best a lazy moron.

What is the likelihood of seeing our original investment money back on this? Who do we contact with our information?

The likelihood is zero. The money you invested is gone. Worre might have spent it on that private jet he keeps showing off on social media. Buggs might have bought a car with it. Who knows.

Your best bet is restitution but it’s far too early for that.

I appreciate your information!

@AlanNoble although I don’t agree with “Oz” many times and he may be a little to harsh on you, as Leader in the industry and your company you need to understand this comes with huge responsibility, what you do and say does influence others.

I believe you that you were just an investor like many on that list however, to lure people into this Ponzi scheme and others Promoter were using names like yours, that you had invested probably how you personally were pitched and made the decision to go ahead, so by this standard you were guilty of association. The best thing to do is own up to the mistake.

Being a top leader in my company for a few decades now my personal philosophy has always been never invest money in an investment program that has a referral program or any affiliate commissions attached to it.

I would recommend to all who read this make that your philosophy or big mistakes of greed like in this case will hurt alot of people along the way…

Article updated with The Traders Domain May 2025 mediation date.

Dean Kosage Grey stole over $7m of Skylab investor funds and funneled it to trader’s domain. He is now living in a Van in Europe, driving country to country, posting on Social Media as he is now a federal fugitive facing a minimum of 20 years for securities fraud.

He fraudulently updated investors with bullshit updates blaming other executives for his failures all while stealing their money to pay for his lavish lifestyle of expensive cars, yachts, prostitutes, high rise luxury apartments and watches.

Truth is Dean syphoned millions through a shell corporation and his complicit CPA. He is one of the worst narcissists and liars I’ve ever met and from what I was told, was a complete tyrant and lunatic to his staff.

Everything about him and is so-called success is all a lie. He is your typically MLM bullshit artist. He belongs in prison for many years. If you’re reading this Dean, the authorities have EVERYTHING.

Article updated to note pending Fortini and Likos settlements.